2025 BEFE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BEFE's Market Position and Investment Value

BEFE (BEFE), as a memecoin aiming to bring back the glory days of memecoins, has made waves in the cryptocurrency market since its launch. As of 2025, BEFE's market capitalization has reached $1,064,180, with a circulating supply of approximately 94,325,558,290 tokens, and a price hovering around $0.000011282. This asset, dubbed the "ultimate meme king," is playing an increasingly crucial role in the meme-driven cryptocurrency sector.

This article will provide a comprehensive analysis of BEFE's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, offering investors professional price predictions and practical investment strategies.

I. BEFE Price History Review and Current Market Status

BEFE Historical Price Evolution

- 2024: BEFE reached its all-time high of $0.00095 on January 8, marking a significant milestone for the token.

- 2025: The token experienced a sharp decline, hitting its all-time low of $0.00000588 on April 18.

- 2025: BEFE has shown signs of recovery, with the current price at $0.000011282 as of October 29.

BEFE Current Market Situation

BEFE is currently trading at $0.000011282, with a 24-hour trading volume of $26,425.92. The token has experienced a 3.86% decrease in the last 24 hours. BEFE's market capitalization stands at $1,064,180.95, ranking it at 2804 in the cryptocurrency market. The circulating supply is 94,325,558,290.59 BEFE, which represents 94.33% of the total supply of 100,000,000,000 tokens. Despite the recent short-term decline, BEFE has shown positive growth over the past 30 days, with an 8.27% increase. However, the token has seen a significant drop of 64.12% over the past year, indicating high volatility in its price performance.

Click to view the current BEFE market price

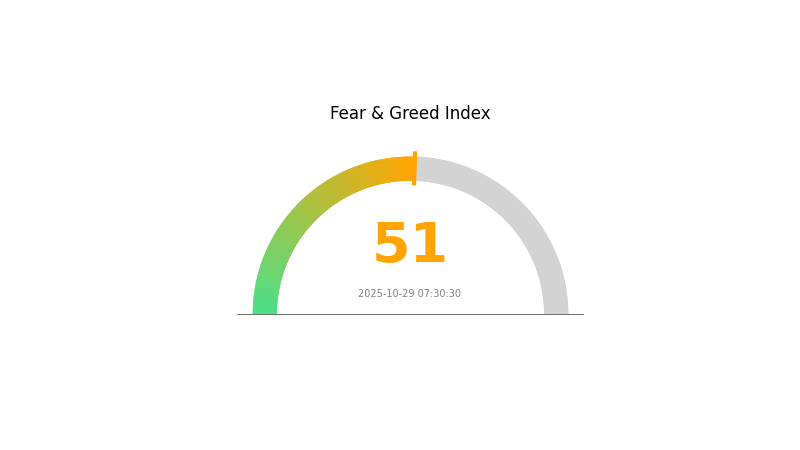

BEFE Market Sentiment Index

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral stance. This equilibrium suggests investors are neither overly optimistic nor pessimistic about current market conditions. While caution is still advised, the neutral reading may present opportunities for strategic trading. As always, it's crucial to conduct thorough research and manage risks effectively when navigating the crypto market landscape.

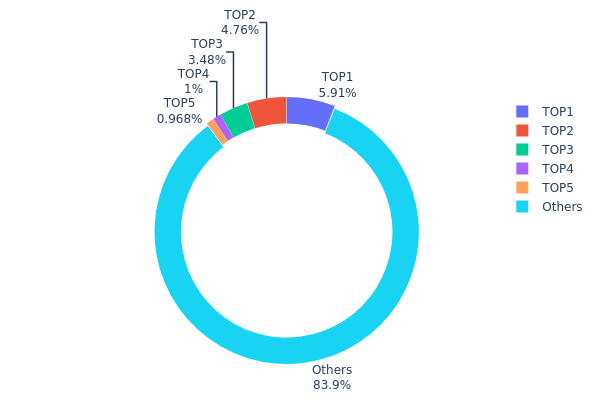

BEFE Holdings Distribution

The address holdings distribution data for BEFE reveals a relatively decentralized ownership structure. The top 5 addresses collectively hold approximately 16.1% of the total supply, with the largest individual holder possessing 5.91% of BEFE tokens. This distribution suggests a moderate level of concentration, which is not uncommon in the cryptocurrency market.

Notably, 83.9% of BEFE tokens are distributed among "Others," indicating a wide base of smaller holders. This broad distribution can be viewed positively in terms of decentralization and reduced risk of market manipulation by a few large holders. However, it's important to note that the top addresses still have significant holdings that could potentially impact market dynamics if large transactions were to occur.

The current distribution pattern reflects a balance between major stakeholders and a diverse community of holders. This structure may contribute to relative price stability and reduced vulnerability to sudden large-scale sell-offs, although market participants should remain aware that significant movements by top holders could still influence short-term price action.

Click to view the current BEFE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd8a8...6d7272 | 5910136.73K | 5.91% |

| 2 | 0x0d07...b492fe | 4764034.81K | 4.76% |

| 3 | 0x8c4a...e051ba | 3477467.16K | 3.47% |

| 4 | 0xd837...451088 | 1000000.00K | 1.00% |

| 5 | 0x4982...6e89cb | 968241.47K | 0.96% |

| - | Others | 83880119.85K | 83.9% |

II. Key Factors Influencing BEFE's Future Price

Market Sentiment

-

Investor Confidence: Investor sentiment and confidence directly impact BEFE price movements. Positive news about BEFE's widespread adoption or significant technological breakthroughs can drive prices up.

-

Community Support: The BEFE team is working to create a community of blockchain enthusiasts, which could influence investment decisions and price trends.

Technical Development and Ecosystem Building

-

Technological Breakthroughs: Any major technological advancements in BEFE could significantly affect its price.

-

Ecosystem Growth: The development of DApps and other projects within the BEFE ecosystem may contribute to increased value and adoption.

Macroeconomic Environment

- General Market Trends: BEFE's price is likely to be influenced by overall cryptocurrency market trends and global economic conditions.

III. BEFE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00001

- Neutral forecast: $0.00001

- Optimistic forecast: $0.00001 (requires stable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00001 - $0.00002

- 2028: $0.00001 - $0.00002

- Key catalysts: Increased adoption and market recognition

2029-2030 Long-term Outlook

- Base scenario: $0.00001 - $0.00002 (assuming steady market growth)

- Optimistic scenario: $0.00002 (assuming favorable market conditions)

- Transformative scenario: $0.00002 (with exceptional market performance)

- 2030-12-31: BEFE $0.00002 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00001 | 0.00001 | 0.00001 | 0 |

| 2026 | 0.00002 | 0.00001 | 0.00001 | 13 |

| 2027 | 0.00002 | 0.00002 | 0.00001 | 32 |

| 2028 | 0.00002 | 0.00002 | 0.00001 | 49 |

| 2029 | 0.00002 | 0.00002 | 0.00001 | 82 |

| 2030 | 0.00002 | 0.00002 | 0.00001 | 94 |

IV. BEFE Professional Investment Strategies and Risk Management

BEFE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate BEFE tokens during market dips

- Stake BRISE to earn BEFE tokens

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Moving Averages: Identify trend directions and potential reversals

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined price targets

BEFE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Gate.com's built-in wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for BEFE

BEFE Market Risks

- High volatility: Meme coins are prone to extreme price swings

- Market sentiment: Heavily influenced by social media trends and celebrity endorsements

- Liquidity risk: Limited trading volume may lead to slippage during large trades

BEFE Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of meme coins by financial authorities

- Legal classification: Risk of being classified as a security, leading to trading restrictions

- Cross-border regulations: Varying regulatory approaches in different jurisdictions

BEFE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token's underlying code

- Network congestion: High transaction fees and slow confirmations during peak trading periods

- Centralization risks: Potential concentration of token ownership among a few large holders

VI. Conclusion and Action Recommendations

BEFE Investment Value Assessment

BEFE presents a high-risk, high-reward opportunity within the meme coin sector. While it offers potential for significant short-term gains, its long-term value proposition remains speculative and heavily dependent on community engagement and market trends.

BEFE Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of overall crypto portfolio, focus on education and risk management

✅ Experienced investors: Consider short-term trading opportunities with strict risk controls

✅ Institutional investors: Approach with caution, conduct thorough due diligence before any significant allocation

BEFE Trading Participation Methods

- Spot trading: Buy and sell BEFE tokens on Gate.com's spot market

- Staking: Earn BEFE rewards by staking BRISE tokens

- DeFi participation: Explore decentralized finance opportunities involving BEFE tokens (if available)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is BEFE token safe to invest in?

BEFE token, associated with Bitgert, has shown reliability. Its safety for investment depends on market conditions and your risk tolerance. Always research thoroughly before investing.

Can yearn finance reach $1 million?

Yes, Yearn Finance (YFI) has the potential to reach $1 million. Its innovative features, growing value locked, and past performance suggest this is possible in the long term.

Does Bee crypto have a future?

Yes, Bee crypto has a promising future. Projections indicate an upward trend, with a potential maximum price of $0.008033 by 2025. Current market conditions suggest growth potential for Bee.

Is BEFE token a meme coin?

Yes, BEFE is a meme coin. It's designed to be the 'funniest and most meme-worthy crypto', aiming to become the ultimate meme king in the cryptocurrency space.

2025 BANANAS31Price Prediction: Market Trends and Investment Outlook for the Emerging Crypto Asset

Is cheems (CHEEMS) a good investment?: Analyzing the potential and risks of the meme-inspired cryptocurrency

2025 LKY Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ANDYETH Price Prediction: Bullish Outlook Amid Blockchain Advancements and Market Expansion

Is Simons Cat (CAT) a good investment?: A Comprehensive Analysis of Price Trends, Market Potential, and Risk Factors

What Does 'Stonks' Mean ?

What is the crypto market overview: market cap rankings, trading volume, and liquidity analysis?

A Comprehensive Guide to Buying BABYTRUMP Tokens Safely

# How Does UNI Price Volatility Compare to Bitcoin and Ethereum in 2025?

What is NIGHT token: Midnight's privacy blockchain fundamentals, whitepaper logic, and tokenomics analysis?

What is BAS: A Comprehensive Guide to Building Automation Systems and Their Applications in Modern Smart Buildings