2025 BONE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BONE's Market Position and Investment Value

Bone ShibaSwap (BONE), as the governance token of the ShibaSwap ecosystem, has played a crucial role in the Shiba Inu community since its inception in 2021. As of 2025, BONE's market capitalization has reached $24.68 million, with a circulating supply of approximately 249,892,047 tokens, and a price hovering around $0.09877. This asset, often referred to as the "backbone of Shibarium," is increasingly vital in facilitating gas payments, validator voting, and node rewards on the Shibarium network.

This article will comprehensively analyze BONE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BONE Price History Review and Current Market Status

BONE Historical Price Evolution

- 2021: BONE launched, reaching an all-time high of $15.5 on July 7

- 2021: Market correction, price dropped to an all-time low of $0.083 on August 13

- 2025: Ongoing bear market, price declined by 77.52% over the past year

BONE Current Market Situation

As of November 19, 2025, BONE is trading at $0.09877, with a 24-hour trading volume of $34,216.92. The token has seen a 3.09% increase in the last 24 hours, but a 9.58% decrease over the past week. BONE's market capitalization stands at $24,681,837, ranking it 838th in the cryptocurrency market. The circulating supply is 249,892,047 BONE, which is 99.96% of the total supply of 250,000,000 BONE. Despite recent gains, BONE is still down 16.25% in the past 30 days and 77.52% over the last year, reflecting the broader crypto market's bearish sentiment.

Click to view the current BONE market price

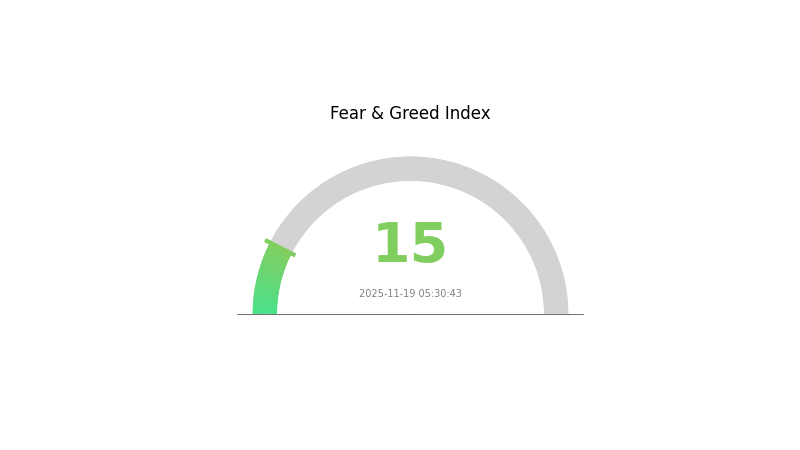

BONE Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 15. This level of pessimism often indicates a potential buying opportunity for long-term investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider using Gate.com's advanced trading tools to navigate these uncertain waters. As always, diversification and risk management are key in volatile markets.

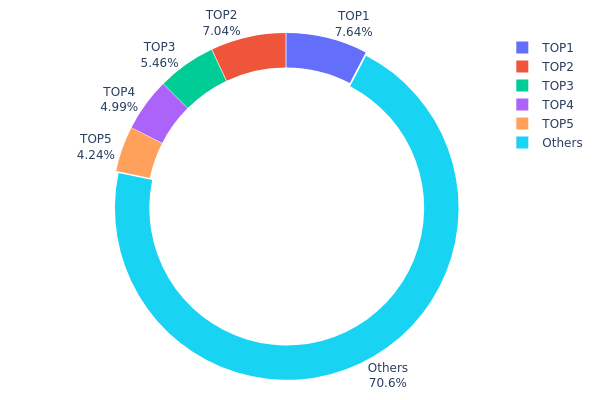

BONE Holdings Distribution

The address holdings distribution data for BONE reveals a moderate level of concentration among top holders. The top 5 addresses collectively control 29.35% of the total BONE supply, with the largest holder possessing 7.63%. This distribution pattern indicates a relatively decentralized structure, as no single address holds a dominant position that could significantly influence market dynamics.

However, the presence of several large holders still warrants attention. The top 5 addresses each hold over 4% of the supply, which could potentially impact price movements if these positions were to be liquidated simultaneously. Nevertheless, with 70.65% of BONE tokens distributed among other addresses, the overall market structure appears to maintain a healthy balance between major stakeholders and smaller holders.

This distribution suggests a moderate level of decentralization for BONE, which may contribute to market stability and reduce the risk of price manipulation by any single entity. The absence of extreme concentration also indicates a more robust on-chain structure, potentially fostering a more resilient and equitable ecosystem for BONE token holders.

Click to view the current BONE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf585...0509a0 | 19095.38K | 7.63% |

| 2 | 0xbab4...225e96 | 17600.00K | 7.04% |

| 3 | 0x3cc9...aecf18 | 13658.74K | 5.46% |

| 4 | 0x885f...32c995 | 12462.80K | 4.98% |

| 5 | 0x9642...2f5d4e | 10607.71K | 4.24% |

| - | Others | 176574.77K | 70.65% |

II. Key Factors Influencing BONE's Future Price

Technical Development and Ecosystem Building

- Shibarium Layer-2 Network: BONE serves as the gas token for transactions on the Shibarium network, potentially increasing its utility and demand.

- Ecosystem Applications: ShibaSwap, a decentralized exchange, uses BONE as one of its core tokens, contributing to its ecosystem value.

III. BONE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.0722 - $0.0989

- Neutral forecast: $0.0989 - $0.11

- Optimistic forecast: $0.11 - $0.13846 (requires positive market sentiment and increased adoption)

2027 Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2026: $0.10325 - $0.17327

- 2027: $0.13576 - $0.21459

- Key catalysts: Ecosystem expansion, technological advancements, and broader market recovery

2030 Long-term Outlook

- Base scenario: $0.18028 - $0.23062 (assuming steady growth and adoption)

- Optimistic scenario: $0.23062 - $0.27444 (assuming strong ecosystem development and market leadership)

- Transformative scenario: $0.27444 - $0.30 (assuming revolutionary use cases and mainstream adoption)

- 2030-12-31: BONE $0.23062 (potential steady growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13846 | 0.0989 | 0.0722 | 0 |

| 2026 | 0.17327 | 0.11868 | 0.10325 | 20 |

| 2027 | 0.21459 | 0.14598 | 0.13576 | 47 |

| 2028 | 0.20732 | 0.18028 | 0.11899 | 82 |

| 2029 | 0.26745 | 0.1938 | 0.1531 | 96 |

| 2030 | 0.27444 | 0.23062 | 0.12684 | 133 |

IV. Professional Investment Strategies and Risk Management for BONE

BONE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in the Shiba Inu ecosystem

- Operation suggestions:

- Accumulate BONE during market dips

- Hold for at least 1-2 years to ride out short-term volatility

- Store in a secure non-custodial wallet like Gate Web3 Wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined levels

BONE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, be cautious of phishing attempts

V. Potential Risks and Challenges for BONE

BONE Market Risks

- High volatility: BONE price can fluctuate wildly in short periods

- Liquidity risk: Limited trading volume may cause slippage

- Correlation risk: BONE may be affected by overall crypto market sentiment

BONE Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of meme coins

- Compliance challenges: Future regulations may impact BONE's utility or trading

- Cross-border restrictions: Some jurisdictions may limit or ban BONE trading

BONE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High gas fees on Ethereum network may impact transactions

- Dependence on Shibarium: BONE's success is tied to Shibarium's development

VI. Conclusion and Action Recommendations

BONE Investment Value Assessment

BONE presents a high-risk, high-reward opportunity within the Shiba Inu ecosystem. Its long-term value proposition is tied to the success of Shibarium and the broader Shiba Inu community. Short-term risks include high volatility and regulatory uncertainties.

BONE Investment Recommendations

✅ Beginners: Invest only a small portion of portfolio, focus on education

✅ Experienced investors: Consider as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence, monitor ecosystem developments

BONE Trading Participation Methods

- Spot trading: Buy and hold BONE on Gate.com

- Staking: Participate in staking programs if available

- DeFi: Explore liquidity provision on ShibaSwap (with caution)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the bone prediction for 2025?

Based on market trends and expert analysis, BONE price is predicted to reach around $1.50 to $2.00 by 2025, showing potential for significant growth.

Is bone a good investment?

Yes, BONE shows potential as a good investment in 2025. With its growing utility in the Shiba Inu ecosystem and increasing adoption, BONE's value is likely to appreciate over time.

Will Bonfida crypto go up?

Yes, Bonfida (BONE) is likely to go up in the future. Its innovative DeFi solutions and growing ecosystem on Solana suggest potential for price appreciation by 2025.

Can Shiba in 2030 reach $1?

It's highly unlikely for Shiba Inu to reach $1 by 2030. Given its massive supply, it would require an astronomical market cap. A more realistic target might be a fraction of a cent.

Latest Shiba Inu Price Analysis for 2025: Insights into SHIB Token Market Trends

Shiba Inu (SHIB) in 2025: Ecosystem Growth and Price Analysis

FLOKI Decoded: Core Logic, Roadmap and $0.002 Price Potential by 2031

2025 PUMP Price Prediction: Analyzing Market Trends and Growth Potential for Cryptocurrency Investors

What Does Shiba Mean in Korean: Exploring the Language and Cultural Significance

Is RichQUACK (QUACK) a Good Investment? Analyzing the Potential and Risks of This Meme Token in 2024

Is Rarible (RARI) a good investment?: A Comprehensive Analysis of the NFT Platform's Tokenomics, Market Position, and Future Potential in the Digital Art Ecosystem

Is READY! (READY) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Is Hifi Finance (HIFI) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Potential for 2024

Is Agoric (BLD) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is Chrono.tech (TIMECHRONO) a good investment?: A Comprehensive Analysis of Features, Performance, and Future Potential