2025 CRWNPrice Prediction: Analyzing Market Trends and Growth Potential for Crown Cryptocurrency

Introduction: CRWN's Market Position and Investment Value

Crown by Third Time Games (CRWN) has established itself as a key player in the play-to-earn virtual horse racing ecosystem since its inception. As of 2025, CRWN's market capitalization has reached $19,392,500, with a circulating supply of 250,000,000 tokens and a price hovering around $0.07757. This asset, known as the "Kentucky Derby's Gaming Partner," is playing an increasingly crucial role in the virtual sports and blockchain gaming sectors.

This article will provide a comprehensive analysis of CRWN's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CRWN Price History Review and Current Market Status

CRWN Historical Price Evolution

- 2025: CRWN reached its all-time high of $0.26626 on July 31, marking a significant milestone in its price history

- 2025: The token experienced a sharp decline, hitting its all-time low of $0.05017 on February 3

- 2025: CRWN has shown volatility throughout the year, with price fluctuations between its all-time high and low

CRWN Current Market Situation

As of October 5, 2025, CRWN is trading at $0.07757, representing a 3% decrease in the last 24 hours. The token has seen a positive trend over the past week with a 9.74% increase, but it's down 27.97% over the last 30 days. The current price is significantly below its all-time high, showing a 70.87% decrease from its peak. CRWN's market capitalization stands at $19,392,500, ranking it 1121st in the cryptocurrency market. The 24-hour trading volume is $18,934.04, indicating moderate market activity. With a circulating supply equal to its total supply of 250,000,000 CRWN, the token has reached its maximum supply, which could impact its future price dynamics.

Click to view the current CRWN market price

CRWN Market Sentiment Indicator

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 74. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, such high levels of greed can also indicate overbought conditions and a possible market correction. Traders should exercise caution and consider taking profits or implementing risk management strategies. It's crucial to stay informed and monitor market trends closely during these periods of elevated sentiment.

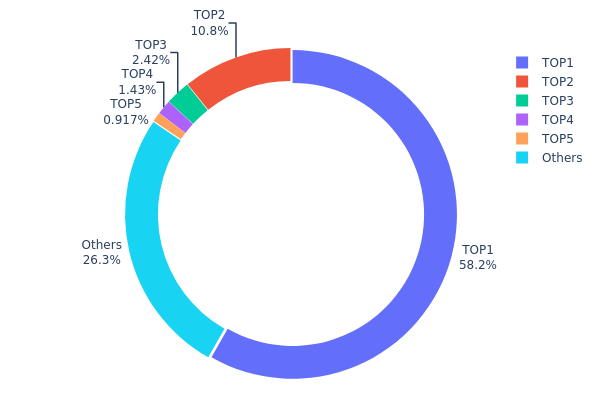

CRWN Holdings Distribution

The address holdings distribution data for CRWN reveals a highly concentrated ownership structure. The top address holds a substantial 58.21% of the total supply, equivalent to 145,543.88K CRWN tokens. This level of concentration raises concerns about potential market manipulation and centralization of control.

The second-largest holder accounts for 10.75% of the supply, while the remaining top 5 addresses collectively hold about 4.74%. This distribution pattern indicates a significant imbalance in token ownership, with the top two addresses controlling nearly 69% of the total supply. Such concentration could lead to increased price volatility and susceptibility to large-scale sell-offs or accumulation events initiated by these major holders.

From a market structure perspective, this high concentration suggests a relatively low level of decentralization for CRWN. It may impact liquidity dynamics and potentially hinder wider adoption of the token. Investors and traders should be aware of these ownership dynamics when considering CRWN, as they could significantly influence future price movements and overall market stability.

Click to view the current CRWN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Cd5sQR...Vswcjd | 145543.88K | 58.21% |

| 2 | HfKFrz...TbgkNm | 26888.39K | 10.75% |

| 3 | 4mwn6j...xrv9Ls | 6039.81K | 2.41% |

| 4 | 3vi3VS...5iPEJ3 | 3562.50K | 1.42% |

| 5 | 4t6Mcs...eT6LUa | 2291.68K | 0.91% |

| - | Others | 65673.46K | 26.3% |

II. Key Factors Affecting CRWN's Future Price

Supply Mechanism

- Historical patterns: Supply and demand imbalances have historically influenced price fluctuations.

- Current impact: The ongoing pandemic has disrupted supply chains, potentially affecting CRWN's price dynamics.

Macroeconomic Environment

- Geopolitical factors: Global geopolitical tensions and trade policies in the semiconductor industry may impact CRWN's market dynamics and price.

Technological Development and Ecosystem Building

- Layer 2 solutions: CROWN has introduced Layer 2 solutions, enhancing system throughput and potentially supporting long-term price trends.

- Cross-chain data aggregation gateway: This technological upgrade has strengthened CROWN's ecosystem, which could influence future price movements.

- Ecosystem applications: Regular protocol updates by the CROWN team contribute to the project's ongoing development, potentially supporting long-term price trends.

III. CRWN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03957 - $0.05000

- Neutral prediction: $0.07758 - $0.08500

- Optimistic prediction: $0.09500 - $0.0993 (requires favorable market conditions and increased adoption)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2026: $0.0513 - $0.11674

- 2027: $0.05745 - $0.14978

- Key catalysts: Project developments, market sentiment, and broader crypto adoption

2030 Long-term Outlook

- Base scenario: $0.14946 - $0.16000 (assuming steady market growth)

- Optimistic scenario: $0.18000 - $0.21796 (with strong project performance and market expansion)

- Transformative scenario: $0.22000 - $0.25000 (under extremely favorable conditions and widespread adoption)

- 2030-12-31: CRWN $0.21796 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0993 | 0.07758 | 0.03957 | 0 |

| 2026 | 0.11674 | 0.08844 | 0.0513 | 14 |

| 2027 | 0.14978 | 0.10259 | 0.05745 | 32 |

| 2028 | 0.13881 | 0.12619 | 0.11483 | 62 |

| 2029 | 0.17887 | 0.1325 | 0.0901 | 70 |

| 2030 | 0.21796 | 0.15568 | 0.14946 | 100 |

IV. CRWN Professional Investment Strategy and Risk Management

CRWN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and gaming enthusiasts

- Operation suggestions:

- Accumulate CRWN tokens during market dips

- Participate actively in the Photo Finish™ LIVE ecosystem

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor game updates and partnerships for potential price impact

- Set strict stop-loss and take-profit levels

CRWN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance CRWN with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for CRWN

CRWN Market Risks

- Volatility: High price fluctuations common in gaming tokens

- Competition: Emerging play-to-earn games could impact market share

- Liquidity: Limited trading pairs may affect ease of buying/selling

CRWN Regulatory Risks

- Gaming regulations: Changes in online gambling laws could affect the project

- Token classification: Potential for CRWN to be classified as a security

- Cross-border restrictions: International regulations may limit global participation

CRWN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: High user growth could strain the platform

- Blockchain network congestion: Solana network issues could impact transactions

VI. Conclusion and Action Recommendations

CRWN Investment Value Assessment

CRWN presents a unique opportunity in the play-to-earn gaming sector, backed by a strong team and partnerships. However, it faces significant competition and regulatory uncertainties. The token's value is closely tied to the success of Photo Finish™ LIVE.

CRWN Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the game ecosystem ✅ Experienced investors: Consider a balanced approach, monitoring game metrics closely ✅ Institutional investors: Conduct thorough due diligence on the project's long-term viability

CRWN Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Explore potential staking options within the Photo Finish™ LIVE ecosystem

- In-game purchases: Use CRWN for transactions within the game platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the target price for CRWD in 2026?

The target price for CRWD in 2026 is $487.00, based on analysts' median forecast. Some predict a low target of $330.00.

What meme coin will explode in 2025 price prediction?

BONK is predicted to explode in price in 2025, driven by internet culture and community hype. Its potential growth is based on past trends of popular meme coins.

What is the stock market prediction for Crown Capital Partners?

Crown Capital Partners stock is predicted to reach 0.754 CAD in 14 days, with long-term forecasts suggesting a potential decline.

What is CRWD stock price prediction 2025?

CRWD stock is predicted to reach $761.95 by 2025, representing an 81.18% increase from current levels.

2025 GOG Price Prediction: Will This Gaming Platform's Stock Soar to New Heights?

2025 WZRD Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

2025 VIRTUALPrice Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Ecosystem

2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

Is Vanar (VANRY) a good investment?: A Comprehensive Analysis of Risk and Potential Returns

Hiểu Về NFT Treasure: Hướng Dẫn Chi Tiết và Nền Tảng Giao Dịch

What is SEND: A Comprehensive Guide to Understanding Special Educational Needs and Disabilities

What is XEM: A Comprehensive Guide to NEM's Native Cryptocurrency and Its Role in Blockchain Technology

What is NIZA: A Comprehensive Guide to Understanding the Next-Generation Internet Security Architecture

What is PSG: A Comprehensive Guide to Paris Saint-Germain Football Club's History, Achievements, and Global Impact