2025 ETCPrice Prediction: Analyzing Key Factors and Market Trends for Ethereum Classic's Future Value

Introduction: ETC's Market Position and Investment Value

Ethereum Classic (ETC), as a decentralized platform for executing smart contracts, has made significant strides since its inception in 2016. As of 2025, Ethereum Classic's market capitalization has reached $3.17 billion, with a circulating supply of approximately 153,457,938 coins, and a price hovering around $20.64. This asset, often referred to as the "Original Ethereum," is playing an increasingly crucial role in the field of decentralized applications and smart contracts.

This article will provide a comprehensive analysis of Ethereum Classic's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ETC Price History Review and Current Market Status

ETC Historical Price Evolution

- 2016: ETC was created following the Ethereum hard fork, starting at $0.615038

- 2017: Bull market, price surged to over $40

- 2018-2019: Crypto winter, price dropped to around $4

- 2021: All-time high of $167.09 reached on May 7th

- 2022-2023: Market downturn, price declined to $15-$20 range

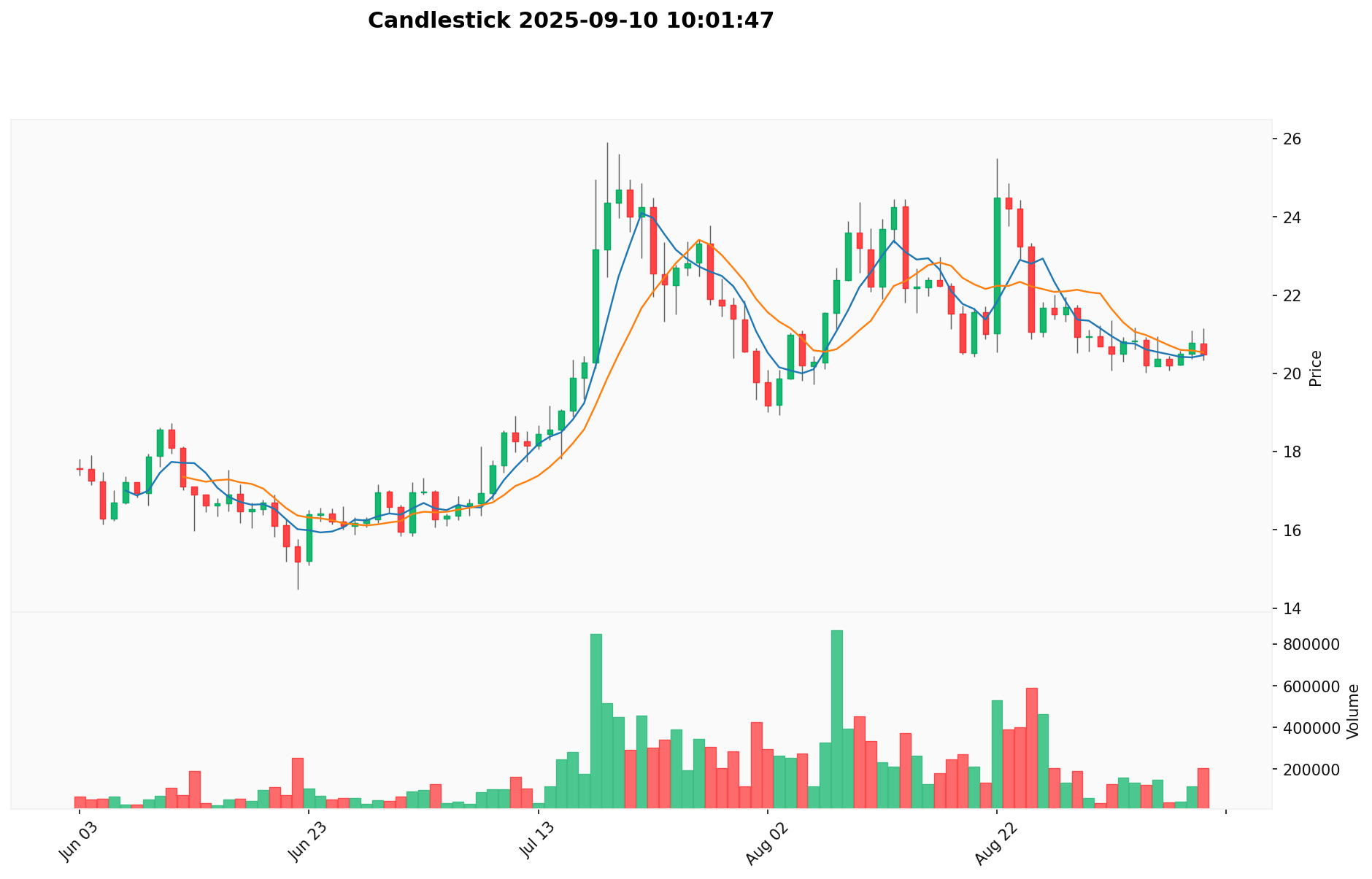

ETC Current Market Situation

As of September 10, 2025, Ethereum Classic (ETC) is trading at $20.637. The 24-hour trading volume stands at $2,878,053.69, with a market cap of $3,166,911,470. ETC has experienced a 1.68% decrease in the last 24 hours, and a 10.78% decline over the past 30 days. However, it shows a 12.57% increase year-over-year. The current price is 87.65% below its all-time high of $167.09, recorded on May 7, 2021. ETC ranks 51st in the cryptocurrency market, with a market dominance of 0.076%.

Click to view the current ETC market price

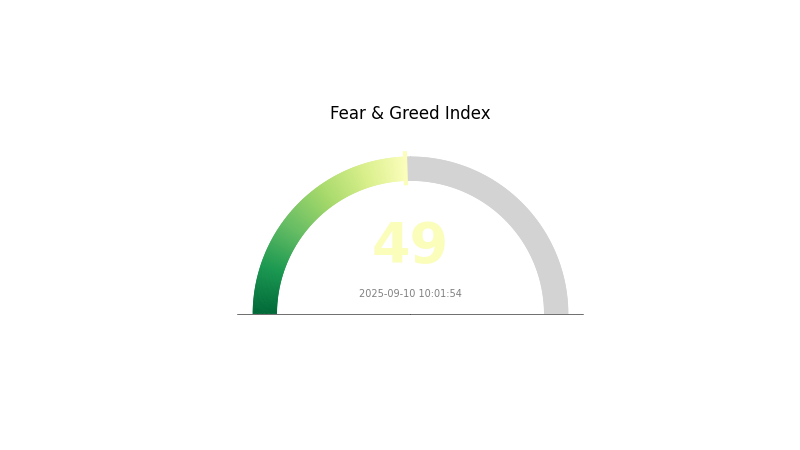

ETC Market Sentiment Indicator

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment for Ethereum Classic (ETC) remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic about ETC's prospects. Traders should remain vigilant, as the market could swing in either direction. It's advisable to conduct thorough research and consider multiple factors before making investment decisions in the current ETC market climate.

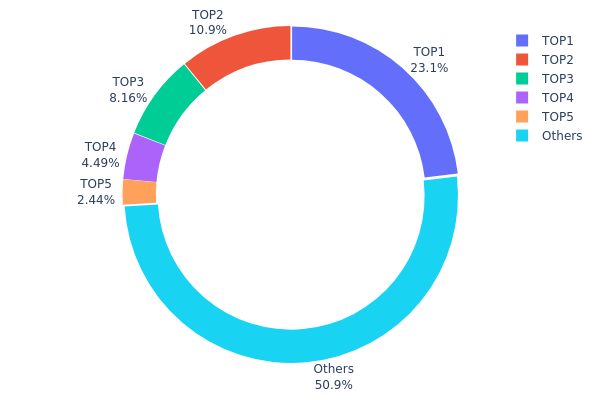

ETC Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of ETC ownership. The top 5 addresses collectively hold 49.08% of the total ETC supply, with the largest holder possessing 23.11%. This indicates a relatively high concentration of ETC in a few hands, which could potentially impact market dynamics.

Such concentration raises concerns about market stability and vulnerability to large-scale movements. The top address, holding nearly a quarter of the supply, has significant influence over price action. This concentration could lead to increased volatility if large holders decide to liquidate their positions. Additionally, it may pose risks of market manipulation, as coordinated actions by top holders could sway prices considerably.

Despite these concerns, it's noteworthy that over 50% of ETC is distributed among other addresses, suggesting some level of decentralization. This wider distribution may help mitigate some risks associated with high concentration. However, the overall holdings structure indicates that ETC's on-chain ownership is still relatively centralized, which could impact its long-term stability and adoption as a decentralized asset.

Click to view the current ETC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x13cd...6d02ad | 35631.88K | 23.11% |

| 2 | 0xd4e3...af5d4d | 16810.59K | 10.90% |

| 3 | 0x00cd...0ade91 | 12580.00K | 8.16% |

| 4 | 0x8793...5e494f | 6912.82K | 4.48% |

| 5 | 0x1f1c...cd5b94 | 3756.04K | 2.43% |

| - | Others | 78434.11K | 50.92% |

II. Key Factors Affecting ETC's Future Price

Supply Mechanism

- Deflationary Model: ETC has a fixed maximum supply of 210.7 million coins, with a decreasing emission rate.

- Historical Pattern: Past supply reductions have generally led to price increases due to scarcity.

- Current Impact: The upcoming reduction in ETC's emission rate is expected to create upward pressure on the price, assuming demand remains stable or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have added ETC to their portfolios, indicating growing institutional interest.

- Corporate Adoption: Some companies are exploring ETC for smart contract applications, potentially driving demand.

- National Policies: Regulatory clarity in some jurisdictions has made ETC more attractive for institutional investors.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued loose monetary policies may drive investors towards cryptocurrencies like ETC as a hedge.

- Inflation Hedging Properties: ETC is increasingly viewed as a potential store of value in inflationary environments.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions may increase interest in decentralized assets like ETC.

Technological Development and Ecosystem Building

- Ethereum Compatibility: ETC maintains compatibility with Ethereum, allowing for easy porting of dApps and smart contracts.

- Scalability Solutions: Ongoing development of layer-2 solutions could enhance ETC's transaction capacity and reduce fees.

- Ecosystem Applications: The growth of DeFi and NFT projects on ETC is expanding its utility and attracting new users to the network.

III. ETC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $10.53 - $15.00

- Neutral prediction: $15.00 - $20.65

- Optimistic prediction: $20.65 - $22.71 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $17.76 - $23.90

- 2028: $14.00 - $31.50

- Key catalysts: Technological advancements, wider institutional acceptance, and overall crypto market trends

2030 Long-term Outlook

- Base scenario: $30.40 - $35.00 (assuming steady growth and adoption)

- Optimistic scenario: $35.00 - $39.58 (assuming favorable regulatory environment and increased utility)

- Transformative scenario: $40.00 - $50.00 (extreme positive conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: ETC $31.67 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 22.7128 | 20.648 | 10.53048 | 0 |

| 2026 | 23.84844 | 21.6804 | 15.39308 | 5 |

| 2027 | 23.90264 | 22.76442 | 17.75625 | 10 |

| 2028 | 31.50027 | 23.33353 | 14.00012 | 13 |

| 2029 | 35.91614 | 27.4169 | 17.82098 | 32 |

| 2030 | 39.58315 | 31.66652 | 30.39986 | 53 |

IV. Professional ETC Investment Strategies and Risk Management

ETC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable growth

- Operation suggestions:

- Accumulate ETC during market dips

- Set a target holding period of at least 2-3 years

- Store ETC in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to limit potential losses

ETC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official ETC wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ETC

ETC Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Competition: Pressure from other smart contract platforms

- Market sentiment: Susceptible to broader crypto market trends

ETC Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations

- Tax implications: Evolving tax laws for cryptocurrency transactions

- Legal status: Varying legal recognition across jurisdictions

ETC Technical Risks

- 51% attacks: Vulnerability to network attacks due to lower hash rate

- Smart contract vulnerabilities: Potential for exploits in dApps

- Scalability challenges: Limited transaction throughput compared to newer blockchains

VI. Conclusion and Action Recommendations

ETC Investment Value Assessment

Ethereum Classic offers long-term potential as a established smart contract platform, but faces short-term risks from market volatility and technical challenges.

ETC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Evaluate ETC as part of a diversified crypto portfolio

ETC Participation Methods

- Spot trading: Buy and hold ETC on Gate.com

- Futures trading: Engage in leveraged trading for short-term opportunities

- Staking: Participate in ETC staking programs for passive income

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can ETC reach $1000?

While ambitious, ETC reaching $1000 is possible. Market trends and growing adoption could drive significant price growth, but it's not guaranteed.

How much will ETC be worth in 2030?

Based on current trends, ETC could be worth between $30 and $56 by 2030, assuming a 5-10% annual growth rate.

Does ETC have a future?

Yes, ETC has potential. Its price has shown gains, and its future depends on market trends and technological advancements. Broader adoption and innovation will be key to its long-term viability.

Will ETC hit $100?

Yes, ETC has the potential to hit $100. Market trends and growing adoption suggest it could reach this milestone in the coming years.

Will Crypto Recover in 2025?

2025 ZRX Price Prediction: Navigating the Future of Decentralized Exchange Tokens

Discover Top Decentralized Exchange Platforms for Crypto Traders

The Future of Decentralized Finance Platforms: Exploring DeFi Exchanges

Innovative Approaches to Decentralized Trading Systems

Explore Velodrome Finance: Everything You Need to Know About the Velodrome Token

A Beginner's Guide to Revolutionary AI Token for DAO Management

Crypto Token Generation Event: A Comprehensive Guide for Investors

Blum Launch Schedule Explained

2025 GRIFFAIN Price Prediction: Expert Analysis and Market Forecast for the Next Generation Digital Asset

2025 ALICE Price Prediction: Expert Analysis and Market Forecast for the Coming Year