2025 FRIEND Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: FRIEND's Market Position and Investment Value

Friend.tech (FRIEND), as a pioneering SocialFi application built on the Layer 2 network Base, has made significant strides since its inception. As of 2025, FRIEND's market capitalization has reached $15,345,782, with a circulating supply of approximately 92,422,200 tokens, and a price hovering around $0.16604. This asset, dubbed "the social influence token," is playing an increasingly crucial role in the realm of social trading and digital influence monetization.

This article will comprehensively analyze FRIEND's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. FRIEND Price History Review and Current Market Status

FRIEND Historical Price Evolution

- 2024: Launch of Friend.tech, price reached all-time high of $5 on May 8, 2024

- 2025: Market correction, price dropped to all-time low of $0.032 on March 10, 2025

- 2025: Gradual recovery, price stabilized around $0.16-$0.17 range

FRIEND Current Market Situation

FRIEND is currently trading at $0.16604, with a 24-hour trading volume of $9,883.57. The token has experienced a slight decrease of 0.97% in the past 24 hours. FRIEND's market capitalization stands at $15,345,782, ranking it at 1029th position in the crypto market. The circulating supply is 92,422,200 FRIEND tokens, with a total supply of 92,620,365.3 and a max supply of 84,805,017 tokens. The token's all-time high was $5, achieved on May 8, 2024, while its all-time low was $0.032, recorded on March 10, 2025. Over the past year, FRIEND has seen a significant decline of 30.53%, reflecting the challenging market conditions in the crypto space.

Click to view the current FRIEND market price

FRIEND Market Sentiment Indicator

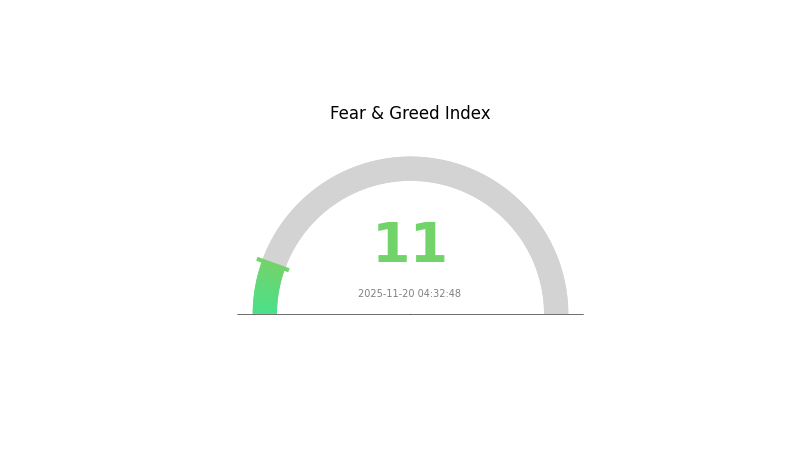

2025-11-20 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the Fear and Greed Index plummeting to a mere 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these turbulent waters.

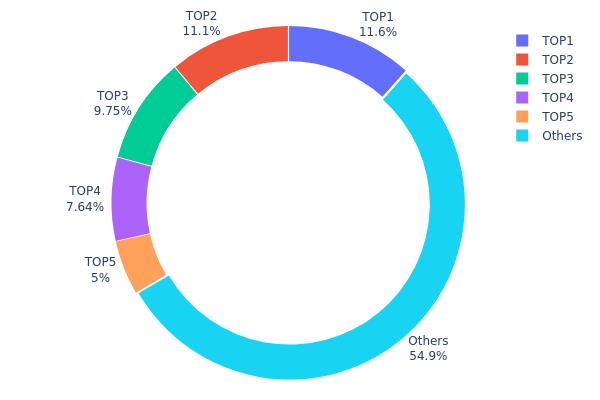

FRIEND Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of FRIEND tokens among different wallet addresses. Analysis of this data reveals a relatively high concentration among the top holders. The top 5 addresses collectively control 45.05% of the total FRIEND supply, with the largest holder possessing 11.59% of tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. The top two addresses each hold over 10% of the supply, giving them significant influence over the token's ecosystem. While 54.95% of tokens are distributed among other addresses, the substantial holdings of the top 5 addresses could impact market dynamics and liquidity.

The current distribution suggests a moderate level of centralization, which may affect the token's resilience to large sell-offs and its overall market stability. Investors should be aware that actions taken by these major holders could have outsized effects on FRIEND's price and trading volume.

Click to view the current FRIEND Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf0ea...79df3d | 11000.03K | 11.59% |

| 2 | 0x7cfc...ef4acf | 10516.66K | 11.08% |

| 3 | 0x2078...be0929 | 9249.41K | 9.74% |

| 4 | 0xdfda...5ac1a1 | 7253.17K | 7.64% |

| 5 | 0xbdbd...80909f | 4744.93K | 5.00% |

| - | Others | 52120.92K | 54.95% |

II. Key Factors Influencing FRIEND's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, significantly affect cryptocurrency prices. Interest rate hikes typically lead to capital flowing towards low-risk assets, causing Bitcoin and other cryptocurrencies to decline. Conversely, rate cuts or abundant market liquidity may drive more funds into the crypto market, pushing prices up.

-

Geopolitical Factors: International situations and geopolitical tensions can influence FRIEND's price. For instance, countries adopting cryptocurrencies as legal tender, like El Salvador did with Bitcoin in 2021, can boost market confidence and potentially impact FRIEND's value.

Regulatory Policies

-

Global Regulatory Landscape: The evolving regulatory stance of various countries towards cryptocurrencies plays a crucial role in shaping FRIEND's future. Regulatory changes, from strict control to open development, affect market confidence and capital flows, introducing variables to the cryptocurrency's future.

-

Compliance Dynamics: The compliance status of major cryptocurrency exchanges can significantly impact FRIEND's price. Positive developments in regulatory compliance can enhance market confidence and potentially drive up prices.

Market Sentiment

-

FOMO and FUD: Market sentiment in the crypto space is heavily influenced by Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD). These psychological factors can lead to rapid price fluctuations, sometimes more significantly than technical or fundamental analyses.

-

News and Social Media Impact: The cryptocurrency market is highly reactive to news and social media trends. Positive or negative news can quickly sway investor sentiment, leading to substantial price movements for FRIEND.

III. FRIEND Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.11325 - $0.15000

- Neutral forecast: $0.15000 - $0.17000

- Optimistic forecast: $0.17000 - $0.18154 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.15004 - $0.28589

- 2028: $0.17103 - $0.33473

- Key catalysts: Technological advancements, expanding use cases, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.28953 - $0.32862 (assuming steady growth and adoption)

- Optimistic scenario: $0.32862 - $0.39762 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.39762+ (with breakthrough innovations and mainstream integration)

- 2030-12-31: FRIEND $0.32862 (97% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.18154 | 0.16655 | 0.11325 | 0 |

| 2026 | 0.23148 | 0.17404 | 0.11487 | 4 |

| 2027 | 0.28589 | 0.20276 | 0.15004 | 21 |

| 2028 | 0.33473 | 0.24433 | 0.17103 | 46 |

| 2029 | 0.3677 | 0.28953 | 0.14766 | 73 |

| 2030 | 0.39762 | 0.32862 | 0.21031 | 97 |

IV. FRIEND Professional Investment Strategies and Risk Management

FRIEND Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and belief in SocialFi

- Operation suggestions:

- Accumulate FRIEND tokens during market dips

- Monitor Friend.tech platform growth and user adoption

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage risk

- Take profits at predetermined price targets

FRIEND Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple SocialFi projects

- Use of stop-loss orders: Limit potential losses on volatile trades

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, be wary of phishing attempts

V. FRIEND Potential Risks and Challenges

FRIEND Market Risks

- High volatility: Price can fluctuate dramatically in short periods

- Liquidity risk: Limited trading volume may lead to slippage

- Competitive landscape: Emergence of new SocialFi projects may impact market share

FRIEND Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of SocialFi platforms

- Cross-border compliance: Varying regulations across jurisdictions may limit growth

- Data privacy concerns: Regulatory focus on user data protection in social platforms

FRIEND Technical Risks

- Smart contract vulnerabilities: Potential for exploitation if security flaws exist

- Scalability challenges: Base network congestion could impact user experience

- Dependency on Twitter: Changes to Twitter's API or policies may affect Friend.tech

VI. Conclusion and Action Recommendations

FRIEND Investment Value Assessment

FRIEND presents a high-risk, high-reward opportunity in the emerging SocialFi sector. Long-term value is tied to the growth of social token economies, while short-term risks include regulatory uncertainty and market volatility.

FRIEND Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the SocialFi ecosystem ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider FRIEND as part of a diversified crypto portfolio

FRIEND Trading Participation Methods

- Spot trading: Purchase FRIEND tokens on Gate.com

- Social token trading: Engage directly on the Friend.tech platform

- Yield farming: Explore potential liquidity provision opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will fun tokens reach $1 dollar?

Based on current projections, FUN tokens are unlikely to reach $1. The highest expected price is estimated to be around $0.0035 in the foreseeable future.

What is the most accurate crypto predictor?

CryptoPredictions.com is widely considered the most accurate, offering daily, monthly, and yearly forecasts for over 8,000 cryptocurrencies.

How much will a link be worth in 2025?

Based on current market trends, analysts predict Chainlink (LINK) could trade between $14.17 and $19.74 in 2025, with an average estimated price of $16.66.

What is the puffer price prediction for 2025?

Based on current market trends, Puffer is predicted to trade between $0.06214 and $0.2486 in 2025.

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Cyber (CYBER) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

What is HYPE: The Psychology Behind Social Media Trends and Viral Content

2025 POL Price Prediction: Bullish Outlook as DeFi Adoption Accelerates

How Has the Crypto Market Volatility Evolved in 2025?

2025 CELR Price Prediction: Analyzing Growth Potential and Market Trends for Celer Network

XRP Price Forecast for 2025-2026: Is It a Good Time to Invest?

Quant Price Forecast 2023-2031: Is QNT a Smart Long-Term Investment?

What is QUACK: A Comprehensive Guide to Understanding This Emerging Technology and Its Applications in Modern Computing

What is VINU: A Comprehensive Guide to Virtual Integrated Network Utilities

What is SHDW: A Comprehensive Guide to Shadow's Revolutionary Blockchain Infrastructure