2025 JUV Price Prediction: Expert Analysis and Market Outlook for Juventus Fan Token

Introduction: Market Position and Investment Value of JUV

Juventus Fan Token (JUV) is a functional token that empowers fans of Juventus Football Club to participate in club governance decisions through the Socios platform and services. Since its launch in December 2020, JUV has established itself as a pioneering fan engagement asset in the sports blockchain ecosystem. As of December 2025, JUV's market capitalization has reached approximately $14.53 million, with a circulating supply of about 14.25 million tokens trading at approximately $0.7283 per token. This innovative "fan governance token" is playing an increasingly important role in transforming how sports organizations interact with their global fan communities through blockchain-based mechanisms.

This comprehensive analysis examines JUV's price trends and market dynamics through 2025, integrating historical performance patterns, market supply and demand factors, ecosystem development, and broader market conditions to provide investors with professional price forecasts and actionable investment strategies.

I. JUV Price History Review and Current Market Status

JUV Historical Price Evolution Trajectory

-

December 2020: Juventus Fan Token launched on Socios platform, reaching an all-time high of $37.83 on December 21, 2020, marking the peak of initial investor enthusiasm for sports-focused fan tokens.

-

April 2020 to Present: The token experienced a significant decline from its historical peak, with an all-time low of $0.604811 recorded on April 16, 2020, reflecting the broader market volatility and changing investor sentiment toward fan tokens.

-

2025 Performance: Over the past year, JUV has declined by 54.97%, indicating sustained downward pressure on the token's valuation despite its foundational utility within the Socios ecosystem.

JUV Current Market Status

As of December 22, 2025, JUV is trading at $0.7283 with a 24-hour trading volume of $301,121.24. The token demonstrates modest short-term positive momentum, with a 1-hour gain of 0.85% and a 24-hour increase of 2.25%. However, this is offset by a 7-day decline of 13.15%, suggesting increased selling pressure over the medium term.

The token's market capitalization stands at approximately $10.38 million, with a fully diluted valuation of $14.53 million, representing a market cap to FDV ratio of 71.41%. JUV has 14,251,086 tokens in circulation out of a maximum supply of 19,956,000, with circulating supply comprising 71.41% of total supply. The token maintains a market dominance of 0.00045%, indicating its relatively modest position within the broader cryptocurrency market.

The current 24-hour trading range for JUV spans from $0.7083 to $0.7998, with 16 active trading pairs available across various platforms. The token maintains 7,810 active holders, reflecting a stable but limited investor base.

Click to view current JUV market price

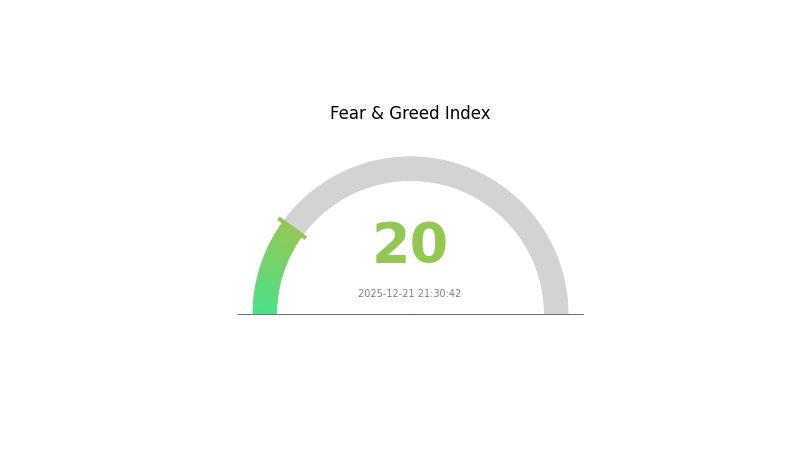

JUV 市场情绪指标

2025-12-21 恐惧与贪婪指数:20(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This reading indicates intense market pessimism and widespread investor anxiety. When the index reaches such lows, it often signals oversold conditions where panic selling dominates. However, extreme fear levels historically present contrarian opportunities, as markets tend to recover when sentiment reaches these depths. Investors should exercise caution while remaining vigilant for potential entry points. Monitor market developments closely on Gate.com to track real-time sentiment shifts and adjust your trading strategy accordingly.

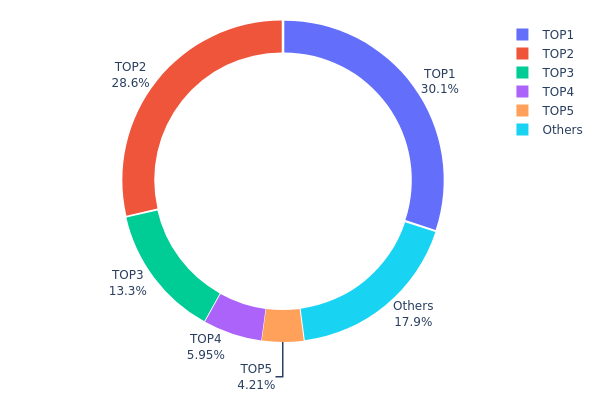

JUV Holdings Distribution

The address holdings distribution chart illustrates the concentration of JUV tokens across the top wallet addresses on the blockchain. This metric serves as a critical indicator of tokenomic health, measuring the degree to which token supply is concentrated among major holders versus dispersed across a broader network of participants. By analyzing the distribution patterns, market participants can assess the potential risks associated with large holder influence and the overall decentralization characteristics of the token ecosystem.

JUV's current holdings distribution exhibits significant concentration risk. The top two addresses collectively control 58.66% of the total token supply, with the leading address alone commanding 30.07% of all circulating tokens. When examining the top five addresses, their combined holdings reach 82.16% of the total supply, leaving only 17.84% distributed among all other addresses. This extreme concentration indicates a highly centralized token structure where decision-making power and market influence are heavily concentrated in the hands of a limited number of entities.

This pronounced concentration presents considerable implications for market dynamics and stability. Such heavily concentrated holdings create elevated risks of potential price manipulation, sudden liquidation events, or coordinated selling that could trigger significant market volatility. The dominance of institutional or whale addresses raises concerns about the sustainability of price stability and the authentic market discovery mechanism. The limited distribution among retail and smaller investors further constrains organic liquidity and may hinder the development of a healthy, self-sustaining market ecosystem. To foster improved decentralization and reduce systemic risk, continued token distribution initiatives and broader community participation would be beneficial for JUV's long-term market maturation.

Click to view current JUV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 6000.00K | 30.07% |

| 2 | 0x6F45...41a33D | 5704.91K | 28.59% |

| 3 | 0x8791...988062 | 2661.14K | 13.34% |

| 4 | 0x76eC...78Fbd3 | 1188.10K | 5.95% |

| 5 | 0x4368...26F042 | 839.35K | 4.21% |

| - | Others | 3562.51K | 17.84% |

II. Core Factors Affecting JUV's Future Price

Supply Mechanism

- Fan Token Liquidity Model: As a fan token, JUV possesses financial attributes through trading liquidity. Fans can freely buy and sell these tokens on major cryptocurrency trading platforms, with prices fluctuating according to market supply and demand dynamics.

Macroeconomic Environment

-

Cryptocurrency Market Sentiment: JUV's price, as a cryptocurrency asset, is influenced by major cryptocurrencies such as Bitcoin and Ethereum. When the overall cryptocurrency market experiences positive momentum, JUV may follow with price increases.

-

Labor Market and Macroeconomic Outlook: Weak labor market data signals lower prices for cryptocurrencies and helps predict macroeconomic conditions. Such data impacts growth expectations, interest rate trends, and liquidity conditions, which in turn affect the broader crypto market where JUV operates.

Team Performance Dynamics

- Juventus Competitive Performance: The team's performance in Serie A, the Italian Cup, and European competitions directly influences fan sentiment and token demand. When the team achieves significant victories or advances in key competitions, fan engagement and token demand typically increase, potentially supporting price appreciation.

III. 2025-2030 JUV Price Forecast

2025 Outlook

- Conservative Forecast: $0.627 - $0.729

- Neutral Forecast: $0.729

- Optimistic Forecast: $0.985 (pending market recovery and increased adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and ecosystem development

- Price Range Forecast:

- 2026: $0.514 - $1.242 (17% upside potential)

- 2027: $0.588 - $1.291 (44% upside potential)

- Key Catalysts: Ecosystem expansion, strategic partnerships, improved market sentiment, and increased utility adoption on Gate.com and other major platforms

2028-2030 Long-term Outlook

- Base Case: $0.901 - $1.592 by 2028 (60% growth trajectory)

- Optimistic Case: $1.119 - $1.961 by 2029 (89% growth potential with sustained bullish momentum)

- Transformational Case: $1.621 - $2.423 by 2030 (129% exponential growth under favorable market conditions and breakthrough developments)

Key Observation: Long-term price trajectory shows sustained growth momentum from 2025 through 2030, with average prices increasing from $0.729 to $1.671, indicating a compound annual growth pattern reflecting increasing market confidence and utility value expansion.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.98442 | 0.7292 | 0.62711 | 0 |

| 2026 | 1.24237 | 0.85681 | 0.51409 | 17 |

| 2027 | 1.291 | 1.04959 | 0.58777 | 44 |

| 2028 | 1.5916 | 1.1703 | 0.90113 | 60 |

| 2029 | 1.96095 | 1.38095 | 1.11857 | 89 |

| 2030 | 2.42287 | 1.67095 | 1.62082 | 129 |

Juventus Fan Token (JUV) Professional Investment Analysis Report

IV. JUV Professional Investment Strategy and Risk Management

JUV Investment Methodology

(1) Long-Term Holding Strategy

-

Target Audience: Sports fans, long-term believers in blockchain-based fan engagement platforms, and investors seeking exposure to tokenized sports entertainment ecosystems.

-

Operational Recommendations:

- Accumulate JUV tokens during market downturns when price volatility creates entry opportunities, particularly during periods of negative sentiment in the broader cryptocurrency market.

- Participate actively in Socios governance voting to maximize the utility and engagement benefits of token holdings beyond speculative value.

- Reinvest rewards earned from Socios activities back into JUV positions to compound holdings over extended periods.

-

Storage Solution:

- Utilize Gate.com's Web3 Wallet for convenient staking and participation in governance activities while maintaining security standards.

- For enhanced security, consider hardware wallet solutions for portions of holdings exceeding your active trading allocation.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour price range (currently $0.7083 to $0.7998) to identify breakout opportunities and consolidation patterns that signal potential trend reversals.

- Volume Analysis: Track the 24-hour trading volume of approximately $301,121 on Gate.com to assess liquidity conditions and confirm the sustainability of price movements.

-

Wave Trading Key Points:

- Execute buy orders during 7-day downtrends (currently at -13.15%) when oversold conditions emerge and technical indicators suggest potential reversal patterns.

- Take profit positions when monthly positive momentum (currently +10.09%) reaches resistance levels, particularly when volume increases significantly above the 24-hour average.

JUV Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: Limit JUV holdings to 1-2% of total cryptocurrency portfolio due to the token's speculative nature, high volatility, and dependency on sustained fan engagement with Juventus FC.

-

Aggressive Investors: Allocate 3-5% of cryptocurrency portfolio to JUV, leveraging governance participation and reward opportunities while maintaining strict stop-loss discipline.

-

Professional Investors: Structure 2-4% positions with dynamic rebalancing based on governance event calendars, liquidity analysis, and correlation studies with broader sports entertainment sector developments.

(2) Risk Hedging Solutions

-

Volatility Management: Execute scaled position entries over multiple tranches rather than lump-sum purchases to reduce timing risk exposure when price swings exceed 10% in either direction.

-

Liquidity Monitoring: Maintain awareness of the current 7,810 token holders and track changes in holder concentration that could signal sudden selling pressure or reduced market depth.

(3) Secure Storage Solutions

-

Hot Wallet Option: Gate.com Web3 Wallet provides seamless integration for participating in Socios governance votes and claiming staking rewards while maintaining reasonable security protocols for active allocations.

-

Cold Storage Approach: For long-term holdings exceeding 6 months, transfer JUV tokens to non-custodial wallets where you control private keys completely, eliminating platform-dependent risks.

-

Security Considerations:

- Never share recovery phrases or private keys with any third party.

- Enable multi-signature authentication where possible when managing significant holdings.

- Verify contract addresses on Chiliz Chain scan (https://scan.chiliz.com/) before executing transfers to avoid phishing schemes.

- Regularly monitor your address on the blockchain explorer for unauthorized access attempts.

V. JUV Potential Risks and Challenges

JUV Market Risks

-

Extreme Price Volatility: JUV has experienced a catastrophic -54.97% decline over the past year and trades 98% below its all-time high of $37.83 (set December 21, 2020), indicating severe loss of investor confidence and market liquidity constraints that could lead to wider price swings with minimal volume catalysts.

-

Liquidity Concentration: With only 16 exchanges listing JUV and a 24-hour trading volume of approximately $301,121, large position exits could cause cascading price declines due to insufficient market depth to absorb sell-side pressure.

-

Token Oversupply Risk: Circulating supply of 14.25 million tokens represents 71.41% of the maximum supply cap of 19.96 million, with future supply increases potentially diluting existing holder value if governance decisions authorize additional token emissions.

JUV Regulatory Risks

-

Sports Licensing Uncertainty: Changes in Italian football federation regulations or UEFA policies regarding tokenized fan participation could render JUV's core utility obsolete or create compliance barriers for Juventus FC's continued operation of the Socios platform.

-

Cryptocurrency Regulatory Evolution: Increasing regulatory scrutiny of token-based governance mechanisms in the European Union could impose restrictions on voting rights or reward distributions to JUV holders in specific jurisdictions.

-

Financial Services Classification: Regulatory bodies may reclassify fan tokens as financial securities, imposing licensing requirements on Socios and potentially limiting retail investor access to JUV trading and participation.

JUV Technical Risks

-

Chiliz Chain Dependency: JUV operates exclusively on Chiliz Chain (a Proof-of-Authority sidechain built on Ethereum), creating single-point-of-failure risk if the underlying chain experiences technical failures, consensus attacks, or abandonment by its developer community.

-

Smart Contract Vulnerabilities: Although Socios operates established governance mechanisms, undiscovered security flaws in JUV's smart contracts could result in permanent loss of trapped capital or unauthorized token redistribution.

-

Cross-Chain Bridge Risk: Future integration with other blockchains would require bridge technology that introduces additional technical complexity and attack vectors that could compromise token security during cross-chain transfers.

VI. Conclusion and Action Recommendations

JUV Investment Value Assessment

Juventus Fan Token (JUV) represents a niche investment opportunity within the tokenized sports entertainment sector, offering governance participation and reward mechanisms for Juventus FC fans. However, the token's catastrophic -54.97% annual decline, extreme distance from historical price peaks, and significant oversupply trajectory present substantial headwinds. The token's value proposition remains contingent on sustained fan engagement through the Socios platform and the blockchain ecosystem's continued viability. Investors should recognize that JUV functions primarily as a governance and engagement utility rather than an appreciating asset class, with historical performance indicating structural challenges in maintaining market value over extended periods.

JUV Investment Recommendations

✅ Beginners: Allocate minimal capital (under 1% of cryptocurrency holdings) exclusively to experience Socios governance participation and fan engagement mechanics. Use small positions to develop direct understanding of how fan tokens function before considering larger allocations.

✅ Experienced Investors: Structure tactical 2-3% allocations using technical support levels as accumulation zones during extended downtrends. Combine position-building with active participation in governance voting to maximize utility value extraction beyond speculative trading.

✅ Institutional Investors: Conduct detailed analysis of Juventus FC's fan base growth trends, Socios platform adoption metrics, and Chiliz ecosystem development before considering JUV as a thematic play on sports tokenization trends. Position sizing should reflect extreme liquidity constraints and regulatory uncertainties in sports-based digital assets.

JUV Trading Participation Methods

-

On Gate.com Spot Trading: Execute buy and sell orders directly through Gate.com's trading interface, where JUV maintains active listing with sufficient liquidity for retail-sized positions. Utilize limit orders to control execution pricing during volatile periods.

-

Socios Platform Integration: Participate in JUV governance voting and reward accumulation activities directly through Socios' fan-focused interface (https://www.socios.com/juventus/), which provides the primary engagement mechanism for token utility beyond trading speculation.

-

Gate.com Web3 Wallet: Maintain JUV holdings in Gate.com's Web3 Wallet for seamless integration with Socios applications while preserving the ability to transfer tokens to external wallets for enhanced security over extended holding periods.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What are the benefits of holding juv coin?

Holding JUV coin provides potential price appreciation, voting rights in the Juventus fan token ecosystem, and exclusive access to club-related perks and benefits.

What is juv coin used for?

JUV is the Juventus Fan Token enabling supporters to engage with Juventus Football Club, participate in club decisions, and access exclusive fan experiences and rewards.

How much is Juventus fan token?

The Juventus Fan Token (JUV) is priced at $0.745618 as of December 21, 2025, with a market cap of $10.40 million. JUV enables fans to participate in voting on club decisions and governance matters.

Crypto Crash or Just a Correction?

Pi to PHP: Current Exchange Rate and Conversion Guide (2025)

2025 KSM Price Prediction: Analyzing Market Trends and Future Growth Potential of Kusama Network

2025 DCR Price Prediction: Analyzing Decred's Future Potential Amid Evolving Market Dynamics

EXT Price Meaning: What It Is and How to Understand It

2025 RVNPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Ravencoin

How does HYPE crypto respond to Federal Reserve policy and macroeconomic inflation data?

Secure Methods to Acquire Memecoins: Comprehensive Guide

What are the compliance and regulatory risks of HYPE crypto token in 2025?

Top Cryptocurrencies to Consider Investing in for 2025

How to Use On-Chain Data Analysis to Track Active Addresses, Whale Movements, and Transaction Trends in Crypto