2025 NFP Price Prediction: Expert Analysis and Market Outlook for Gold and USD in the Coming Year

Introduction: NFP's Market Position and Investment Value

NFPrompt (NFP) is an AI-driven UGC platform designed for the new generation of Web3 creators, serving as an all-in-one ecosystem combining AI-creation, social community, and commercialization. Since its launch in December 2023, the project has established itself in the Web3 creator economy space. As of December 2025, NFP maintains a market capitalization of approximately $22.09 million with a circulating supply of around 534.92 million tokens, trading at approximately $0.02209 per token.

This emerging digital asset is playing an increasingly important role in empowering Web3 creators through AI-driven content generation and tokenized monetization mechanisms.

This article will comprehensively analyze NFP's price trajectory and market dynamics, integrating historical patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for informed decision-making in the Web3 creator economy segment.

NFPrompt (NFP) Market Analysis Report

I. NFP Price History Review and Current Market Status

NFP Historical Price Evolution Trajectory

-

December 2023: NFP reached its all-time high (ATH) of $1.28501 on December 27, 2023, marking the peak of the token's market performance since its launch on December 26, 2023.

-

2024-2025: The token entered a prolonged downward trend, experiencing significant depreciation throughout this period as market conditions shifted.

-

December 2025: NFP touched its all-time low (ATL) of $0.02082 on December 18, 2025, representing a decline of approximately 91.91% from its historical high over roughly two years.

NFP Current Market Status

As of December 21, 2025, NFP is trading at $0.02209, reflecting a modest rebound of approximately 6.10% from its recent low point. Over the past 24 hours, the token has declined by 2.96%, with a trading range between $0.02196 (low) and $0.02326 (high).

Market Capitalization Metrics:

- Market Cap: $11,816,387.04

- Fully Diluted Valuation (FDV): $22,090,000.00

- Market Cap to FDV Ratio: 53.49%

- Trading Volume (24h): $14,974.21

- Market Dominance: 0.00068%

Token Distribution:

- Circulating Supply: 534,920,191.78 NFP (53.49% of total supply)

- Total Supply: 1,000,000,000 NFP

- Total Holders: 11,595

Price Performance Across Timeframes:

- 1 Hour: -2.00%

- 24 Hours: -2.96%

- 7 Days: -14.31%

- 30 Days: -29.45%

- 1 Year: -91.91%

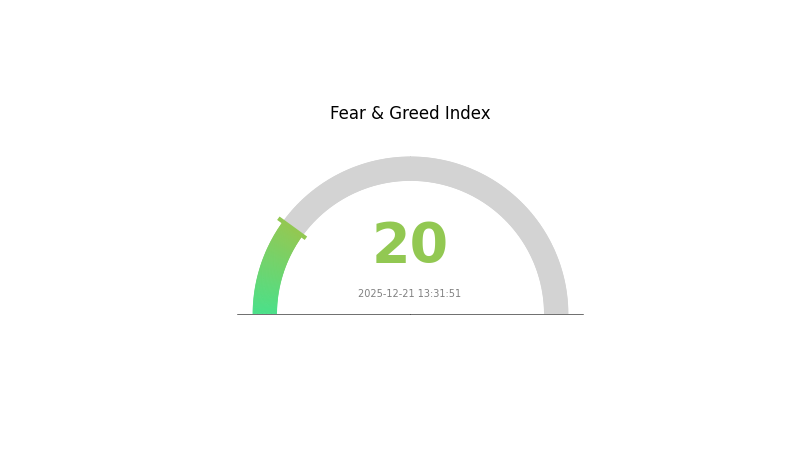

The token is currently listed on 18 exchanges and operates on the BEP20 standard (Binance Smart Chain). The current market sentiment reflects extreme fear, with a Crypto Fear & Greed Index reading of 20.

Check current NFP market price

NFP Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates severe market pessimism and heightened investor anxiety. Such extreme fear levels typically present contrarian opportunities, as historically markets tend to reverse from extreme sentiment readings. Investors should exercise caution while remaining alert to potential buying opportunities. Monitoring market fundamentals and risk management strategies becomes crucial during periods of extreme fear to navigate volatile market conditions effectively.

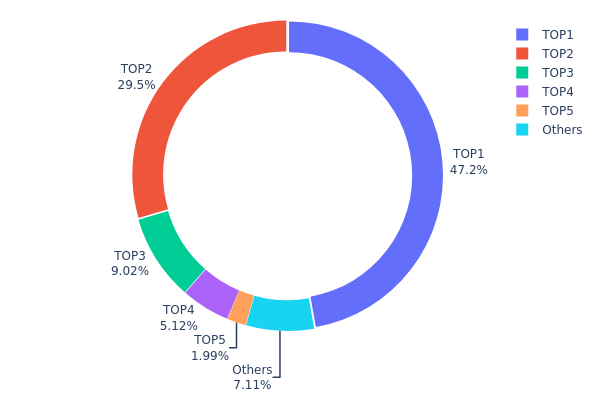

NFP Token Holdings Distribution

The address holding distribution map illustrates the concentration of NFP token ownership across the blockchain ecosystem, revealing the extent to which tokens are distributed among large holders versus smaller participants. This metric serves as a critical indicator of decentralization, market structure stability, and potential vulnerability to price manipulation or coordinated liquidation events.

The current NFP holding distribution exhibits pronounced concentration risk, with the top two addresses collectively commanding 76.75% of total token supply. The leading address (0x3ebc...f7c6e7) alone maintains 47.21% of circulating tokens, representing a dominant single-entity position that substantially exceeds healthy decentralization thresholds. The second-largest holder (0xf977...41acec) controls an additional 29.54%, suggesting these two entities exercise disproportionate influence over protocol governance and market dynamics. The third, fourth, and fifth addresses account for 9.01%, 5.12%, and 1.98% respectively, while the remaining distributed holdings represent merely 7.14% of the token supply.

This extreme concentration profile indicates significant structural vulnerability within the NFP ecosystem. The asymmetric distribution creates conditions favorable for price volatility and potential market manipulation, as the top holders possess sufficient capital to materially influence market sentiment and liquidity conditions. The minimal proportion held by decentralized participants (7.14%) further underscores the token's centralized nature, limiting organic price discovery mechanisms and community-driven governance participation. Such concentration patterns typically correlate with elevated liquidation risk during adverse market conditions and reduced resistance to coordinated selling pressure.

Click to view current NFP Token Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ebc...f7c6e7 | 465079.81K | 47.21% |

| 2 | 0xf977...41acec | 291007.68K | 29.54% |

| 3 | 0xff97...8d739a | 88845.87K | 9.01% |

| 4 | 0x87a7...054039 | 50446.08K | 5.12% |

| 5 | 0x0000...00dead | 19601.11K | 1.98% |

| - | Others | 70019.45K | 7.14% |

II. Core Factors Affecting NFP's Future Price Direction

Macroeconomic Environment

Federal Reserve Policy Impact

- Strong NFP data typically reinforces market confidence in the U.S. economy, potentially pushing the Federal Reserve toward maintaining higher interest rates or continuing rate hikes to control inflation. Conversely, weak employment data may prompt the Fed to pause or reduce rates.

- The Federal Reserve heavily relies on employment data when formulating interest rate policy. Strong job growth can prompt rate hikes to combat inflation, while weak employment figures may lead to rate cuts or maintenance of current levels.

- Interest rate expectations directly impact bond yields, the U.S. dollar exchange rate, and stock market performance.

Inflation Hedging Properties

- NFP data serves as a key indicator for assessing inflation pressures in the labor market. Average Hourly Earnings (AHE) growth is particularly important, as it reflects wage inflation trends and helps policymakers gauge inflationary risks.

- In environments where the Fed faces policy uncertainty—such as market expectations diverging from official guidance—gold and other hedging assets may benefit regardless of whether NFP data is strong or weak, creating dual catalysts for safe-haven demand.

Market Sentiment and Volatility

- When NFP data significantly exceeds expectations, investor confidence strengthens, potentially driving short-term stock market rallies and supporting risk assets.

- Weak employment data may trigger panic selling, with funds withdrawing from risk assets as markets price in economic slowdown concerns.

- Market reaction to NFP is rapid and pronounced. The U.S. dollar index may experience sharp movements (100+ point swings), while gold prices can shift by $30-40 per ounce within minutes of data release.

- The impact extends across multiple asset classes including foreign exchange markets, equity indices, and commodities, with particular sensitivity in rate-sensitive sectors such as financials and technology stocks.

Technical and Structural Analysis

- Different industries show varying sensitivity to employment data. The service and retail sectors typically respond faster to job growth changes due to their direct link to consumer spending, while manufacturing may lag.

- NFP data serves as a key trigger for technical trading signals. Strong data breaking through resistance levels can spark technical buying; weak data breaking support levels may trigger stop-loss orders or short positioning.

- Changes in employment composition matter: private sector growth versus government sector decline can reveal different economic signals despite overall headline figures.

III. 2025-2030 NFP Price Forecast

2025 Outlook

- Conservative Forecast: $0.0158 - $0.02195

- Neutral Forecast: $0.02195

- Bullish Forecast: $0.03205 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Recovery and gradual expansion phase with increasing adoption and market recognition

- Price Range Predictions:

- 2026: $0.02484 - $0.03348

- 2027: $0.0251 - $0.03296

- 2028: $0.0237 - $0.04013

- Key Catalysts: Enhanced tokenomics implementation, expanded partnerships, ecosystem growth initiatives, and positive regulatory environment development

2029-2030 Long-term Outlook

- Base Case: $0.03313 - $0.0364 (assuming steady market maturation and moderate adoption growth)

- Bullish Case: $0.03479 - $0.03694 (contingent on accelerated ecosystem expansion and institutional adoption)

- Transformational Case: $0.04696 (extreme favorable conditions including breakthrough partnerships, major protocol upgrades, and mainstream adoption acceleration)

- 2030-12-31: NFP targeting $0.04696 (peak price projection representing 64% cumulative appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03205 | 0.02195 | 0.0158 | 0 |

| 2026 | 0.03348 | 0.027 | 0.02484 | 22 |

| 2027 | 0.03296 | 0.03024 | 0.0251 | 36 |

| 2028 | 0.04013 | 0.0316 | 0.0237 | 43 |

| 2029 | 0.03694 | 0.03586 | 0.03479 | 62 |

| 2030 | 0.04696 | 0.0364 | 0.03313 | 64 |

NFPrompt (NFP) Professional Investment Strategy and Risk Management Report

IV. NFP Professional Investment Strategy and Risk Management

NFP Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Web3 enthusiasts and creators seeking exposure to AI-driven content platforms with long-term conviction

- Operational Recommendations:

- Accumulate NFP tokens during market downturns, particularly given the current 91.91% decline over the past year, which may present entry opportunities for patient investors

- Set a 2-3 year holding horizon to benefit from potential platform adoption growth and ecosystem expansion

- Establish position targets based on personal risk tolerance and dollar-cost averaging to reduce timing risk

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.02196-$0.02326) and historical lows ($0.02082) as key technical levels for entry and exit decisions

- Moving Averages: Track short-term price trends over 7-day and 30-day periods to identify momentum shifts

- Swing Trading Key Points:

- Monitor volume patterns relative to the 24-hour trading volume of $14,974.21 to confirm price movements

- Watch for breakouts above the current daily high of $0.02326 as potential bullish signals

NFP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Active Investors: 3-7% of total crypto portfolio allocation

- Professional Investors: 7-10% of total crypto portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 40-50% of allocated capital in stablecoins to enable opportunistic purchases during volatility spikes

- Portfolio Diversification: Combine NFP with other established Web3 infrastructure tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hardware Wallet Approach: For amounts exceeding $1,000, transfer NFP to secure self-custody solutions compatible with BSC (Binance Smart Chain)

- Hot Wallet Strategy: Gate.com Web3 wallet for active trading amounts, enabling quick execution while maintaining security standards

- Security Considerations: Never share private keys or recovery phrases; enable multi-signature authorization for large transfers; regularly verify contract addresses to avoid phishing scams

V. NFP Potential Risks and Challenges

NFP Market Risk

- Extreme Price Volatility: NFP has experienced a catastrophic 91.91% decline over the past year and 29.45% depreciation over 30 days, indicating severe market instability and potential for further losses

- Low Trading Liquidity: The relatively modest 24-hour trading volume of $14,974.21 relative to market cap suggests limited liquidity, creating risks of wide bid-ask spreads and slippage during large transactions

- Market Sentiment Deterioration: The ongoing downward pressure across multiple timeframes (1H: -2%, 24H: -2.96%, 7D: -14.31%) indicates sustained negative sentiment

NFP Regulatory Risk

- Cryptocurrency Classification Uncertainty: Evolving global regulations regarding token classification and platform governance may impact NFPrompt's operational status

- Jurisdictional Compliance: Platform expansion into regulated markets may face restrictions or require significant adaptations to legal requirements

- Platform Monetization Scrutiny: Regulatory bodies may challenge the commercial mechanisms embedded in UGC platforms, particularly around content creator compensation models

NFP Technical Risk

- Smart Contract Vulnerability: BSC-based token infrastructure may face unforeseen security vulnerabilities, potentially affecting token transfers or platform functionality

- Platform Adoption Challenges: As an emerging AI-driven platform, NFPrompt faces execution risks in achieving meaningful user adoption and creator engagement

- Technological Obsolescence: Rapid AI and Web3 development may render the platform's current technology stack outdated without continuous innovation investment

VI. Conclusions and Action Recommendations

NFP Investment Value Assessment

NFPrompt presents a speculative investment opportunity targeting the intersection of AI-driven content creation and Web3 creator economics. However, the token's performance—with a 91.91% annual decline and current market sentiment challenges—reflects significant execution risks and market uncertainty. The platform's viability depends on achieving substantial adoption among Web3 creators and monetizing its AI-creation ecosystem effectively. The fully diluted valuation of $22.09 million suggests modest market confidence. Investors should approach this asset with extreme caution, reserving capital allocation for positions they can afford to lose entirely.

NFP Investment Recommendations

✅ Beginners: Start with micro-positions (under 0.5% of crypto allocation) only after thoroughly understanding the NFPrompt platform roadmap and creator economy dynamics. Use Gate.com's educational resources to evaluate the project fundamentals before committing capital.

✅ Experienced Investors: Consider opportunistic accumulation during extreme bearish periods while setting strict stop-loss orders at 20-30% below entry prices. Actively monitor platform adoption metrics and team execution on development milestones.

✅ Institutional Investors: Conduct comprehensive due diligence on NFPrompt's tokenomics, team background, and platform traction metrics. Establish clear liquidity requirements given the relatively low trading volume and structure positions as speculative venture-style allocations rather than core holdings.

NFP Trading Participation Methods

- Gate.com Spot Trading: Access NFP trading pairs directly through Gate.com's spot trading interface for immediate execution with competitive spreads

- Dollar-Cost Averaging: Execute regular small purchases across multiple timeframes to reduce timing risk and average entry costs during prolonged downtrends

- Limit Order Strategy: Set predetermined buy orders at support levels ($0.02082 - $0.02196 range) to capture entries without requiring active monitoring

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose entirely. The crypto market remains highly speculative and unpredictable.

FAQ

What is NFP crypto?

NFP is the native cryptocurrency of the Non-Fungible People project, designed to support a community-driven platform. It facilitates transactions and governance within the NFP ecosystem.

How much is nfp crypto?

As of December 21, 2025, NFP crypto is priced at $0.02226385. The token has experienced a 1.62% decrease in the last 24 hours. Real-time price fluctuations occur continuously in the market.

How much will cryptocurrency be worth in 2025?

Cryptocurrency valuations vary by asset. Bitcoin predictions for 2025 range significantly, with some analysts projecting $200,000+. Actual prices depend on market adoption, regulation, and macroeconomic factors. Individual cryptocurrencies have distinct value drivers and market dynamics.

Janitor Coin Deep Dive: Innovative Whitepaper Logic Reshaping Cryptocurrency Utility

Janitor Crypto Unveiled: How This Token Could Be The Next Blockchain Revolution

What is SIREN: Understanding the Advanced Neural Network Representation for Implicit Functions

Mira Network Price Prediction and Market Insights

What is CGPT: Understanding the Revolutionary AI Language Model That's Changing How We Interact With Technology

What is PAAL: A Comprehensive Guide to the Pathology Artificial Intelligence Augmented Learning Framework

Top Bitcoin Debit Cards for Secure Crypto Payments in 2025

Understanding Ye Coin: A Guide to Investment and Blockchain Insights

Understanding HEHE Coin: A Detailed Overview of HEHE Token and its Role in Web3

Global Leaders in Bitcoin Usage: Top 10 Countries

Ultimate Guide to Safeguarding Your Web3 Assets with a Multi-Chain Wallet