2025 OAS Price Prediction: Market Analysis and Expert Forecasts for the Coming Year

Introduction: Market Position and Investment Value of OAS

Oasys (OAS), as a public blockchain specialized in gaming backed by renowned gaming companies, has established itself as a transformative force in the gaming blockchain sector since its launch. As of December 2025, OAS maintains a market capitalization of approximately $17.36 million with a circulating supply of 6.25 billion tokens, currently trading at $0.001736. This innovative asset, recognized as a "gaming-focused blockchain infrastructure," is playing an increasingly vital role in revolutionizing how games integrate blockchain technology through its unique multi-layer architecture consisting of the highly scalable Hub-Layer and the Verse-Layer powered by Ethereum's Layer 2 scaling solutions.

This comprehensive analysis will examine OAS price trends from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Oasys (OAS) Market Analysis Report

I. OAS Price History Review and Current Market Status

OAS Historical Price Evolution

Based on available data, Oasys has experienced significant volatility since its market introduction:

- February 13, 2024: All-Time High (ATH) reached at $0.141992, representing the peak valuation during the project's market cycle

- December 19, 2025: All-Time Low (ATL) recorded at $0.00169078, marking a historic low point

- December 22, 2025: Current price stabilizes at $0.001736, reflecting substantial depreciation from peak levels

The one-year price movement shows a dramatic decline of -95.36%, indicating severe downward pressure on the token's valuation over the extended period.

OAS Current Market Situation

As of December 22, 2025, Oasys presents the following market metrics:

Price Performance:

- Current trading price: $0.001736

- 24-hour change: -0.4%

- 1-hour change: +0.64%

- 7-day change: -14.01%

- 30-day change: -29.099%

Market Capitalization and Liquidity:

- Market Capitalization: $10,842,398.52

- Fully Diluted Valuation (FDV): $17,360,000

- Market Cap to FDV Ratio: 62.46%

- 24-hour Trading Volume: $18,404.21

- Market Dominance: 0.00054%

Supply Distribution:

- Circulating Supply: 6,245,621,265.71 OAS (62.46% of total supply)

- Total Supply: 10,000,000,000 OAS

- Maximum Supply: 10,000,000,000 OAS

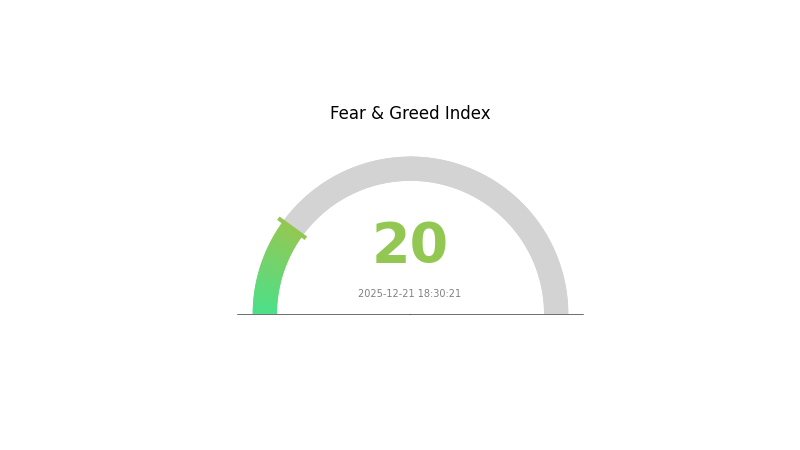

Market Sentiment: Current market conditions reflect extreme fear sentiment (VIX rating: 20), indicating heightened risk aversion across broader cryptocurrency markets.

Visit OAS Market Price on Gate.com for real-time data

OAS Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates severe market pessimism and heightened risk aversion among investors. During periods of extreme fear, markets often present contrarian opportunities for long-term investors, though short-term volatility remains elevated. Traders should exercise caution and maintain strict risk management protocols. Monitor key support levels closely and consider dollar-cost averaging strategies if you plan to enter positions. For real-time market data and sentiment analysis, visit Gate.com's comprehensive market sentiment tools to stay informed on market conditions.

OAS Holdings Distribution

Due to the absence of specific address holdings data in the provided table, a comprehensive analysis of OAS token concentration cannot be conducted at this time. However, the following framework outlines how such analysis would typically be structured:

Address holdings distribution represents a critical on-chain metric that reveals the concentration patterns of token ownership across different wallet addresses. This indicator serves as a fundamental measure of decentralization, providing insights into whether token supply is widely dispersed among numerous participants or concentrated among a limited number of large holders, commonly referred to as "whales." By examining the distribution of holdings across top addresses, analysts can assess potential systemic risks related to price manipulation, sudden liquidity events, and overall market stability.

The concentration degree of token holdings directly influences market dynamics and price discovery mechanisms. When a significant portion of total supply is concentrated in relatively few addresses, the protocol becomes susceptible to coordinated selling pressure or potential market manipulation. Conversely, a well-distributed token supply across numerous addresses typically indicates stronger decentralization and reduced vulnerability to single-entity influence. The relationship between holder concentration and market volatility is particularly pronounced during periods of market stress, where concentrated holders may trigger cascading liquidations or sharp price movements.

To provide a thorough assessment of OAS's current market structure, circulating supply concentration data would need to be available. Such analysis would enable evaluation of the token's decentralization maturity and long-term sustainability prospects.

For current OAS holdings distribution data, please visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing OAS Future Price Trends

Macroeconomic Environment

-

Monetary Policy Impact: U.S. Federal Reserve policy expectations have become the core driving force for future yield curve movements. Markets are gradually pricing in the possibility of inflation decline and economic growth slowdown in 2026. Interest rate changes and monetary policy shifts significantly impact OAS spreads. The Federal Reserve's rate adjustment decisions will continue to be a critical determinant of OAS trajectory.

-

Inflation Hedge Properties: Inflation rates play a crucial role in OAS dynamics. As markets anticipate inflation cooling in 2026 paired with economic deceleration, OAS spreads are expected to respond accordingly. The relationship between inflation expectations and option-adjusted spreads remains a key mechanism through which macroeconomic conditions influence credit market pricing.

-

Geopolitical Factors: Global market conditions and geopolitical events influence OAS performance. Emerging market risks have the potential to spread and affect market performance, similar to patterns observed during 2020. Market sentiment shifts resulting from international tensions can drive OAS volatility.

Technical Development and Ecosystem Building

- MBS Supply and Demand Dynamics: OAS spread changes typically originate from mortgage-backed securities (MBS) supply and demand imbalances, hedge fund trading strategies, and shifts in prepayment expectations. These factors directly influence MBS pricing sensitivity to OAS spread movements, creating technical trading pressures that affect overall spread levels.

III. 2025-2030 OAS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00161-$0.00174

- Neutral Forecast: $0.00174 (annual average)

- Optimistic Forecast: $0.00182 (stable market conditions maintained)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with moderate volatility, transitioning toward growth trajectory as adoption expands.

- Price Range Forecasts:

- 2026: $0.00116-$0.00226

- 2027: $0.0017-$0.00259

- 2028: $0.00173-$0.00311

- Key Catalysts: Increasing ecosystem development, improved liquidity on platforms like Gate.com, growing institutional interest, and potential regulatory clarity in major markets.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00146-$0.00317 (sustained market development and incremental adoption)

- Optimistic Scenario: $0.00270-$0.0042 (accelerated ecosystem expansion and mainstream institutional participation)

- Transformation Scenario: $0.0042+ (breakthrough technological advancement, significant market penetration, and major partnership announcements)

- 2030-12-31: OAS projected at $0.0042 maximum valuation (under favorable cumulative conditions)

Analysis Note: The forecast data indicates a cumulative upside potential of approximately 69% from 2025 to 2030, reflecting a compound annual growth rate trajectory. Investors should monitor ecosystem development milestones and market liquidity conditions through major trading venues such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00182 | 0.00174 | 0.00161 | 0 |

| 2026 | 0.00226 | 0.00178 | 0.00116 | 2 |

| 2027 | 0.00259 | 0.00202 | 0.0017 | 16 |

| 2028 | 0.00311 | 0.0023 | 0.00173 | 32 |

| 2029 | 0.00317 | 0.00271 | 0.00146 | 55 |

| 2030 | 0.0042 | 0.00294 | 0.0027 | 69 |

Oasys (OAS) Professional Investment Strategy and Risk Management Report

IV. OAS Professional Investment Strategy and Risk Management

OAS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Gaming enthusiasts, blockchain infrastructure investors, and those bullish on gaming-focused blockchain ecosystems

- Operational Recommendations:

- Accumulate OAS tokens during market downturns, particularly when prices reach support levels below $0.002

- Maintain positions through market cycles, recognizing that gaming blockchain adoption typically follows longer adoption curves

- Dollar-cost averaging (DCA) approach to reduce timing risk over 6-12 month periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA 20, MA 50, MA 200): Use to identify trend direction and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought (>70) and oversold (<30) conditions for entry/exit signals

- Trading Key Points:

- Current price of $0.001736 represents a 99% decline from all-time high of $0.141992, requiring careful entry timing

- 24-hour volume of approximately $18,404 indicates relatively low liquidity; execute larger orders with caution to avoid slippage

- Recent price stability near all-time lows suggests potential consolidation phase

OAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 2-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Allocate OAS holdings alongside established layer-1 and layer-2 blockchain assets to reduce concentration risk

- Position Sizing: Never exceed predetermined portfolio allocation percentages to manage downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading activities and easy access

- Cold Storage Approach: For long-term holdings, utilize hardware storage solutions to protect against exchange-related risks

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts, use hardware security keys, maintain secure backup of private keys in multiple physical locations, and never share wallet recovery phrases

V. OAS Potential Risks and Challenges

OAS Market Risk

- Extreme Price Volatility: OAS has declined 95.36% over the past year and 99% from its all-time high, indicating substantial market risk and severe price instability

- Liquidity Constraints: With only $18,404 in 24-hour trading volume and limited exchange listing (7 exchanges), liquidity is highly constrained, potentially resulting in significant slippage during large trades

- Market Sentiment Deterioration: Negative 30-day (-29.099%) and 7-day (-14.01%) price performance suggest weakening market confidence in the project

OAS Regulatory Risk

- Blockchain Gaming Regulation Uncertainty: Many jurisdictions are developing regulations specifically targeting gaming tokens and play-to-earn mechanics, creating potential compliance challenges

- Cross-Border Legal Exposure: As a gaming-focused blockchain, OAS may face varying regulatory treatment across different geographic markets where gaming is governed differently

- Financial Designation Risk: Future regulatory classifications of gaming tokens as securities could impact OAS's trading and distribution capabilities

OAS Technical Risk

- Multi-Layer Architecture Complexity: The Hub-Layer and Verse-Layer structure introduces technical complexity that requires robust maintenance and security auditing

- Smart Contract Vulnerability: While EVM-compatible, the platform remains vulnerable to smart contract exploits common in the gaming DApp ecosystem

- Scalability Validation: Achieving the promised scalability through Verse-Layer (Ethereum's layer-2 solutions) requires continuous optimization and may face performance bottlenecks during peak gaming demand

VI. Conclusions and Action Recommendations

OAS Investment Value Assessment

Oasys presents a specialized gaming blockchain opportunity with notable technological differentiation through its Hub-Verse architecture. However, the project faces significant headwinds: the 95.36% annual decline, extreme volatility, and low trading liquidity present substantial risks. The long-term value proposition depends critically on mainstream adoption of gaming DApps and the project's ability to compete within an increasingly crowded gaming blockchain landscape. Current price levels suggest market has repriced the project significantly, potentially offering accumulation opportunities for high-risk-tolerance investors, but the trajectory and adoption metrics require continued monitoring.

OAS Investment Recommendations

✅ Beginners: Allocate only 0.5-1% of portfolio if interested in gaming blockchain exposure; prioritize understanding the Oasys ecosystem before committing capital; consider starting with small positions at current low price levels

✅ Experienced Investors: Implement disciplined position sizing (2-5% allocation), utilize technical analysis to identify reversal patterns, and maintain strict stop-loss levels at 30-40% below entry points

✅ Institutional Investors: Conduct detailed due diligence on game developer partnerships and ecosystem activity metrics; consider exposure only if gaming blockchain thesis becomes core investment theme; evaluate liquidity constraints before determining position sizes

OAS Trading Participation Methods

- Spot Trading: Purchase OAS directly on Gate.com with BTC or stablecoin pairs; suitable for long-term holders

- Limit Orders: Utilize limit order functionality on Gate.com to accumulate at predetermined price levels, avoiding market slippage

- Staking/Yield Programs: Monitor Oasys ecosystem for staking opportunities or liquidity provision mechanisms that may generate additional returns beyond price appreciation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can Oasis Network go?

Based on current market analysis, ROSE token could potentially reach $0.267 by end of 2025. Long-term, with network adoption and ecosystem growth, prices could climb significantly higher in subsequent years.

What is the price of OAS?

The price of OAS is $0.00169467 as of December 21, 2025, down 0.47534% in the last 24 hours. OAS trades actively across major platforms with significant daily trading volume.

What is Oasis Network (OAS) and what are its use cases?

Oasis Network is a Layer 1 blockchain focused on privacy, scalability, and data tokenization. Its use cases include decentralized applications, privacy-protected Web3 services, AI integration, and data ownership solutions with enhanced security and cross-chain interoperability.

What factors could influence OAS price in the future?

OAS price will be influenced by supply and demand dynamics, protocol updates, block reward halvings, hard forks, and real-world events. Market sentiment and trading volume also play significant roles in price movements.

What are the risks and potential challenges for Oasis Network?

Oasis Network faces regulatory uncertainties, technological hurdles, and intense competition from other blockchain projects. These factors could impact market adoption and long-term viability.

2025 CORE Price Prediction: Analyzing Potential Growth Factors and Market Trends in the Cryptocurrency Ecosystem

2025 CORE Price Prediction: Analyzing Growth Potential and Market Factors for Widespread Adoption

What is XAI: Exploring the World of Explainable Artificial Intelligence

What is XAI: Exploring the World of Explainable Artificial Intelligence and Its Impact on Decision-Making Systems

What is XAI: Exploring the World of Explainable Artificial Intelligence and Its Impact on Trust in AI Systems

What is XAI: Understanding Explainable Artificial Intelligence and Its Impact on Modern Decision-Making Systems

Top Bitcoin Debit Cards for Secure Crypto Payments in 2025

Understanding Ye Coin: A Guide to Investment and Blockchain Insights

Understanding HEHE Coin: A Detailed Overview of HEHE Token and its Role in Web3

Global Leaders in Bitcoin Usage: Top 10 Countries

Ultimate Guide to Safeguarding Your Web3 Assets with a Multi-Chain Wallet