2025 STX Price Prediction: Bullish Trends and Potential Catalysts for Stacks' Native Token

Introduction: STX's Market Position and Investment Value

Stacks (STX), as a decentralized Internet platform for distributed applications, has made significant strides since its inception in 2019. As of 2025, Stacks' market capitalization has reached $653,762,476, with a circulating supply of approximately 1,810,976,388 tokens, and a price hovering around $0.361. This asset, often hailed as the "Google of blockchain," is playing an increasingly crucial role in the development of decentralized applications and protocols.

This article will comprehensively analyze Stacks' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. STX Price History Review and Current Market Status

STX Historical Price Evolution Trajectory

- 2020: STX reached its all-time low of $0.04559639 on March 13, during the global market crash

- 2021: Bull market cycle, STX price surged to new heights

- 2024: STX hit its all-time high of $3.86 on April 1, marking a significant milestone

STX Current Market Situation

As of November 15, 2025, STX is trading at $0.361, ranking 117th in the cryptocurrency market. The token has experienced a 4.69% decrease in the last 24 hours, with a trading volume of $259,991.89. STX's market capitalization stands at $653,762,476, representing a 0.019% market share. The circulating supply is 1,810,976,388.53901 STX, which is 99.61% of the maximum supply of 1,818,000,000 STX.

STX has shown negative price trends across various timeframes, with a 0.61% decrease in the past hour, 13.37% decline over the past week, and a substantial 81.5% drop over the past year. The current price is significantly below its all-time high, indicating a bearish market sentiment for STX.

Click to view the current STX market price

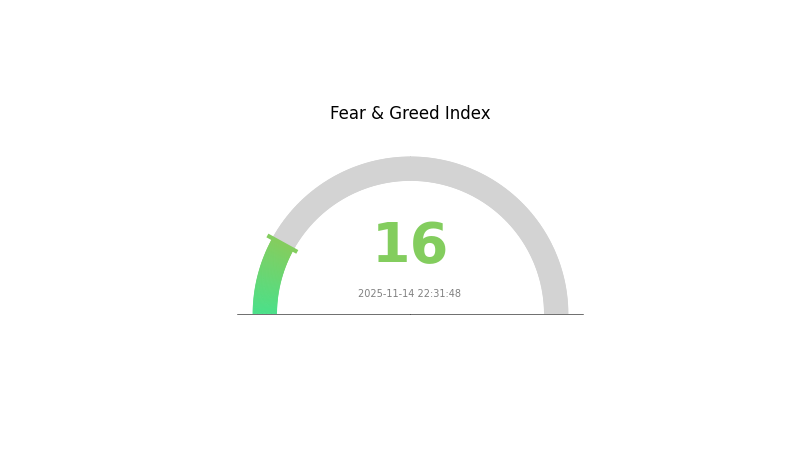

STX Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a period of extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these uncertain times.

STX Holdings Distribution

The address holdings distribution data for STX reveals a relatively decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation by large individual holders appears to be minimal. This distribution pattern suggests a diverse user base and potentially healthy ecosystem engagement.

The absence of highly concentrated holdings is a positive indicator for STX's market stability. It reduces the likelihood of sudden large sell-offs that could dramatically impact price volatility. Furthermore, this distributed ownership aligns well with the principles of decentralization, potentially contributing to a more robust and resilient network structure.

Overall, the current STX address distribution reflects a market with a balanced ownership profile. This characteristic may foster greater price stability and reduce systemic risks associated with whale accounts, ultimately supporting the long-term sustainability and growth potential of the STX ecosystem.

Click to view the current STX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting STX Future Price

Technology Development and Ecosystem Building

- Stacks 2.1 Upgrade: Improved scalability and functionality for the Stacks blockchain, potentially increasing adoption and value.

- Ecosystem Applications: Growing number of DApps and projects built on Stacks, including NFT platforms and DeFi protocols, expanding the utility of STX.

III. STX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.206 - $0.30

- Neutral prediction: $0.30 - $0.40

- Optimistic prediction: $0.40 - $0.52764 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.3604 - $0.66856

- 2028: $0.31558 - $0.63116

- Key catalysts: Technological advancements, wider blockchain integration, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base scenario: $0.61 - $0.73 (assuming steady market growth and continued adoption)

- Optimistic scenario: $0.73 - $0.84 (assuming strong market conditions and significant technological breakthroughs)

- Transformative scenario: $0.84 - $1.00 (assuming mass adoption and integration into mainstream finance)

- 2030-12-31: STX $0.72676 (potential average price, indicating substantial growth from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.52764 | 0.3614 | 0.206 | 0 |

| 2026 | 0.6001 | 0.44452 | 0.33784 | 22 |

| 2027 | 0.66856 | 0.52231 | 0.3604 | 43 |

| 2028 | 0.63116 | 0.59544 | 0.31558 | 64 |

| 2029 | 0.84022 | 0.6133 | 0.42318 | 69 |

| 2030 | 0.79944 | 0.72676 | 0.44332 | 100 |

IV. Professional STX Investment Strategies and Risk Management

STX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate STX during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend direction

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Use stop-loss orders to limit downside risk

- Take profits at predetermined resistance levels

STX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: 10-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Use 2FA, avoid public Wi-Fi for transactions

V. Potential Risks and Challenges for STX

STX Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades

- Correlation risk: High correlation with overall crypto market trends

STX Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations

- Tax implications: Evolving tax laws for cryptocurrency transactions

- Legal status: Possibility of classification as a security

STX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability challenges: Network congestion during high demand periods

- Upgrade risks: Potential issues during protocol updates

VI. Conclusion and Action Recommendations

STX Investment Value Assessment

STX offers long-term potential as a platform for decentralized applications but faces short-term volatility and regulatory uncertainty.

STX Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Explore STX as part of a diversified crypto portfolio

STX Trading Participation Methods

- Spot trading: Buy and sell STX on Gate.com

- staking: Participate in STX staking for potential rewards

- DeFi: Explore decentralized finance applications built on Stacks

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will STX go?

STX could potentially reach $10-$15 by 2026, driven by increased adoption of Bitcoin layer-2 solutions and growing DeFi ecosystem on Stacks.

What is the price target for STX in 2025?

Based on current market trends and expert predictions, the price target for STX in 2025 is estimated to be around $15 to $20 per token.

What is the future of STX coin?

STX coin has a promising future, with potential for significant growth by 2025. Its integration with Bitcoin and focus on smart contracts could drive increased adoption and value appreciation in the Web3 ecosystem.

Is STX coin a good investment?

STX shows potential as a solid investment in the Web3 space. With its role in Bitcoin's ecosystem and growing adoption, STX could see significant value appreciation by 2025.

Introducing $LIGHT:Bitlight Labs' Token & Its Role in Bitcoin's Ecosystem

Bitcoin Operating System ($BOS) Project Overview: Transforming Bitcoin into a Programmability platform.

2025 MP Price Prediction: Analyzing Market Trends and Forecasting Future Values

What is BTR: A Comprehensive Guide to Beyond the Rack and Its Impact on Online Retail

Exploring the Bitcoin DeFi Landscape: Opportunities and Innovations

Exploring Mezo: Enhancing DeFi with Bitcoin's Layer 2 Technology

TKO vs IMX: A Comprehensive Comparison of Two Leading Blockchain Platforms

What is liquidity risk in Crypto Assets? A guide for traders and investors.

What is a Centralized Exchange in Crypto Assets, and how does a Centralized Exchange operate?

What is CeFi and how does CeFi operate in Crypto Assets?

Crypto Wallet Explained: Understanding Digital Wallets