2025 VICEPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Media Giant

Introduction: VICE's Market Position and Investment Value

VICE Token (VICE), as a platform delivering the biggest and best prizes in the crypto space, has achieved significant growth since its inception. As of 2025, VICE's market capitalization has reached $20,361,281, with a circulating supply of approximately 603,136,390 tokens, and a price hovering around $0.033759. This asset, known for its "seamless and intuitive value transaction," is playing an increasingly crucial role in the field of cryptocurrency gaming and prize competitions.

This article will comprehensively analyze VICE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. VICE Price History Review and Current Market Status

VICE Historical Price Evolution

- 2025: Project launch, price started at $0.015

- June 2025: All-time high of $0.098 reached

- July 2025: Market correction, price dropped to all-time low of $0.0065

VICE Current Market Situation

As of October 5, 2025, VICE is trading at $0.033759, representing a 124.39% increase from its initial price. The token has shown strong performance over various timeframes:

- 1 hour: 1.73% increase

- 24 hours: 12.57% increase

- 7 days: 24.48% increase

- 30 days: 53.99% increase

- 1 year: 171.71% increase

VICE's market capitalization stands at $20,361,281, ranking it 1090th among all cryptocurrencies. The 24-hour trading volume is $128,648, indicating moderate market activity. With a circulating supply of 603,136,390 VICE tokens, representing 60.31% of the total supply, there is still room for growth in token distribution.

The current market sentiment for VICE appears bullish, as evidenced by its consistent price increases across all measured timeframes. This positive momentum suggests growing interest and adoption of the VICE platform and its token.

Click to view the current VICE market price

VICE Market Sentiment Indicator

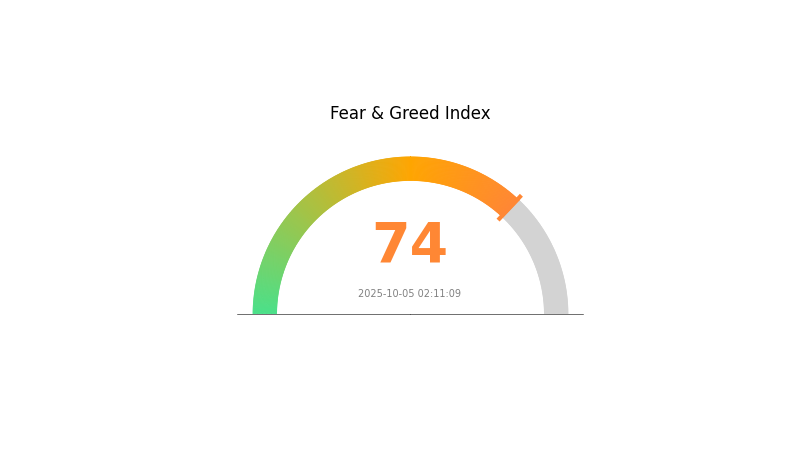

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 74. This suggests investors are becoming overly optimistic, potentially leading to inflated asset prices. While bullish sentiment can drive further gains, it's crucial to remain cautious. Experienced traders might consider taking some profits or hedging positions. For those looking to enter the market, it may be wise to wait for a potential correction or dollar-cost average into positions. Remember, market sentiment can shift rapidly, so stay informed and manage your risk accordingly.

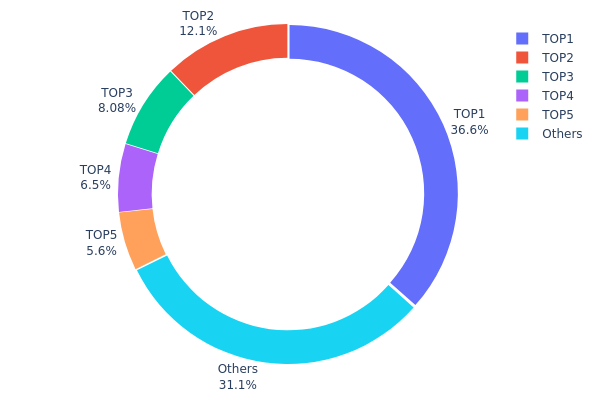

VICE Holdings Distribution

The address holdings distribution for VICE tokens reveals a highly concentrated ownership structure. The top address holds a substantial 36.56% of the total supply, while the top 5 addresses collectively control 68.87% of all VICE tokens. This level of concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution could lead to significant price swings if large holders decide to sell their positions. It also suggests a lower degree of decentralization, which may impact the token's governance and overall market stability. The presence of a single address holding over one-third of the supply is particularly noteworthy, as it could exert considerable influence over the token's ecosystem and market dynamics.

While the remaining 31.13% is distributed among other addresses, the current structure indicates a relatively low level of widespread adoption or distribution among smaller holders. This concentration of ownership may pose risks to the token's long-term sustainability and could deter potential investors concerned about market manipulation or sudden liquidity changes.

Click to view the current VICE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1bfd...0a502c | 365602.84K | 36.56% |

| 2 | 0x286f...c25837 | 121343.62K | 12.13% |

| 3 | 0xff25...a9ed60 | 80833.25K | 8.08% |

| 4 | 0x13b1...2bba91 | 65000.00K | 6.50% |

| 5 | 0xeeeb...5d969f | 56000.00K | 5.60% |

| - | Others | 311220.29K | 31.13% |

II. Core Factors Affecting VICE's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to continue tightening monetary policy due to rising inflation levels.

- Inflation Hedging Properties: VICE's performance in an inflationary environment remains to be seen, as current market narratives have not fully accounted for this factor.

- Geopolitical Factors: The ongoing geopolitical realignment and potential risks need to be incorporated into investment decisions, with a comprehensive assessment of seemingly unlikely scenarios.

Technical Development and Ecosystem Building

- Ecosystem Applications: The evolving labor dynamics and work preferences are prompting a reevaluation of space requirements, with an increased focus on amenities.

III. VICE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02363 - $0.03376

- Neutral prediction: $0.03376 - $0.03848

- Optimistic prediction: $0.03848 - $0.04 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.03524 - $0.05041

- 2028: $0.03801 - $0.06936

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.05844 - $0.06983 (assuming steady market growth)

- Optimistic scenario: $0.07332 - $0.08123 (assuming strong bullish trends)

- Transformative scenario: $0.08500 - $0.09000 (extreme favorable conditions and widespread adoption)

- 2030-12-31: VICE $0.06983 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03848 | 0.03376 | 0.02363 | 0 |

| 2026 | 0.0531 | 0.03612 | 0.02131 | 6 |

| 2027 | 0.05041 | 0.04461 | 0.03524 | 32 |

| 2028 | 0.06936 | 0.04751 | 0.03801 | 40 |

| 2029 | 0.08123 | 0.05844 | 0.03565 | 73 |

| 2030 | 0.07332 | 0.06983 | 0.06564 | 106 |

IV. VICE Professional Investment Strategies and Risk Management

VICE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate VICE tokens during market dips

- Set price targets and stick to your investment plan

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to VICE

- Set stop-loss orders to limit potential losses

VICE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VICE

VICE Market Risks

- High volatility: VICE price may experience significant fluctuations

- Limited liquidity: Trading volume may be low, affecting price stability

- Market sentiment: Crypto market trends can heavily influence VICE's performance

VICE Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations are evolving and may impact VICE

- Compliance issues: Potential challenges in adhering to future regulatory requirements

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

VICE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Ethereum network issues could affect VICE transactions

- Technological obsolescence: Emerging technologies may outpace VICE's platform

VI. Conclusion and Action Recommendations

VICE Investment Value Assessment

VICE offers a unique proposition in the crypto space with its prize-based platform. While it shows potential for growth, investors should be aware of the high volatility and regulatory uncertainties in the cryptocurrency market.

VICE Investment Recommendations

✅ Beginners: Start with small investments and focus on learning the platform ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider VICE as part of a diversified crypto portfolio

VICE Participation Methods

- Direct purchase: Buy VICE tokens on Gate.com

- Platform engagement: Participate in VICE competitions to earn tokens

- Dollar-cost averaging: Regularly invest small amounts to mitigate market volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the vice token worth?

As of October 2025, the VICE token is worth $0.02133. Its 24-hour trading volume is $85,450, with a market cap of $12.86 million.

What is the price prediction for XRP in 2030?

XRP could range between $4.67 and $26.97 in 2030, based on adoption, regulations, and market conditions. Strong institutional use and regulatory clarity are key factors for its potential price growth.

What is the realistic VeChain price prediction?

Based on current trends, VeChain (VET) is predicted to reach $0.02314047 by October 2025. This forecast reflects market indicators as of 2025-10-05.

What is the first helium stock price prediction for 2025?

The first helium stock price is predicted to reach an average of $0.8061 in 2025, with a potential high of $1.2732 and a low of $0.3389.

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

2025 HTPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Huobi Token

2025 MTLPrice Prediction: Analyzing Future Growth Trends and Market Potential for Metal Token

2025 CHEQ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Cheqd Network Token

2025 TOMI Price Prediction: Market Analysis and Future Outlook for the Emerging Digital Asset

2025 CRTSPrice Prediction: Analyzing Market Trends and Future Valuation for CRTS Tokens in the Evolving Cryptocurrency Landscape

Bitcoin Mining Hardware Faces Challenges Amid Manufacturing Expansion in the US

How Does DOGE Exchange Inflow and Outflow Affect Price Movement in 2025?

What is ZBCN holdings and fund flow: exchange inflows, concentration, and staking analysis?

What is ZBCN price volatility and why did it drop 16.40% in the last 7 days?

What is LMWR: A Comprehensive Guide to Low-Molecular-Weight Reagents in Modern Chemistry