2025 VON Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: VON's Market Position and Investment Value

Vameon (VON) is a blockchain gaming studio token powering the Play-to-Earn NFT metaverse ecosystem through its flagship 3D action RPG game, dEmpire of Vampire. As of December 2025, VON has achieved a market capitalization of approximately $4.40 million USD with a circulating supply of around 248.53 billion tokens, currently trading at $0.00001772 per token. This innovative gaming asset is establishing itself as a key participant in the blockchain gaming and metaverse sector.

The VON token serves as the primary reward mechanism within the dEmpire of Vampire ecosystem, a high-tech AAA action-RPG running on the BNB Chain. Players earn VON through gameplay progression and NFT-backed earning mechanisms, creating a sustainable Play-to-Earn model where in-game assets are fully owned by players as NFTs.

This analysis will comprehensively examine VON's price trajectory from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development progress, and macroeconomic factors to deliver professional price forecasting and actionable investment strategies for market participants.

I. VON Price History Review and Market Status

VON Historical Price Evolution Trajectory

- March 2, 2025: Peak market performance with VON reaching its all-time high of $0.000958904

- January 13, 2025: Market bottom reached at $0.000004559, representing the lowest price point in the token's history

- 2025: Significant year-long decline of 83.42% from historical highs, reflecting challenging market conditions for the gaming token

VON Current Market Situation

As of December 24, 2025, VON is trading at $0.00001772, representing a 24-hour price change of +2.01%. The token has shown modest daily recovery despite broader weakness over longer timeframes. Over the past 7 days, VON declined by 0.16%, while the 30-day period saw a steeper correction of 0.38%. The 1-hour price movement shows a slight downward pressure of -0.22%.

The token commands a market capitalization of approximately $4.40 million with a fully diluted valuation of $17.72 million. With 248.53 billion tokens in circulation out of a total supply of 1 trillion VON, the circulating supply represents 24.85% of the maximum supply. The 24-hour trading volume stands at $31,692.48, indicating moderate liquidity. VON maintains a market dominance of 0.00055% within the broader cryptocurrency ecosystem and ranks #1,608 by market capitalization.

The token is supported by 74,337 token holders and maintains presence across 3 major exchanges. Current market sentiment reflects extreme fear conditions with a VIX reading of 24.

Click to view current VON market price

VON Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is experiencing extreme fear with an index reading of 24. This exceptionally low sentiment indicates widespread investor anxiety and pessimism. During such periods, panic selling often dominates, creating potential opportunities for contrarian investors. The extreme fear level suggests the market has likely overcorrected, and historically, these levels often precede recoveries. Investors should exercise caution and conduct thorough research before making investment decisions. Risk management remains critical in volatile market conditions.

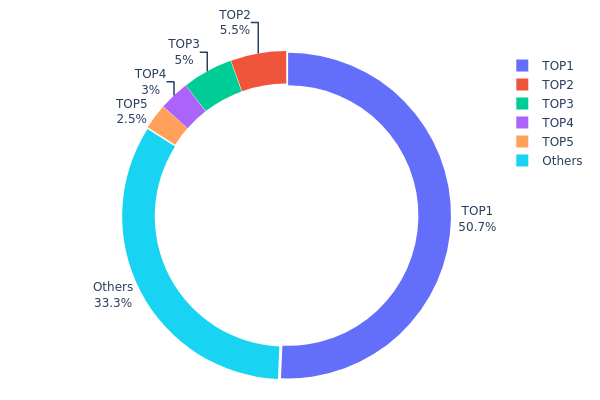

VON Holding Distribution

The address holding distribution map illustrates the concentration of VON tokens across blockchain addresses, revealing the degree of decentralization and potential market structure risks. This metric aggregates wallet positions ranked by holding volume, enabling investors and analysts to assess token concentration dynamics and evaluate market manipulation risks stemming from whale activity.

VON exhibits notable concentration characteristics, with the top holder commanding 50.70% of total supply, representing a significant centralization point. The top five addresses collectively control 66.70% of circulating tokens, while the remaining 33.30% is dispersed among other market participants. This distribution pattern reflects pronounced holder concentration, with a single dominant address maintaining over half the token supply. Such extreme concentration introduces material market structure vulnerabilities, as the leading holder's liquidity decisions could substantially influence price discovery mechanisms and market depth.

The current holding architecture presents considerable systemic risks to market stability. The overwhelming dominance of the primary address suggests limited float availability in secondary markets, potentially constraining liquidity and amplifying price volatility during significant trading events. Furthermore, such top-heavy distribution patterns increase susceptibility to coordinated selling pressure or whale-driven market manipulation, thereby compromising price integrity and fair market mechanisms. The moderate dispersion among the second and third-tier holders (5.50% and 5.00% respectively) does not substantially offset the concentration risk established by the leading position. Overall, VON's current address distribution reflects a highly centralized token structure with limited decentralization characteristics, indicating that market participants should closely monitor whale movements and anticipate elevated volatility risk exposure.

Click to view the current VON holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3f28...4e6d8f | 507000000.00K | 50.70% |

| 2 | 0x58a6...4bac49 | 55000000.00K | 5.50% |

| 3 | 0x5dc5...c160b2 | 50000000.00K | 5.00% |

| 4 | 0x6e22...67d1aa | 30000000.00K | 3.00% |

| 5 | 0x7a47...86d379 | 25000000.00K | 2.50% |

| - | Others | 333000000.00K | 33.3% |

II. Core Factors Influencing VON's Future Price

Supply Mechanism

-

Fixed Supply Model: VON operates on a fixed supply mechanism that fundamentally limits inflationary pressure on the asset. This fixed supply characteristic provides structural defenses against monetary inflation compared to traditional fiat currencies.

-

Inflation Hedge Properties: In inflationary environments, VON's fixed supply structure demonstrates enhanced anti-inflation capabilities. The scarcity model ensures that the asset maintains purchasing power preservation potential during periods of currency debasement and rising price levels.

Macroeconomic Environment

-

Monetary Policy Impact: VON exhibits sensitivity to interest rate changes and US dollar strength fluctuations, similar to other risk assets. The asset typically demonstrates higher correlation with traditional market risk indicators compared to some alternatives, making it responsive to central bank policy adjustments and broader monetary policy shifts.

-

Inflation Hedge Attributes: By leveraging its fixed supply characteristics, VON provides enhanced inflation resistance. This positions the asset as a potential hedge during periods of elevated inflation and currency depreciation, particularly when traditional monetary authorities implement expansionary policies.

-

Geopolitical Factors: Cross-border capital flows and international geopolitical developments influence VON price dynamics through their impact on overall risk sentiment and market confidence in decentralized assets.

Three, 2025-2030 VON Price Forecast

2025 Outlook

- Conservative Prediction: $0.00001

- Neutral Prediction: $0.00002

- Optimistic Prediction: $0.00002 (requires increased market adoption and positive sentiment)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory, characterized by stabilization and incremental value recognition

- Price Range Predictions:

- 2026: $0.00002 - $0.00003 (16% potential upside)

- 2027: $0.00002 - $0.00003 (34% potential upside)

- Key Catalysts: Ecosystem development, increased utility adoption, improved market liquidity, and positive regulatory developments

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00002 - $0.00004 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic Scenario: $0.00003 - $0.00005 (assuming accelerated adoption, strategic partnerships, and favorable macroeconomic environment)

- Transformative Scenario: $0.00005 (assuming breakthrough developments, mainstream integration, and sustained bull market conditions)

- 2030-12-24: VON reaching $0.00005 (114% cumulative appreciation from 2025 baseline, indicating substantial long-term value creation potential)

Note: These predictions are based on available forecast data and should be monitored regularly. Investors are advised to conduct thorough due diligence and consider risk factors before making investment decisions. Trading on Gate.com and other platforms carries inherent market risks.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00002 | 0.00002 | 0.00001 | 0 |

| 2026 | 0.00003 | 0.00002 | 0.00002 | 16 |

| 2027 | 0.00003 | 0.00002 | 0.00002 | 34 |

| 2028 | 0.00004 | 0.00003 | 0.00002 | 52 |

| 2029 | 0.00004 | 0.00003 | 0.00002 | 87 |

| 2030 | 0.00005 | 0.00004 | 0.00002 | 114 |

VON Token Investment Strategy and Risk Management Report

I. Executive Summary

Vameon (VON) is a blockchain gaming studio that developed dEmpire of Vampire, a 3D action RPG game built on the BNB Chain. As of December 24, 2025, VON is trading at $0.00001772 with a market capitalization of approximately $4.4 million and a fully diluted valuation of $17.72 million. The token operates on the BEP-20 standard with a total supply of 1 trillion tokens and approximately 248.5 billion in circulation.

II. VON Market Overview

Current Market Position

| Metric | Value |

|---|---|

| Current Price | $0.00001772 |

| Market Cap | $4,403,919.15 |

| Fully Diluted Valuation | $17,720,000.00 |

| 24h Volume | $31,692.48 |

| Market Ranking | #1608 |

| Circulating Supply | 248,528,168,673 VON |

| Total Supply | 1,000,000,000,000 VON |

| Circulating Supply Ratio | 24.85% |

| Active Holders | 74,337 |

Price Performance Analysis

Recent Price Movements:

- 1 Hour: -0.22%

- 24 Hours: +2.01%

- 7 Days: -0.16%

- 30 Days: -0.38%

- 1 Year: -83.42%

Historical Price Levels:

- All-Time High: $0.000958904 (March 2, 2025)

- All-Time Low: $0.000004559 (January 13, 2025)

- Current Distance from ATH: -98.15%

- Current Distance from ATL: +288.74%

III. Project Fundamentals and Use Cases

Project Description

Vameon is a blockchain gaming studio specializing in Play-to-Earn (P2E) NFT gaming experiences. The flagship product, dEmpire of Vampire, represents a modern approach to blockchain gaming that prioritizes user experience and immediate accessibility.

Key Project Features:

-

Game Platform: dEmpire of Vampire is a 3D mobile action RPG/PVP game designed with AAA-quality mechanics and intuitive gameplay systems.

-

Blockchain Integration: Operating on BNB Chain, the game leverages blockchain technology to enable true asset ownership through NFT characters.

-

Play-to-Earn Mechanics: Players can earn VON tokens through multiple pathways:

- Earning through revenue-generating NFT tokens

- Acquiring cryptocurrency rewards during gameplay

- Collecting character skins and NFTs

- Increasing NFT character value through progression

-

NFT Ownership Model: All in-game characters are minted as NFTs, providing players with full ownership and the ability to trade or sell these assets independently.

Tokenomics

Supply Structure:

- Total Supply: 1 trillion VON

- Circulating Supply: 248.53 billion VON (24.85%)

- Remaining Supply: 751.47 billion VON (75.15%)

The relatively low circulation ratio indicates significant potential for supply-side price pressure as tokens gradually enter circulation. Long-term tokenomics will be critical to monitor.

IV. VON Professional Investment Strategy and Risk Management

VON Investment Methodology

(1) Long-Term Investment Strategy

-

Target Audience: GameFi enthusiasts, blockchain technology believers, P2E economy participants, and long-term cryptocurrency portfolio holders.

-

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Implement regular, fixed-amount purchases over extended periods to mitigate volatility impact and reduce timing risk.

- Position Accumulation During Market Downturns: Leverage historical volatility to establish positions at reduced price levels, particularly given the current -98% distance from ATH.

- Active Engagement Monitoring: Follow project development updates, game launches, and community growth metrics as fundamental indicators.

-

Storage Approach:

- For significant holdings, utilize secure custody solutions through Gate Web3 wallet for reliable asset management.

- Implement multi-signature wallets for enhanced security and institutional-grade protection.

- Maintain separate holding and trading wallets to minimize operational risk.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels using historical price data. Current significant levels include the ATL at $0.000004559 and ATH at $0.000958904.

- Volume Analysis: Monitor the 24-hour trading volume ($31,692.48) relative to market cap to assess liquidity and potential slippage in position entry/exit.

- Moving Averages: Track short-term (7-day, 14-day) and medium-term (30-day, 90-day) moving averages to identify directional trends and momentum shifts.

-

Swing Trading Key Points:

- Volatility Assessment: VON exhibits significant price swings, creating opportunities for tactical entries during oversold periods indicated by technical indicators.

- Liquidity Windows: Focus trading activity during periods of elevated volume to ensure efficient execution at intended price levels.

VON Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 0.5-1.0% of total portfolio

- Suitable for investors prioritizing capital preservation with minimal risk tolerance.

- Focus on long-term position building through modest, periodic contributions.

-

Moderate Investors: 1.5-3.0% of total portfolio

- Appropriate for experienced cryptocurrency investors with balanced risk/reward preferences.

- Allows meaningful exposure while maintaining diversification across asset classes.

-

Aggressive Investors: 3.0-5.0% of total portfolio

- Intended for professional traders and high-risk-tolerance investors.

- Requires active management and sophisticated risk mitigation strategies.

(2) Risk Hedging Strategies

-

Diversification Approach: Maintain VON as a component within a broader GameFi token portfolio rather than as a concentrated position, reducing idiosyncratic project risk exposure.

-

Profit-Taking Protocol: Establish predetermined profit targets (e.g., 50%, 100%, 200% gains) and systematically reduce position size at these milestones to lock in gains and reduce downside exposure.

(3) Secure Storage Solutions

-

Hot Wallet Solution: Gate Web3 Wallet is recommended for active trading and frequent transactions, offering balance between accessibility and security with institutional-grade key management protocols.

-

Cold Storage Option: For long-term holdings exceeding 90-180 day holding periods, transfer VON to secure self-custody solutions with offline storage capabilities, significantly reducing hacking and theft risks.

-

Security Considerations:

- Never share private keys or seed phrases with any third party.

- Verify smart contract addresses before token transfers to prevent phishing attacks targeting blockchain addresses.

- Enable multi-factor authentication on all exchange accounts and wallets.

- Maintain regular backups of wallet recovery information in geographically distributed secure locations.

V. VON Potential Risks and Challenges

Market Risks

-

Extreme Volatility Exposure: VON exhibits extreme price fluctuations, demonstrated by -83.42% annual decline and -98.15% drawdown from all-time high. This volatility creates substantial risk of rapid capital loss, particularly for inexperienced investors with poor risk management discipline.

-

Low Trading Liquidity: With only $31,692.48 in 24-hour trading volume against a $4.4 million market cap, liquidity constraints create significant slippage risk for meaningful position entries or exits, potentially requiring extended accumulation/distribution periods.

-

Limited Market Adoption: As the #1608 ranked cryptocurrency with only 74,337 active token holders, VON faces challenges in achieving mainstream adoption and sustained market interest, which could constrain long-term price appreciation potential.

Regulatory Risks

-

Gaming Regulatory Uncertainty: The blockchain gaming sector faces evolving regulatory frameworks globally, with potential restrictions on Play-to-Earn mechanics, NFT trading, or token rewards that could impact Vameon's business model and token utility.

-

Geographic Compliance Challenges: Different jurisdictions implement varying cryptocurrency and gaming regulations. Vameon may encounter restrictions in certain markets, limiting player base expansion and revenue potential.

-

Token Classification Risk: Regulatory bodies in certain jurisdictions may reclassify gaming tokens as securities, subjecting VON to securities regulations and potential delisting from certain platforms or restrictions on trading.

Technical Risks

-

Smart Contract Vulnerabilities: Any undetected vulnerabilities in dEmpire of Vampire's smart contracts could result in player asset loss, token supply disruptions, or complete platform compromise, severely damaging project credibility and token value.

-

Blockchain Dependency Risk: As a BNB Chain-dependent token, VON is exposed to layer-one blockchain risks. Any critical BNB Chain security issues, network congestion, or consensus mechanism failures would directly impact game functionality and token tradability.

-

Game Development Execution Risk: Delivering high-quality AAA-grade gaming experiences on blockchain requires sophisticated development capabilities. Project delays, feature underperformance, or poor user experience could result in player retention failures and token demand deterioration.

VI. Conclusions and Action Recommendations

VON Investment Value Assessment

Vameon represents a speculative opportunity within the blockchain gaming sector, combining NFT asset ownership with Play-to-Earn incentive mechanisms. The project addresses fundamental gaming demand but faces significant execution, market adoption, and regulatory challenges. The current valuation reflects extreme depreciation from peak levels, potentially indicating capitulation or fundamental reassessment of project viability. VON's low liquidity and limited holder base create both substantial upside potential for early believers and pronounced downside risk for late entrants.

VON Investment Recommendations

✅ New Investors: Begin with micro-position accumulation ($50-$200) using Dollar-Cost Averaging methodology across 6-12 month periods. Treat initial capital as entirely expendable with zero expectation of recovery. Allocate only 0.5% maximum of total portfolio and focus on understanding Vameon's game development progress before increasing exposure.

✅ Experienced Traders: Implement tactical swing trading strategies targeting technical support/resistance levels while maintaining strict position size discipline (2-3% maximum per trade). Utilize Gate.com for efficient execution and maintain 15-20% portfolio dry powder for volatility-driven entry opportunities during sharp market dislocations.

✅ Institutional Investors: Conduct comprehensive due diligence on Vameon's development team, game metrics, player retention data, and monetization mechanisms before considering allocation. Any institutional consideration should represent <1% of total fund assets and include detailed exit criteria and risk mitigation protocols. Prioritize direct communications with project management to assess execution capability and realistic timeline assessments.

VON Trading Participation Methods

-

Direct Purchase via Gate.com: Access VON/USDT trading pairs on Gate.com platform with competitive fees and institutional-grade liquidity infrastructure. Register account, complete KYC verification, fund with USDT, and execute purchases directly through advanced or basic trading interfaces.

-

DCA Investment Program: Establish automated recurring purchases at fixed intervals (weekly, bi-weekly, or monthly) to systematically reduce timing risk and average entry costs across extended market cycles, ideal for long-term conviction positioning.

-

Limit Order Strategy: Set predetermined buy orders at technical support levels and sell orders at identified resistance levels on Gate.com, enabling passive portfolio management without requiring active monitoring of real-time price movements.

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. All investors must carefully evaluate VON against personal risk tolerance, investment objectives, and financial circumstances before deploying capital. Strongly recommended to consult qualified financial advisors. Never invest capital you cannot afford to lose entirely. Past performance does not guarantee future results. Regulatory frameworks remain uncertain, and fundamental project execution risks remain substantial.

FAQ

What is von crypto?

VON is a global digital currency offering cryptocurrency trading and staking options. It provides advanced tools for both beginners and experts, enabling users to participate in the digital asset market with comprehensive trading volume and financial services.

What is the price prediction for VON in 2025?

Based on current market analysis, VON is projected to reach approximately $0.00001435 by the end of 2025. This prediction reflects potential market dynamics and token performance throughout the year.

What factors influence VON token price?

VON token price is influenced by market liquidity, supply and demand dynamics, and investor sentiment. Automated Market Makers determine pricing based on token supply in liquidity pools. Trading volume and market conditions also impact price movements.

What is the historical price performance of VON?

VON has demonstrated steady micro-cap trading patterns, hovering around $0.000019-$0.00002 USD in recent months. The token maintains low volatility with consistent trading activity, reflecting its niche market position in the Web3 ecosystem.

2025 PYM Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 PVU Price Prediction: Analyzing Market Trends and Future Potential of Plant vs Undead Token

Is Vameon (VON) a good investment?: A Comprehensive Analysis of Price Trends, Market Potential, and Risk Factors for 2024

P2E vs Play-to-Earn: Maximizing Rewards in Crypto Gaming 2025

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

What Is the Future of YGG: A Comprehensive Analysis of Yield Guild Games' Fundamentals in 2025?

Exploring Decentraland $MANA: A Top Metaverse Coin for Future Investment

The remarkable surge of an AI-powered cryptocurrency: Is this the beginning of a new era?

What is UOS: A Comprehensive Guide to the Unified Operating System

What is POR: A Comprehensive Guide to Plan of Record in Project Management

What is KYVE: A Decentralized Data Validation and Archiving Protocol for Web3