What is MVRK: The Revolutionary AI Technology Transforming Industries

Mavryk Network's Positioning and Significance

In 2025, Mavryk Network (MVRK) was launched as a next-generation Layer-1 blockchain, aiming to address the challenge of bringing real-world assets (RWA) onto the blockchain at scale. As a pioneering platform for large-scale RWA tokenization, Mavryk Network plays a crucial role in bridging traditional finance with decentralized technology.

As of 2025, Mavryk Network has already established itself as a significant player in the RWA tokenization space, securing the largest RWA tokenization deal in history—a $10B+ agreement with MultiBank Group and MAG. This article will delve into its technological architecture, market performance, and future potential.

Origins and Development History

Birth Background

Mavryk Network was created in 2025 to solve the challenge of efficiently tokenizing large-scale real-world assets. It emerged during a period of growing interest in bringing traditional assets onto the blockchain, aiming to provide a robust infrastructure for RWA and DeFi applications.

Mavryk Network's launch opened new possibilities for institutional asset managers and property developers to tokenize and manage traditional assets on the blockchain.

Important Milestones

- 2025: Mainnet launch, enabling the tokenization of over $10 billion in real-world assets.

- 2025: Secured a landmark $10B+ agreement with MultiBank Group and MAG, bringing luxury real estate, including Ritz-Carlton and Keturah Reserve, on-chain.

With support from regulated partners and institutional asset managers, Mavryk Network continues to optimize its technology, security, and real-world applications.

How Does Mavryk Network Operate?

Decentralized Control

Mavryk Network operates on a decentralized network of computers (nodes) spread across the globe, free from control by any single entity. These nodes collaborate to validate transactions, ensuring system transparency and attack resistance, granting users greater autonomy and enhancing network resilience.

Blockchain Core

Mavryk Network's blockchain is a public, immutable digital ledger that records every transaction. Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain. Anyone can view the records, establishing trust without intermediaries.

Ensuring Fairness

Mavryk Network employs a consensus mechanism to validate transactions and prevent fraudulent activities like double-spending. Participants maintain network security through activities such as staking or running nodes, and are rewarded with MVRK tokens.

Secure Transactions

Mavryk Network uses public-private key encryption to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security while maintaining transaction privacy. Additional security features may be in place to support the tokenization of high-value real-world assets.

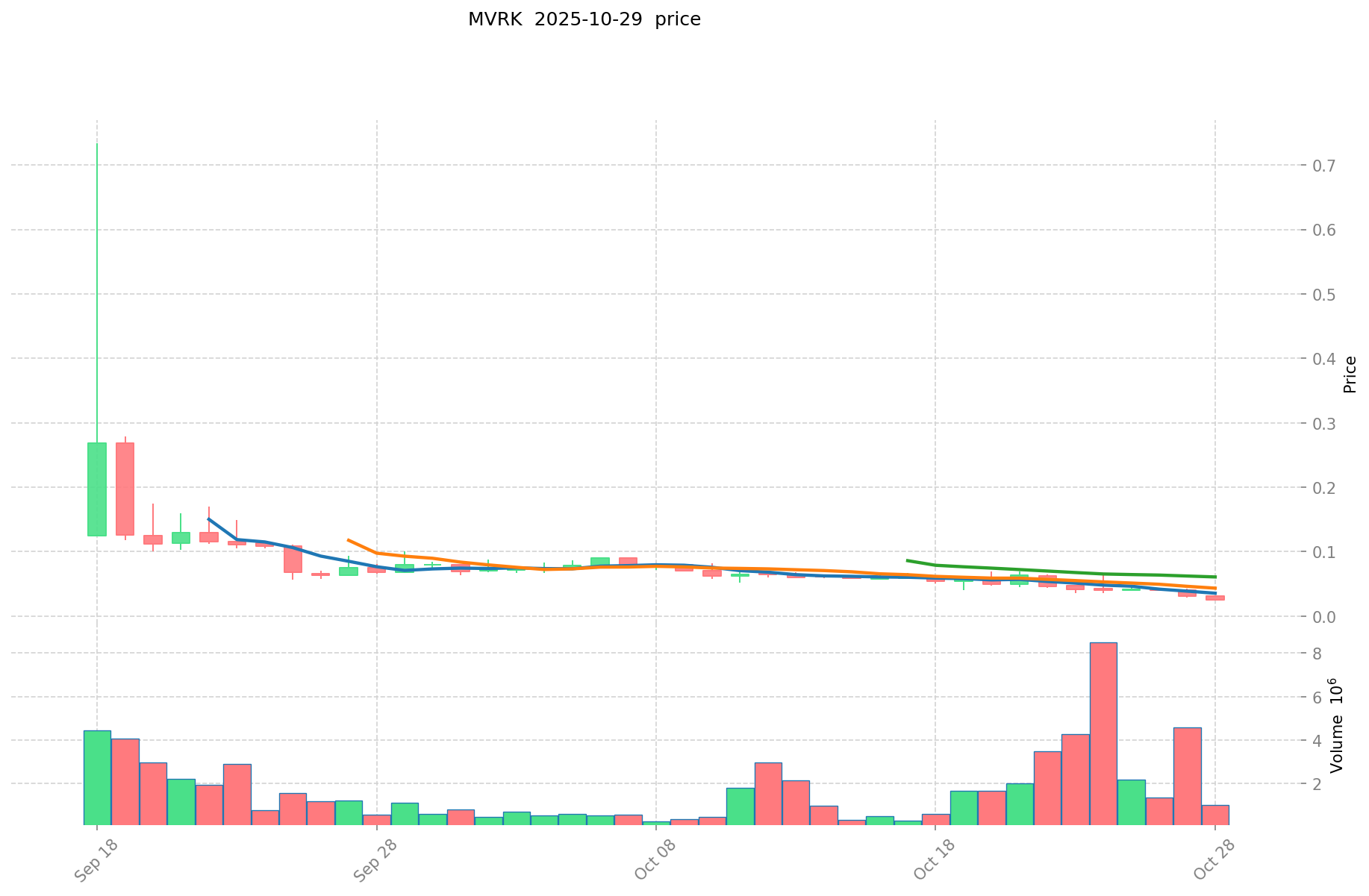

MVRK's Market Performance

Circulation Overview

As of October 29, 2025, MVRK has a circulating supply of 56,200,000 tokens, with a total supply of 1,000,000,000 tokens. The maximum supply is capped at 1,000,000,000 MVRK.

Price Fluctuations

MVRK reached its all-time high of $0.734 on September 18, 2025, likely driven by the announcement of the $10 billion+ real-world asset tokenization deal with MultiBank Group and MAG.

Its lowest price was $0.0209, recorded on October 29, 2025. This significant drop may reflect market volatility or specific challenges faced by the project.

These fluctuations demonstrate the market's reaction to Mavryk Network's developments and broader crypto market trends.

Click to view the current market price of MVRK

On-Chain Metrics

- Daily Trading Volume: $21,892.88 (indicating current network activity)

- Market Cap: $1,348,238 (reflecting the project's current valuation)

- Circulating Supply Ratio: 5.62% (percentage of total supply in circulation)

Mavryk Network Ecosystem Applications and Partnerships

Core Use Cases

Mavryk Network's ecosystem supports various applications:

- Real-World Asset (RWA) Tokenization: Tokenizing luxury real estate like Ritz-Carlton and Keturah Reserve, bringing traditional assets on-chain.

- DeFi: Providing robust infrastructure for decentralized finance applications.

Strategic Partnerships

Mavryk Network has established partnerships with MultiBank Group and MAG, enhancing its market influence and tokenization capabilities. These partnerships have laid a solid foundation for Mavryk's ecosystem expansion, including the $10B+ RWA tokenization deal.

Controversies and Challenges

Mavryk Network faces the following challenges:

- Regulatory Risks: Potential scrutiny from financial regulators due to large-scale RWA tokenization.

- Competitive Pressure: Competition from other blockchain platforms offering similar RWA tokenization solutions.

These issues have sparked discussions within the community and market, driving Mavryk's continuous innovation.

Mavryk Network Community and Social Media Atmosphere

Fan Enthusiasm

Mavryk Network's community shows vigor, with the recent $10B+ tokenization deal generating significant interest.

On X platform, related posts and tags (such as #MavrykNetwork) often trend, with the RWA tokenization announcement being a major catalyst for community excitement.

Social Media Sentiment

Sentiment on X presents a mix of reactions:

- Supporters praise Mavryk Network's large-scale RWA tokenization capabilities, viewing it as a "bridge between traditional finance and blockchain".

- Critics focus on potential regulatory challenges and the complexities of tokenizing real-world assets.

Recent trends show increased interest due to the groundbreaking RWA tokenization deal.

Hot Topics

X users actively discuss Mavryk Network's regulatory implications, the impact on traditional real estate markets, and the potential for democratizing access to luxury assets.

More Information Sources for Mavryk Network

- Official Website: Visit Mavryk Network official website for features, use cases, and latest updates.

- White Paper: Mavryk Network Litepaper details its technical architecture, goals, and vision.

- X Updates: On X platform, Mavryk Network uses @MavrykNetwork, covering technological updates, community events, and partnership news.

Mavryk Network Future Roadmap

- Ecosystem Goal: Support large-scale tokenization of real-world assets and expand DeFi applications

- Long-term Vision: Become a leading platform for bridging traditional assets with blockchain technology

How to Participate in Mavryk Network?

- Purchase Channels: Buy MVRK on Gate.com

- Storage Solutions: Use secure wallet solutions for storing MVRK tokens

- Participate in Governance: Stay tuned for community decision-making opportunities

- Build the Ecosystem: Visit developer documentation to contribute to the Mavryk ecosystem

Summary

Mavryk Network is redefining asset tokenization through blockchain technology, offering transparency, security, and efficient RWA tokenization. Its groundbreaking partnerships, rich resources, and strong market performance set it apart in the cryptocurrency field. Despite facing regulatory challenges and technological hurdles, Mavryk Network's innovative spirit and clear roadmap position it as a key player in the future of decentralized finance and asset tokenization. Whether you're a newcomer or an experienced player, Mavryk Network is worth watching and participating in.

What is MVRK: Exploring the Revolutionary Multi-View Rendering Kit for 3D Graphics

How Does Chainlink's Community Activity Impact LINK Token Value?

What is POLYX: Understanding the Native Token of the Polymesh Blockchain

2025 BAS Price Prediction: Analyzing Market Trends and Potential Growth Factors

What is SIX: The Swiss Stock Exchange Powering Global Financial Markets

What is MVRK: The Revolutionary AI-Powered Marketing Platform Transforming Digital Advertising

Comprehensive Crypto Project Overview: Updates, Presale & Airdrop Insights

What Are Crypto Derivatives Market Signals and How Do Futures Open Interest, Funding Rates, and Liquidation Data Impact Trading?

BAS vs AVAX: A Comprehensive Comparison of Two Leading Blockchain Networks

TSTBSC vs LINK: Comprehensive Comparison of Two Blockchain Oracle Solutions

How to Redeem a Gift Card on a Crypto Trading Platform