#GateJanTransparencyReport From Exchange to Financial Infrastructure (January 2026 Outlook)

Gate’s January 2026 Transparency Report marks a decisive strategic transformation. The platform is no longer positioning itself merely as a centralized crypto exchange, but as a fully integrated DeTraFi ecosystem, combining decentralized finance, traditional markets, and AI-driven infrastructure into a unified capital network.

This evolution reflects a broader industry shift: leading platforms are becoming financial systems rather than trading venues.

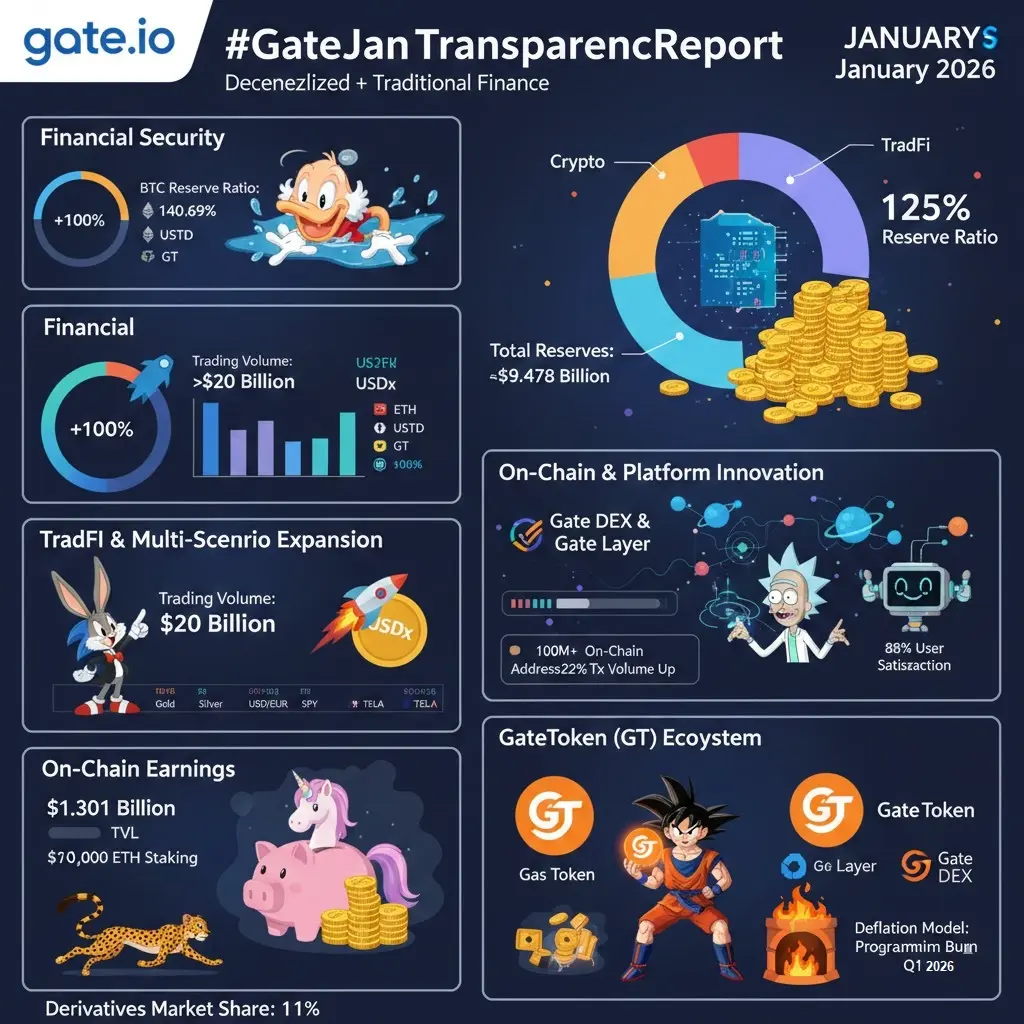

Financial Security: Transparency as Competitive Advantage

At the core of Gate’s expansion lies institutional-grade risk management and capital protection.

With an overall reserve ratio of 125% and total reserves approaching $9.5 billion, Gate maintains strong solvency even under extreme market stress. Bitcoin reserves exceeding 140%, along with consistent over-collateralization across major assets, reinforce confidence among institutional and high-net-worth participants.

In an industry where trust remains fragile, transparency has become Gate’s primary strategic moat.

TradFi Integration: Eliminating Capital Friction

January’s strongest growth driver was Gate’s integration with traditional financial markets.

By enabling trading in metals, forex, indices, and equities using USDT-based margins, Gate has effectively unified digital and legacy assets within a single infrastructure layer. This removes conversion barriers, reduces settlement delays, and enhances portfolio flexibility.

With cumulative TradFi volume surpassing $20 billion, this model reflects growing demand for cross-asset exposure during periods of macroeconomic volatility.

USDx: A Unified Settlement Layer

The introduction of USDx, pegged 1:1 to USDT, strengthens Gate’s internal capital ecosystem.

USDx functions as a universal settlement medium, enabling seamless transitions between crypto and traditional instruments without repeated currency conversions. This improves capital efficiency, simplifies risk management, and reduces operational friction for active traders and institutional participants.

Web3 Expansion: Building On-Chain Infrastructure

Gate’s decentralized transformation is accelerating.

The rebrand to Gate DEX and rapid adoption of Gate Layer (L2) signal long-term commitment to scalable on-chain infrastructure. Network activity continues to rise, with addresses exceeding 100 million and transaction volume growing 22% month-over-month.

These metrics reflect expanding developer participation, application deployment, and user engagement across Gate’s Web3 stack.

AI Integration: GateAI as Trading Intelligence Layer

Technology integration is another defining pillar of Gate’s strategy.

The launch of GateAI introduces real-time market interpretation, advanced candlestick analytics, and behavioral pattern recognition. With reported 88% user satisfaction, GateAI illustrates how artificial intelligence is becoming a core component of modern trading systems rather than an auxiliary feature.

AI is now embedded into decision support, risk assessment, and execution optimization.

Asset Management and Yield: From Speculation to Allocation

Gate’s asset management and yield products demonstrate strong structural momentum.

“On-Chain Earnings” has surpassed $1.3 billion in total value locked, while ETH staking nearing 170,000 ETH reflects growing trust in Gate’s custody and yield infrastructure.

These trends indicate a transition from short-term speculation toward structured capital deployment and long-term portfolio construction.

GateToken (GT): Anchoring the Ecosystem

Within this integrated system, GateToken (GT) has evolved into a foundational utility asset.

As the exclusive gas token for Gate Layer and Gate DEX, GT anchors network activity and transaction settlement. The upcoming deflationary burn mechanism—linked to platform revenue and on-chain usage—aligns token economics directly with ecosystem growth.

This design strengthens long-term value capture and reinforces GT’s role as a core infrastructure token.

Derivatives Growth: Institutional Liquidity Engine

Gate’s derivatives market share has risen to 11%, positioning it among the fastest-growing centralized platforms entering 2026.

This growth reflects:

Increasing liquidity depth

Enhanced risk management systems

Improved margin frameworks

Rising institutional participation

Derivatives now function as a central liquidity engine within Gate’s broader ecosystem.

Strategic Positioning: The DeTraFi Blueprint

Gate is strategically positioning itself at the intersection of:

Crypto markets

Traditional finance

Decentralized infrastructure

AI-driven analytics

This convergence enables capital to move fluidly across asset classes without structural barriers.

In an era defined by regulatory scrutiny, capital volatility, and institutional onboarding, this integrated architecture may serve as a blueprint for next-generation financial platforms.

Conclusion: Competing on Infrastructure, Not Fees

Gate is no longer competing primarily on trading fees, token listings, or short-term incentives.

It is competing on:

✔ System resilience

✔ Transparency

✔ Cross-market integration

✔ Technological depth

✔ Institutional trust

This strategic shift transforms Gate from a marketplace into a financial operating system.

Gate is no longer just facilitating trades.

It is building financial infrastructure for the next decade.

Gate’s January 2026 Transparency Report marks a decisive strategic transformation. The platform is no longer positioning itself merely as a centralized crypto exchange, but as a fully integrated DeTraFi ecosystem, combining decentralized finance, traditional markets, and AI-driven infrastructure into a unified capital network.

This evolution reflects a broader industry shift: leading platforms are becoming financial systems rather than trading venues.

Financial Security: Transparency as Competitive Advantage

At the core of Gate’s expansion lies institutional-grade risk management and capital protection.

With an overall reserve ratio of 125% and total reserves approaching $9.5 billion, Gate maintains strong solvency even under extreme market stress. Bitcoin reserves exceeding 140%, along with consistent over-collateralization across major assets, reinforce confidence among institutional and high-net-worth participants.

In an industry where trust remains fragile, transparency has become Gate’s primary strategic moat.

TradFi Integration: Eliminating Capital Friction

January’s strongest growth driver was Gate’s integration with traditional financial markets.

By enabling trading in metals, forex, indices, and equities using USDT-based margins, Gate has effectively unified digital and legacy assets within a single infrastructure layer. This removes conversion barriers, reduces settlement delays, and enhances portfolio flexibility.

With cumulative TradFi volume surpassing $20 billion, this model reflects growing demand for cross-asset exposure during periods of macroeconomic volatility.

USDx: A Unified Settlement Layer

The introduction of USDx, pegged 1:1 to USDT, strengthens Gate’s internal capital ecosystem.

USDx functions as a universal settlement medium, enabling seamless transitions between crypto and traditional instruments without repeated currency conversions. This improves capital efficiency, simplifies risk management, and reduces operational friction for active traders and institutional participants.

Web3 Expansion: Building On-Chain Infrastructure

Gate’s decentralized transformation is accelerating.

The rebrand to Gate DEX and rapid adoption of Gate Layer (L2) signal long-term commitment to scalable on-chain infrastructure. Network activity continues to rise, with addresses exceeding 100 million and transaction volume growing 22% month-over-month.

These metrics reflect expanding developer participation, application deployment, and user engagement across Gate’s Web3 stack.

AI Integration: GateAI as Trading Intelligence Layer

Technology integration is another defining pillar of Gate’s strategy.

The launch of GateAI introduces real-time market interpretation, advanced candlestick analytics, and behavioral pattern recognition. With reported 88% user satisfaction, GateAI illustrates how artificial intelligence is becoming a core component of modern trading systems rather than an auxiliary feature.

AI is now embedded into decision support, risk assessment, and execution optimization.

Asset Management and Yield: From Speculation to Allocation

Gate’s asset management and yield products demonstrate strong structural momentum.

“On-Chain Earnings” has surpassed $1.3 billion in total value locked, while ETH staking nearing 170,000 ETH reflects growing trust in Gate’s custody and yield infrastructure.

These trends indicate a transition from short-term speculation toward structured capital deployment and long-term portfolio construction.

GateToken (GT): Anchoring the Ecosystem

Within this integrated system, GateToken (GT) has evolved into a foundational utility asset.

As the exclusive gas token for Gate Layer and Gate DEX, GT anchors network activity and transaction settlement. The upcoming deflationary burn mechanism—linked to platform revenue and on-chain usage—aligns token economics directly with ecosystem growth.

This design strengthens long-term value capture and reinforces GT’s role as a core infrastructure token.

Derivatives Growth: Institutional Liquidity Engine

Gate’s derivatives market share has risen to 11%, positioning it among the fastest-growing centralized platforms entering 2026.

This growth reflects:

Increasing liquidity depth

Enhanced risk management systems

Improved margin frameworks

Rising institutional participation

Derivatives now function as a central liquidity engine within Gate’s broader ecosystem.

Strategic Positioning: The DeTraFi Blueprint

Gate is strategically positioning itself at the intersection of:

Crypto markets

Traditional finance

Decentralized infrastructure

AI-driven analytics

This convergence enables capital to move fluidly across asset classes without structural barriers.

In an era defined by regulatory scrutiny, capital volatility, and institutional onboarding, this integrated architecture may serve as a blueprint for next-generation financial platforms.

Conclusion: Competing on Infrastructure, Not Fees

Gate is no longer competing primarily on trading fees, token listings, or short-term incentives.

It is competing on:

✔ System resilience

✔ Transparency

✔ Cross-market integration

✔ Technological depth

✔ Institutional trust

This strategic shift transforms Gate from a marketplace into a financial operating system.

Gate is no longer just facilitating trades.

It is building financial infrastructure for the next decade.