# GoldandSilverHitNewHighs

8.48K

Gold and silver both reached record highs as safe-haven demand increased. Are you adding precious metals here? What’s your strategy?

Yusfirah

#GoldandSilverHitNewHighs

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

- Reward

- 5

- 11

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

Hey everyone,

What a wild ride in the precious metals space right now! Gold and silver both smashed through fresh all-time highs this week as safe-haven demand exploded amid the escalating geopolitical noise. With Trump's latest tariff threats hanging over Europe (tied to that whole Greenland saga), investors are piling into traditional havens like never before. Gold is trading around $4,665–$4,670 per ounce after hitting peaks near $4,700, and silver has surged even harder—pushing past $93–$94 per ounce in recent sessions. That's insane momentum, especially with sil

Hey everyone,

What a wild ride in the precious metals space right now! Gold and silver both smashed through fresh all-time highs this week as safe-haven demand exploded amid the escalating geopolitical noise. With Trump's latest tariff threats hanging over Europe (tied to that whole Greenland saga), investors are piling into traditional havens like never before. Gold is trading around $4,665–$4,670 per ounce after hitting peaks near $4,700, and silver has surged even harder—pushing past $93–$94 per ounce in recent sessions. That's insane momentum, especially with sil

- Reward

- 40

- 93

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

Gold and silver hit new highs simultaneously, and the risk pricing logic is reshaping

Spot gold and spot silver both reached new cycle highs. This is not just an ordinary price rally but more like a signal that the global risk pricing logic is changing. Historically, gold and silver rising together often occurred in three stages: runaway inflation expectations, shaky monetary credit, or rising systemic uncertainties. Currently, the market is experiencing all three simultaneously.

From a macro perspective, although interest rate expectations have fluctuated, the logic that “high interest rates

View OriginalSpot gold and spot silver both reached new cycle highs. This is not just an ordinary price rally but more like a signal that the global risk pricing logic is changing. Historically, gold and silver rising together often occurred in three stages: runaway inflation expectations, shaky monetary credit, or rising systemic uncertainties. Currently, the market is experiencing all three simultaneously.

From a macro perspective, although interest rate expectations have fluctuated, the logic that “high interest rates

- Reward

- 5

- 5

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

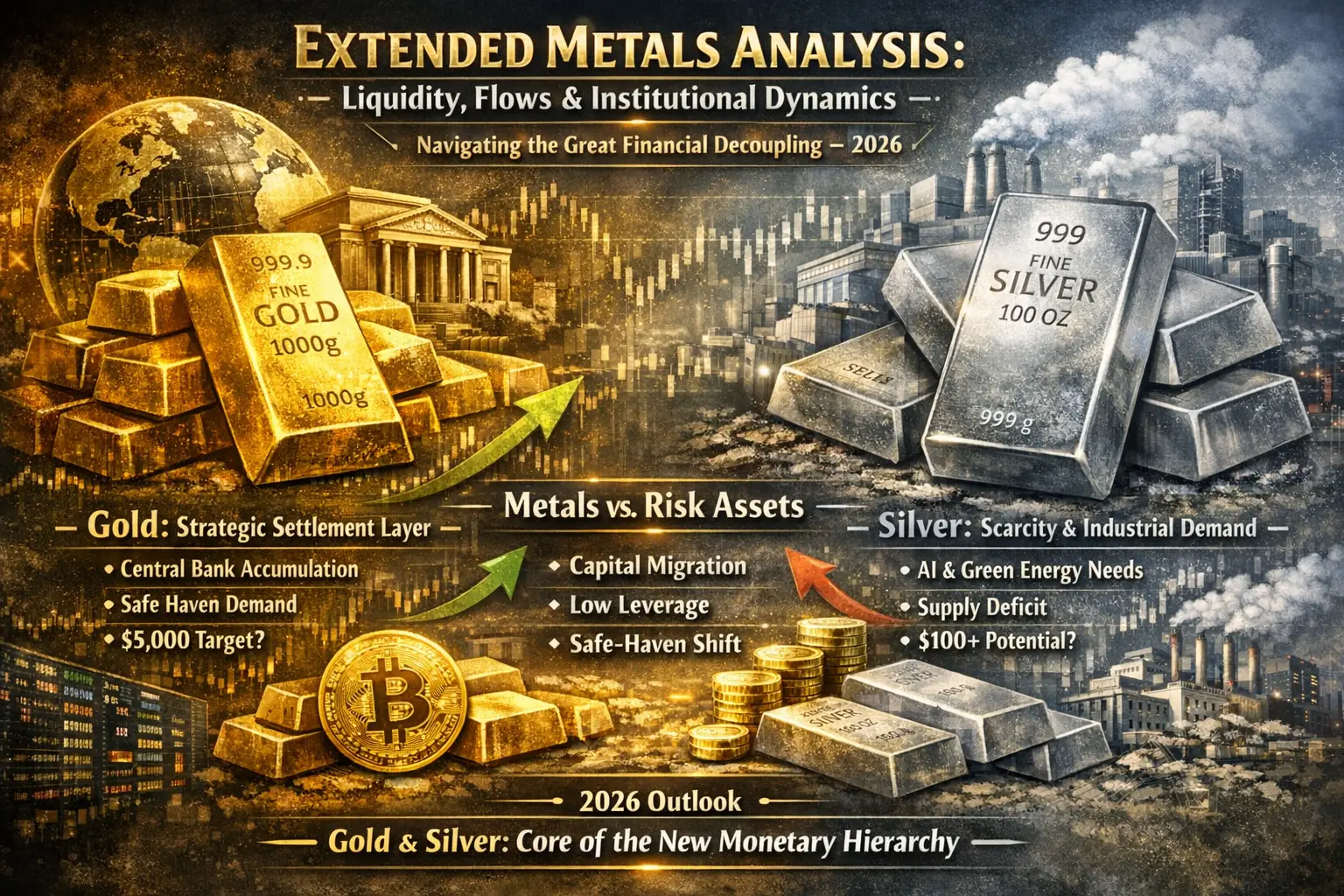

#GoldandSilverHitNewHighs 🏆💰

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

#GoldandSilverHitNewHighs 🏆💰

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

- Reward

- 12

- 16

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

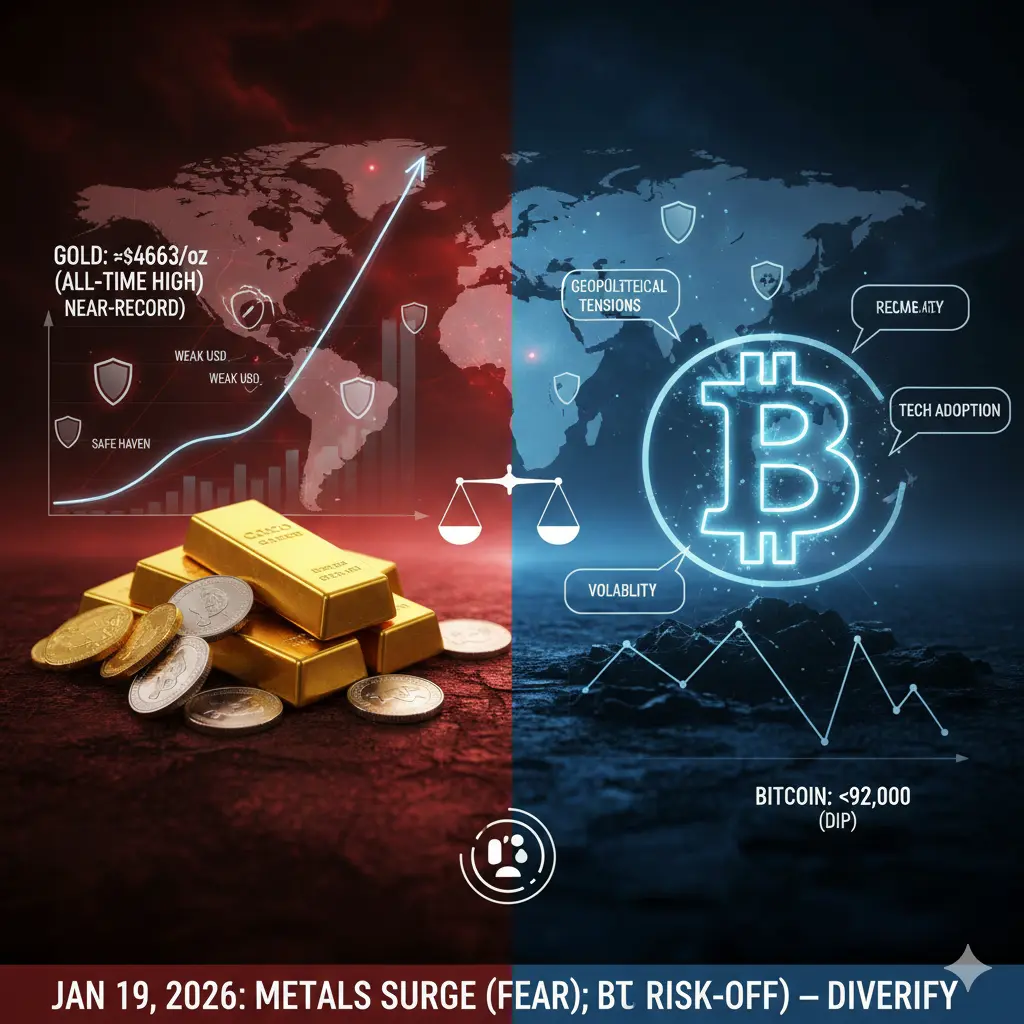

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

- Reward

- 20

- 27

- Repost

- Share

CryptoFiler :

:

Happy New Year! 🤑View More

Gold remains "steady," while silver moves "aggressively," with capital preferences already diverging

Although gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

View OriginalAlthough gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

- Reward

- 6

- 7

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊View More

#GoldandSilverHitNewHighs

Gold and silver prices are making headlines around the world today as both precious metals hit new all-time highs, reflecting a powerful shift in investor behavior amid global uncertainty. Across major financial markets, gold has surged to historic price levels, breaking previous ceilings and drawing attention from traders, analysts, and everyday investors alike. Silver has also gained strong momentum, reaching price levels not seen in years. This rally is not driven by hype alone; it is the result of several economic and geopolitical forces coming together at the sa

Gold and silver prices are making headlines around the world today as both precious metals hit new all-time highs, reflecting a powerful shift in investor behavior amid global uncertainty. Across major financial markets, gold has surged to historic price levels, breaking previous ceilings and drawing attention from traders, analysts, and everyday investors alike. Silver has also gained strong momentum, reaching price levels not seen in years. This rally is not driven by hype alone; it is the result of several economic and geopolitical forces coming together at the sa

- Reward

- 3

- 8

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

Recently, gold and silver prices have reached new record or near-record highs across global markets. This surge reflects a combination of geopolitical tensions, market uncertainty, and increased investor demand for safe-haven assets. Here is a clear, detailed analysis:

1. Precious Metals Reaching Record Levels

Gold has climbed above $4,650 per ounce, reaching unprecedented levels.

Silver has surged toward $90 per ounce, marking a historic high.

These levels show strong demand and investor confidence in metals as stores of value.

2. Safe-Haven Demand

Investors are mov

Recently, gold and silver prices have reached new record or near-record highs across global markets. This surge reflects a combination of geopolitical tensions, market uncertainty, and increased investor demand for safe-haven assets. Here is a clear, detailed analysis:

1. Precious Metals Reaching Record Levels

Gold has climbed above $4,650 per ounce, reaching unprecedented levels.

Silver has surged toward $90 per ounce, marking a historic high.

These levels show strong demand and investor confidence in metals as stores of value.

2. Safe-Haven Demand

Investors are mov

- Reward

- 4

- 7

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

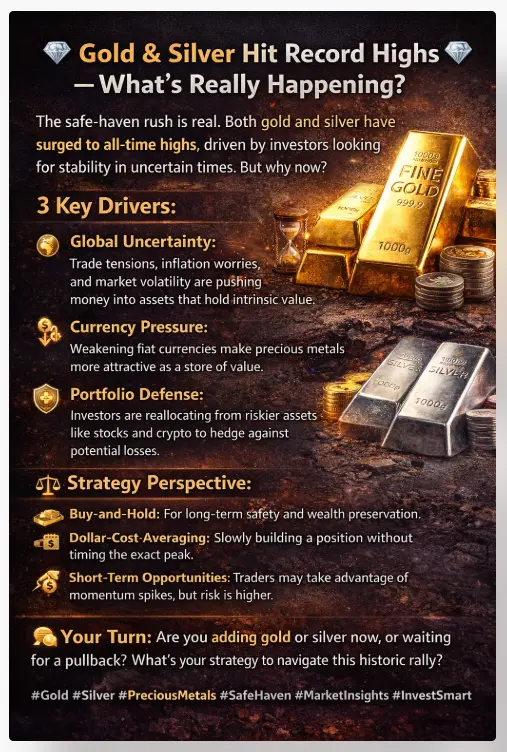

💎 Gold & Silver Hit Record Highs — What’s Really Happening? 💎

The safe-haven rush is real. Both gold and silver have surged to all-time highs, driven by investors looking for stability in uncertain times. But why now?

1️⃣ Global Uncertainty: Trade tensions, inflation worries, and market volatility are pushing money into assets that hold intrinsic value.

2️⃣ Currency Pressure: Weakening fiat currencies make precious metals more attractive as a store of value.

3️⃣ Portfolio Defense: Investors are reallocating from riskier assets like stocks and crypto to hedge agains

💎 Gold & Silver Hit Record Highs — What’s Really Happening? 💎

The safe-haven rush is real. Both gold and silver have surged to all-time highs, driven by investors looking for stability in uncertain times. But why now?

1️⃣ Global Uncertainty: Trade tensions, inflation worries, and market volatility are pushing money into assets that hold intrinsic value.

2️⃣ Currency Pressure: Weakening fiat currencies make precious metals more attractive as a store of value.

3️⃣ Portfolio Defense: Investors are reallocating from riskier assets like stocks and crypto to hedge agains

- Reward

- 10

- 7

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

Gold and silver reaching new highs is not the end, but the starting point of a new round of competition

Many investors, after seeing gold and silver hit new highs, their first reaction is "Is it time to top out?" But based on historical experience, the true top often appears after a consensus is extremely unanimous, not just when a breakthrough is formed.

Currently, there is a clear characteristic in the market:

* Prices are reaching new highs

* But sentiment is not extremely euphoric

* Mainstream funds are still hesitating whether to fully increase their positions

What does this mean? It indi

View OriginalMany investors, after seeing gold and silver hit new highs, their first reaction is "Is it time to top out?" But based on historical experience, the true top often appears after a consensus is extremely unanimous, not just when a breakthrough is formed.

Currently, there is a clear characteristic in the market:

* Prices are reaching new highs

* But sentiment is not extremely euphoric

* Mainstream funds are still hesitating whether to fully increase their positions

What does this mean? It indi

- Reward

- 5

- 5

- Repost

- Share

CoinRelyOnUniversal :

:

New Year Wealth Explosion 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

26.69K Popularity

336.28K Popularity

46.84K Popularity

8.48K Popularity

7.27K Popularity

46.97K Popularity

3.97K Popularity

5.54K Popularity

105.66K Popularity

13.58K Popularity

180.99K Popularity

12.54K Popularity

6.55K Popularity

7.82K Popularity

165.8K Popularity

News

View MoreFF(Falcon Finance)24小时上涨13.31%

1 m

A trader entered a short position with 40x leverage on 130 BTC, with an average entry price of $91,564.9.

1 m

Trade.xyz switches XYZ100 trading to isolated margin mode

5 m

Magic Eden Co-founder predicts a "Speculative Super Cycle": Forecasting Market and Crypto Gambling Heating Up Across the Board

8 m

Ethereum Hong Kong Community Center is opening soon, with an official launch event on January 24th.

13 m

Pin