# JapanBondMarketSell-Off

5.73K

Japan’s bond market saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after plans to end fiscal tightening and boost spending. Will this impact global rates and risk assets?

Discovery

#JapanBondMarketSell-Off

The recent sharp sell-off in Japan's bond market is shaking global financial balances! 📉🇯🇵

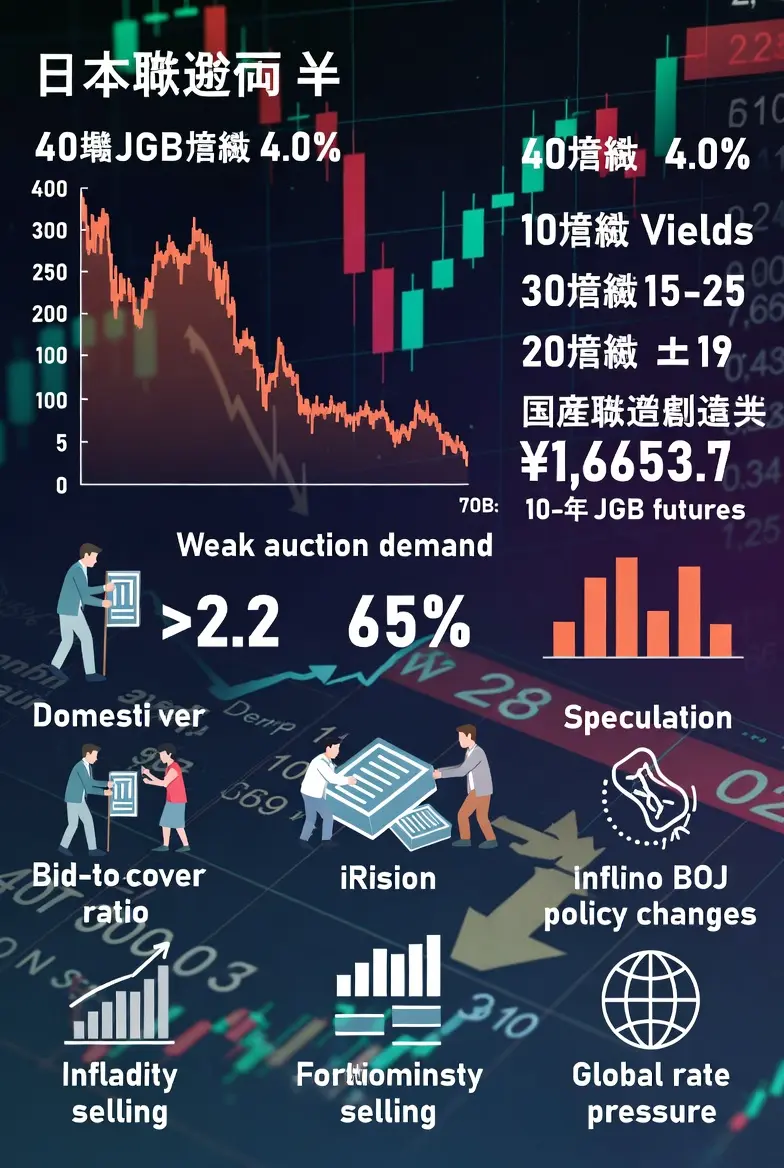

Yesterday, record-high selling was seen in Japanese government bonds (JGB), especially long-term ones. The 40-year bond yield exceeded 4% for the first time, reaching its highest level since 2007, while 30 and 20-year yields jumped by more than 25 basis points. This movement stemmed from Prime Minister Sanae Takaichi's promise to suspend the food consumption tax for two years and increased borrowing concerns following expansionary fiscal policies. Ahead of the snap electio

The recent sharp sell-off in Japan's bond market is shaking global financial balances! 📉🇯🇵

Yesterday, record-high selling was seen in Japanese government bonds (JGB), especially long-term ones. The 40-year bond yield exceeded 4% for the first time, reaching its highest level since 2007, while 30 and 20-year yields jumped by more than 25 basis points. This movement stemmed from Prime Minister Sanae Takaichi's promise to suspend the food consumption tax for two years and increased borrowing concerns following expansionary fiscal policies. Ahead of the snap electio

- Reward

- 45

- 46

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

#CryptoMarketPullback | Gold Speaks, Bitcoin Listens

This Is Not a Contradiction — It’s a Cycle.

What’s pulling back today isn’t just price.

It’s confidence, risk appetite, and market conviction.

📉 BTC: ~87.7K

💥 Over $1.8B in long liquidations in 48 hours

😨 Fear & Greed Index: 24 → Extreme Fear

At the same time, something else is happening 👇

🟡 Spot gold surged ~10% in 20 days, breaking above $4,800/oz.

This is not an inflation rally.

This is global risk-off being priced in.

🌍 The Macro Triggers Behind the Fear

US–EU trade war rhetoric has sharply weakened risk appetite

Stress in the Japa

This Is Not a Contradiction — It’s a Cycle.

What’s pulling back today isn’t just price.

It’s confidence, risk appetite, and market conviction.

📉 BTC: ~87.7K

💥 Over $1.8B in long liquidations in 48 hours

😨 Fear & Greed Index: 24 → Extreme Fear

At the same time, something else is happening 👇

🟡 Spot gold surged ~10% in 20 days, breaking above $4,800/oz.

This is not an inflation rally.

This is global risk-off being priced in.

🌍 The Macro Triggers Behind the Fear

US–EU trade war rhetoric has sharply weakened risk appetite

Stress in the Japa

BTC-0,08%

- Reward

- 16

- 19

- Repost

- Share

CrypTen :

:

Good Job!View More

#JapanBondMarketSell-Off

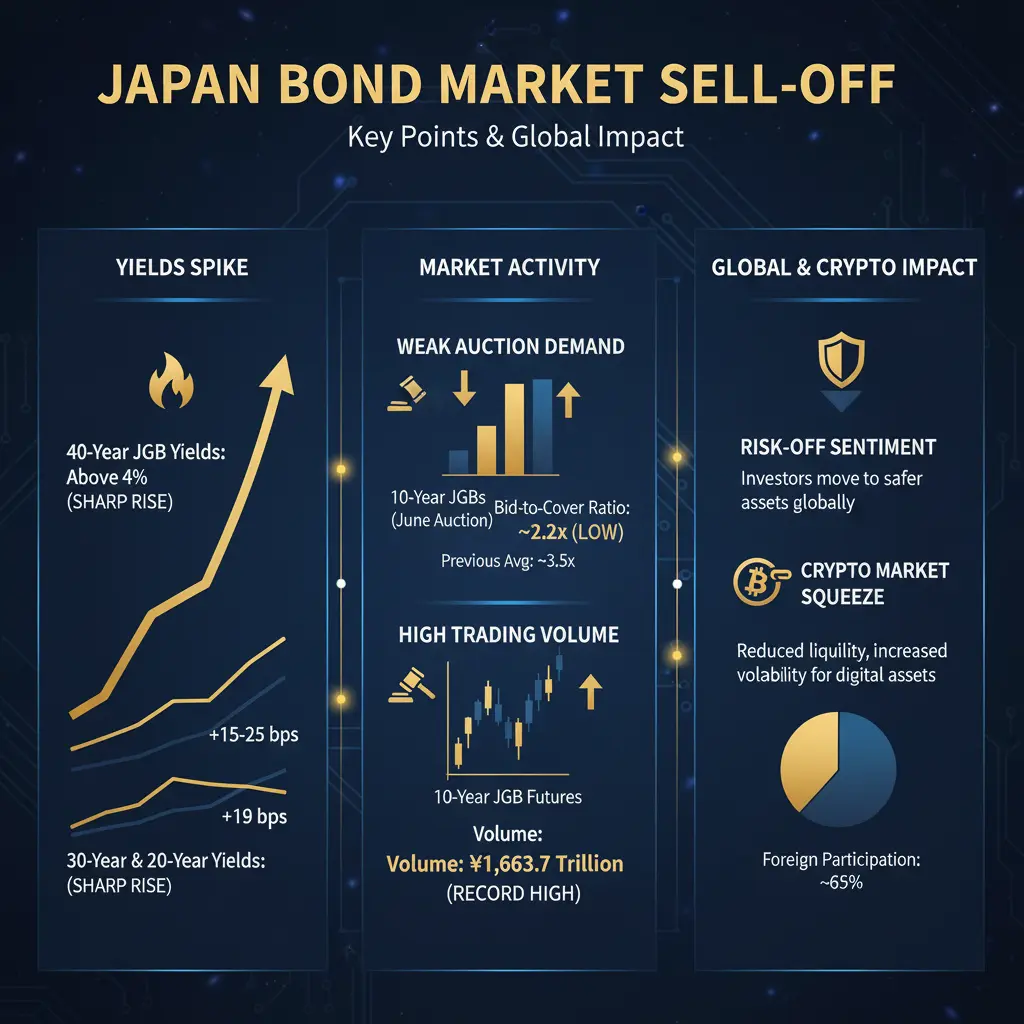

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 19

- 22

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro signal worth watching closely.

A sharp sell-off pushed 30Y and 40Y JGB yields up more than 25 bps after reports of ending fiscal tightening and increasing government spending.

Japan has been a global anchor for low yields, so sudden moves like this can ripple across global bond markets.

If higher Japanese yields persist, capital flows and risk pricing worldwide could start to adjust.

The big question is spillover:

Does this push global rates higher and pressure risk assets, or is it a short-lived domestic reaction?

Markets often re

#JapanBondMarketSell-Off is a macro signal worth watching closely.

A sharp sell-off pushed 30Y and 40Y JGB yields up more than 25 bps after reports of ending fiscal tightening and increasing government spending.

Japan has been a global anchor for low yields, so sudden moves like this can ripple across global bond markets.

If higher Japanese yields persist, capital flows and risk pricing worldwide could start to adjust.

The big question is spillover:

Does this push global rates higher and pressure risk assets, or is it a short-lived domestic reaction?

Markets often re

- Reward

- 7

- 12

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

The Japan Bond Market Shake-up: Why Every Investor Should Pay Attention

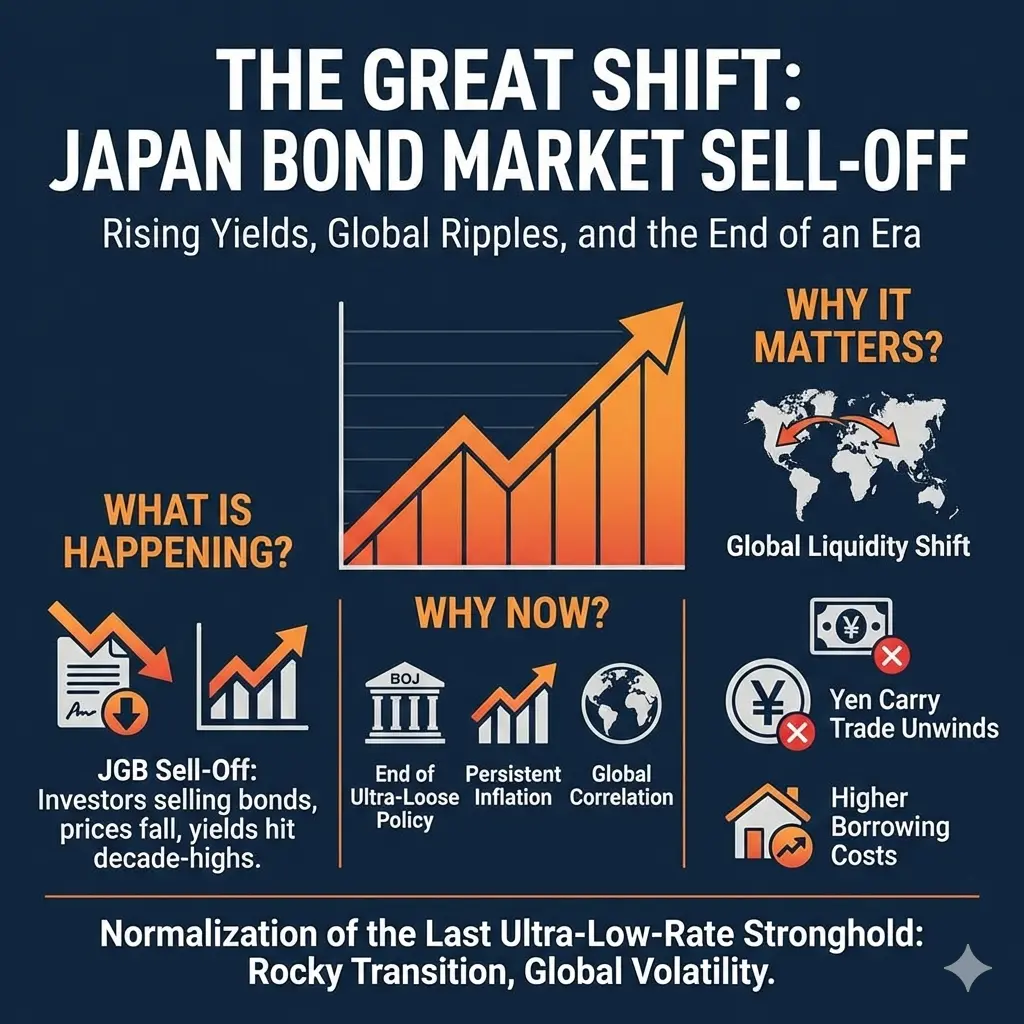

For decades, the Japanese Government Bond (JGB) market was seen as a predictable, almost stagnant corner of the financial world. But that has changed. A significant sell-off in JGBs is sending shockwaves through global markets, signaling the end of an era of ultra-low interest rates in Japan.

Why is the Sell-Off Happening?

The driver is a fundamental shift in Japan's monetary landscape. After years of fighting deflation with negative rates and heavy central bank intervention, inflation is finally

The Japan Bond Market Shake-up: Why Every Investor Should Pay Attention

For decades, the Japanese Government Bond (JGB) market was seen as a predictable, almost stagnant corner of the financial world. But that has changed. A significant sell-off in JGBs is sending shockwaves through global markets, signaling the end of an era of ultra-low interest rates in Japan.

Why is the Sell-Off Happening?

The driver is a fundamental shift in Japan's monetary landscape. After years of fighting deflation with negative rates and heavy central bank intervention, inflation is finally

- Reward

- 21

- 18

- Repost

- Share

CrypTen :

:

Good Job!View More

#JapanBondMarketSell-Off

📉 The Great Shift: Understanding the JapanBondMarketSell-Off

The land of the rising sun is seeing a historic rise in yields, and the ripples are being felt across every major financial hub. For decades, Japan was the anchor of low interest rates, but that era is officially transitioning.

What is happening?

The Japanese Government Bond (JGB) market is experiencing a significant sell-off. As investors sell bonds, their prices fall and their yields rise. Recently, the 10-year JGB yield has been hitting levels we haven't seen in over a decade.

Why is this happening now?

📉 The Great Shift: Understanding the JapanBondMarketSell-Off

The land of the rising sun is seeing a historic rise in yields, and the ripples are being felt across every major financial hub. For decades, Japan was the anchor of low interest rates, but that era is officially transitioning.

What is happening?

The Japanese Government Bond (JGB) market is experiencing a significant sell-off. As investors sell bonds, their prices fall and their yields rise. Recently, the 10-year JGB yield has been hitting levels we haven't seen in over a decade.

Why is this happening now?

- Reward

- 7

- 11

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 5

- 9

- Repost

- Share

GateUser-cbf7def4 :

:

so happy growth mindest activatedView More

#JapanBondMarketSell-Off

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

- Reward

- 4

- 6

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

#JapanBondMarketSell-Off

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

- Reward

- 9

- 7

- Repost

- Share

DragonFlyOfficial :

:

HODL Tight 💪View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off 📉🌏

Japan’s government bond market is making global headlines today as a sharp sell-off in Japanese Government Bonds (JGBs) has sent ripples through financial markets worldwide. On January 21, 2026, yields on long-term JGBs surged to multi-decade highs, with the 40-year bond yield breaking above 4%, reflecting a combination of fiscal uncertainty, evolving monetary policy, and shifting investor sentiment. Historically considered one of the safest fixed-income markets, Japan’s debt has suddenly become a focal point for global risk reassessment,

#JapanBondMarketSell-Off 📉🌏

Japan’s government bond market is making global headlines today as a sharp sell-off in Japanese Government Bonds (JGBs) has sent ripples through financial markets worldwide. On January 21, 2026, yields on long-term JGBs surged to multi-decade highs, with the 40-year bond yield breaking above 4%, reflecting a combination of fiscal uncertainty, evolving monetary policy, and shifting investor sentiment. Historically considered one of the safest fixed-income markets, Japan’s debt has suddenly become a focal point for global risk reassessment,

- Reward

- 3

- 7

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

37.39K Popularity

20.09K Popularity

7.4K Popularity

57.36K Popularity

343.48K Popularity

5.73K Popularity

6.31K Popularity

14.84K Popularity

107.82K Popularity

20.79K Popularity

196.79K Popularity

17.81K Popularity

6.76K Popularity

13.68K Popularity

169.56K Popularity

News

View MoreData: In the past 24 hours, the total liquidation across the network was $1.005 billion, with long positions liquidated at $670 million and short positions at $335 million.

35 m

ETH breaks through 3050 USDT

48 m

The US Dollar Index rose to 98.8, and the Euro against the US Dollar briefly fell to 1.1685.

1 h

BTC breaks through 90,000 USDT

1 h

BTC breaks through 89,000 USDT

1 h

Pin