#USCoreCPIHitsFour-YearLow

The U.S. Core Consumer Price Index (CPI) — which measures inflation excluding volatile food and energy — dropped to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Headline CPI fell to 2.4% YoY, below expectations, signaling that inflationary pressures are steadily easing.

Prices for services, rent, and goods are rising slower, easing cost pressures for consumers and businesses, and signaling a smoother economic trajectory.

📉 Core CPI: Why It Matters

Core vs Headline CPI: Core strips out food and energy to show underlying inflation.

Main Drivers of the Drop:

Shelter/rent easing to 3% YoY (from 3.2%)

Slower growth in recreation, household goods, and services

Energy decline (-7.5% monthly drop) helped headline CPI

Macro Implications:

Inflation closer to Fed’s 2% target

Fed may pause or cut rates sooner than expected

Supports liquidity, risk appetite, and market confidence

🏦 Economic & Policy Impact

Federal Reserve: Easing pressure on interest rate hikes; markets now expect 1–3 potential rate cuts in 2026.

Borrowing & Spending: Lower rates → cheaper loans & mortgages → higher consumer/business spending.

Soft Landing Signal: Strong growth continues without overheating.

📊 Traditional Markets Reaction

Stocks: Tech & growth sectors likely rally on lower rate expectations; S&P 500 and Nasdaq could gain.

Bonds: Yields drop as rate-cut bets rise; 10Y Treasuries dip.

USD: Slight softening → supports exports, commodities, and USD-priced assets.

Risk Sentiment: Shifts to risk-on; investors favor equities & crypto over safe havens.

₿ Crypto Market & BTC/ETH Outlook

Current Prices:

Bitcoin (BTC): ~$69,000

Ethereum (ETH): ~$2,050

Impact of Lower Core CPI:

Cooling inflation strengthens the “Fed pivot” narrative → liquidity inflows to crypto.

Lower real yields → zero-yield assets like BTC become more attractive.

Institutions likely increase allocations → ETFs, custody, and spot flows.

Weaker USD → supports global buying power.

Price Dynamics Post-CPI:

BTC initially bounced from $67k–$68k toward $70k resistance.

ETH and major altcoins followed in a correlated risk-on move ($2,050 → $2,200+ potential).

Volatility remains — profit-taking and macro events can cause short-term swings.

Key Levels & Targets:

BTC Support: $65k–$67k

BTC Resistance / Bull Target: $70k → $72k–$75k

ETH Target: $2,200+ if momentum persists

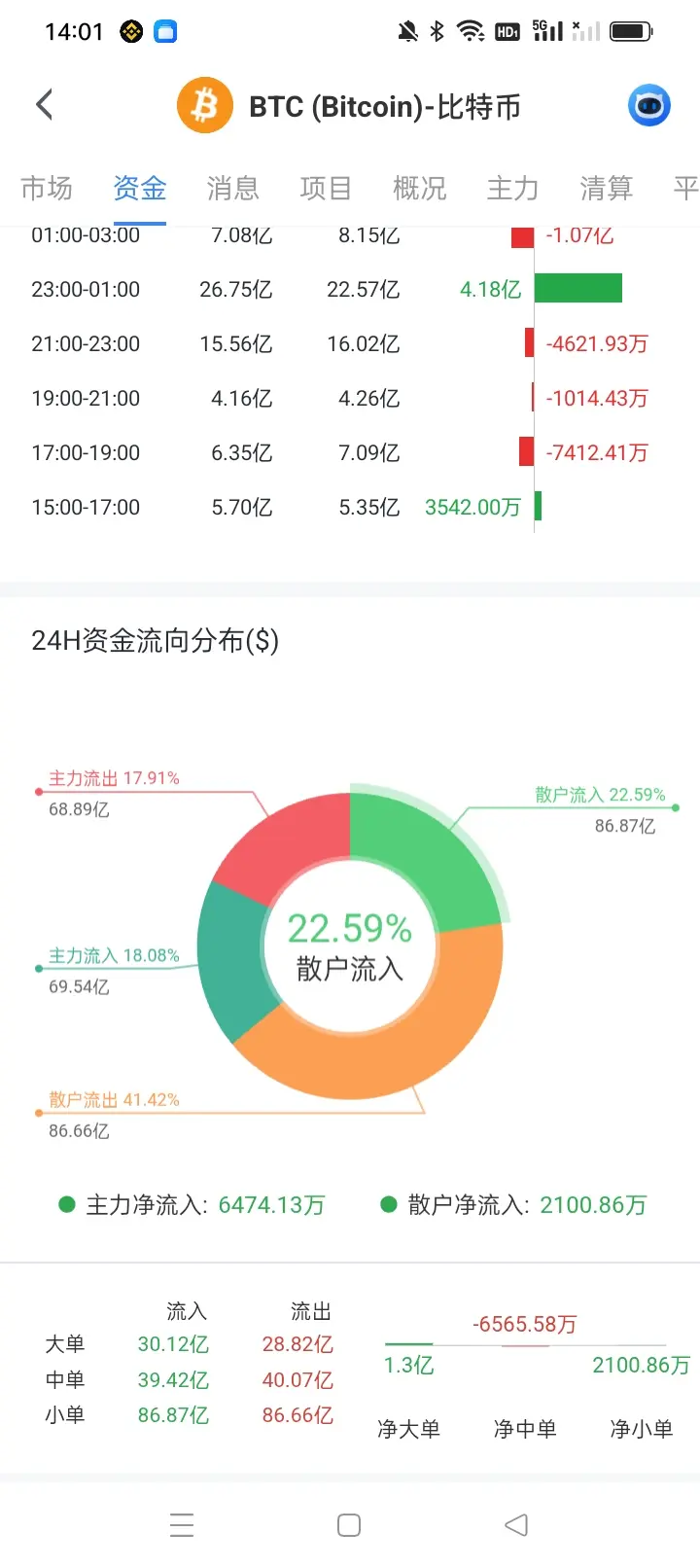

Liquidity & Trading Signals:

Increased trading volumes and stablecoin inflows around the release

Futures funding may normalize as traders adjust positions

Risk-on sentiment dominates — more “buy the dip” mentality emerges

🧠 Investor & Trader Takeaways

Macro Tailwind: Cooling Core CPI favors Fed rate cuts → supportive for risk assets.

Crypto Bullish Bias: BTC & ETH likely trend higher if broader macro and liquidity conditions remain favorable.

Volatility Still Present: Short-term spikes, choppy moves, and “sell the news” scenarios are possible.

Strategic Action: Maintain stop-loss discipline, monitor key levels, watch volume/liquidity, and avoid over-leveraging.

📌 Summary

US Core CPI hitting a four-year low confirms disinflation is underway. This boosts expectations for rate cuts, improves liquidity, and strengthens risk appetite — creating a medium-term bullish outlook for Bitcoin and crypto markets. BTC eyes $70k+ if momentum holds, while ETH and major altcoins may follow a similar trajectory.

Bottom Line: Lower inflation → potential Fed easing → more money in the system → favorable environment for BTC, ETH, and risk-on assets — with careful trading still required due to volatility.

The U.S. Core Consumer Price Index (CPI) — which measures inflation excluding volatile food and energy — dropped to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Headline CPI fell to 2.4% YoY, below expectations, signaling that inflationary pressures are steadily easing.

Prices for services, rent, and goods are rising slower, easing cost pressures for consumers and businesses, and signaling a smoother economic trajectory.

📉 Core CPI: Why It Matters

Core vs Headline CPI: Core strips out food and energy to show underlying inflation.

Main Drivers of the Drop:

Shelter/rent easing to 3% YoY (from 3.2%)

Slower growth in recreation, household goods, and services

Energy decline (-7.5% monthly drop) helped headline CPI

Macro Implications:

Inflation closer to Fed’s 2% target

Fed may pause or cut rates sooner than expected

Supports liquidity, risk appetite, and market confidence

🏦 Economic & Policy Impact

Federal Reserve: Easing pressure on interest rate hikes; markets now expect 1–3 potential rate cuts in 2026.

Borrowing & Spending: Lower rates → cheaper loans & mortgages → higher consumer/business spending.

Soft Landing Signal: Strong growth continues without overheating.

📊 Traditional Markets Reaction

Stocks: Tech & growth sectors likely rally on lower rate expectations; S&P 500 and Nasdaq could gain.

Bonds: Yields drop as rate-cut bets rise; 10Y Treasuries dip.

USD: Slight softening → supports exports, commodities, and USD-priced assets.

Risk Sentiment: Shifts to risk-on; investors favor equities & crypto over safe havens.

₿ Crypto Market & BTC/ETH Outlook

Current Prices:

Bitcoin (BTC): ~$69,000

Ethereum (ETH): ~$2,050

Impact of Lower Core CPI:

Cooling inflation strengthens the “Fed pivot” narrative → liquidity inflows to crypto.

Lower real yields → zero-yield assets like BTC become more attractive.

Institutions likely increase allocations → ETFs, custody, and spot flows.

Weaker USD → supports global buying power.

Price Dynamics Post-CPI:

BTC initially bounced from $67k–$68k toward $70k resistance.

ETH and major altcoins followed in a correlated risk-on move ($2,050 → $2,200+ potential).

Volatility remains — profit-taking and macro events can cause short-term swings.

Key Levels & Targets:

BTC Support: $65k–$67k

BTC Resistance / Bull Target: $70k → $72k–$75k

ETH Target: $2,200+ if momentum persists

Liquidity & Trading Signals:

Increased trading volumes and stablecoin inflows around the release

Futures funding may normalize as traders adjust positions

Risk-on sentiment dominates — more “buy the dip” mentality emerges

🧠 Investor & Trader Takeaways

Macro Tailwind: Cooling Core CPI favors Fed rate cuts → supportive for risk assets.

Crypto Bullish Bias: BTC & ETH likely trend higher if broader macro and liquidity conditions remain favorable.

Volatility Still Present: Short-term spikes, choppy moves, and “sell the news” scenarios are possible.

Strategic Action: Maintain stop-loss discipline, monitor key levels, watch volume/liquidity, and avoid over-leveraging.

📌 Summary

US Core CPI hitting a four-year low confirms disinflation is underway. This boosts expectations for rate cuts, improves liquidity, and strengthens risk appetite — creating a medium-term bullish outlook for Bitcoin and crypto markets. BTC eyes $70k+ if momentum holds, while ETH and major altcoins may follow a similar trajectory.

Bottom Line: Lower inflation → potential Fed easing → more money in the system → favorable environment for BTC, ETH, and risk-on assets — with careful trading still required due to volatility.