2025 ATRS Fiyat Tahmini: Antares Pharma Hissesi İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: ATRS'nin Piyasa Konumu ve Yatırım Değeri

Attarius Network (ATRS), Web2 ile Web3 teknolojilerini birleştirmek üzere tasarlanmış bir platform olarak, kuruluşundan bu yana blokzincir entegrasyonu alanında önemli ilerlemeler kaydetmiştir. 2025 yılı itibarıyla ATRS'nin piyasa değeri 10.687,06 $ seviyesinde olup, dolaşımdaki arzı yaklaşık 9.653.204 tokendir ve fiyatı 0,0011071 $ civarındadır. “Web3 geçiş kolaylaştırıcısı” olarak nitelendirilebilecek bu varlık, geliştiriciler, oyuncular ve NFT üreticileri için blokzincir entegrasyonunu sadeleştirme konusunda giderek daha önemli bir rol üstleniyor.

Bu makalede, 2025'ten 2030'a kadar ATRS'nin fiyat trendleri kapsamlı biçimde analiz edilmekte; önceki fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler bir arada değerlendirilerek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejiler sunulmaktadır.

I. ATRS Fiyat Geçmişi ve Güncel Piyasa Durumu

ATRS Tarihsel Fiyat Gelişimi

- 2024: ATRS, 10 Temmuz'da 0,14888 $ ile tarihi zirvesine ulaşarak proje için önemli bir kilometre taşı kaydetti.

- 2025: Token, 7 Mart’ta 0,000334 $ ile tüm zamanların en düşük seviyesini görerek şiddetli piyasa oynaklığını yansıttı.

ATRS Güncel Piyasa Durumu

4 Kasım 2025 itibarıyla ATRS, 0,0011071 $ seviyesinden işlem görüyor. Son 24 saatte fiyatında %29,22 artış yaşanmış olup, yüksek oynaklık gözlenmektedir. Mevcut piyasa değeri 10.687,06 $ iken, dolaşımdaki ATRS token adedi 9.653.204’tür. 24 saatlik işlem hacmi ise 16.192,76 $ ile piyasada orta yoğunlukta bir aktiviteye işaret ediyor.

ATRS, farklı zaman dilimlerinde karışık bir performans sergilemiştir. Kısa vadede (son bir haftada %27,83 ve son bir ayda %27,15) ciddi kazançlar elde etse de, son bir yılda %80,71 oranında büyük bir kayıp yaşamıştır. Bu durum, token’ın toparlanma sürecinde olduğunu ancak hala önceki zirvelerinden oldukça uzak olduğunu gösteriyor.

Mevcut fiyat, tüm zamanların en yüksek seviyesinden %99,26 oranında bir düşüşe ve en düşük seviyesinden %231,47 artışa işaret ediyor. Bu da token’ın toparlanma potansiyeli taşıdığını, ancak eski değerlerini geri kazanmakta zorluk yaşadığını ortaya koyuyor.

Güncel ATRS piyasa fiyatını görmek için tıklayın

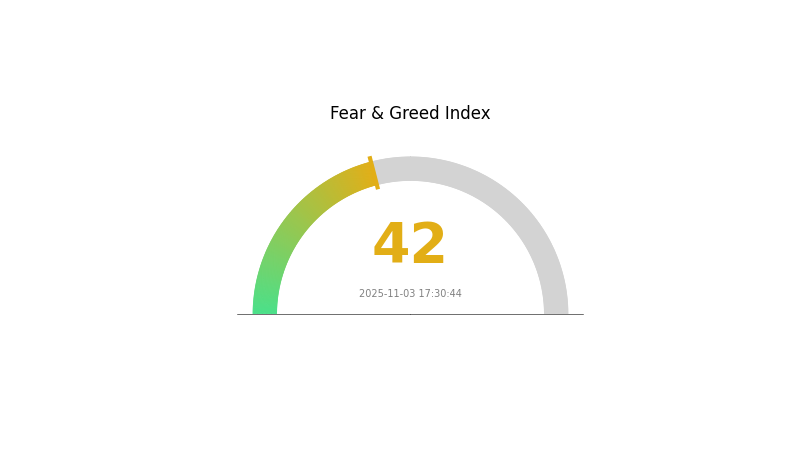

ATRS Piyasa Duyarlılığı Göstergesi

2025-11-03 Korku ve Açgözlülük Endeksi: 42 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık, Korku ve Açgözlülük Endeksi'nin 42 seviyesinde bulunmasıyla birlikte ihtiyatlı kalmaya devam ediyor ve piyasada korkunun hakim olduğunu gösteriyor. Yatırımcılar giderek daha temkinli ve riskten kaçan bir tavır sergiliyor. Bu dönemlerde bazı yatırımcılar “diğerleri açgözlü olduğunda kork, korktuklarında açgözlü ol” yaklaşımına göre hareket ederek bunu fırsat olarak görebilir. Ancak, bu dalgalı piyasa ortamında yatırım yapmadan önce mutlaka kapsamlı araştırma yapmak ve dikkatli adım atmak gerekmektedir.

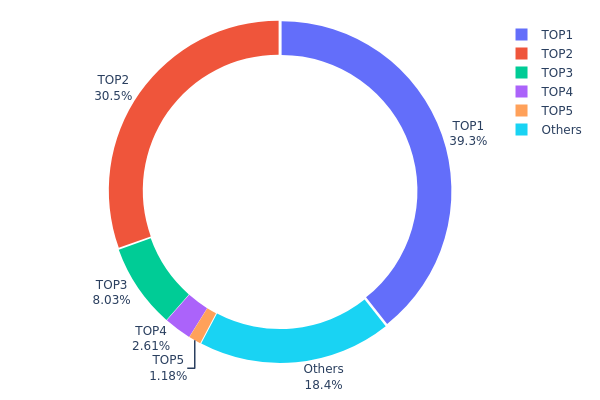

ATRS Varlık Dağılımı

Adres bazlı token dağılımı, ATRS tokenlerinin büyük bir bölümünün az sayıda adreste toplandığını gösteriyor. İlk iki adres toplam arzın %69,8’ini (sırasıyla %39,32 ve %30,48) elinde bulunduruyor. Bu yüksek yoğunluk, piyasa manipülasyonu ve fiyat oynaklığı risklerini gündeme getiriyor.

Ayrıca, ilk 5 adresin toplam ATRS arzının %81,61’ini kontrol ettiği, geri kalan %18,39’un ise diğer yatırımcılar arasında dağıldığı görülüyor. Bu kadar merkezi bir dağılım, piyasa dinamiklerini etkileyebilir, fiyat dalgalanmalarını artırabilir ve likiditeyi azaltabilir. Ayrıca ATRS ekosisteminde merkezsizleşmenin düşük seviyede olduğunu, bunun da uzun vadeli istikrarı ve benimsenmeyi olumsuz etkileyebileceğini gösteriyor.

Bu yoğunlaşma, ATRS'nin zincir üstü yapısında büyük yatırımcıların etki sahibi olduğunu, bunun da piyasa verimliliği ve adil fiyat oluşumu açısından risk oluşturduğunu ortaya koyuyor. Yatırımcılar, ATRS’yi portföylerine eklerken dağılım yapısını dikkate almalıdır.

Güncel ATRS Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 58.984,42K | 39,32% |

| 2 | 0xc882...84f071 | 45.724,73K | 30,48% |

| 3 | 0x1156...75668c | 12.045,84K | 8,03% |

| 4 | 0x2084...61369e | 3.920,29K | 2,61% |

| 5 | 0xd7b1...b10175 | 1.767,04K | 1,17% |

| - | Diğerleri | 27.557,68K | 18,39% |

II. ATRS'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Özellikle ABD Merkez Bankası'nın da aralarında bulunduğu büyük merkez bankalarının sıkılaştırıcı politikalarını sürdürmesi bekleniyor. Agresif faiz artırımları ve küresel likidite daralması, ATRS fiyat trendlerini doğrudan etkileyebilir.

-

Enflasyona Karşı Koruma Özellikleri: Çekirdek PCE enflasyonunun %2'nin üzerinde kalması, ATRS'nin enflasyonist ortamlardaki performansını önemli kılacak.

-

Jeopolitik Faktörler: Uluslararası gelişmeler ve çatışmalar, ATRS fiyat hareketlerinde etkili olabilir.

Teknolojik Gelişim ve Ekosistem Kurulumu

- Ekosistem Uygulamaları: ATRS ile bağlantılı önde gelen DApp ve ekosistem projelerinin gelişimi, gelecekteki fiyat performansında belirleyici rol oynayacaktır.

III. 2025-2030 Arası ATRS Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00094 $ - 0,00111 $

- Tarafsız tahmin: 0,00111 $ - 0,00120 $

- İyimser tahmin: 0,00120 $ - 0,0013 $ (olumlu piyasa duyarlılığı halinde)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00141 $ - 0,00208 $

- 2028: 0,00123 $ - 0,00231 $

- Ana katalizörler: Artan benimseme ve teknolojik ilerlemeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00210 $ - 0,00230 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00230 $ - 0,00260 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,00260 $ - 0,00279 $ (çığır açıcı yenilikler halinde)

- 2030-12-31: ATRS 0,00279 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,0013 | 0,00111 | 0,00094 | 0 |

| 2026 | 0,00179 | 0,0012 | 0,00088 | 8 |

| 2027 | 0,00208 | 0,0015 | 0,00141 | 35 |

| 2028 | 0,00231 | 0,00179 | 0,00123 | 61 |

| 2029 | 0,00215 | 0,00205 | 0,00113 | 84 |

| 2030 | 0,00279 | 0,0021 | 0,00159 | 89 |

IV. ATRS için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ATRS Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli değer yatırımcıları ve blokzincir meraklıları

- İşlem önerileri:

- Piyasa geri çekilmelerinde ATRS token biriktirin

- Önemli fiyat hareketleri için fiyat uyarıları oluşturun

- Token’larınızı güvenli, saklayıcı olmayan bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik Analiz Araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım koşullarını takip edin

- Salınım Ticareti için Temel Noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini izleyin

- Risk yönetimi için zarar durdur emirleri ayarlayın

ATRS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Birden fazla kripto varlığa yatırım yapın

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Yazılım cüzdanı seçeneği: Resmi Attarius Cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, güçlü şifreler oluşturun

V. ATRS için Olası Riskler ve Zorluklar

ATRS Piyasa Riskleri

- Yüksek volatilite: Kripto piyasası dalgalanmaları büyük fiyat hareketlerine yol açabilir

- Sınırlı likidite: Düşük işlem hacmi pozisyon açıp kapamayı zorlaştırabilir

- Piyasa duyarlılığı: Yatırımcı algısındaki ani değişimlerden etkilenebilir

ATRS Regülasyon Riskleri

- Gelişen düzenlemeler: Kripto varlıkları etkileyebilecek yeni yasa ihtimali

- Sınır ötesi uyum: Uluslararası düzenlemelere uyumda zorluklar

- Vergisel etkiler: Kripto varlıklar için belirsiz veya değişken vergi rejimi

ATRS Teknik Riskleri

- Akıllı sözleşme açıkları: Kodda istismar riski

- Ağ tıkanıklığı: Yüksek ağ aktivitesinde işlem gecikmeleri

- Teknolojik eskime: Yeni blokzincir çözümleri karşısında geri kalma riski

VI. Sonuç ve Eylem Önerileri

ATRS Yatırım Değeri Değerlendirmesi

ATRS, Web3 geçiş alanında yüksek riskli ancak yüksek potansiyele sahip bir yatırım olanağı sunar. Blokzincir entegrasyonunda yenilikçi çözümler sunsa da, projenin erken aşamada olması ve buna bağlı dalgalanma yatırımcılar için önemli bir risk unsurudur.

ATRS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzün yalnızca küçük bir kısmını ayırın, öğrenmeye öncelik verin ✅ Tecrübeli yatırımcılar: Dengeli bir strateji izleyin ve portföyünüzü düzenli olarak dengeleyin ✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapın, büyük işlemler için OTC seçeneklerini değerlendirin

ATRS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden doğrudan token alımı yapılabilir

- Limit emirleri: Belirli fiyat seviyelerinden otomatik alım/satım için kullanılır

- Dolar-maliyet ortalaması: Fiyat dalgalanmasının etkisini azaltmak için düzenli küçük alımlar yapın

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

Tarsus hissesi iyi bir yatırım mı?

Tarsus hissesi potansiyel taşıyor, ancak zamanlama kritik. Sağlam finansal yapısı ve uzun nakit dayanıklılığı olumlu; kısa vadeli büyüme beklentisi ise sınırlı.

Aurora Innovation hissemi satmalı mıyım?

Son verilere göre Aurora Innovation hissesini satmak mantıklı olabilir. Hisse fiyatı son dönemde %1,92 geriledi ve hem kısa hem uzun vadeli hareketli ortalamalardan olumsuz sinyaller geliyor.

Athira Pharma hissesi alınır mı?

Athira Pharma'nın potansiyeli karışık. Momentum derecesi C seviyesinde, uzun vadeli büyüme ise belirsiz. Yatırım yapmadan önce güncel piyasa eğilimlerini mutlaka değerlendirin.

AT&T hissesi yükselecek mi?

Mevcut piyasa trendleri ve analist tahminlerine göre AT&T hissesinde önümüzdeki aylarda ılımlı bir yükseliş bekleniyor.

2025 VRA Fiyat Tahmini: Sanal Gerçeklik Varlıkları İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 AIOZ Fiyat Tahmini: Web3 Ağ Tokeni'nin Büyüme Faktörleri ve Piyasa Potansiyelinin Analizi

2025 SAITO Fiyat Tahmini: Piyasa Trendleri ve Bir Sonraki Boğa Sezonu İçin Büyüme Potansiyelinin Analizi

2025 DAG Fiyat Tahmini: Constellation Network’ün Token’ı İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 JOYSTREAM Fiyat Tahmini: Merkeziyetsiz video platformu token’inin büyüme potansiyeli ile piyasa trendlerini analiz etmek

2025 ATRS Fiyat Tahmini: Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

XTTA Nedir: Sınır Ötesi Ticaret Doğrulaması Hakkında Kapsamlı Bir Rehber

TOKE nedir: Dijital Token Devrimini Anlamaya Yönelik Kapsamlı Bir Rehber

ARIAIP Nedir: Erişilebilirlik ve Yapay Zeka Destekli Etkileşimli Protokollere Kapsamlı Bir Rehber

FTRB Nedir: Sabit Zamanlı Ters Kırılma Ticaret Stratejisine Kapsamlı Bir Rehber

Dijital Cüzdanınızda Airdrop Almanın Rehberi