2025 ESG Price Prediction: The Future of Sustainable Investing and Its Impact on Global Markets

Introduction: ESG's Market Position and Investment Value

ESG (ESG), as a cryptocurrency focused on environmental, social, and governance aspects, has made significant strides since its inception. As of 2025, ESG's market capitalization stands at $110,580, with a circulating supply of approximately 2,850,000 tokens and a price hovering around $0.0388. This asset, often referred to as a "sustainable finance token," is playing an increasingly crucial role in the voluntary carbon reduction domain.

This article will provide a comprehensive analysis of ESG's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ESG Price History Review and Current Market Status

ESG Historical Price Evolution

- 2022: All-time high reached, price peaked at $3.83

- 2023-2024: Market downturn, price experienced significant decline

- 2025: Continuous market fluctuations, price dropped to a historical low of $0.03359959

ESG Current Market Situation

As of November 1, 2025, ESG is trading at $0.0388, marking a 24-hour decline of 5.85%. The token's market capitalization stands at $110,580, ranking 4939th in the overall cryptocurrency market. Despite the recent downturn, ESG has shown some resilience over the past week with a 10.44% increase. However, the longer-term outlook remains challenging, with a 30-day decrease of 6.35% and a substantial year-on-year drop of 81.58%.

The current circulating supply of ESG is 2,850,000 tokens, which represents only 5.82% of the total supply of 49,000,000. This low circulation ratio could potentially impact liquidity and price volatility. The 24-hour trading volume is relatively modest at $12,276.87, indicating limited market activity.

ESG's price is currently closer to its all-time low than its all-time high, suggesting a bearish market sentiment. The token's fully diluted valuation of $1,901,200 and its market dominance of 0.000048% reflect its current position as a small-cap cryptocurrency in a competitive market.

Click to view the current ESG market price

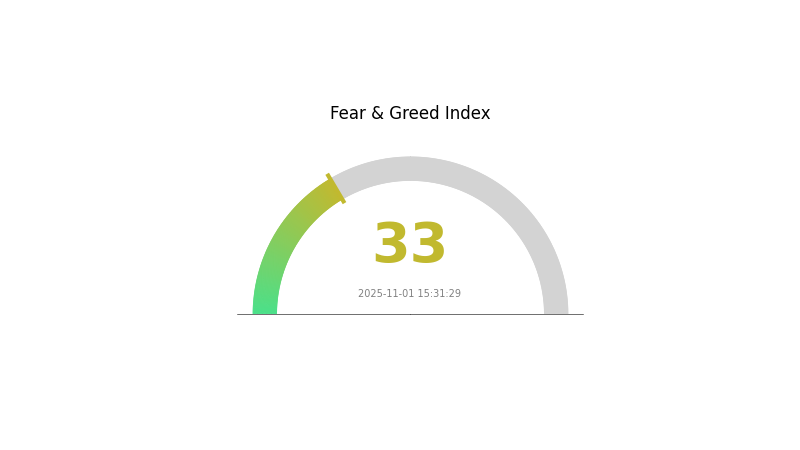

ESG Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 33. This suggests a cautious sentiment among investors, potentially indicating undervalued market conditions. However, it's essential to remember that market sentiment can shift rapidly. While fear may present buying opportunities for some, it's crucial to conduct thorough research and manage risks carefully before making any investment decisions. As always, diversification and a long-term perspective are key strategies in navigating volatile crypto markets.

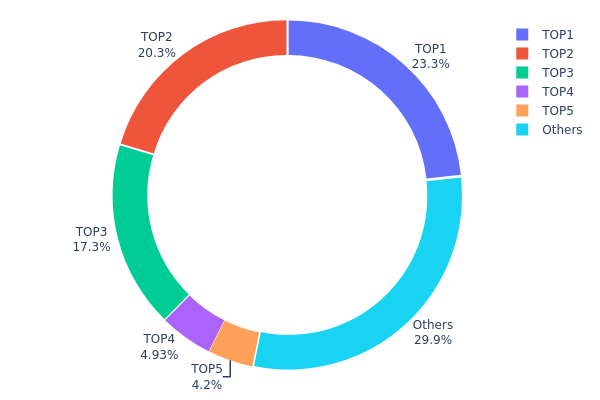

ESG Holdings Distribution

The address holdings distribution data reveals a significant concentration of ESG tokens among a few key addresses. The top five addresses collectively hold 70.03% of the total supply, with the largest holder possessing 23.26%. This level of concentration indicates a relatively centralized distribution, which could have implications for market dynamics.

Such a concentrated distribution raises concerns about potential market manipulation and price volatility. The top holders have substantial influence over the token's supply, potentially affecting liquidity and price movements. This concentration also suggests that the ESG token ecosystem may not be as decentralized as ideal, with a small number of entities wielding considerable control.

However, it's worth noting that 29.97% of the tokens are distributed among other addresses, indicating some level of wider participation. This distribution pattern reflects a market structure that is somewhat top-heavy but still maintains a base of smaller holders, which could contribute to overall ecosystem stability despite the concentration at the top.

Click to view the current ESG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcd8c...a90955 | 11397.63K | 23.26% |

| 2 | 0x54a5...30d9e1 | 9959.88K | 20.32% |

| 3 | 0x33d9...430cc2 | 8493.82K | 17.33% |

| 4 | 0x0365...f42fad | 2415.69K | 4.92% |

| 5 | 0x4fc3...2440e8 | 2058.81K | 4.20% |

| - | Others | 14674.17K | 29.97% |

II. Key Factors Affecting Future ESG Prices

Macroeconomic Environment

- Impact of Monetary Policy: Low interest rates are expected to drive long-term investment strategies, making ESG frameworks increasingly important.

- Inflation Hedging Properties: ESG performance is becoming an indicator for long-term investor success, potentially offering protection against economic instability.

- Geopolitical Factors: Global regulatory trends are pushing for increased ESG integration and disclosure, particularly in Asia and emerging markets.

Institutional and Major Investor Dynamics

- Institutional Holdings: Major credit rating agencies like S&P, Moody's, and Fitch have incorporated ESG considerations into their rating methodologies.

- Corporate Adoption: Companies with strong ESG performance are attracting more investors and commanding price premiums.

- National Policies: Regulatory bodies worldwide are actively promoting ESG integration into corporate valuation frameworks, with 60 out of 110 global stock exchanges issuing ESG reporting guidelines.

Technological Development and Ecosystem Building

- ESG Data Integration: Financial data providers such as MSCI, Bloomberg, and Refinitiv have established proprietary ESG scoring systems, providing important indicators for market analysis.

- Valuation Model Upgrades: Traditional valuation methods are being adjusted to incorporate ESG factors, particularly in market approach and income approach methodologies.

III. ESG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0225 - $0.03

- Neutral prediction: $0.03 - $0.0388

- Optimistic prediction: $0.0388 - $0.03996 (requires positive market sentiment)

2026-2028 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.02875 - $0.04214

- 2027: $0.03016 - $0.0485

- 2028: $0.03437 - $0.06561

- Key catalysts: Increasing adoption of ESG principles in crypto, favorable regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $0.05512 - $0.06725 (assuming steady market growth)

- Optimistic scenario: $0.06725 - $0.07937 (assuming accelerated adoption of ESG in crypto)

- Transformative scenario: $0.07937 - $0.08877 (assuming widespread integration of ESG in blockchain technology)

- 2030-12-31: ESG $0.08877 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03996 | 0.0388 | 0.0225 | 0 |

| 2026 | 0.04214 | 0.03938 | 0.02875 | 1 |

| 2027 | 0.0485 | 0.04076 | 0.03016 | 4 |

| 2028 | 0.06561 | 0.04463 | 0.03437 | 14 |

| 2029 | 0.07937 | 0.05512 | 0.04906 | 41 |

| 2030 | 0.08877 | 0.06725 | 0.06254 | 72 |

IV. ESG Professional Investment Strategies and Risk Management

ESG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and ESG enthusiasts

- Operation suggestions:

- Accumulate ESG tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor ESG project developments and partnerships

- Set stop-loss orders to manage downside risk

ESG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple ESG and sustainability-focused projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ESG

ESG Market Risks

- Volatility: ESG token price may experience significant fluctuations

- Liquidity risk: Limited trading volume may affect entry and exit positions

- Market sentiment: Changes in overall crypto market sentiment can impact ESG token performance

ESG Regulatory Risks

- Regulatory uncertainty: Evolving regulations may affect ESG token's utility and adoption

- Compliance challenges: Potential difficulties in meeting changing ESG standards and reporting requirements

- Cross-border issues: Varying ESG regulations across jurisdictions may impact global operations

ESG Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible limitations in handling increased transaction volumes

- Interoperability issues: Difficulties in integrating with other blockchain networks or traditional systems

VI. Conclusion and Action Recommendations

ESG Investment Value Assessment

ESG presents a unique opportunity in the intersection of blockchain and sustainability. While it offers long-term potential in addressing environmental and social challenges, short-term risks include market volatility and regulatory uncertainties.

ESG Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Implement a balanced approach of holding and strategic trading ✅ Institutional investors: Consider ESG as part of a diversified crypto portfolio with a focus on sustainability

ESG Participation Methods

- Direct purchase: Buy ESG tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- Engage with the project: Follow official channels for updates and potential governance opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the ESG prediction for 2025?

ESG regulation is deeply embedded, with sophisticated management of mandatory and voluntary requirements. ESG disclosures remain a key focus for SEC examinations, and pension funds are adopting increased ESG criteria.

What is the forecast for ESG?

ESG market is projected to grow significantly by 2028. Forecasts indicate robust expansion across regions and industries, with substantial revenue expected. Increasing corporate focus on sustainability is driving this growth trend.

Are ESG stocks a good investment?

ESG stocks can be excellent investments, offering strong financial performance and potential for long-term growth. They often outperform traditional stocks while promoting sustainability and social responsibility.

What did Elon Musk say about ESG?

Elon Musk criticized ESG ratings, calling them 'the devil'. He pointed out that tobacco companies often receive higher ESG scores than Tesla, despite Tesla's environmental efforts.

Share

Content