2025 SHOE Fiyat Tahmini: Ayakkabı Sektörü Tahminlerinde Piyasa Trendleri ve Ekonomik Faktörlerin Yönlendirilmesi

Giriş: SHOE'nin Piyasadaki Konumu ve Yatırım Değeri

ShoeFy (SHOE), 2021'den bu yana NFT ve FT'leri bir araya getiren yenilikçi, merkeziyetsiz bir platform olarak dikkat çekiyor. 2025 itibarıyla SHOE'nin piyasa değeri 14.515,53 dolar, dolaşımdaki arzı yaklaşık 13.013.746,88 token ve fiyatı 0,0011154 dolar seviyesinde. "Geleceğin NFT projesi" olarak öne çıkan bu varlık, ileri DeFi araçlarıyla maksimum getiri sağlama konusunda giderek daha önemli bir rol oynuyor.

Bu makalede, SHOE'nin 2025-2030 fiyat hareketleri kapsamlı biçimde incelenecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. SHOE Fiyat Geçmişi ve Güncel Piyasa Durumu

SHOE Fiyat Geçmişi

- 2021: Proje lansmanı, fiyat 19 Ekim'de tüm zamanların en yüksek seviyesi olan 0,856973 dolara çıktı

- 2025: Piyasa gerilemesiyle fiyat 24 Mart'ta tüm zamanların en düşük seviyesi olan 0,00065215 dolara indi

- 2025: Kademeli toparlanma, 3 Kasım itibarıyla güncel fiyat 0,0011154 dolar

SHOE Güncel Piyasa Görünümü

SHOE şu anda 0,0011154 dolardan işlem görüyor, 24 saatlik işlem hacmi ise 9.550,59 dolar. Son 24 saatte yüzde 0,87'lik hafif bir artış yaşandı. Ancak, haftalık bazda yüzde 6,34 ve son 30 günde yüzde 4,61'lik düşüşle uzun vadede negatif bir trend görülüyor. Güncel piyasa değeri 14.515,53 dolar olan SHOE, kripto para piyasasında 7.026'ncı sırada. Dolaşımdaki arz 13.013.746,88 SHOE, toplam arz ise 100.000.000 token. Proje, piyasada yüzde 0,0000029 oranında bir hakimiyet sağlıyor.

Güncel SHOE piyasa fiyatını görmek için tıklayın

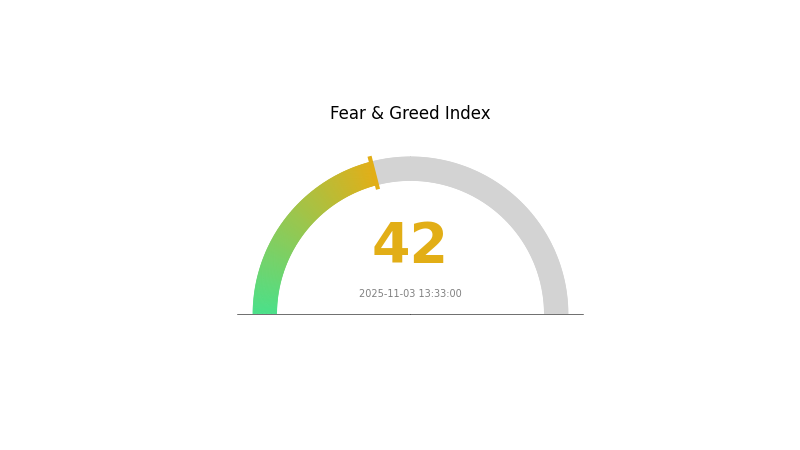

SHOE Piyasa Duyarlılığı Göstergesi

2025-11-03 Korku ve Açgözlülük Endeksi: 42 (Korku)

Kripto piyasasında duyarlılık hâlâ "Korku" bölgesinde ve endeks 42 seviyesinde seyrediyor. Bu, yatırımcıların temkinli davrandığını ve piyasanın göreceli olarak düşük değerlendiğini gösterir. Tarihsel olarak, korku dönemleri uzun vadeli yatırımcılar için alım fırsatları sunmuştur. Yine de yatırım kararı almadan önce mutlaka derinlemesine araştırma yapılmalı ve risk profiline göre hareket edilmelidir. Piyasa trendlerini takip edip Gate.com'un piyasa verisi araçlarından faydalanarak dalgalı piyasa ortamında bilinçli tercihler yapabilirsiniz.

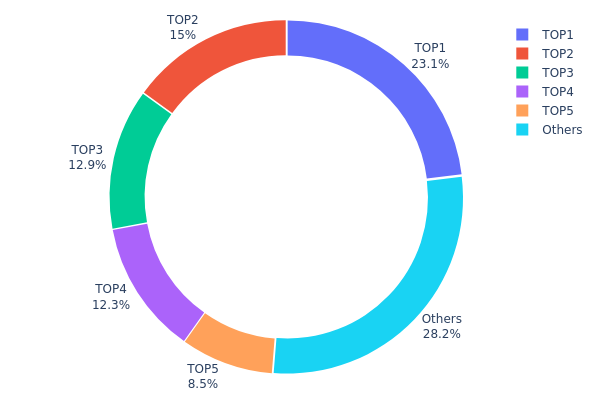

SHOE Varlık Dağılımı

SHOE'nin adres bazlı varlık dağılımı, oldukça yoğun bir sahiplik yapısını ortaya koyuyor. En büyük 5 adres toplam arzın yüzde 71,74'ünü elinde bulunduruyor; en büyük tek adres ise yüzde 23,05'lik paya sahip. Bu kadar yüksek yoğunluk, potansiyel piyasa manipülasyonu ve yüksek fiyat oynaklığı riski doğuruyor.

Arzın yüzde 15'ini tutan yakım adresi (0x0000...00dead), dolaşımdaki token miktarını azaltarak likidite üzerinde etkili olabilir. Büyük sahipler arasında yoğunlaşmış dağılım, sahiplikte ciddi bir dengesizlik olduğunu gösteriyor ve bu da projenin merkeziyetsizleşme hedefleri ve piyasa dinamikleri üzerinde etkili olabilir. Bu yapı, büyük işlemlerde fiyat hassasiyetini artırır ve büyük yatırımcıların etkisi nedeniyle küçük yatırımcılar için riskleri yükseltir.

Genel olarak mevcut SHOE token dağılımı, istikrara ve "balina" hareketlerine karşı hassasiyete işaret eden görece merkezi bir ekosistem sergiliyor. Tokenin uzun vadeli potansiyelini ve piyasa davranışlarını değerlendirirken bu faktörlerin dikkate alınması gerekir.

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf5db...ee2fc2 | 23052,18K | 23,05% |

| 2 | 0x0000...00dead | 15008,25K | 15,00% |

| 3 | 0x0d07...b492fe | 12929,39K | 12,92% |

| 4 | 0x1c7f...20b151 | 12278,79K | 12,27% |

| 5 | 0xb195...4983f8 | 8501,53K | 8,50% |

| - | Diğerleri | 28229,87K | 28,26% |

II. SHOE'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Doygunluğu: Satış hacmi ve pazar payı belirli bir seviyeye ulaştıkça SHOE'nin satış büyümesi doğal olarak yavaşlayabilir ve müşteri kaybı riski artabilir.

- Tarihsel Örüntü: HOKA'nın satış büyümesi yüzde 50'nin üzerindeyken şu anda yaklaşık yüzde 11 seviyesinde.

- Güncel Etki: Büyümedeki yavaşlama, markanın olgunluk aşamasına gelmesi, artan rekabet ve azalan marka gizeminden kaynaklanıyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: HOKA ve On Running gibi koşu markaları, Çin pazarında yüksek fiyatlı ürünlerle üst segmente hitap ederek önemli başarılar elde ediyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Deckers Brands yönetimi, ABD'deki makroekonomik baskılar doğrultusunda gümrük vergileri ve temkinli tüketici davranışları gibi etkileri dikkate alıyor.

- Jeopolitik Faktörler: Döviz kurlarındaki dalgalanmalar, bazı markaların kârlılığını belirli çeyreklerde etkiledi.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ürün İnovasyonu: Nike, Adidas ve yerli markalar taban teknolojileri ve karbon plaka koşu ayakkabıları gibi yenilikçi ürünler için büyük yatırımlar yapıyor.

- Ekosistem Uygulamaları: Çin'de koşu ekosistemi hızlı büyüyor; maratonlar, patika koşuları ve koşuya dair sosyal medya içeriği artıyor.

III. SHOE 2025-2030 Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00099 - 0,00112 dolar

- Tarafsız tahmin: 0,00112 - 0,00115 dolar

- İyimser tahmin: 0,00115 - 0,00118 dolar (olumlu piyasa koşullarıyla)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Büyüme potansiyeli

- Fiyat tahmin aralıkları:

- 2027: 0,00084 - 0,00152 dolar

- 2028: 0,00095 - 0,00195 dolar

- Ana katalizörler: Benimsenme artışı, teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00166 - 0,00173 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,00180 - 0,00195 dolar (güçlü ekosistem gelişimiyle)

- Dönüştürücü senaryo: 0,00195 - 0,00204 dolar (çığır açıcı yenilikler ve kitlesel benimsemeyle)

- 2030-12-31: SHOE 0,00204 dolar (muhtemel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00118 | 0,00112 | 0,00099 | 0 |

| 2026 | 0,00125 | 0,00115 | 0,00062 | 3 |

| 2027 | 0,00152 | 0,0012 | 0,00084 | 7 |

| 2028 | 0,00195 | 0,00136 | 0,00095 | 22 |

| 2029 | 0,0018 | 0,00166 | 0,00099 | 48 |

| 2030 | 0,00204 | 0,00173 | 0,00163 | 55 |

IV. SHOE için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SHOE Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli değer yatırımcıları

- Operasyon önerileri:

- Piyasa düşüşlerinde SHOE token biriktirin

- ShoeFy'nin staking ve farming programlarına katılın

- Tokenleri saklama hizmeti olmayan bir cüzdanda güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve potansiyel dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım ve aşırı satım durumlarını izleyin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- ShoeFy proje gelişmeleri ve NFT piyasası trendlerini izleyin

SHOE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3'ü

- Saldırgan yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Risk algısına bağlı olarak portföyün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: SHOE varlıklarını diğer kripto ve geleneksel yatırımlarla dengeleyin

- Zarar durdur emri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdan

- Soğuk cüzdan çözümü: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü parola kullanın, yazılımı güncel tutun

V. SHOE için Potansiyel Riskler ve Zorluklar

SHOE Piyasa Riskleri

- Yüksek oynaklık: SHOE fiyatı ciddi dalgalanmalara maruz kalabilir

- Sınırlı likidite: Düşük işlem hacmi, büyük emirlerde kaymaya ve işlem zorluğuna neden olabilir

- NFT piyasası bağımlılığı: Performansı genel NFT piyasası trendlerine bağlıdır

SHOE Regülasyon Riskleri

- Belirsiz düzenleyici ortam: NFT ve DeFi projelerine yönelik daha sıkı düzenleme ihtimali

- Sınır ötesi uyum: Farklı ülkelerdeki düzenlemeler, küresel benimsemeyi etkileyebilir

- Vergi etkileri: Değişen vergi mevzuatı, SHOE sahipleri ve NFT işlemlerini etkileyebilir

SHOE Teknik Riskler

- Akıllı sözleşme riskleri: ShoeFy platformunda açık veya hata olasılığı

- Ölçeklenebilirlik sorunları: Ethereum ağ tıkanıklığı performansı etkileyebilir

- Uyumluluk sorunları: Diğer blok zincirleri ve NFT standartlarıyla entegrasyon

VI. Sonuç ve Eylem Önerileri

SHOE Yatırım Değeri Değerlendirmesi

SHOE, NFT ve DeFi alanında yenilikçi yaklaşımıyla bu teknolojilerin birleşiminden yararlanmak isteyen yatırımcılara uzun vadede değer sunabilir. Ancak, piyasadaki oynaklık, regülasyon belirsizliği ve teknik zorluklar nedeniyle kısa vadede riskler de taşımaktadır.

SHOE Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, NFT ve DeFi hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Portföyün bir kısmını SHOE'ye ayırıp çeşitlendirme sağlayabilir ✅ Kurumsal yatırımcılar: ShoeFy'nin teknolojisi ve piyasa konumunu detaylı incelemeden büyük yatırım yapmamalıdır

SHOE Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden SHOE token satın alın

- Staking: ShoeFy staking programlarına katılarak pasif gelir elde edin

- NFT etkileşimi: ShoeFy platformunda NFT özelliklerini keşfedin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını dikkate almalı ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Ayakkabı fiyatları artıyor mu?

Evet, ayakkabı fiyatları yükseliyor. Son veriler, ağustos ayında yüzde 1,4'lük artış ile son 17 ayın en yüksek seviyesine ulaşıldığını gösteriyor. Tüketicilerin çoğu fiyatlardaki artışı fark etti ve önümüzdeki aylarda ek artışlar bekliyor.

Bir ayakkabının değeri artacak mı, nasıl anlaşılır?

Nadirlik, marka itibarı ve talep eğilimlerini inceleyin. Sınırlı üretim ve talep gören tasarımlar genellikle değer kazanır. Yeniden satış piyasası ve lansman heyecanı gibi göstergeleri takip edin.

2025'te ayakkabılar neden bu kadar pahalı?

2025'te ayakkabı fiyatlarının artmasında yeni gümrük vergileri, tedarik zinciri kesintileri ve yükselen üretim maliyetleri etkili oldu. Bu faktörler fiyatları ciddi biçimde yükseltti.

Nike 2025'te yükselecek mi?

Evet, Nike'ın 2025'te yükselmesi bekleniyor. 1 Haziran 2025'ten itibaren spor ayakkabı ve giyim fiyatlarını 10 dolara kadar artırmayı planlıyorlar; bu, gelirlerinde ve hisse fiyatında artış sağlayabilir.

BLUR ve CRO: NFT Pazar Yeri Hakimiyetinde Rekabet

Web3 Gigachad Stratejisi: 2025'te Kripto Varlıkları Dominasyonu

2025'te Kripto Varlıklar borsasında MSTR ve Robinhood hisseleri nasıl işlem yapılır?

2025 SOL Fiyat Tahmini: Solana'nın Gelecekteki Değerine Yönelik Büyüme Katalizörleri ve Piyasa Senaryolarının Analizi

MYX Coin Yatırım Rehberi: 2025 için Analiz ve Stratejiler

BNB'den USD'ye Fiyat Güncellemesi

2025 BZZ Fiyat Tahmini: Uzman Analizi ve Swarm'ın Yerel Token'ı İçin Piyasa Görünümü

Zincirler arası ticaret artık daha basit: Hyperswap'ın en yeni lansmanını ve airdrop'un temel noktalarını keşfedin

DeAgentAI (AIA) iyi bir yatırım mı?: Tokenomik, teknoloji ve piyasa potansiyeline dair kapsamlı bir analiz