2026 NVDA Stock Price Forecast: Future Trends, Analyst Targets, and Investment Opportunities

NVDA Current Stock Price and Market Position

By the end of 2025, NVIDIA (NVDA) shares traded around $180, with recent gains driven by progress in exporting H200 AI chips to China. This development has reinforced market confidence in NVIDIA’s dominance in global AI infrastructure demand.

As a leading supplier of AI accelerator chips, NVIDIA’s market capitalization has reached several trillion dollars worldwide, setting new all-time highs throughout 2025.

NVDA Key Price Target Forecasts for 2026

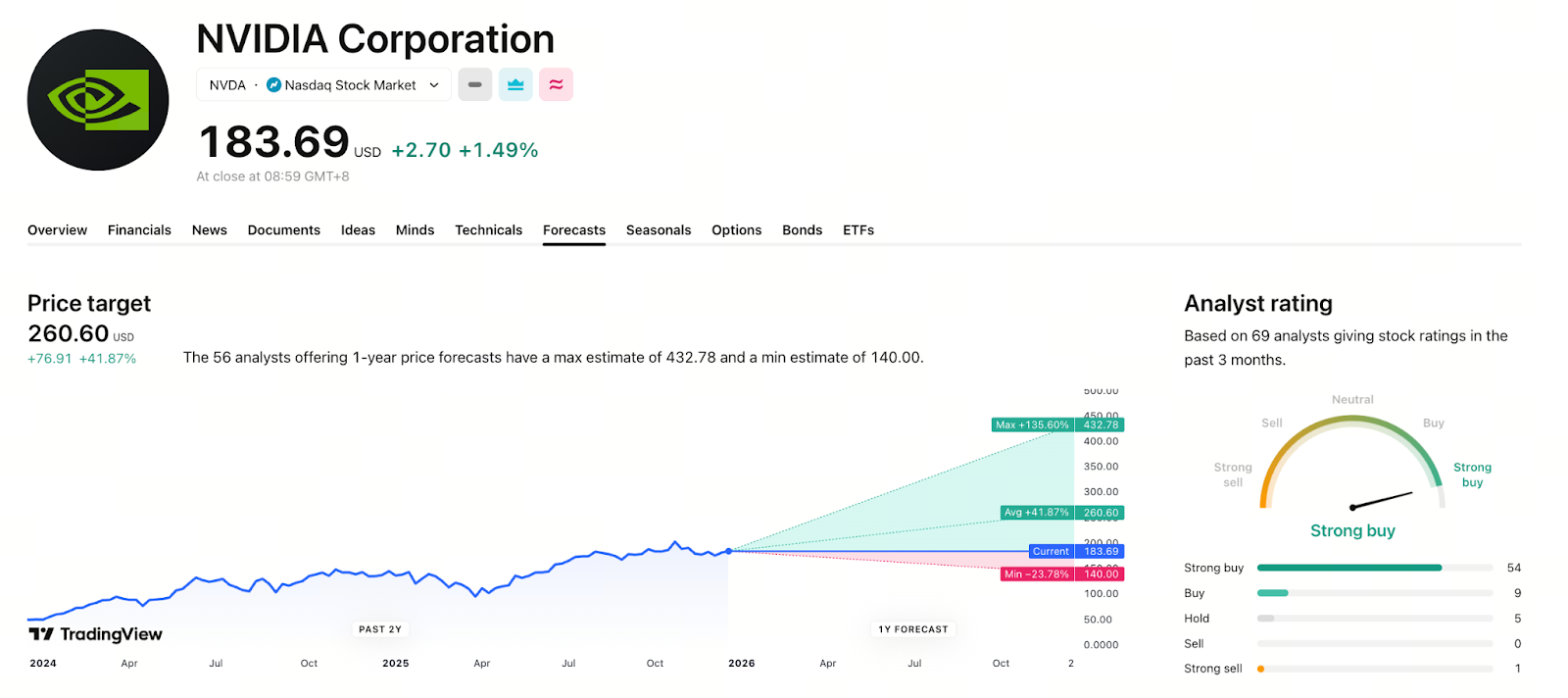

Source: https://www.tradingview.com/symbols/NASDAQ-NVDA/forecast/

Market forecasts for NVDA’s 2026 share price vary widely:

- Some analysts project NVDA could exceed $300 per share by year-end 2026, with some estimates even higher.

- Data from 247WallSt and TradingView show an average target range of $250–$260, while the most bullish outlooks put the ceiling above $400.

- Certain research firms take a moderately optimistic stance, forecasting roughly 20% upside in 2026.

In summary, 2026 price targets for NVDA cluster between $230 and $350, but institutional expectations differ significantly.

Core Drivers of Stock Price Growth

1. Robust Global Demand for AI Chips

NVIDIA commands a clear lead in the AI training and inference chip segment, with its data center GPUs preferred by major technology companies. As AI models become more complex, demand for high-performance GPUs in servers continues to climb. This trend underpins NVDA’s valuation.

2. Expansion into China and H200 Export Progress

Recent reports indicate NVIDIA plans to begin H200 AI chip exports to China in early 2026. If approved, this move will significantly boost the company’s revenue and market share.

3. Technology and Product Launches Inspire Investor Confidence

Rollouts of new chip generations and AI platforms are expected to spark fresh growth cycles and raise long-term revenue projections.

Risk Factors and Cautious Perspectives

Despite a positive outlook, several risks merit attention:

- Overvaluation and Bubble Risks: Some market watchers warn that the AI boom could fuel a valuation bubble, arguing that NVDA’s current lofty valuation requires stronger fundamentals.

- High P/E Risk: Trading at a high price-to-earnings ratio may lead to increased share price volatility.

- Global Economic and Policy Headwinds: US-China trade policy, interest rate shifts, and other macroeconomic factors could impact tech stock performance.

How Investors Should Formulate Strategies

Given the range of 2026 NVDA price forecasts, a rational investment strategy is essential:

- Staggered Position Building to Lower Costs: Consider phased entries to reduce short-term volatility risks.

- Monitor Fundamentals and Delivery Data: Focus on quarterly revenue, chip shipments, and market feedback.

- Integrate Market Valuation and Technical Analysis: Look beyond target prices and apply technical indicators for optimal entry timing.

Conclusion: 2026 Stock Price Forecast Overview

Market sentiment for NVDA in 2026 is moderately optimistic, with most analyst targets in the $230–$350 range. While valuation and market risks exist, sustained AI demand growth and strategic product execution support NVDA’s outlook. Rational investors should prioritize fundamentals and trend analysis over single-point price targets.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution