Bitcoin Crashes to $86,000 as Owen Gunden Whales Dump $1.3B BTC, Triggering Market Panic

Image: https://x.com/lookonchain/status/1991322573112766740

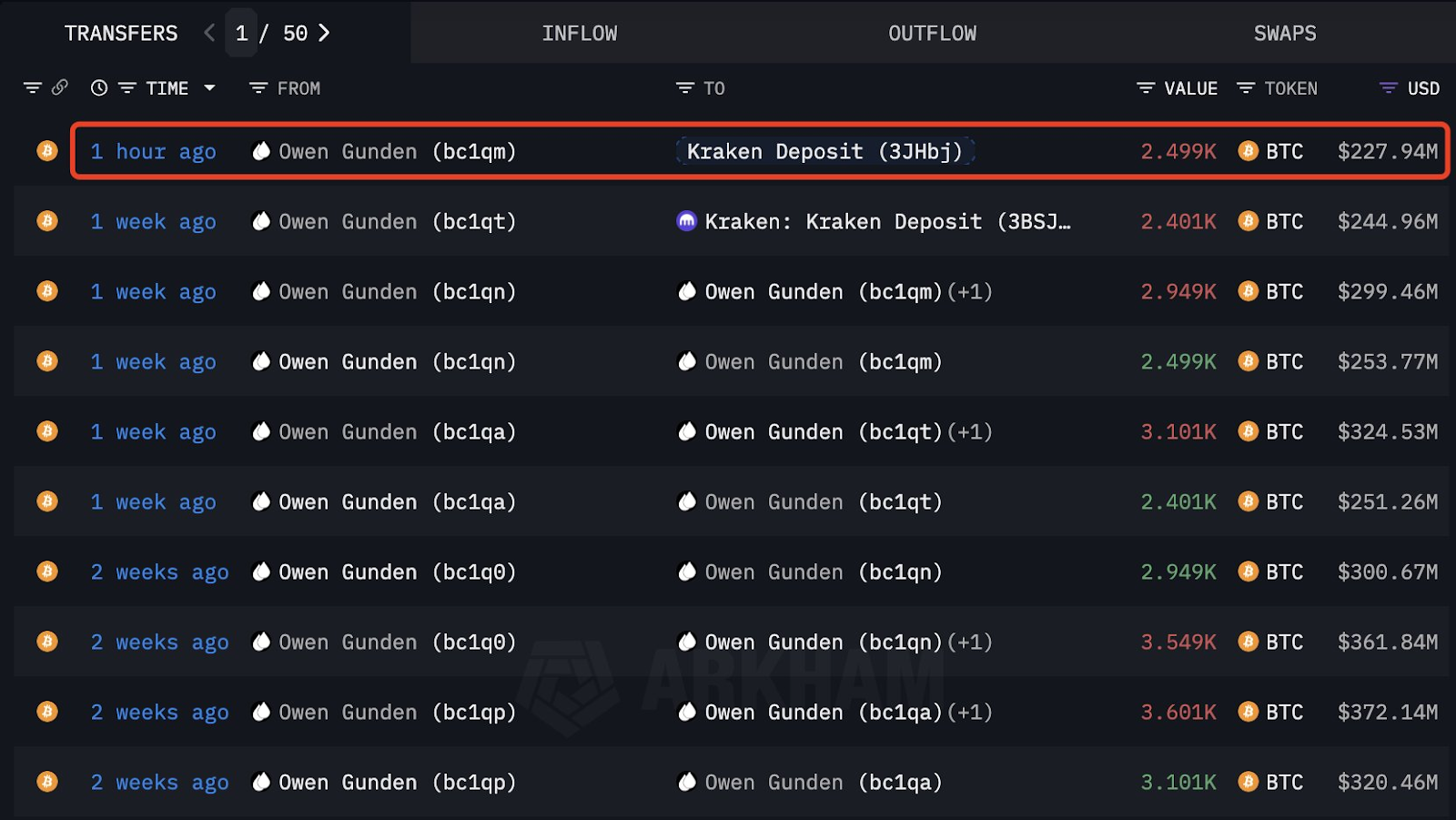

In November 2025, the Bitcoin market saw a rare and rapid correction. The price held near record highs but then suddenly reversed and plunged to about $86,000 in a short span, sparking widespread debate across the crypto community. This decline resulted from a combination of factors rather than a single cause. The most significant was the decision by whale Owen Gunden—an investor with over a decade in the market—to liquidate his entire position, selling off roughly $1.3 billion in Bitcoin at once.

Why Did Bitcoin Suddenly Crash?

Bitcoin’s price is naturally sensitive to both sentiment and major events. Several critical factors combined to drive this downturn.

Technical Support Breakdown

Over recent weeks, the $90,000 level was tested multiple times without meaningful rebound. When this crucial support finally gave way, a cascade of stop-loss orders triggered, accelerating the price drop.

Macroeconomic Pressure

Global monetary policy remains tight, with increased sensitivity to interest rate shifts. Overall risk appetite has fallen, prompting broad sell-offs in risk assets like Bitcoin.

Cascading Derivatives Liquidations

The sharp price decline triggered mass liquidations of leveraged long positions, further amplifying short-term losses.

$1.3 Billion Whale Sell-Off: The Amount Isn’t Massive, but the Signal Is Critical

The most disruptive event was an early investor, holding since 2011, suddenly selling everything. Roughly 11,000 BTC were moved on-chain and ultimately liquidated, totaling over $1.3 billion.

Why did this trigger panic?

- Long-term holders rarely exit entirely during a bull market: This suggests to many market participants that upside potential may be limited.

- Massive sell orders can impact short-term liquidity: Large dumps tend to spark additional selling pressure.

- On-chain transparency amplifies whale moves: Every whale action is quickly broadcast and magnified, fueling volatility.

As a result, once the whale began to sell, market optimism quickly gave way to caution—and even panic—pushing Bitcoin lower.

Panic Spreads: Capital Shifts to Safe Havens

As the price plunged, market panic increased. Trading volume increased, but buying demand lagged, and the market entered a short period of risk aversion.

Key themes surfaced in the community:

- Growing debate over whether the top is in

- Bullish confidence dropping, with more investors waiting on the sidelines

- Some investors are opting to proactively reduce their exposure

- Altcoins slumping in tandem, widening overall losses

As a result, sentiment is rapidly shifting from euphoria to caution.

Three Potential Paths for Bitcoin

Looking ahead, Bitcoin could follow one of three main trajectories:

Scenario 1: Consolidation Between $80,000 and $90,000

If the market digests the whale’s sell-off quickly and liquidity stabilizes, Bitcoin may trade sideways at elevated levels.

Scenario 2: Correction Toward $70,000

If macro headwinds persist and leverage continues to unwind, there’s room for further downside.

Scenario 3: Swift Rebound, Challenging $95,000+

If institutions step in to accumulate at lower levels, Bitcoin could regain bullish momentum.

At present, further consolidation or even another dip seems more likely. However, monitoring capital inflows remains essential.

What Should Retail Investors Do Now?

During heightened volatility, new and everyday investors should stay calm and disciplined:

- Avoid buying during rapid price increases or selling in panic to limit emotional trading

- Reduce leverage and keep positions flexible

- Use a staggered buying strategy—avoid going all-in at once

- Set reasonable stop-loss levels

- Monitor on-chain data and whale activity closely

For long-term investors, strategically accumulating during price dips remains a viable approach; however, timing is crucial.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution