Circle Accelerates USDC Expansion from Solana Minting to Enterprise Blockchain Strategy

Solana Emerges as the Hub for USDC Issuance and Liquidity

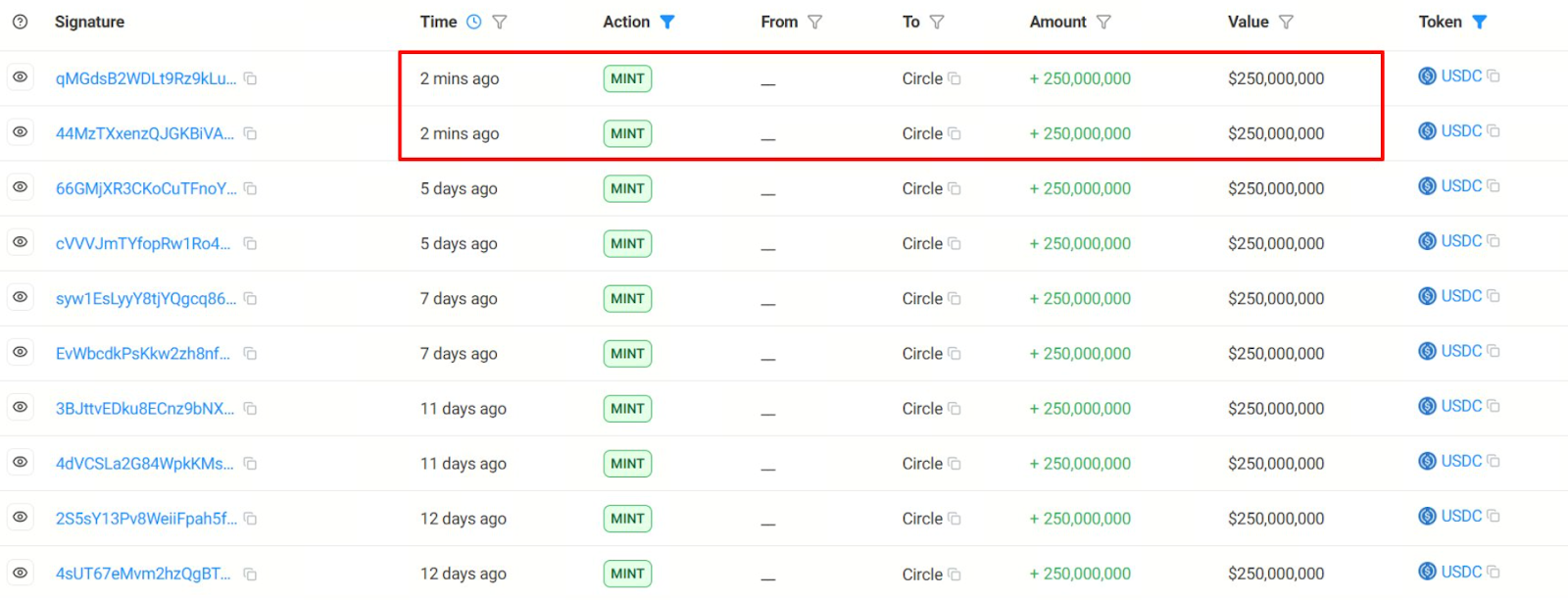

Public data shows that on December 22, Circle minted an additional 500 million USDC on the Solana network. Since October 11, Circle has issued approximately $18 billion worth of USDC within the Solana ecosystem. This trend clearly highlights Solana’s rapid ascent as a primary platform for USDC liquidity.

(Source: OnchainLens)

Solana’s low transaction fees and high throughput create an ideal environment for stablecoins, supporting real-time payments and high-frequency settlements. These technical advantages have propelled Solana from a DeFi utility to a central stage for large-scale capital flows.

Lowering Barriers: Cross-Chain Usability Becomes the Competitive Edge

To further expand stablecoin use cases, Circle partnered with Coinbase and payment infrastructure provider Mercuryo to offer a roughly 50% fee discount for MetaMask users transferring assets to the Base network.

This initiative reduces both cross-chain and deposit costs for users. It also signals a shift in stablecoin competition—from focusing on issuance volume to prioritizing user experience. As cross-chain costs decline, user- and application-driven Layer 2 networks like Base become more attractive destinations for capital and long-term user engagement.

Accelerating Payment Adoption in the Base Ecosystem

At the application layer, Base is rapidly expanding real-world payment scenarios for USDC. Base Pay has started integrating with merchant platforms like Shopify, enabling instant, fee-free USDC payments and directly entering the e-commerce and everyday payments markets.

During its early development, Coinbase launched a bridged version of USDC (USDbC) to maintain a 1:1 peg with Ethereum mainnet, quickly building liquidity and market trust. Now, Base is transitioning from a liquidity platform to a full-fledged payment and application layer.

Deep API and Enterprise Integration

Beyond consumer payments, Circle is strengthening its enterprise strategy. Through API services, businesses can automate collections, fiat conversions, subscription billing, and cross-border settlements. This enables USDC to integrate seamlessly into Web3 business models. As a result, stablecoins are evolving from simple on-chain assets to core components of enterprise-level cash flow and settlement systems, delivering more efficient solutions for SaaS, platform-based applications, and cross-border operations.

Arc: A Layer 1 Blueprint with USDC as Gas

For long-term infrastructure, Circle is developing Arc, a new Layer 1 blockchain that uses USDC as its gas fee and features EVM compatibility. Arc will be interoperable with the 24 blockchains that currently support USDC.

Arc is designed to meet enterprise-level needs, including large-scale payments, foreign exchange, asset tokenization, and capital markets infrastructure. This move shows Circle’s intent to position stablecoins at the very core of on-chain economic settlement.

Technical Goals and Launch Timeline

According to current plans, Arc targets transaction finality within approximately 350 milliseconds and aims to process about 3,000 transactions per second. The network will feature a built-in stablecoin FX engine and optional privacy protections to meet diverse compliance requirements for enterprises and financial institutions. About 20 validators will maintain high throughput and security during the network’s initial phase. The testnet is scheduled for launch in fall 2025, with the mainnet beta potentially opening to the public in 2026.

To learn more about Web3, click to register: https://www.gate.com/

Conclusion

From large-scale minting on Solana, to cost optimization and payment adoption in the Base ecosystem, and the long-term Arc Layer 1 blueprint, Circle is steadily positioning USDC at the heart of global payments and financial systems. As stablecoins evolve, the market opportunity grows—along with regulatory scrutiny. One thing is certain: as the on-chain economy expands, USDC is becoming the essential fuel powering the entire system.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution