Gate Research: Polymarket Builders — New Paradigm and Ecosystem

Abstract

- Polymarket is undergoing a strategic transformation from a single platform to an open ecosystem through Builder Codes, addressing core challenges such as excessive liquidity concentration, diversified user demands, and intensifying market competition.

- The Polymarket ecosystem has formed a four-layer structure consisting of backend, middleware, frontend applications, and AI Agents, with Builders primarily focused on frontend applications, particularly Trading Bots, which account for less than 3% of the parent platform’s trading volume.

- Drawing on the mature paradigm of ecosystems like Hyperliquid Builder, the Polymarket Builders ecosystem demonstrates significant growth potential, theoretically capable of achieving several-fold or even tenfold expansion.

- The development of the Polymarket Builders ecosystem still requires time and faces challenges such as immature business models and external competition, particularly the market pressure from compliant competitors like Kalshi, which leverages Robinhood as a core distribution channel.

I. Introduction

Prediction markets, as platforms that aggregate collective intelligence through market mechanisms to forecast future event outcomes, are gradually transitioning from a niche crypto domain to mainstream attention. This trend has been particularly evident during the 2024 election and the 2025 NFL season, not only sparking public curiosity and discussion about future trends but also demonstrating the significant media and commercial value of capital-based predictions. Against this backdrop, Polymarket, as one of the earliest pioneers and leaders in this field, warrants particular attention for its developments.

1.1 Polymarket: A Leader in the Global Prediction Market

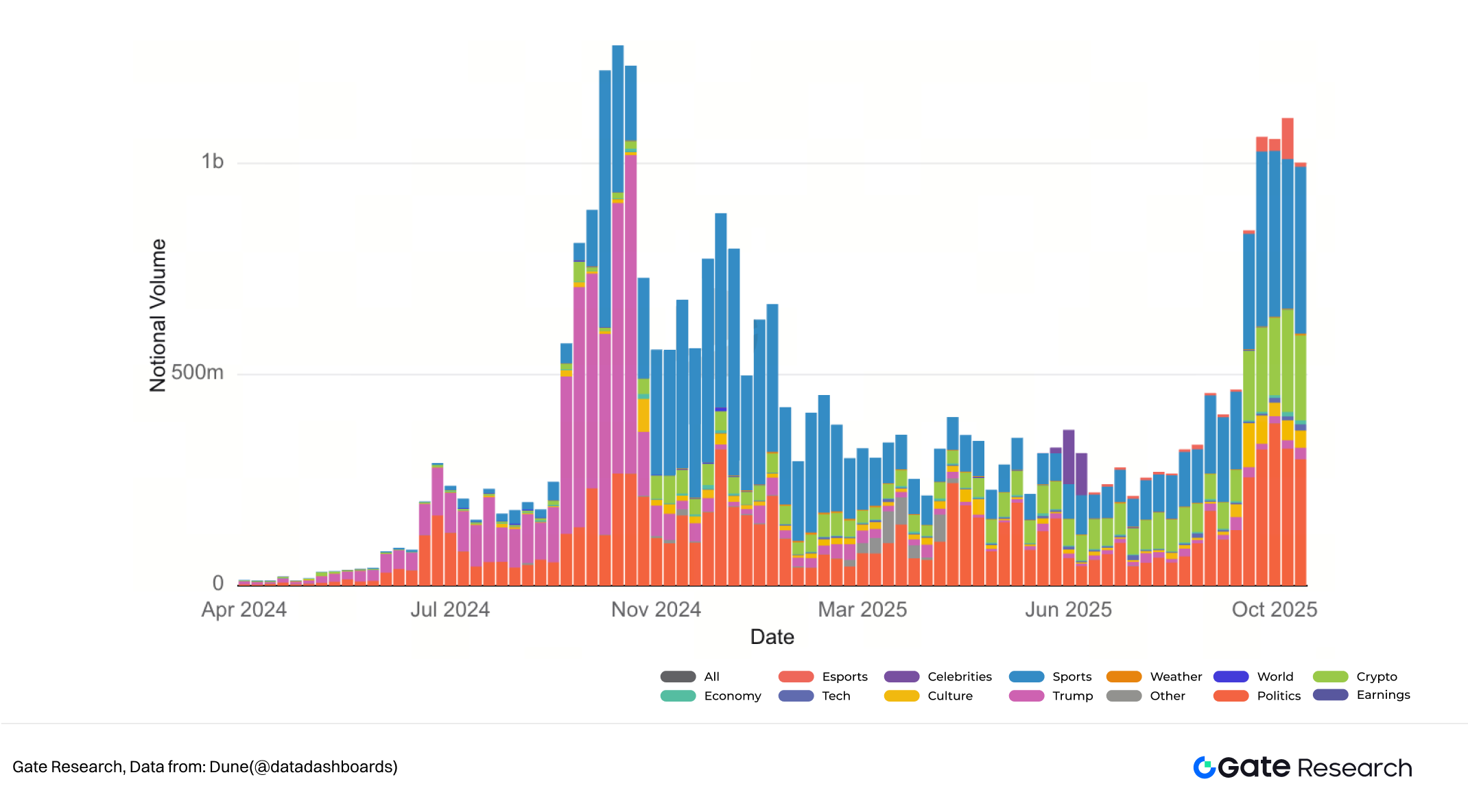

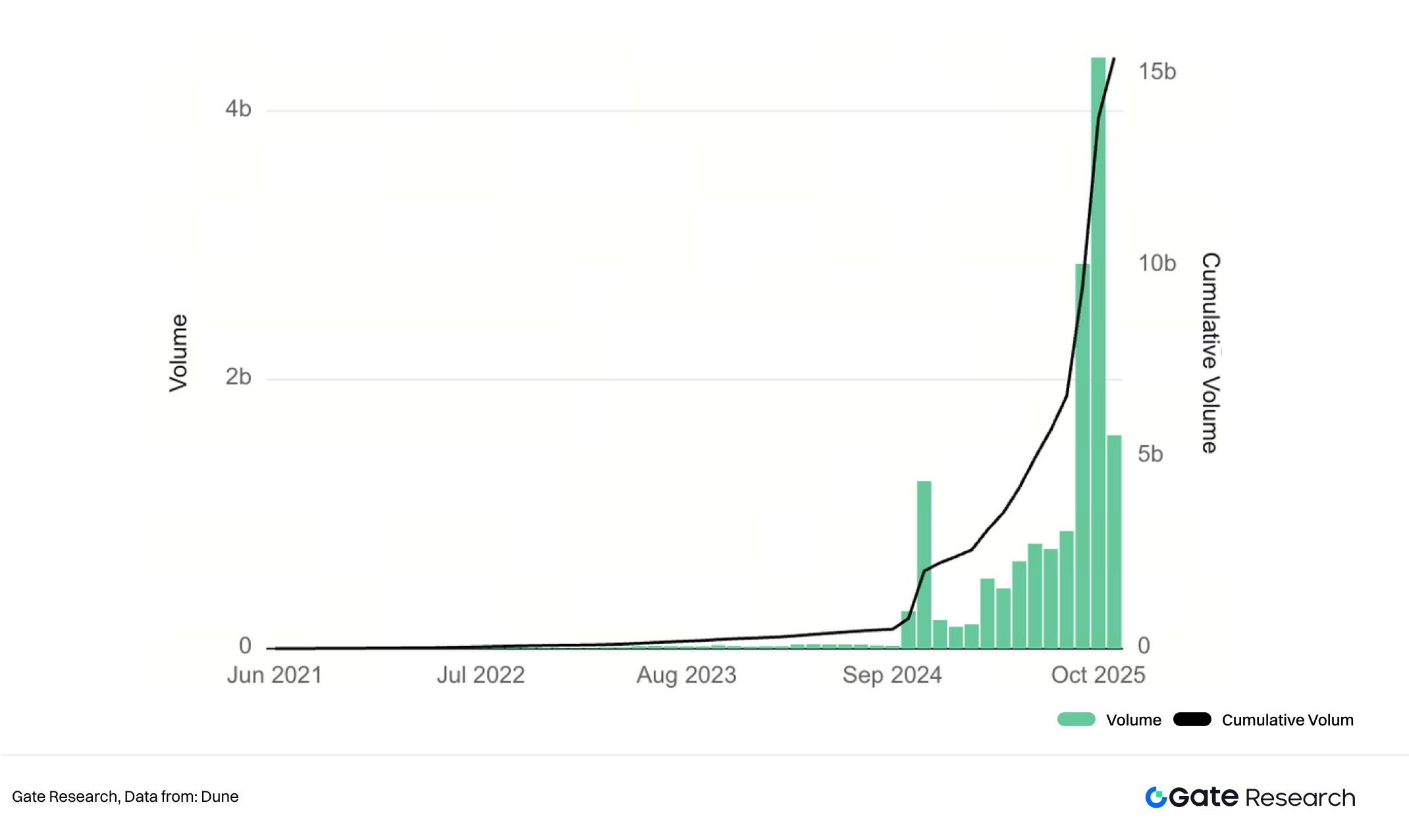

Ⅰ: Weekly Trading Volume on Polymarket

Polymarket has firmly established itself as one of the world’s largest decentralized prediction markets, with its growth metrics serving as the best evidence: both monthly trading volume and active users reached all-time highs in October, with monthly trading volume exceeding $3 billion and monthly active users surpassing 470k. Leveraging accurate predictions on trending events in politics, sports, and economics, Polymarket’s data has been frequently cited by mainstream media outlets such as Bloomberg and Reuters, extending its influence beyond the cryptocurrency space into broader societal discussions. The immense traffic and trading activity have transformed it from merely a trading platform into an “information hub” that reflects collective intelligence in real time.

1.2 Builder Codes: A Strategic Shift from a Single Platform to a Broad Ecosystem

In response to explosive growth and increasingly diverse user demands, Polymarket has not opted to develop in isolation within a single platform. Instead, it recently introduced Builder Codes, a core tool for its ecosystem strategy.

Builder Codes are a standardized access and identification mechanism that allows third-party developers to seamlessly integrate their frontend applications—such as trading terminals or Telegram Bots—with Polymarket’s underlying order book, markets, and liquidity pools. Developers can use unique codes to enable order routing and transaction tracking, thereby maintaining their own user and brand relationships while sharing the same deep market. This enables any developer to quickly build prediction applications with unique features and interfaces based on Polymarket’s backend capabilities.

The launch of Builder Codes represents a fundamental shift in production dynamics, transforming Polymarket from a fully-featured “super app” into an “infrastructure” open to all developers. Future innovation will no longer be confined to the official team but will be driven by the entire developer ecosystem—anyone can leverage Polymarket’s robust infrastructure to create diverse frontend applications tailored to the unique needs of different user groups. In turn, applications built around Builder Codes serve as channels for Polymarket’s markets to extend deeper into external distribution.

Notably, this open architecture aligns with the “Builder model” seen in other sectors. The on-chain perpetual protocol Hyperliquid employs a similar mechanism, using Builder Codes to achieve frontend diversification and transaction flow tracking. While the two serve different types of markets, they converge in their approach to ecosystem openness and distribution logic—shifting from “doing it ourselves” to “building an ecosystem together.”

II. The Necessity of Building a Prediction Market Ecosystem

Polymarket’s shift from a “platform” to an “ecosystem” is not a spontaneous strategic decision but an inevitable response to addressing the structural pain points inherent in both its own operations and the broader prediction market sector. To understand the value of Builder Codes, it is essential to first grasp why these pain points cannot be resolved under a single-platform model.

2.1 Pain Points in Prediction Market Development

Under the single-platform model, prediction markets face several increasingly evident contradictions:

- Liquidity’s “Matthew Effect”: The value of a prediction market lies in the accuracy of its prices, which directly depends on sufficient liquidity. However, liquidity naturally concentrates toward high-profile, popular events, leaving many long-tail or niche markets—such as local elections or specific tech project milestones—trapped in a “low liquidity → inaccurate predictions → user churn → even lower liquidity” death spiral. For instance, trading volumes in politics and sports predictions significantly outpace those in niche sectors like technology and culture. Within politics, liquidity for national elections far exceeds that for local elections, even though local elections reflect factional power dynamics that ultimately influence national election odds. A comprehensive platform struggles to maintain equal visibility across all market types and subsectors, ultimately exacerbating liquidity disparities.

- The “Chicken-and-Egg” Dilemma of Market Cold Starts: Creating a new market is akin to launching a new asset—easy to establish but difficult to scale. Without initial liquidity and attention, a new market cannot generate accurate price signals; without accurate price signals, it cannot attract users or liquidity. This “chicken-or-egg” problem, under a top-down market creation model in a single platform, limits the innovation and expansion speed of market types.

- One-Size-Fits-All Product Experience: Professional traders demand robust charting tools, API access, and fast execution speeds; casual users prefer simple interfaces, clear rules, and instant usability; community-driven users may want copy-trading features and social interactions. A single frontend interface, attempting to cater to all user needs, often ends up serving only “average users,” compromising the experience for both high-end and niche users.

- Information Asymmetry and Cognitive Barriers: The core of prediction markets is the arbitrage of information disparities. In a single platform, users often lack effective tools to aid decision-making. For example, a market on “whether a tech company will go public by a specific date” requires traders to closely follow the company’s business revenue, growth barriers, roadmap plans, and core team. This high level of expertise and information asymmetry excludes many potential users with insufficient knowledge or leads to losses due to informational disadvantages.

- Multidimensional Competitive Pressure: The prediction market sector is becoming increasingly crowded, with Polymarket facing intense competition from multiple fronts. On one hand, fully compliant platforms like Kalshi, integrated with mainstream brokers like Robinhood, offer seamless experiences and easily reach millions of traditional finance users. On the other hand, new prediction market protocols are emerging on ecosystems like Base and BNB Chain, backed by ecosystem funds and blockchain resources in an attempt to catch up. In this multi-front competitive landscape, if Polymarket relies solely on its own team’s resources and a single product roadmap, it will struggle to maintain a decisive advantage across different battlegrounds, risking user diversion and market share erosion.

2.2 The Logic Behind Polymarket’s Ecosystem Transformation

These pain points are not insurmountable. On the contrary, it is precisely these structural contradictions, combined with changes in the external environment, that form the core driving force behind the shift of prediction markets from closed platforms to open ecosystems. Polymarket’s decision to launch its ecosystem strategy with Builder Codes is a strategic move that leverages its inherent strengths to align with this trend.

- Hybrid On-Chain and Off-Chain Model

Unlike some fully off-chain prediction markets or those reliant on APIs for transaction data, Polymarket employs a hybrid model: order matching occurs off-chain to enhance efficiency and reduce costs, while transaction settlement and execution are completed on the Polygon network. On-chain settlement benefits from the immutability and non-custodial nature of blockchain, with orders executed via signed messages, mitigating the trust risks associated with centralized platforms while preserving the finality of asset ownership. This makes Polymarket’s order book and liquidity a relatively secure and programmable “public utility.” Such composability provides the technical foundation for ecosystem development. Third-party developers can securely and seamlessly access its core liquidity through standardized Builder Codes without requiring prior platform authorization, much like assembling LEGO blocks. This fundamentally lowers the integration barrier, enabling the rapid development of diverse applications.

- User Expansion and Demand Segmentation

Ⅱ: Weekly Trading Volume on Polymarket (by Market Category)

Polymarket has achieved relatively balanced development in event prediction, primarily focusing on politics, sports, and Crypto, with culture and esports rapidly gaining traction. This demonstrates Polymarket’s proven value across diverse event types, with its user base expanding swiftly from the crypto-native community to mainstream audiences across various sectors. Different event types attract new users with distinct usage habits and needs, making a single product interface tailored for crypto-native users clearly insufficient to meet everyone’s demands. The market naturally develops demand segmentation, creating significant opportunities for vertical frontends tailored to specific event types or user groups with unique characteristics, thereby attracting external developers to fill these gaps.

- Economic Drivers and Incentive Alignment

Polymarket operates as a platform without transaction fees or a native token, but Builder Codes do not restrict third-party developers from charging fees or issuing tokens. Among the more than ten Polymarket Builders, some platforms have already implemented standard fees ranging from 0.5% to 2% per transaction and have launched their own tokens. Interestingly, many of these fee-charging platforms allocate a portion of their revenue to token buybacks. Additionally, Polymarket’s official team has created a data dashboard to track Builders’ progress and has invested over $1 million in grants to support top-tier Builders, ensuring they can generate some revenue support even without charging fees.

- Upgrading Competitive Strategy

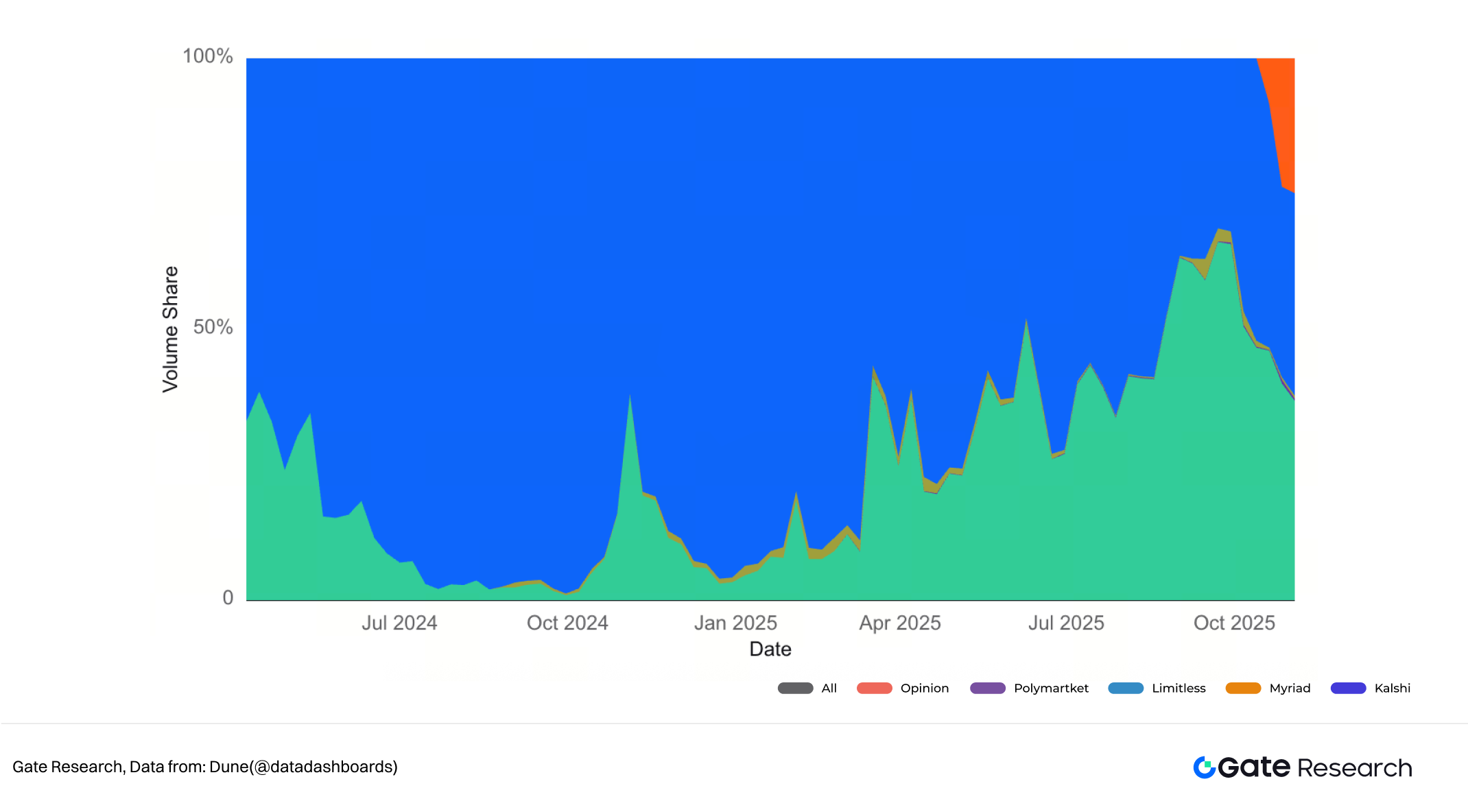

Ⅲ: Market Share of Trading Volume in Prediction Markets

Despite Polymarket’s strong first-mover advantage, the growing attention on prediction markets has brought pressure from centralized, compliant competitors like Kalshi and emerging protocols like Opinion, which are catching up in resources and traffic. An open ecosystem allows Polymarket to leverage the breadth of its ecosystem to counter the depth of single products, elevating competition from “team vs. team” to “ecosystem vs. ecosystem.” Polymarket is also actively expanding its reach, forming ecosystem alliances with traditional giants like Twitter and Google. By leveraging its network of developers, users, community alliances, and traditional strengths to compete against other ecosystems, Polymarket builds deeper moats that are harder to replicate.

2.3 The Role of Builder Codes

Polymarket’s Builder Codes, as a strategic solution for its ecosystem, are not merely technical interfaces but serve as the core connector and innovation enabler for the entire ecosystem. They capitalize on Polymarket’s strengths to address user pain points and market competition.

- Distribution and Aggregation

Polymarket Builders logically take on the mission of serving as distribution channels and shared liquidity pools. Any authorized third-party application—whether a professional trading terminal, a simplified mobile app, or a chatbot embedded in a community—routes directly to Polymarket’s unified order book and liquidity pool. This means:

- For New Markets: A vertical application focused on “sports events” or “tech product launches” does not need to build its user base or liquidity from scratch. Upon launch, its users can immediately trade in a shared deep market, alleviating the “chicken-and-egg” dilemma of market cold starts.

For Long-Tail Markets: Niche markets that previously suffered from insufficient liquidity due to limited exposure on the official frontend can now reach specific user groups interested in them through numerous vertical frontends, revitalizing existing liquidity and effectively countering the natural tendency toward liquidity concentration.

Prediction as a Service

Builder Codes transform “prediction,” the core function, from being confined to Polymarket’s website as a single destination into a prediction-as-a-service model that can be embedded in any online scenario.

- Scenario Integration: Sports media can embed real-time prediction modules alongside event coverage; financial news platforms can integrate relevant prediction markets under macroeconomic news; DAOs can create dedicated prediction pages for governance proposals, allowing users without voting rights to participate in predictions.

- Value Extension: Through this ubiquitous integration, prediction markets evolve from trading tools into infrastructure for information interaction and consensus formation, exponentially amplifying their value and influence.

III. Polymarket’s Diverse Ecosystem Development Represented by Trading Bots

3.1 Polymarket Ecosystem Segmentation

Based on the logic of backend, middleware, and frontend, the Polymarket ecosystem can be categorized into backend arbitration (e.g., UMA Oracle), middleware (various APIs), frontend applications (e.g., terminals and Telegram Bots such as Trading Bots), and emerging categories (e.g., AI Agents).

- UMA Oracle Plays a Critical “Arbitrator” Role in Polymarket’s Backend

The workflow of the UMA Oracle is straightforward. When a smart contract requires real-world data, any user can act as a proposer, staking a bond and submitting a data point. Within a specified period after the proposal, others can dispute the submitted data point. If a dispute is raised during the challenge period, the system activates UMA’s data verification mechanism. At that point, UMA token holders vote within 48 hours to determine the final, accepted result.

In the context of Polymarket’s prediction markets, when an event expires and requires settlement, the UMA Oracle initiates the above process to determine the final outcome. If no disputes are raised against the submitted result, the system automatically completes the fund settlement based on that result. The UMA Oracle enables the adjudication of diverse events—spanning politics, sports, Crypto, and more—at a low cost, allowing Polymarket to create a wide range of prediction events without relying on centralized authorities to announce results.

However, controversy-free arbitration remains a heavily debated topic in prediction markets. Some platforms adopt manual arbitration for consistent rulings, while others leverage AI for judgments. Although the UMA Oracle appears robust, it has repeatedly faced controversies, whether for objective events like the “Rare Earth Protocol Incident” or subjective ones like the “Suit Incident.” The critical issue lies in the voting rights held by token holders during disputes, which are highly susceptible to manipulation by whales. This exposes a market handling billions of dollars in monthly trading volume to a token with a market capitalization of only $130 million.

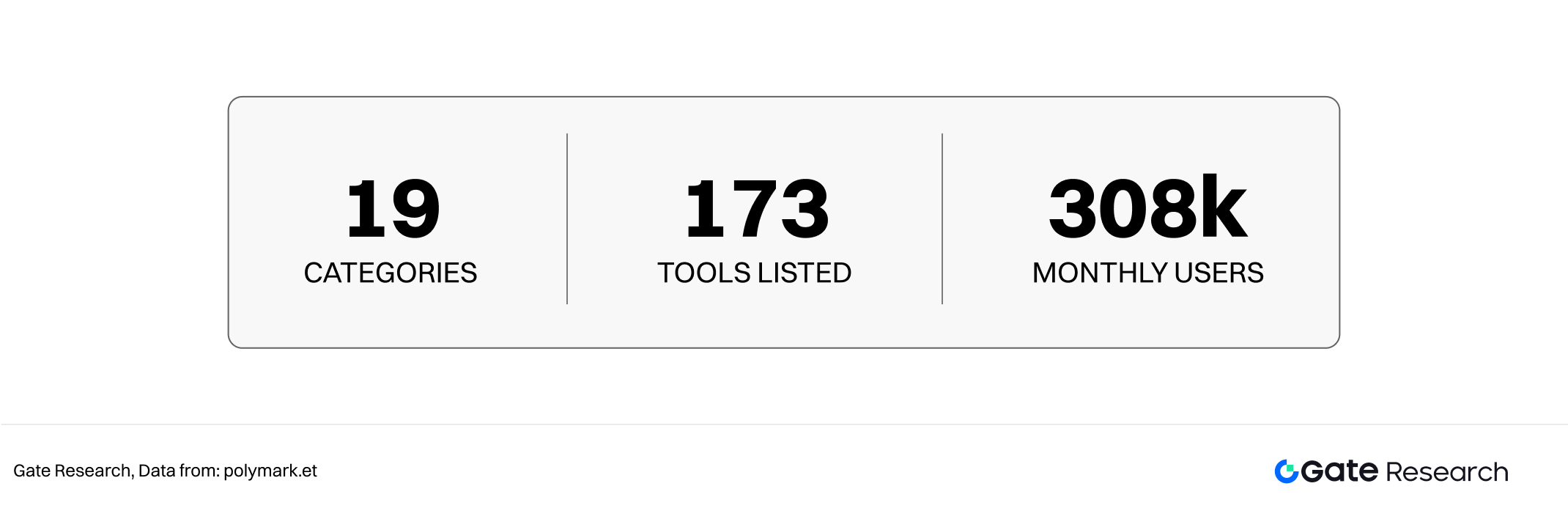

- Middleware and Enhancement Tools

Ⅳ: Overview of the Polymarket Ecosystem Data

The middleware layer bridges the gap between low-level infrastructure and user-facing applications, enriching the ecosystem’s data and interaction capabilities. Polymarket has given rise to a range of data analytics tools, such as the official Polymarket Analytics, the all-in-one analysis platform Polysights, and the whale-tracking tool PolyInsider, transforming raw on-chain data into actionable insights for decision-making. On the community-supported Polymarket website, tools are categorized into 19 types, including Analytics Tools, Portfolio Tracking, and Dashboards, with over 170 tools listed.

- Frontend Applications

Frontend applications are the most vibrant and user-facing segment of the ecosystem. Built on shared backend infrastructure and middleware, they create diverse, highly targeted user interfaces to meet the needs of different event domains, ranging from professional traders to casual users. Since the introduction of Builder Codes, these frontend applications have gained data-tracking capabilities, enabling them to coalesce into a cohesive whole. A variety of Telegram Bots and terminals have emerged, becoming the most active components of the Polymarket ecosystem.

- Emerging Force: AI Agents

AI Agents represent a disruptive, emerging force in the ecosystem, currently integrating in two primary ways:

- As Decision-Support Tools: AI assistants like Polytale can index thousands of markets, providing users with market analysis, trend interpretations, and personalized recommendations through natural language interactions, reducing information asymmetry and cognitive barriers.

- As Autonomous Traders: Some strategic bots allow users to configure complex conditional trigger rules for 24/7 unattended automated trading. More cutting-edge explorations involve AI Agents beginning to make autonomous prediction and trading decisions based on real-time information flows, evolving from mere “tools” into a new class of participants within the ecosystem.

3.2 Polymarket’s Most Mature Ecosystem: Trading Bots

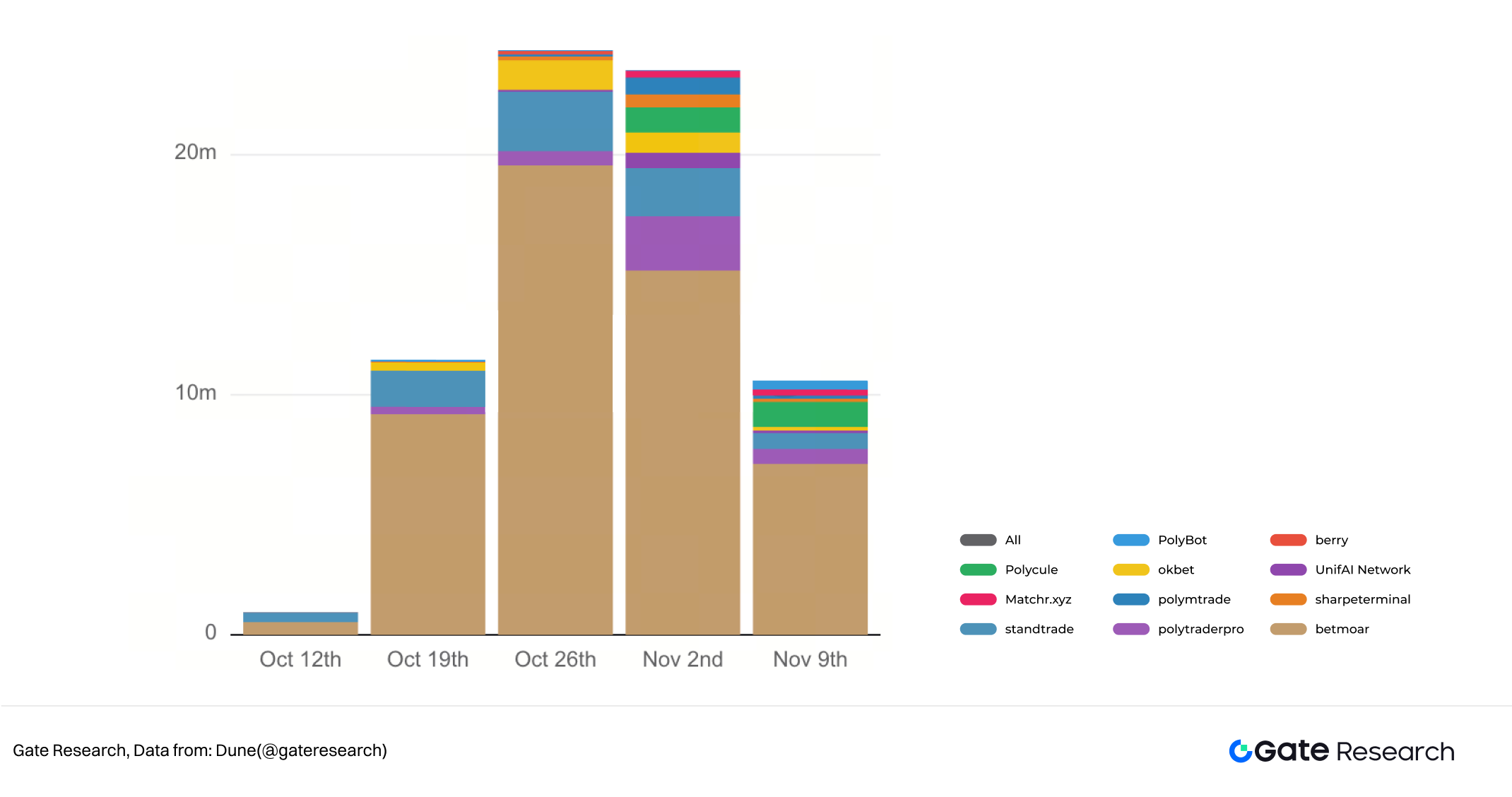

Ⅴ: Weekly Trading Volume of Polymarket Builders

In Polymarket’s diverse ecosystem landscape, Trading Bots undoubtedly represent the most mature and clearly defined segment. The launch of Builder Codes can be seen as a tailor-made growth engine for this type of frontend application. Currently, the more than ten Polymarket Builders generate a weekly trading volume exceeding $20 million, accounting for approximately 2.5% of Polymarket’s total volume. Among them, Betmoar has emerged as the first Trading Bot to surpass $50 million in cumulative trading volume within about a month of Builder Codes’ launch, capturing over 70% of the market share.

As the most original Polymarket terminal, Betmoar not only facilitates trading but also serves as an efficient scout, helping users quickly identify opportunities within Polymarket’s vast array of prediction markets through an aggregated dashboard. Betmoar’s core functionalities can be divided into four main sections: Movers, which tracks trending markets by 1-hour, 6-hour, and 24-hour timeframes to quickly identify markets with the largest price movements or highest trading activity; Bonds, which monitors soon-to-expire events with potential for reversals or mispricings, offering high-risk, high-reward opportunities; Disputes, which displays all markets currently in arbitration or result-determination phases on a single interface; and Comments, which aggregates the latest comments and activity levels across markets to gauge community sentiment. Additionally, Betmoar has been integrated into over 40 Discord servers, reaching more than 53k users, and supports command-based operations via bots. This has shifted it from an isolated frontend to a socialized one, allowing users to trade directly within community groups, significantly enhancing user stickiness and activity.

Ⅵ: Cumulative Trading User Rankings of Polymarket Builders

Although Betmoar dominates in trading volume, it does not hold a significant advantage in terms of user base. In contrast, Polycule boasts the second-largest trading community among Builders and is the first Telegram Bot in the Polymarket ecosystem to secure venture capital funding, receiving investment from AllianceDAO, an incubator that previously backed Pump.Fun, in mid-2025. Polycule’s key features include built-in Solana-to-Polygon cross-chain transactions, simplifying the token conversion process for new users—a feature that has since become standard for prediction market Telegram Bots. Within Telegram, users can complete all operations via commands, including browsing trending markets, placing YES/NO orders, managing positions, viewing assets, and sharing profit links. Polycule was also one of the earliest Bots to introduce copy-trading functionality, earning support from Polymarket’s official data site, Polymarket Analytics, with direct copy-trading links on its Traders interface.

Additionally, Polycule is one of the few Trading Bots to implement fee collection, charging a 0.5% fee on redemption transactions. This means that growth in trading volume directly translates into revenue and enables token empowerment. Since enabling fees on June 29, 2025, the Polycule team has accumulated over $56k in revenue, with a portion of the fees used between late July and early October to buy back approximately 0.34% of its total token supply. However, as the team shifted its focus to launching a new prediction market on Solana, Polycule, while still operational, has been rebranded as PMX Trade.

Overall, with Builder Codes as the engine, frontend applications—represented by terminals and Telegram Bots like Trading Bots—have become the most dynamic growth pole in the Polymarket ecosystem. However, beneath the surface prosperity, the ecosystem’s evolution is not without challenges. First, the user base served by Builders remains relatively limited, yet the number of products continues to grow, intensifying competition. Second, whether it’s Betmoar’s absolute dominance in trading volume that is disproportionate to its user base, or Polycule’s initial success as a benchmark project followed by a rebrand and shift in focus to new ventures, these cases reveal that as the ecosystem transitions from “early adoption” to “sustained prosperity,” it is brimming with new opportunities while simultaneously facing a series of profound challenges.

3.3 Opportunities in the Polymarket Ecosystem

The most fundamental and certain opportunity for the Polymarket ecosystem, represented by Builders, lies in the immense growth dividend from co-evolving with the parent platform Polymarket and the broader prediction market, as well as the massive growth potential—potentially several-fold or even tenfold—stemming from its extremely low current market penetration rate. Integrated Builder platforms currently contribute less than 3% of Polymarket’s total trading volume, and for platforms that charge fees, the trading volume share is under 1%. This indicates that the vast majority of users still prefer the official frontend, and the ecosystem’s commercialization efforts are only just beginning.

When observing successful cases in similar ecosystems, we can glimpse the potential future for Polymarket Builders. In the on-chain perpetual protocol Hyperliquid, its Builders ecosystem already accounts for approximately 10%-20% of the platform’s total trading volume, generating tens of millions of dollars in stable revenue for developers. Similarly, in the Meme trading space, professional data terminals capture a significant share of traffic, serving as key distribution platforms for Meme development. These two mature paradigms demonstrate that a healthy and active third-party ecosystem is fully capable of capturing 10%-20% or more of its underlying platform’s trading volume.

IV. Comparative Analysis with Competitors and Similar Products

After dissecting the construction and segmentation of Polymarket’s own ecosystem, an indispensable perspective is to place it within a broader competitive landscape. Comparing it with various similar products helps us more clearly evaluate the unique positioning, development potential, and challenges faced by Polymarket Builder.

4.1 Channel is King: Robinhood Empowers Kalshi’s Distribution

Unlike Polymarket’s crypto-native path of building an open and composable ecosystem around Builder Codes, its strongest compliant rival, Kalshi, has adopted a starkly different strategy—leveraging the powerful channels of internet broker Robinhood to successfully reach tens of millions of traditional financial users, achieving a remarkable growth leap this year.

Robinhood’s Prediction Market Hub launched within its app in March of this year, with Kalshi, as a CFTC-regulated exchange, providing the compliant market infrastructure framework. Initially, their collaboration focused on political and economic events, such as elections and Federal Reserve interest rate decisions; in August, the partnership expanded to sports, introducing prediction markets for NFL and college football game outcomes; by October, it further extended to entertainment and pop culture, allowing users to predict celebrity developments, music releases, and other cultural events.

In its Q2 earnings call, Robinhood stated that its users traded approximately $1 billion in notional value of contracts on Kalshi’s prediction markets (each contract with a $1 notional value). The company charges about $0.01 in commissions per contract, meaning the prediction market business generated approximately $10 million in revenue for Robinhood in Q2.

Ⅶ: Weekly Trading Volume on Kalshi

In its recently released third-quarter earnings report, Robinhood’s prediction market business achieved further growth, with annualized revenue exceeding $100 million. Specifically, the total number of event contracts traded in Q3 more than doubled quarter-over-quarter, reaching 2.3 billion contracts, generating approximately $23 million in revenue. Additionally, the total contracts traded in October 2025 reached 2.5 billion, with monthly revenue hitting $25 million—surpassing the entire Q3 2025 total. Notably, Kalshi’s notional trading volume in October was approximately $4.4 billion, meaning Robinhood facilitated over 50% of its transaction distribution.

The partnership between Kalshi and Robinhood is fundamentally a powerful alliance between compliant content and massive distribution channels. For Kalshi, it provides a golden gateway to Robinhood’s vast user base. According to the Q3 report, Robinhood has over 26.8 million funded customers, dramatically reducing Kalshi’s customer acquisition costs. For Robinhood, this represents a critical step in its transformation toward a “super app,” enriching its product matrix with Kalshi’s prediction markets to boost user engagement and trading activity. When market volatility may potentially slow growth in traditional businesses, innovative segments like prediction markets are poised to emerge as new growth engines.

Ⅷ: Comparison Between Polymarket and Kalshi

There is no denying that the incremental growth brought by Kalshi’s leverage of traditional internet brokerage channels far outpaces Polymarket’s efforts within the crypto ecosystem. This “compliance + mainstream channel” model has already posed direct competitive pressure on Polymarket.

4.2 Comparison with Hyperliquid Builder: Lessons and Differences in Ecosystem Models

Hyperliquid, a leader in on-chain perpetual contract trading, serves as an important reference for Polymarket’s Builders system. While the two share similarities in ecosystem logic, differences arise due to their distinct market segments.

At the technical implementation level, Hyperliquid embeds Builder codes as parameters in order data, with on-chain transaction data directly including Builder addresses. Combined with Hyperliquid Explorer or publicly available builder_fills data files, this design allows for easy tracking of Builder traffic and revenue sharing, enabling data scientists to perform intuitive on-chain analysis and developers to extract data directly from blockchain explorers. In contrast, Polymarket Builder primarily integrates through API Keys and Relayer Client, which are off-chain, making it impossible to directly distinguish native and Builder transactions from on-chain transactions.

These technical differences in the Builders ecosystem also reflect their core objectives and product logic. Hyperliquid, serving perpetual contract trading, prioritizes transaction speed, execution efficiency, and leverage functionality, with Builder applications like professional frontends and trading bots centered around these core demands. Polymarket, as a prediction market, focuses more on users’ needs for information discovery, analysis, and convenient participation rather than solely pursuing speed.

Ⅸ: Daily Revenue of Hyperliquid Builders

The highly mature Hyperliquid Builder ecosystem has cumulatively captured over $41 million in revenue, painting a successful blueprint for Polymarket’s ecosystem, particularly in terms of revenue potential. This also prompts Polymarket Builders projects to consider how to develop their own revenue models, rather than solely relying on official Grants.

4.3 Comparison with Meme Terminal: A Potential Cross-Sector Rivalry

Beyond direct competitors in the prediction market, Polymarket and its ecosystem also face cross-sector competition from the Meme trading space, fundamentally vying for users’ limited attention and capital.

In this dimension, the mature Meme trading terminal Axiom is an undeniable potential rival that Polymarket Builders cannot ignore. Axiom has established a dominant position in Solana’s Meme trading sector, consistently maintaining over 60% market share in the track regardless of market conditions. More importantly, it boasts extensive ecosystem-building experience, having supported Hyperliquid Builders from its launch day and consistently ranking among the top five in Hyperliquid’s ecosystem for trading volume and revenue. The Axiom team clearly possesses the capability to rapidly integrate and successfully operate a third-party frontend ecosystem. Should Axiom decide to enter the prediction market space in the future, it could easily leverage its mature technical architecture and vast user base to deliver a devastating blow to existing Polymarket Builders.

Although Axiom operates in a completely different trading sector, its successful experience is highly transferable. On the surface, Meme trading and prediction markets have distinct core demands: Meme trading requires an environment with extreme transaction speed and first-mover information on new asset launches to satisfy users’ pursuit of “lottery-style” high returns, while prediction markets derive value from information analysis and probability judgment, not prioritizing speed alone. However, at a deeper level, both Builders and trading platforms share a fundamental commonality: the optimization of the ultimate trading experience. Whether it’s Axiom empowering users with speed and information in the fast-paced Meme market, or Polymarket Builders reducing participation barriers through simplified interfaces, information aggregation, and social features, their ultimate goal is to attract and retain users by enhancing user experience. Thus, this competition is not only a battle for traffic but also a contest of user experience design capabilities and development efficiency. Having already proven its prowess, Axiom is undoubtedly a cross-sector challenger that the Polymarket Builders ecosystem must remain vigilant about.

V. Conclusion and Outlook

The development of prediction markets is at a critical juncture. The core competitiveness of prediction markets lies not only in “who can establish reliable liquidity and user base earlier” but also in “who can build a more vibrant and self-evolving ecosystem.” Polymarket’s choice to promote ecosystem openness through Builder Codes is undoubtedly a landmark strategic decision—it transforms the prediction market from a single-platform system into a sustainably evolving open network.

However, ecosystem openness does not guarantee complacency. Network effects take time to cultivate, while external competitive pressures are immediate. The most direct pressure comes from the strategic alliance between Kalshi and Robinhood. The channel advantages of Robinhood’s user base have enabled Kalshi to achieve user education and large-scale breakthroughs in just a few months, establishing itself as a mainstream prediction market capable of rivaling Polymarket. This combination of “compliant content + giant distribution channels” poses a highly tangible external threat to Polymarket—when prediction markets are integrated into traditional brokerage apps and presented with fiat settlement, they have lower user barriers, broader reach, and faster conversion.

In the short term, Polymarket’s ecosystem development remains in its early stages. Builders account for less than 3% of trading volume, commercialization mechanisms are not yet mature, user habits remain concentrated on the official frontend, and the ecosystem as a whole requires time for accumulation and iterative improvement. Meanwhile, while Polymarket’s reliance on the UMA Oracle for underlying settlement and result arbitration offers advantages in cost and decentralization, past controversies such as the “Rare Earth Protocol Incident” and “Suit Incident” have exposed potential vulnerabilities. As the ecosystem continues to expand, persistent issues with oracle manipulation or voting distortions could trigger chain reactions and trust crises.

Yet, as the success of Hyperliquid Builders demonstrates, once ecosystem network effects begin to take shape, the mutual growth of developers and users will form a self-reinforcing cycle. In the long term, the Polymarket Builders system has the potential to become the “App Store” of prediction markets, hosting countless vertical frontends, trading tools, and innovative applications, propelling Polymarket’s evolution from a “financial tool” to a “social infrastructure.” While this open path is far from smooth, it is an inevitable journey capable of unlocking boundless possibilities and building deep competitive strength.

Ⅵ. Reference

- Dune, https://dune.com/datadashboards/prediction-markets

- Dune, https://dune.com/datadashboards/polymarket-overview

- Dune, https://dune.com/datadashboards/kalshi-overview

- Dune, https://dune.com/gateresearch/pmbuilders

- Polymarket, https://docs.polymarket.com/developers/builders/builder-intro

- Polymark, https://polymark.et/

- Gate, https://www.gate.com/news/detail/13789413

- Globenewswire, https://www.globenewswire.com/news-release/2025/11/05/3181923/0/en/Robinhood-Reports-Third-Quarter-2025-Results.html

- FlowScan, https://www.flowscan.xyz/builders?builder=all

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review