Gate Ventures Weekly Crypto Recap (November 24, 2025)

TL;DR

- Nonfarm payroll report surprises the market, easing recession fears, while the upward unemployment rate boosts rate cut expectations.

- This week’s incoming data includes the US Fed Indexes from Chicago, Dallas and Richmond, 2nd reading of US Q3 GDP, October core PCE, etc.

- Market pulled back sharply: BTC fell 7.88%, ETH dropped 9.44%, and both BTC and ETH ETFs saw heavy weekly outflows (–$1.22B and –$500.25M).

- Macro sentiment remains weak: MicroStrategy risks index exclusion, Fear & Greed stays at 19 (Extreme Fear), and ETH/BTC slid to 0.326.

- Altcoins hit hardest: Total crypto market cap fell 7.48%; excluding majors dropped 5.89%; assets outside the top 10 plunged 9.18%.

- Top 30 performance: Average decline was -9.8%. Only BCH (+12.8%), WLFI (+7.6%), and LEO posted gains. BCH spiked on whale longs; WLFI gained despite a security breach and $22.14M emergency burn. HYPE -14.7% after a $320M unlock.

- Ethereum Foundation unveils Interop Layer to solve L2 fragmentation and interoperability.

- Aave Labs introduces high-yield savings app with insured deposits rails and 12,000-bank support.

- Paxos launches USDG0 to bring regulated dollar liquidity across chains.

Macro Overview

Nonfarm payroll report surprises the market, easing recession fears, while the upward unemployment rate boosts rate cut expectations

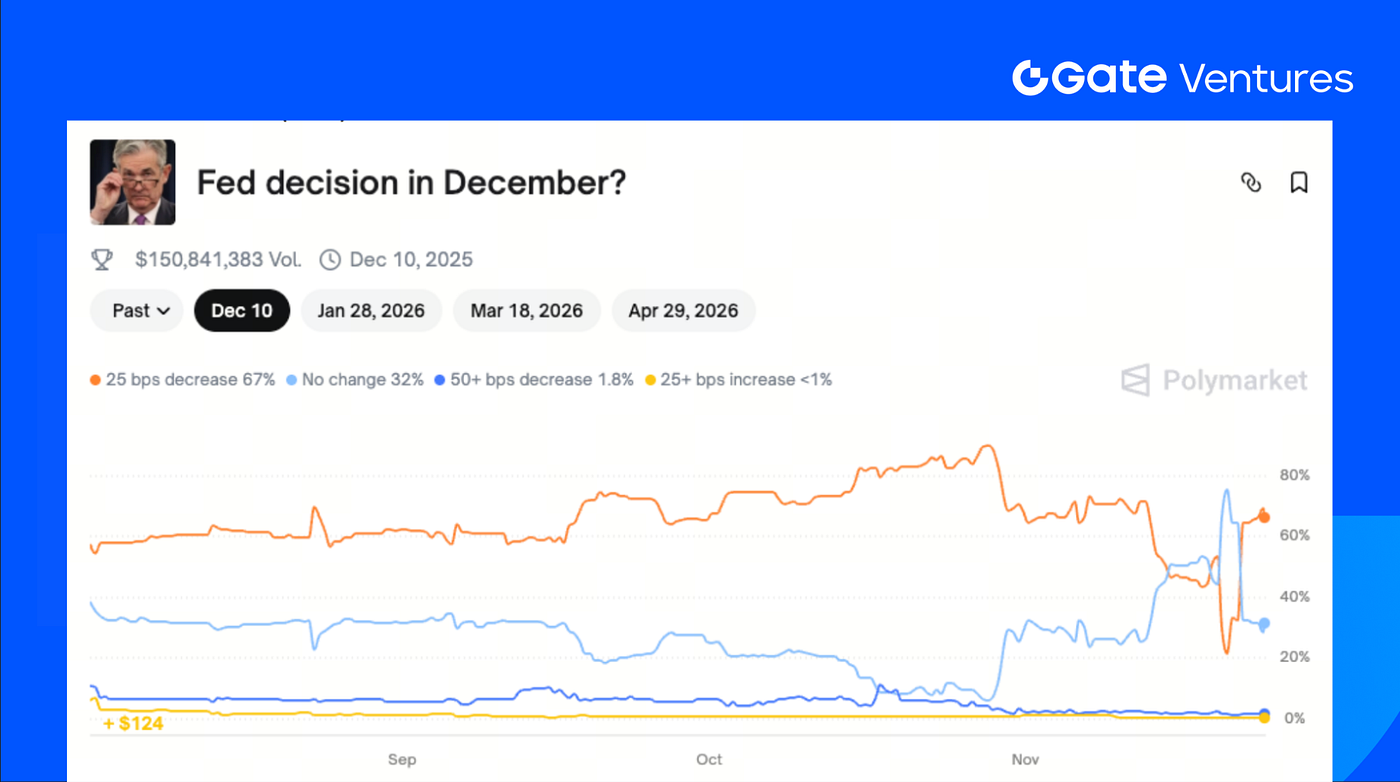

In September, the US added 119k nonfarm payroll jobs, exceeding the consensus forecast of 51k, while the previous two months’ figures were revised down by a total of 34k. The unemployment rate rose by 0.1 pp to 4.4%, slightly above expectations. Average hourly earnings growth slipped by 0.2 pp to 0.2% MoM, below the expected 0.3%. Average weekly hours remained steady at 34.2, in line with forecasts. The stronger‑than‑expected job gains eased market concerns about recession or a sharp economic slowdown. Meanwhile, the upward trend in unemployment and softer wage growth fueled expectations for potential rate cuts by the Federal Reserve.

Although current rates remain restrictive, leaving the Fed room to cut, recent signs of economic re‑acceleration and internal disagreement within the Fed have lowered the necessity for a December rate cut. Boston Fed President Susan Collins saying she has not yet made up her mind on a potential move, while the New York Fed President John WIlliams said he expects the central bank can lower its key rate. As the Bureau of Labor Statistics (BLS) has announced that the October and November nonfarm payroll data will be released together on December 16, the September report is the last official employment data the Fed will see before its next FOMC meeting. Further attention will focus on initial jobless claims and other indicators on the impact of layoffs and the government shutdown.

This week’s incoming data includes the US Fed Indexes from Chicago, Dallas and Richmond, 2nd reading of US Q3 GDP, October core PCE, etc. Due to the Thanksgiving holiday this week being shortened, the new week will still see the late issuance of US producer price data and business surveys from the Chicago, Dallas and Richmond Feds, as well as Conference Board consumer sentiment data. The other data will be gradually published, as the ripples of US government shutdown continues to interfere with the official data releases. (1, 2)

Polymarket: Fed Decision in December

DXY

The US dollar stayed above $100 since last Monday, hovering near a six-month high as the investors continue to access the Fed’s policy paths, as clear divisions between regional Fed governors appeared.(3)

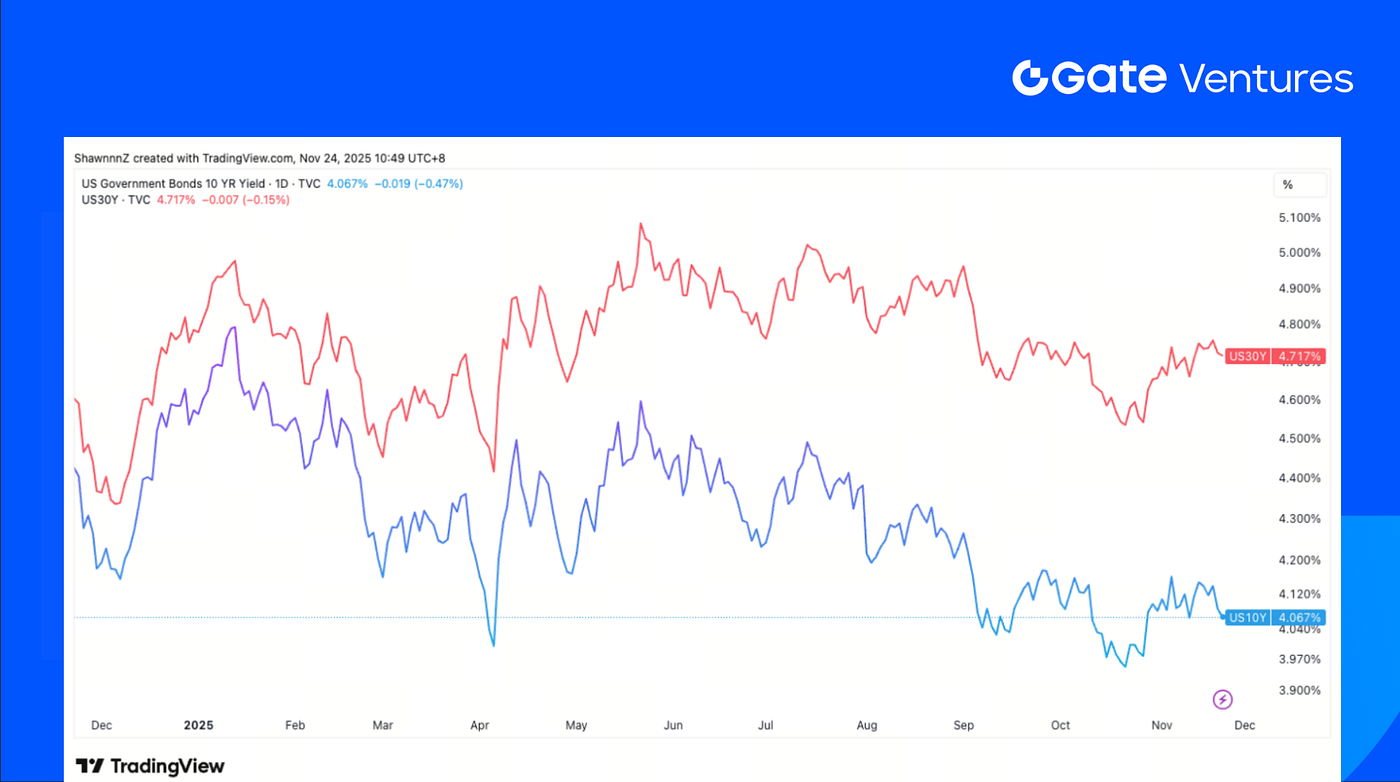

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields both sliced last Friday, as the New York Fed President stated that he still “see room for a further adjustment in the near term to the target range”.(4)

Gold

Gold prices stayed steady last week, as investors boosted bets on the December US interest rate cut, after the New York Fed President released a dovish signal. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC fell 7.88% over the past week, while ETH declined 9.44%, extending the market’s downside momentum. BTC ETFs have now posted four consecutive weeks of net outflows, recording -$1.22B this week, and ETH ETFs also saw continued weakness with -$500.25M in weekly outflows. (6)

MicroStrategy faces potential index exclusion from MSCI and Nasdaq as digital assets now account for over 50% of its total assets, with an average BTC cost basis of $74,430, adding further pressure to sentiment. (7)

The Fear & Greed Index remains deep in “Extreme Fear” at 19, and the ETH/BTC ratio slipped another 1.77% to 0.326, signaling relative underperformance from ETH. (8)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap declined 7.48% last week. Excluding BTC and ETH, the broader market was down 5.89%, while assets outside the top 10 fell a sharper 9.18%. This indicates that altcoins experienced a noticeably heavier pullback compared with the major assets.

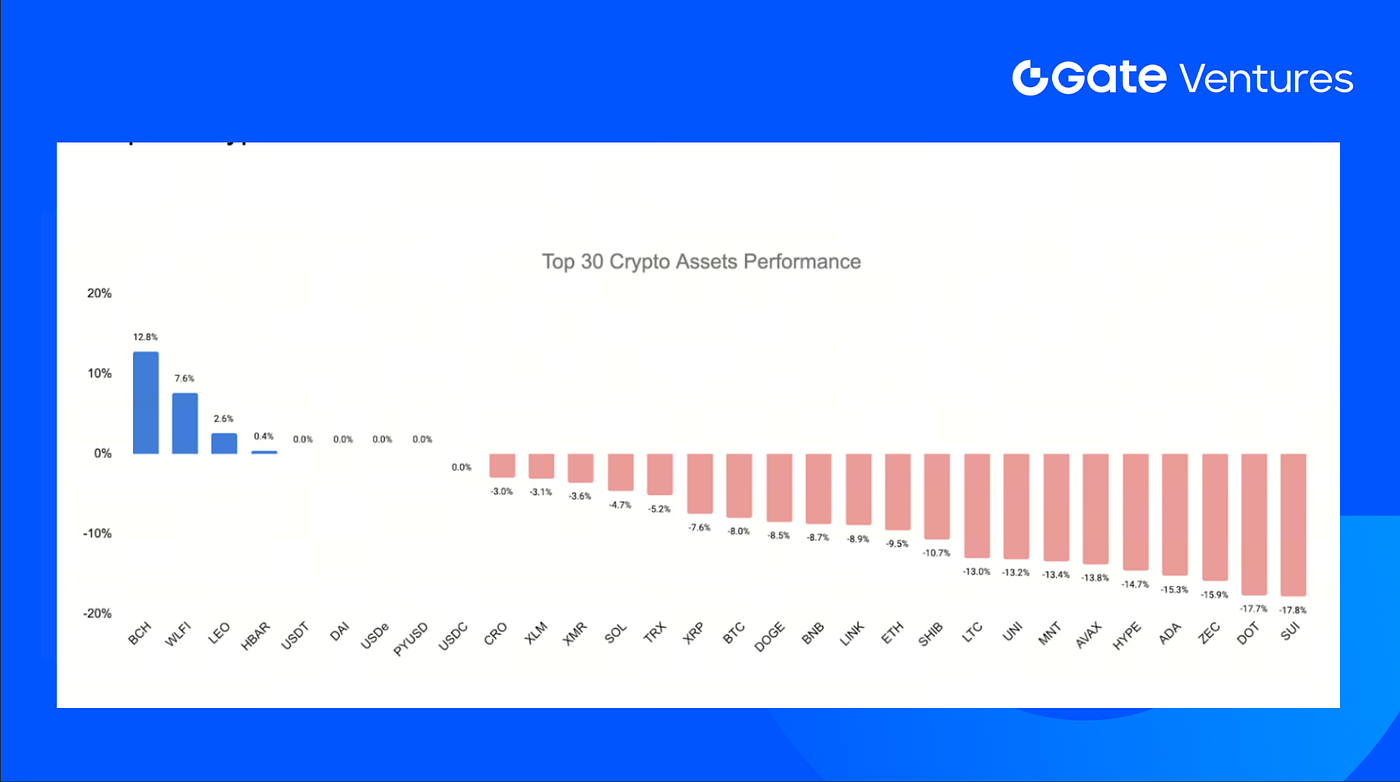

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Nov 24th 2025

Among the top 30 crypto assets, prices fell an average of 9.8% over the week. Only BCH, WLFI, and LEO managed to post gains.

BCH led the outperformers with a 12.8% increase, supported by notable whale activity on Hyperliquid, where large traders were seen 10x longing BCH with positions of ~US$900K. (9)

WLFI rose 7.6%, despite the project disclosing a major security incident that impacted user wallets ahead of its official launch. The team responded by freezing affected wallets and conducting an emergency token burn worth US$22.14M. (10)

On the downside, HYPE dropped 14.7% following a US$320M token unlock, which added significant selling pressure. (11)

The Key Crypto Highlights

1. Ethereum Foundation unveils Interop Layer to solve L2 fragmentation and interoperability

The Ethereum Foundation introduced new details on its Interop Layer, an onchain protocol designed to eliminate fragmentation across the rapidly growing L2 ecosystem. Built on ERC-4337 account abstraction, the Interop Layer makes wallets and dapps multichain-native by default, enabling asset transfers and interactions across all rollups without bridges or chain-specific UX. Now open for testing, the initiative strengthens Ethereum’s long-term scaling roadmap by unifying liquidity, improving developer experience, and restoring a single-chain feel to the broader EVM environment. (12)

2. Aave Labs introduces high-yield savings app with insured deposits rails and 12,000-bank support

Aave Labs is launching a savings app offering a 5% base rate, up to 9% with activity boosts, and insurance-backed protection on deposits up to $1M. The product connects to over 12,000 banks and debit cards for fiat funding while supporting unlimited stablecoin transfers, framing DeFi yields as a safer, consumer-friendly alternative to fintech savings accounts. Interest accrues via Aave’s over-collateralized lending markets, where Aave Labs captures the spread between user rates and underlying protocol returns. The app will debut on iOS with a waitlist now open. (13)

3. Paxos launches USDG0 to bring regulated dollar liquidity across chains

Paxos Labs introduced USDG0, an omnichain extension of its regulated USDG stablecoin, enabling a single, fully backed dollar supply to move across Hyperliquid, Plume and Aptos using LayerZero’s OFT standard. The design avoids wrapped assets while preserving Paxos’ regulatory protections and Treasury-benchmarked yield profile. Each ecosystem can embed USDG0 into trading, lending or modular DeFi rails, creating unified liquidity without traditional bridges. The launch expands the Global Dollar Network as Paxos continues scaling regulated tokenization, having processed over $180B since 2018. (14)

Key Ventures Deals

1. 0xbow raises $3.5M Seed gound amid growing demand for regulated privacy rails

0xbow raised $3.5M Seed round led by Starbloom Capital with Coinbase Ventures, BOOST VC and other investors supporting the expansion of Privacy Pools, a compliant privacy protocol tied to the Ethereum Foundation’s Kohaku initiative. Backed by prior research from Vitalik Buterin, the system enables fund anonymization while screening bad actors. The funding supports multi-asset extensions and cross-chain deployment, strengthening 0xbow’s position as a privacy infrastructure aligned with regulatory expectations. (15)

2. Former BlackRock team lands $4.6M for HelloTrade — mobile-first U.S. assets trading infrastructure

HelloTrade raised $4.6M led by Dragonfly Capital with Mirana Ventures and other investors backing its blockchain-powered platform for global access to U.S. assets. Founded by former BlackRock digital-asset leads, the product aims to streamline cross-border participation in stocks and commodities through a mobile-first interface. The funding supports product launch, security investment and user education, positioning HelloTrade to modernize retail access to traditional markets via onchain rails. (16)

3. Ledn receives strategic investment from Tether to scale BTC-collateralized credit loan

Ledn received a strategic investment round from Tether to scale its bitcoin-backed lending platform after originating over $2.8B in loans and surpassing $100M in ARR. The capital supports custody, risk, and liquidation infrastructure as centralized BTC-collateralized lending grows across retail and institutions. By letting borrowers unlock liquidity without selling BTC, the deal targets rising demand for non-dilutive credit and positions Ledn as core infrastructure for the next wave of bitcoin-based financial services. (17)

Ventures Market Metrics

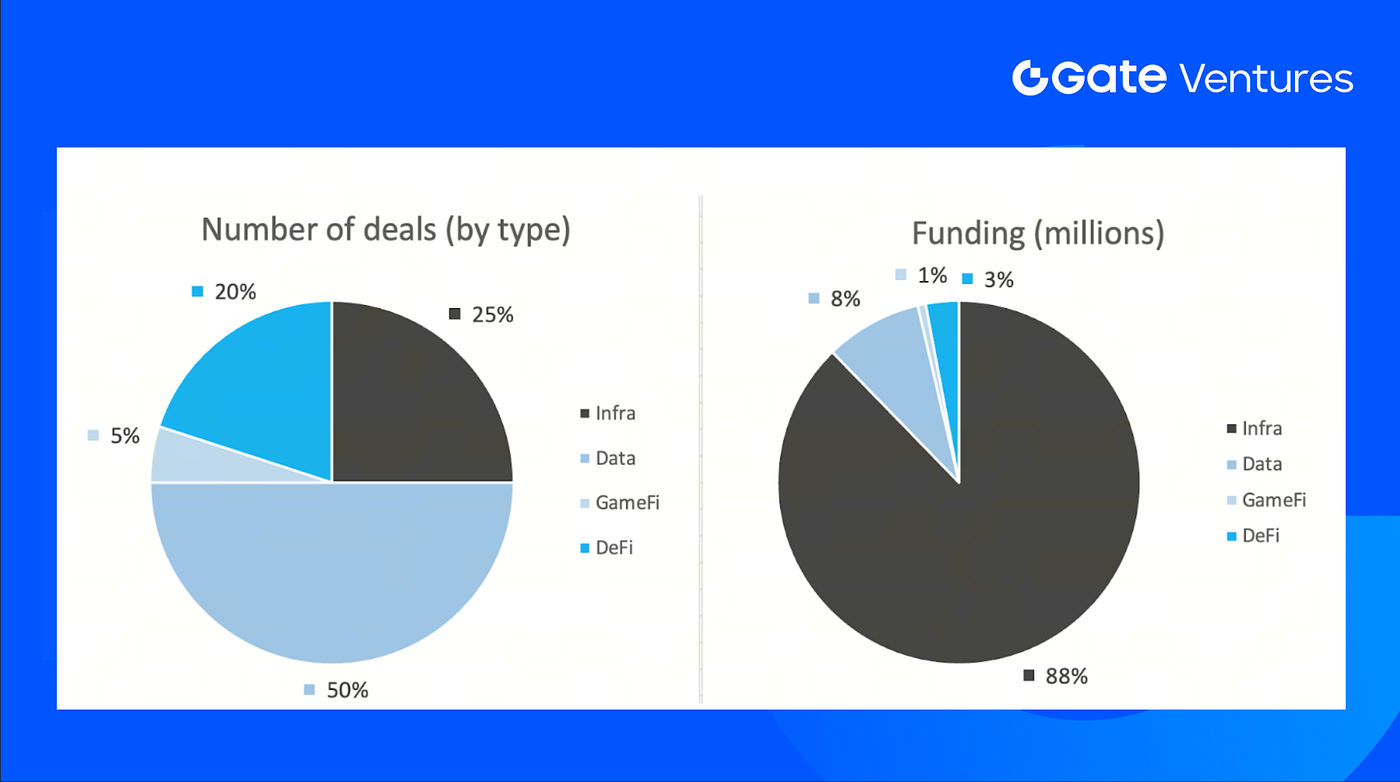

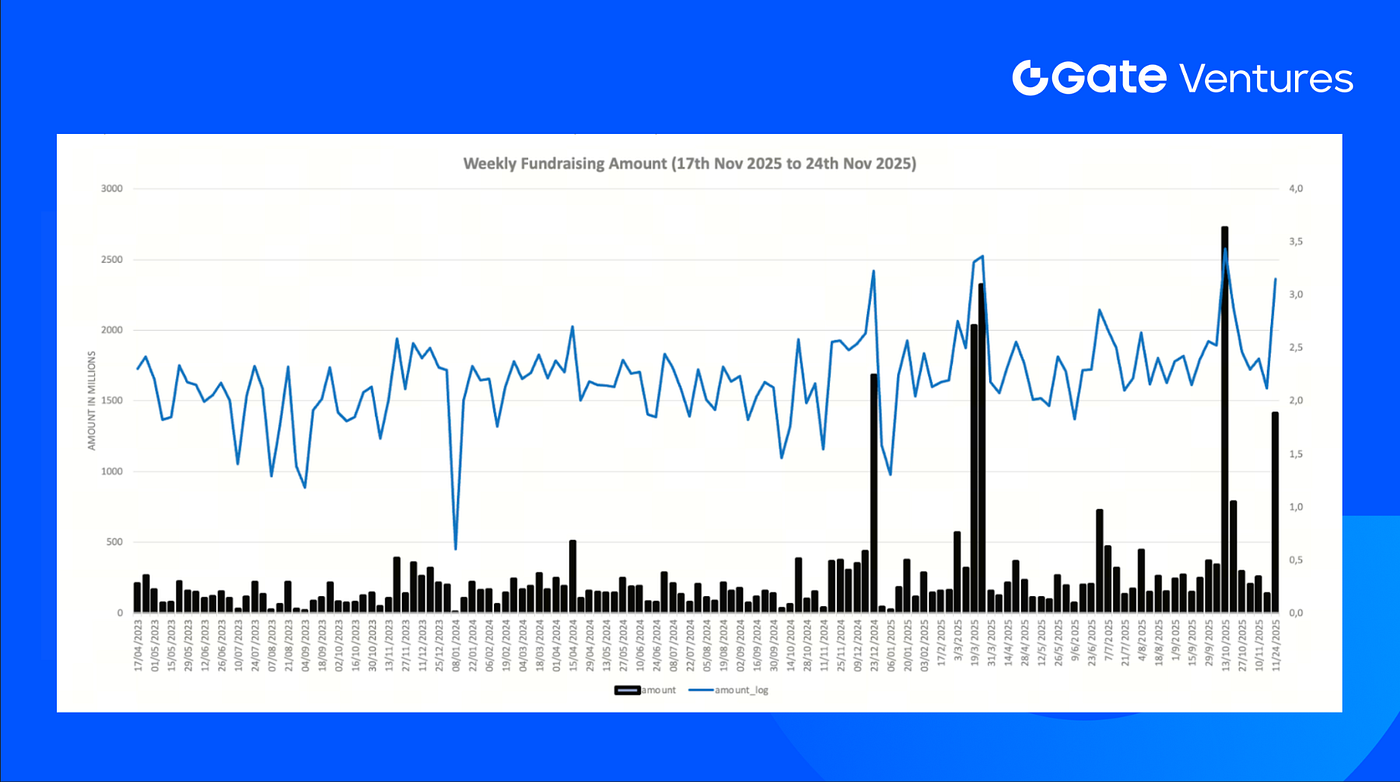

The number of deals closed in the previous week was 20, with Data having 10 deals, representing 50% of the total number of deals. Meanwhile, Infra had 5 (25%), GameFi had 1 (5%) and DeFi had 4 (20%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 24th Nov 2025

The total amount of disclosed funding raised in the previous week was $1,410M, 35% (7/20) deals in the previous week didn’t public the raised amount. The top funding came from Infra sector with $1,237M. Most funded deals: Kalshi $1,000M, Kraken $200M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 24th Nov 2025

Total weekly fundraising rose to $1,410M for the 3rd week of Nov-2025, an increase of 968% compared to the week prior. Weekly fundraising in the previous week was up 279% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-17-november-2025.html

- Fed Decision in December, Polymarket, https://polymarket.com/event/fed-decision-in-december?tid=1763953866107

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Micro Strategy’s exclusion from index, https://www.investing.com/news/analyst-ratings/microstrategy-stock-faces-index-exclusion-risk-jpmorgan-warns-93CH-4371553

- Hyperliquid whale’s position, https://hypurrscan.io/address/0x8d0e342e0524392d035fb37461c6f5813ff59244

- WLFI token burn, https://www.bitget.com/amp/news/detail/12560605074433

- Hyperliquid token unlock, https://www.odaily.news/en/post/5207726

- Ethereum Foundation unveils Interop Layer to solve L2 fragmentation and interoperability, https://www.theblock.co/post/379355/ethereum-foundation-interop-layer-l2-ecosystem-feel-like-one-chain

- Aave Labs introduces high-yield savings app with insured deposits rails and 12,000-bank support, https://www.theblock.co/post/379080/aave-labs-high-yield-savings-app-insurance-backed-protection-deposits-1-million

- Paxos launches USDG0 to bring regulated dollar liquidity across chains, https://cointelegraph.com/news/paxos-labs-announces-launch-of-new-stablecoin-usdgo

- 0xbow raises $3.5M Seed gound amid growing demand for regulated privacy rails, https://www.theblock.co/post/379395/0xbow-raises-3-5-million-seed-round-ethereum-foundation-backed-privacy-pools

- Former BlackRock team lands $4.6M for HelloTrade — mobile-first U.S. assets trading infrastructure, https://fortune.com/2025/11/20/former-blackrock-employees-raise-4-6-million/

- Ledn receives strategic investment from Tether to scale BTC-collateralized credit loan, https://tether.io/news/tether-makes-strategic-investment-in-ledn-expanding-opportunities-in-bitcoin-backed-lending/

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)