Tether Challenges S&P Downgrade, Citing Strong Equity and Robust Revenue Streams

Tether Addresses Ratings Controversy

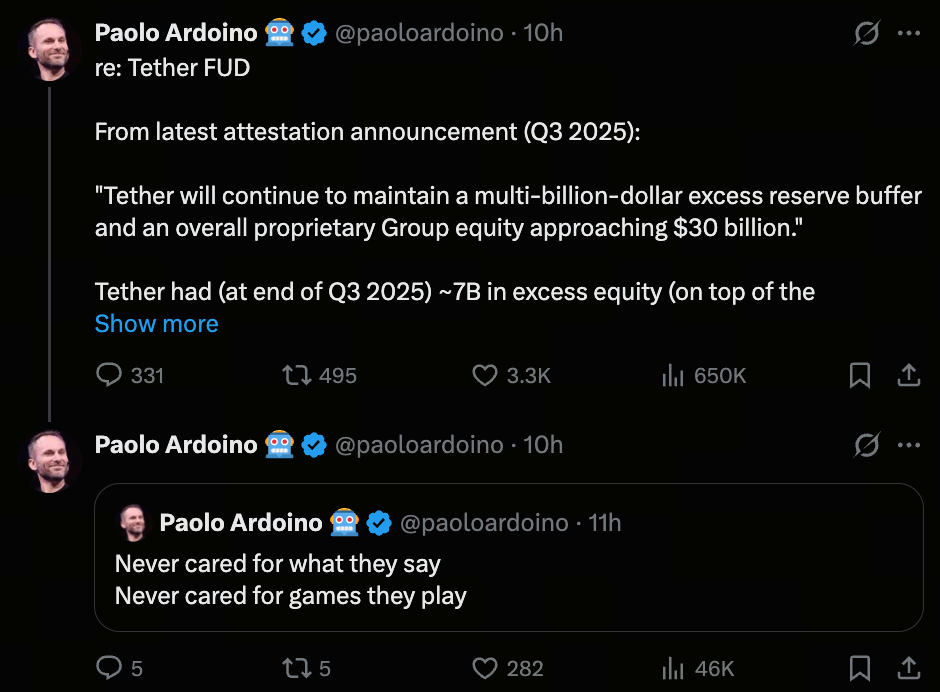

After S&P Global downgraded USDT’s U.S. dollar peg stability to its lowest rating, sparking market anxiety, Tether CEO Paolo Ardoino responded directly. He stressed that the ratings agency’s report failed to capture the full extent of Tether’s assets and operational income.

(Source: paoloardoino)

Tether’s Q3 audit shows total assets of roughly $215 billion, with stablecoin-related liabilities around $184.5 billion. Ardoino highlighted an additional $7 billion in surplus equity and up to $23 billion in retained earnings. This makes Tether’s capital structure significantly stronger than commonly perceived. He also pointed out that monthly U.S. Treasury income alone provides about $500 million in base profit. This key revenue stream was omitted from the S&P report.

Downgrade Fuels Market Uncertainty

S&P’s downgrade labeled USDT’s peg maintenance as “weak,” igniting a fresh wave of fear, uncertainty, and doubt (FUD) in the stablecoin market. As the world’s largest stablecoin, any rating change for Tether quickly draws intense market scrutiny.

Despite this, Tether remains a foundational stablecoin within the crypto ecosystem. The controversy has also amplified the industry’s focus on stablecoin asset transparency and revenue sources.

Risks and Strengths Go Hand in Hand

Some analysts have presented views that contrast with Ardoino’s. BitMEX founder Arthur Hayes argued that with falling yields due to Federal Reserve rate cuts, Tether may boost allocations to gold and Bitcoin to offset declining income.

Hayes noted that if gold or BTC suffers a sharp correction, it could significantly pressure Tether’s equity. If these assets drop by more than 30%, Tether’s capital could be eliminated.

Contrasting Analyst Perspectives

Former Citi digital asset chief analyst Joseph Ayoub countered Hayes’s claims. He stated he has spent considerable time researching Tether and reached very different conclusions. Ayoub emphasized:

- Tether holds more assets than most realize

- Its business model is highly profitable

- With only about 150 employees, it generates substantial interest income

- Its reserves exceed liabilities, even surpassing the standards of traditional banks

Ayoub asserts that the market consistently underestimates Tether’s financial resilience.

For more information about Web3, visit: https://www.gate.com/

Summary

The ratings downgrade has sparked debate, underscoring the rising importance of stablecoins in global finance. While S&P’s rating has raised some market concerns, responses from the Tether team and industry analysts highlight USDT’s strong capital adequacy and robust profitability. The market will continue to monitor Tether’s transparency and asset disclosures. Current evidence shows it remains a resilient cornerstone of the crypto financial system.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution