Post content & earn content mining yield

placeholder

GateToken

A phone number has been in use for 16 years. How much contribution have I made to them over these years? Even at 30,000 a year, that's almost 500,000.

View Original- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

T

Ton

Created By@ProfitFivePointsEvery

Listing Progress

0.00%

MC:

$2.53K

Create My Token

- Reward

- like

- 1

- Repost

- Share

GateUser-1379e90d :

:

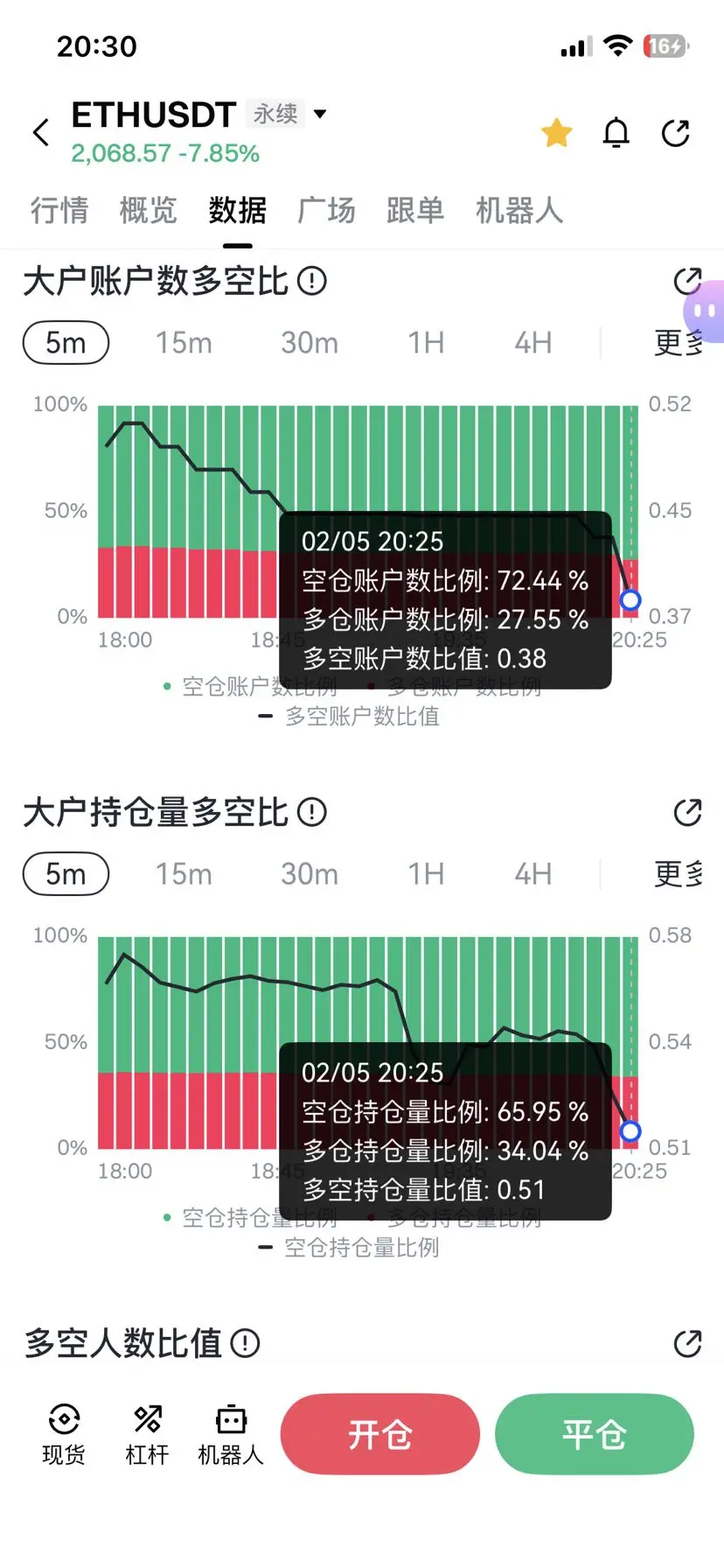

They're not fools. Many are currently short on cash. If they don't short, how can spot traders be forced to exit their positions through arbitrage?What CZ does in the books before tweeting \'4\' and \'FUD\'

- Reward

- like

- Comment

- Repost

- Share

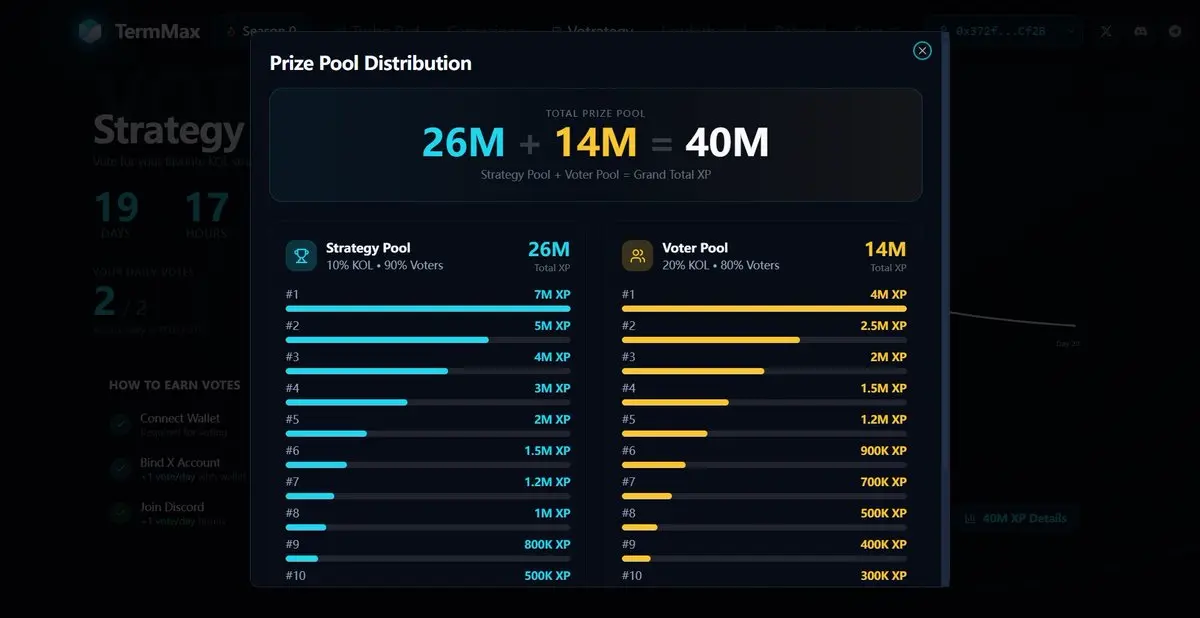

Currently, the DeFi world seems to be caught in a competition of "higher yields" and "faster liquidations." But an often overlooked fact is that true scarcity has never been high returns, but rather a clear and predictable risk structure. @TermMaxFi's launch of the DeFi Renaissance Program Phase 2 aims to turn this "certainty" into infrastructure. Its core is to create a more stable and efficient operating environment for users—especially investors holding long-term tokenized assets (such as RWA)—through fixed interest rate lending and fixed risk structures. This is not to deny the value of vo

View Original

- Reward

- like

- Comment

- Repost

- Share

I for just hold my short position oWho send me to close ham 😟Tragedy of a day traderNow pull back sef I no see chai

- Reward

- like

- Comment

- Repost

- Share

NEW VIDEO: Data and facts speak a clear language. The Bitcoin bear market is here. Many investors are now wondering how much further the Bitcoin price can fall and whether an 80 percent correction by 2026 is realistic. But who is actually selling Bitcoin right now, and how are institutional investors positioned? We will examine these questions using concrete on-chain data and market indicators. Even more important, however, is what strategy makes sense now and what investors can expect from the #Bitcoin market in the coming months. That and more in today's video.

BTC-8,82%

- Reward

- like

- Comment

- Repost

- Share

Gift form @Backpack Thanks @Miiiho420

- Reward

- like

- Comment

- Repost

- Share

Buy the Dip or Wait Now?

Market pullbacks always test investor discipline. “Buying the dip” can be a smart strategy when the broader trend remains intact and fundamentals are strong—but rushing in without confirmation can expose you to unnecessary risk. In volatile conditions, patience often pays.

A professional approach is to balance opportunity with risk management: watch key support levels, monitor volume and momentum, and wait for confirmation before committing capital. Scaling into positions, setting clear stop-loss levels, and keeping some liquidity on the sidelines can help navigate unc

Market pullbacks always test investor discipline. “Buying the dip” can be a smart strategy when the broader trend remains intact and fundamentals are strong—but rushing in without confirmation can expose you to unnecessary risk. In volatile conditions, patience often pays.

A professional approach is to balance opportunity with risk management: watch key support levels, monitor volume and momentum, and wait for confirmation before committing capital. Scaling into positions, setting clear stop-loss levels, and keeping some liquidity on the sidelines can help navigate unc

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

new year Wealth ExplosionNEW: US House lawmakers have launched a probe into WLFI following reports that a UAE-linked entity acquired a $500M stake.

- Reward

- like

- Comment

- Repost

- Share

NGC-1405

Blackhole

Created By@Rhmaatt29

Listing Progress

0.00%

MC:

$2.54K

Create My Token

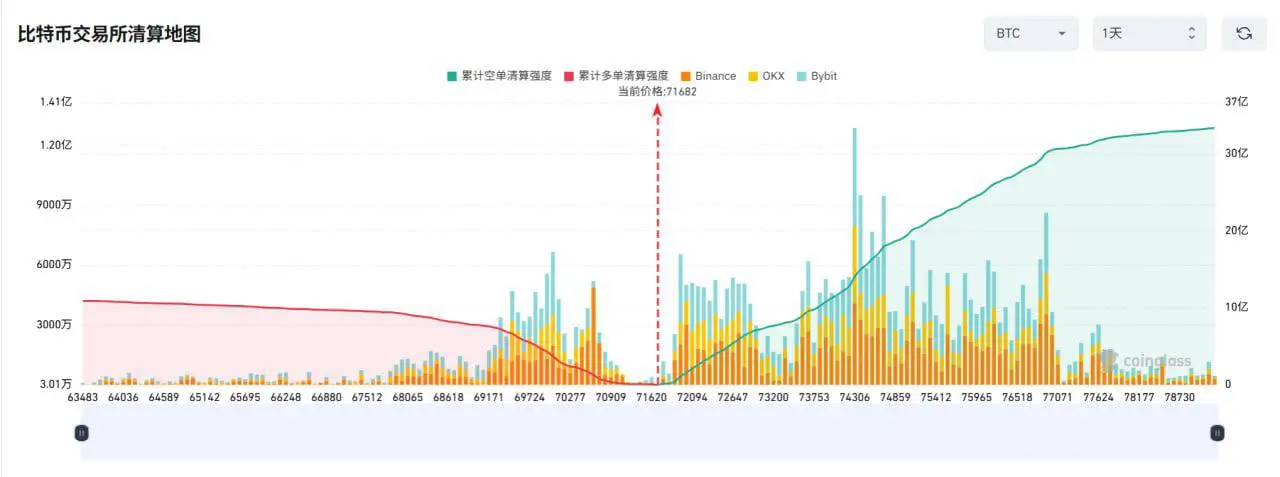

Today I took a serious look at the liquidation chart. From the chart, even if BTC drops to 63,000 USDT, it can only liquidate 30-40 million USDT worth of long leverage. In this bear market atmosphere, almost no one is going long;

But if BTC rises to around 76,000 USDT, it can liquidate over 2 billion USDT of chasing shorts.

Comment: Shorting is not wrong, but be aware of the risk of upward short squeezes. If there is an upward spike, the odds of shorting successfully in the 75,000-78,000 range are very high! Let's look forward to tonight's big move!

But if BTC rises to around 76,000 USDT, it can liquidate over 2 billion USDT of chasing shorts.

Comment: Shorting is not wrong, but be aware of the risk of upward short squeezes. If there is an upward spike, the odds of shorting successfully in the 75,000-78,000 range are very high! Let's look forward to tonight's big move!

BTC-8,82%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4020?ref=VGCSVFPYCQ&ref_type=132

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

stay strong and HODLView More

JUST IN: $100,000,000 liquidated from the crypto market in the past 60 minutes.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More76.48K Popularity

4.72K Popularity

1.66K Popularity

2.29K Popularity

6.02K Popularity

News

View MoreEuropean Stoxx 600 Index drops further, with a decline of 0.8%.

2 m

ETH drops below 2050 USDT

2 m

Nasdaq futures fell by 1%, and Alphabet's stock price dropped by 5% in pre-market trading.

9 m

In January, the number of layoffs in the United States surged, reaching the highest level for the month in 17 years

17 m

Bitcoin's "limited supply of 21 million" selling point faces market skepticism, as ETFs and futures create "synthetic supply" to impact the market

21 m

Pin