Post content & earn content mining yield

placeholder

ybaser

#CryptoMarketPullback

Is Solana's Price Recovery Difficult? What Do On-Chain Data Show?

Following recent losses, Solana is showing a strong recovery today. SOL jumped powerfully, marking the day with approximately $200 billion added to the overall cryptocurrency market.

Aggressive dip buying prevented deeper losses. As a result, Solana has gained relative stability and achieved a 12% daily increase despite market uncertainty.

At the end of the chain, a slowdown in the appetite for long-term buying occurred. The HODLer Net Position Change indicator fell, suggesting a weakening of the accumulat

Is Solana's Price Recovery Difficult? What Do On-Chain Data Show?

Following recent losses, Solana is showing a strong recovery today. SOL jumped powerfully, marking the day with approximately $200 billion added to the overall cryptocurrency market.

Aggressive dip buying prevented deeper losses. As a result, Solana has gained relative stability and achieved a 12% daily increase despite market uncertainty.

At the end of the chain, a slowdown in the appetite for long-term buying occurred. The HODLer Net Position Change indicator fell, suggesting a weakening of the accumulat

SOL-0,11%

- Reward

- 4

- 3

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- like

- Comment

- Repost

- Share

#TopCoinsRisingAgainsttheTrend

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

- Reward

- 7

- 7

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.92K

Create My Token

#晒出我的合约收益# #当前行情抄底还是观望?

Sharp rebound! Bitcoin surged 20% in one day. Can it go higher? What if you missed the bottom? Let’s take a look.

$BTC $ETH

1. First, let’s talk about resistance levels. Bitcoin’s resistance at 71,500 is very strong, but that doesn’t necessarily mean this rebound is over. The level I’m most focused on is 74,000. Once it reaches here, I will definitely be shorting, as it’s very likely to drop significantly. So, what about catching the bottom?

2. I’m not in a rush to catch the bottom. Not to mention, the final bottom this year will definitely fall to 50,000. Even if 60,

View OriginalSharp rebound! Bitcoin surged 20% in one day. Can it go higher? What if you missed the bottom? Let’s take a look.

$BTC $ETH

1. First, let’s talk about resistance levels. Bitcoin’s resistance at 71,500 is very strong, but that doesn’t necessarily mean this rebound is over. The level I’m most focused on is 74,000. Once it reaches here, I will definitely be shorting, as it’s very likely to drop significantly. So, what about catching the bottom?

2. I’m not in a rush to catch the bottom. Not to mention, the final bottom this year will definitely fall to 50,000. Even if 60,

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

Trader_Re0 :

:

Hop on board!🚗View More

- Reward

- like

- Comment

- Repost

- Share

Removed over 100 inactive mfersLet me know if your active I need to follow more of you mfers

- Reward

- 1

- Comment

- Repost

- Share

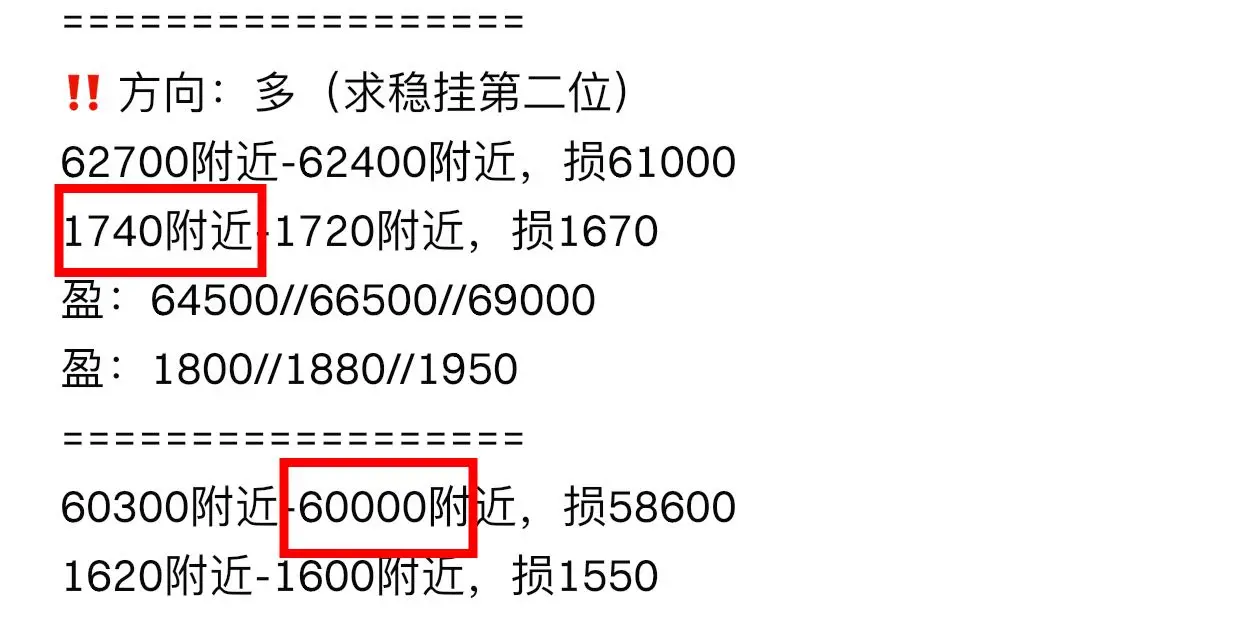

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

Why can I understand transgender people and homosexuals? Civil liberties and freedom are macro values, and the core is that I have crossed my own perceptions several times. I hadn't completed secondary development before puberty, so I was quite handsome. Who knew I would quickly grow into a standard woman later on. Handsomeness was very brief. My initial ideal was to be a 1.8-meter-tall transgender person, but I didn't grow to 1.8 meters. I felt that without being 1.8 meters tall as a man, I was also unqualified, so I gave up and decided to honestly be a beautiful woman.

View Original

- Reward

- like

- Comment

- Repost

- Share

【$FIL Signal】Long | Breakout and Retest Confirmation

After completing the breakout on the 4H timeframe, $FIL is currently undergoing a healthy retest and chip exchange below the previous high resistance zone. Price action indicates that buying pressure is continuously absorbing selling volume in the 0.969-0.975 range. The 4H candlestick shows low volatility convergence, which is a typical cooling pattern after a breakout.

Key data confirmation: Despite the price increase, open interest (OI) remains stable, and Taker Volume shows active buying dominance. This rules out a short squeeze and sugg

View OriginalAfter completing the breakout on the 4H timeframe, $FIL is currently undergoing a healthy retest and chip exchange below the previous high resistance zone. Price action indicates that buying pressure is continuously absorbing selling volume in the 0.969-0.975 range. The 4H candlestick shows low volatility convergence, which is a typical cooling pattern after a breakout.

Key data confirmation: Despite the price increase, open interest (OI) remains stable, and Taker Volume shows active buying dominance. This rules out a short squeeze and sugg

- Reward

- like

- Comment

- Repost

- Share

#比特币跌破六万五美元 Crypto research firm 10X Research indicates that Bitcoin may experience a brief counter-trend rebound or consolidation next, but could still hit new lows this summer. The firm's research director, Markus Thielen, estimates that Bitcoin could potentially drop to as low as $50,000, or even fall within the $40,000 to $50,000 range. This week's selling pressure in the crypto market was mainly driven by the sell-off of Bitcoin spot ETFs, a sharp decline in prices triggering a wave of forced liquidations, and the spillover effects from the sell-off of software stocks, further intensifyin

BTC-1,68%

- Reward

- 3

- 8

- Repost

- Share

INVESTERCLUB :

:

Relax my friend, it's shopping TimeView More

February 8 Bitcoin Market | Large-Scale Structure and Trading Awareness

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently still missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually layin

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently still missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually layin

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

35X on $LIQUID$40K to $1.55MIL MCAPPRINTING SEASON BABY got loads more coming!!!🍿

- Reward

- like

- Comment

- Repost

- Share

TMQF

踏马起飞

Created By@FocusOnJungle

Listing Progress

0.00%

MC:

$0.1

Create My Token

#GlobalTechSell-OffHitsRiskAssets Risk Assets — Why Crypto Feels It Most (Feb 2026) 🔥

The global technology sector has been at the center of market turbulence in early February 2026, sparking a widespread risk-off rotation across asset classes. Cryptocurrencies, in particular, have behaved like a leveraged extension of tech equities, amplifying volatility and fear. This is not random chaos—it’s a textbook example of how high-beta, sentiment-driven markets react when stretched valuations, leverage, and macro concerns converge.

📉 Tech Sector Carnage — Current Reality

The Nasdaq Composite has b

The global technology sector has been at the center of market turbulence in early February 2026, sparking a widespread risk-off rotation across asset classes. Cryptocurrencies, in particular, have behaved like a leveraged extension of tech equities, amplifying volatility and fear. This is not random chaos—it’s a textbook example of how high-beta, sentiment-driven markets react when stretched valuations, leverage, and macro concerns converge.

📉 Tech Sector Carnage — Current Reality

The Nasdaq Composite has b

BTC-1,68%

- Reward

- 2

- 5

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

The prototype of the Bitcoin channel has been established, spanning from 60,000 to 71,600.

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

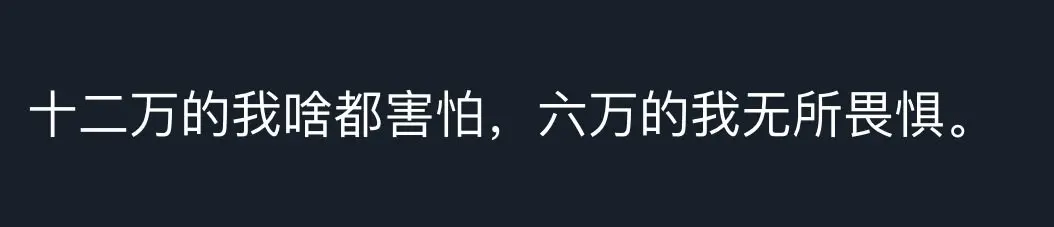

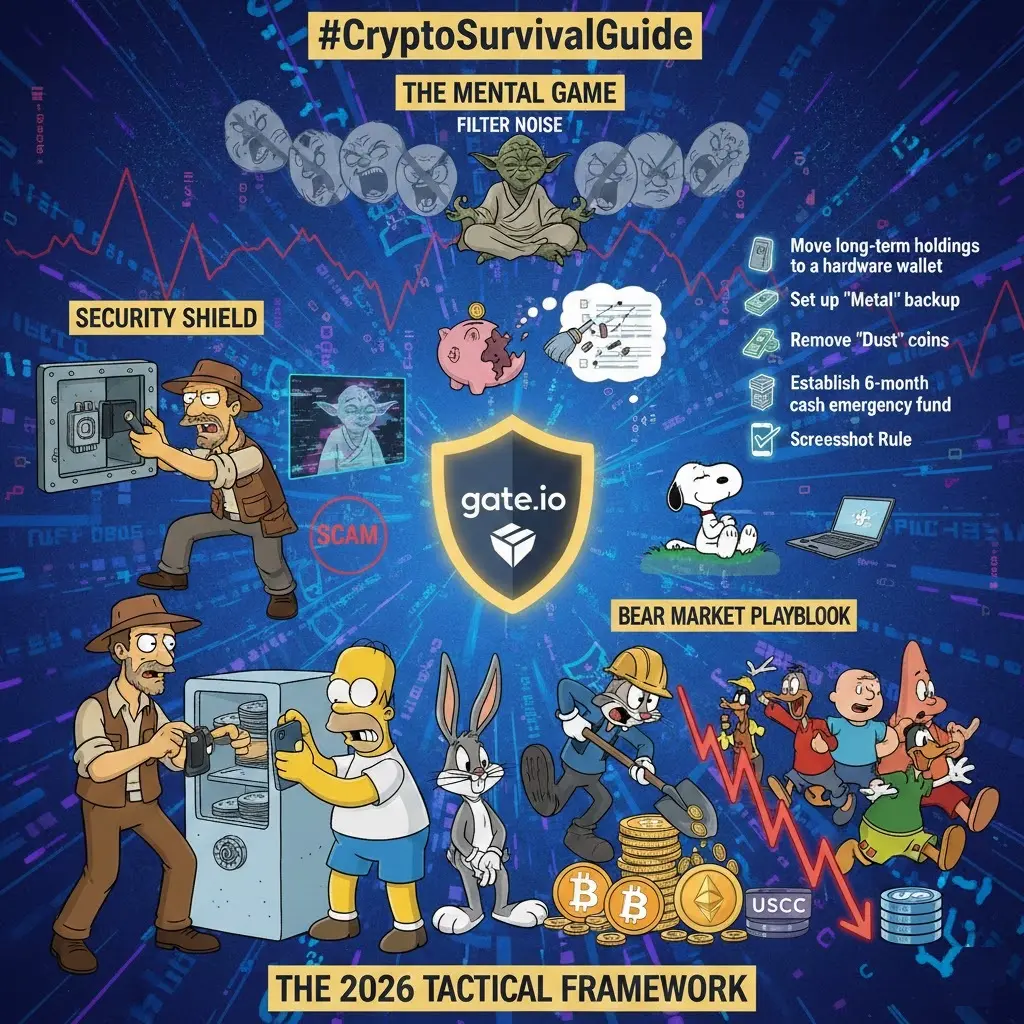

#CryptoSurvivalGuide

Welcome to the Crypto Survival Guide.

Whether you're navigating a "crypto winter" or just trying to keep your digital head above water in a volatile 2026 market, the goal is simple: Stay in the game. In crypto, survival is the prerequisite for success. Here is your tactical framework for protecting your capital and your sanity.

The Security Shield (Don't Get Rekt)

Security isn't a one-time setup; it’s a lifestyle. If you lose your keys, the "moon" doesn't matter.

The 90/10 Rule: Keep 90% of your assets in a Cold Wallet and only 10% on exchanges for active trading.

Seed

Welcome to the Crypto Survival Guide.

Whether you're navigating a "crypto winter" or just trying to keep your digital head above water in a volatile 2026 market, the goal is simple: Stay in the game. In crypto, survival is the prerequisite for success. Here is your tactical framework for protecting your capital and your sanity.

The Security Shield (Don't Get Rekt)

Security isn't a one-time setup; it’s a lifestyle. If you lose your keys, the "moon" doesn't matter.

The 90/10 Rule: Keep 90% of your assets in a Cold Wallet and only 10% on exchanges for active trading.

Seed

- Reward

- 5

- 6

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

See both Chart $Bigtrout $whitewhale See first run up then dropped then rebound Buy the dip here and thanks me later

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow?

The question of whether to buy the dip or wait is one of the most common dilemmas facing investors in volatile markets. Cryptocurrency, equities, and even commodities experience regular fluctuations, and market participants are constantly evaluating whether a recent pullback represents a genuine buying opportunity or a signal to exercise caution.

Understanding the broader context is essential. Price corrections are a natural part of any market cycle. They allow for the redistribution of capital, enable profit-taking, and can reflect temporary shifts in

The question of whether to buy the dip or wait is one of the most common dilemmas facing investors in volatile markets. Cryptocurrency, equities, and even commodities experience regular fluctuations, and market participants are constantly evaluating whether a recent pullback represents a genuine buying opportunity or a signal to exercise caution.

Understanding the broader context is essential. Price corrections are a natural part of any market cycle. They allow for the redistribution of capital, enable profit-taking, and can reflect temporary shifts in

- Reward

- 3

- 4

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More142.06K Popularity

34.42K Popularity

393.16K Popularity

14.62K Popularity

13.54K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreOverview of popular cryptocurrencies on February 8, 2026, with the top three in popularity being: SIREN, BREV, PTB

1 m

Arthur Hayes: There is no secret conspiracy behind the crypto market crash. The collapse was driven by a combination of factors including regulatory crackdowns, market overleveraging, and macroeconomic pressures. Many believe that the downturn was a natural correction after a period of excessive speculation, rather than the result of any hidden plot. Investors should remain cautious and focus on fundamentals rather than conspiracy theories.

1 m

Arthur Hayes: There is no secret conspiracy causing crashes in the cryptocurrency market

7 m

Trend Research Sells Additional 20,770 ETH Worth $43.57M, Retains Only 10,303 ETH

24 m

Market Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

1 h

Pin