Post content & earn content mining yield

placeholder

GateUser-39ee119f

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJCVLANBW

View Original

- Reward

- like

- Comment

- Repost

- Share

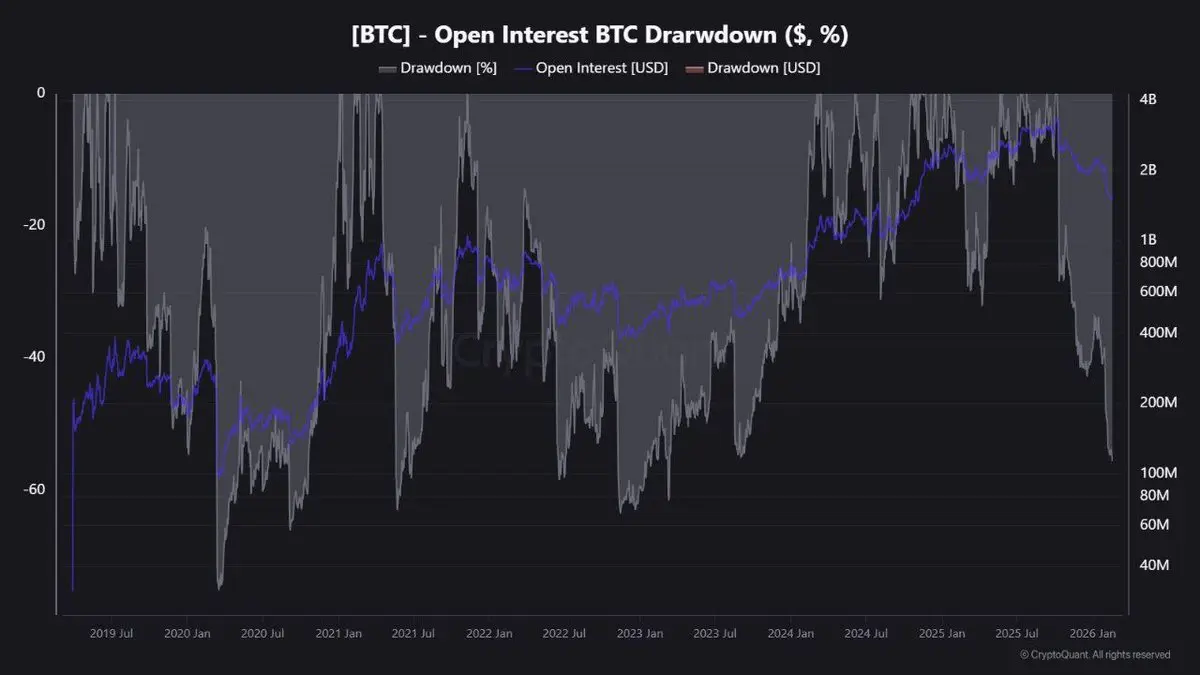

Bitcoin open interest has fallen 55% from its all-time high, marking the steepest drawdown since April 2023.

BTC0,28%

- Reward

- like

- Comment

- Repost

- Share

Anyone who says I don’t provide any value here is 100% correct, I’m not here to provide value for you

I’m here to create value for myself and my family

Just being real

I’m here to create value for myself and my family

Just being real

- Reward

- like

- Comment

- Repost

- Share

Bling Snacks

blingblingsnacks

Created By@PiHomework

Listing Progress

0.00%

MC:

$2.47K

More Tokens

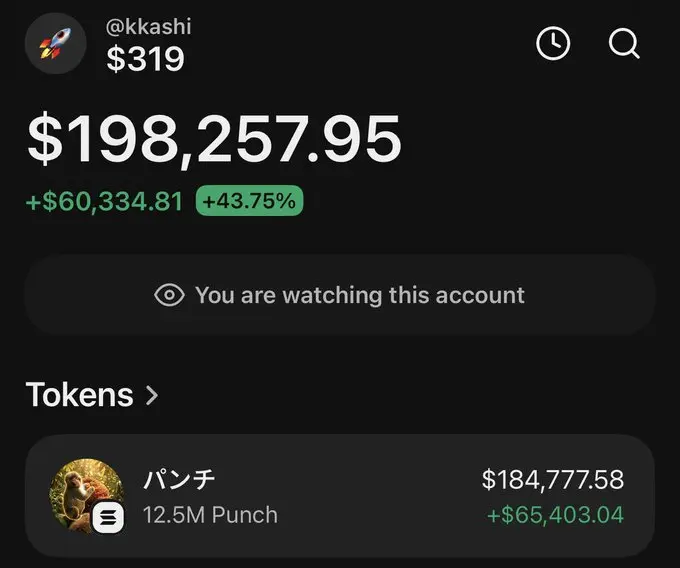

This was only $317 on $PUNCH

This could be you today,

Lock in.

7:00 PM UTC

This could be you today,

Lock in.

7:00 PM UTC

- Reward

- 1

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare:

#CelebratingNewYearOnGateSquare 🌌🚀

Midnight hits differently in the world of crypto.

There’s no silence.

No pause.

No slowing down.

Instead, there’s energy.

As 2026 begins, GateSquare transforms into a living, breathing digital celebration a place where ambition meets opportunity and innovation meets community. The skyline glows with futuristic fireworks. Holographic screens flash market insights. Conversations spark across continents in real time.

This isn’t just a New Year’s event.

It’s a momentum shift.

GateSquare becomes the epicenter of possibility. Tra

#CelebratingNewYearOnGateSquare 🌌🚀

Midnight hits differently in the world of crypto.

There’s no silence.

No pause.

No slowing down.

Instead, there’s energy.

As 2026 begins, GateSquare transforms into a living, breathing digital celebration a place where ambition meets opportunity and innovation meets community. The skyline glows with futuristic fireworks. Holographic screens flash market insights. Conversations spark across continents in real time.

This isn’t just a New Year’s event.

It’s a momentum shift.

GateSquare becomes the epicenter of possibility. Tra

OP0,8%

- Reward

- 2

- 8

- Repost

- Share

MissCrypto :

:

DYOR 🤓View More

Futures Positioning:Leverage remains controlled, limiting liquidation risk

- Reward

- like

- Comment

- Repost

- Share

BlockBeats News, February 18 — According to crypto research firm 10x Research, despite Bitcoin prices dropping 46% from their peak, Bitcoin ETFs only experienced $8.5 billion in net outflows, which is a relatively moderate decrease relative to the total assets under management of the ETFs. The structural characteristics of ETF ownership show that market makers and hedge funds focused on arbitrage are dominant, holding mostly hedged or market-neutral positions rather than directional bets on Bitcoin. Additionally, long-term institutional investors, who have a higher proportion of holdings, tend

BTC0,28%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

🚨 INDIA’S AI POWERHOUSE: 20,000+ NVIDIA GPUs! 🇮🇳

Yotta Data Services has announced the creation of Asia's largest AI cluster in Greater Noida!

20,736 NVIDIA Blackwell Ultra GPUs will be deployed—which are the world's most advanced AI chips.

This cluster will be liquid-cooled, ensuring top-notch performance even during heavy AI training.

It will be Asia's largest AI GPU hub, putting India in the front seat of the global AI race.

Yotta Data Services has announced the creation of Asia's largest AI cluster in Greater Noida!

20,736 NVIDIA Blackwell Ultra GPUs will be deployed—which are the world's most advanced AI chips.

This cluster will be liquid-cooled, ensuring top-notch performance even during heavy AI training.

It will be Asia's largest AI GPU hub, putting India in the front seat of the global AI race.

- Reward

- like

- Comment

- Repost

- Share

Trump Family Enters Mining: Eric Trump Says American Bitcoin Holds Over 6,000 BTC

- Reward

- like

- Comment

- Repost

- Share

Bling Snacks

blingblingsnacks

Created By@PiHomework

Listing Progress

0.00%

MC:

$0.1

More Tokens

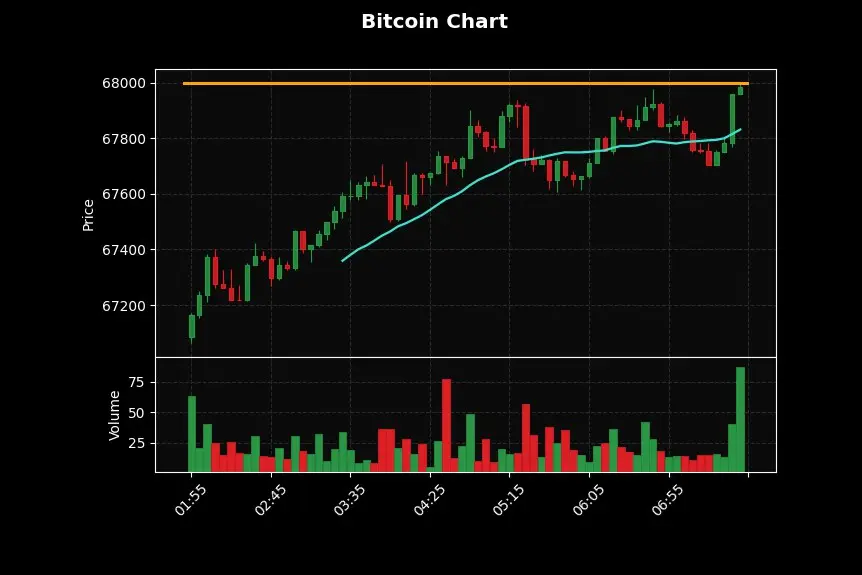

If this isn’t a breakout,

it’s the cleanest bull trap in months.

But if 190 holds?

Late bears are about to fund the next leg to 220.

it’s the cleanest bull trap in months.

But if 190 holds?

Late bears are about to fund the next leg to 220.

- Reward

- like

- Comment

- Repost

- Share

#我在Gate广场过新年

The Hong Kong Securities and Futures Commission (SFC) has issued virtual asset trading platform licenses to 12 licensed platforms—what is the impact on the market?

The SFC's issuance of licenses to VDX marks a significant step forward in Hong Kong's efforts to build a global digital asset hub. This licensing not only recognizes VDX's compliance capabilities but also sends a clear regulatory signal to promote industry "normalization and expansion," positively influencing cryptocurrency market sentiment and long-term development.

1. Policy Shift Clarified, Boosting Market Confidenc

View OriginalThe Hong Kong Securities and Futures Commission (SFC) has issued virtual asset trading platform licenses to 12 licensed platforms—what is the impact on the market?

The SFC's issuance of licenses to VDX marks a significant step forward in Hong Kong's efforts to build a global digital asset hub. This licensing not only recognizes VDX's compliance capabilities but also sends a clear regulatory signal to promote industry "normalization and expansion," positively influencing cryptocurrency market sentiment and long-term development.

1. Policy Shift Clarified, Boosting Market Confidenc

- Reward

- 5

- 4

- Repost

- Share

FatYa888 :

:

Happy New Year 🧨View More

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQDEXAXYUW

- Reward

- like

- Comment

- Repost

- Share

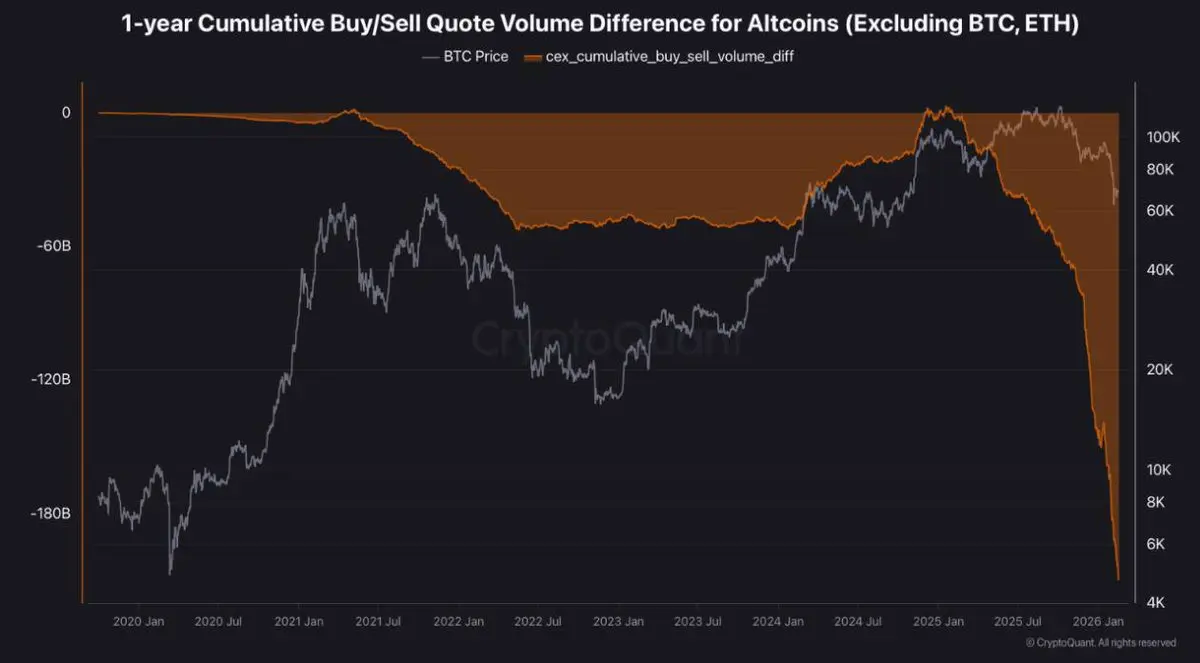

📊📉 #Altcoin Sell Pressure Just Hit a 5-Year Extreme

“Retail is out. #Smart money rotated. No institutional alt accumulation in sight. This is not a dip. It's 13 months of continuous net selling on CEX spot.” #crypto

“Retail is out. #Smart money rotated. No institutional alt accumulation in sight. This is not a dip. It's 13 months of continuous net selling on CEX spot.” #crypto

- Reward

- 1

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/bot-13?ch=dW9BLCxQ&ref_type=132

- Reward

- 2

- 11

- Repost

- Share

dragon_fly2 :

:

To The Moon 🌕View More

GM fam! ☀️

Quick swim before today’s trading charts 📈

Quick swim before today’s trading charts 📈

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More195.97K Popularity

7.07K Popularity

41.37K Popularity

82.23K Popularity

847.29K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.49KHolders:00.00%

- MC:$2.48KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:00.00%

News

View MoreEuropean Central Bank official: Digital euro network will be ready for use by private payment systems before 2029

13 m

European Central Bank official: Digital euro will allow bank cards from payment systems like "Bancomat" to be used outside Italy

16 m

Ju.com completes the third phase of the SOL 20% discount Launchpad event, and the fourth phase XRP is scheduled to launch on February 19.

18 m

Nightfall, the zero-knowledge privacy protocol developed by Ernst & Young, has been deployed on Starknet

21 m

Famous tech stocks strengthen in pre-market US stocks, Nvidia and Micron Technology rise over 1%

38 m

Pin