Post content & earn content mining yield

placeholder

AnnaCryptoWriter

📉 📊 ⏳ 💰 📈 🔍 🧠 ⚖️ 🏦 💹 🛡️

"Timing is determined not by luck, but by discipline: the market rewards those who prepare, not those who rush."

The question of the optimal entry point into the cryptocurrency market remains central to the entire crypto community regardless of participants' experience. As of 22:25 on February 18, 2026, the price of Bitcoin is $66,316.1, reflecting a significant correction after the October 2025 all-time high. The current phase is characterized by increased volatility, reduced risk appetite, and cautious investor behavior. At the same time, such periods often l

View Original"Timing is determined not by luck, but by discipline: the market rewards those who prepare, not those who rush."

The question of the optimal entry point into the cryptocurrency market remains central to the entire crypto community regardless of participants' experience. As of 22:25 on February 18, 2026, the price of Bitcoin is $66,316.1, reflecting a significant correction after the October 2025 all-time high. The current phase is characterized by increased volatility, reduced risk appetite, and cautious investor behavior. At the same time, such periods often l

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

good information about cryptoO Allah! let my feet stand before the Ka‘abah.

Let my eyes behold the Black Stone. Let my tongue overflow with Your remembrance in Masjid al-Haram.

And let my heart bow in complete humility in the Rawdah in Madinah the city of Your Beloved, Muhammad (S.A.W)🥹❤️

Ya Rabb Let me be there in sujood, whispering Your beautiful Names, crying in the most sacred places, calling upon You with a heart that has nothing but hope in You.

Ya ‘Azza wa Jallah Make it easy for me🥺 Ameen.

GN FRIENDS 🧡

Let my eyes behold the Black Stone. Let my tongue overflow with Your remembrance in Masjid al-Haram.

And let my heart bow in complete humility in the Rawdah in Madinah the city of Your Beloved, Muhammad (S.A.W)🥹❤️

Ya Rabb Let me be there in sujood, whispering Your beautiful Names, crying in the most sacred places, calling upon You with a heart that has nothing but hope in You.

Ya ‘Azza wa Jallah Make it easy for me🥺 Ameen.

GN FRIENDS 🧡

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 5

- Comment

- Repost

- Share

Linh

Linh

Created By@GateUser-2bb6da51

Listing Progress

0.00%

MC:

$2.44K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVMULLAUG

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLNHU15FBQ

- Reward

- 2

- Comment

- Repost

- Share

As tokenized real-world assets continue to expand, on-chain yield markets are entering a more competitive phase.

Assets like $LINK are gaining attention not only for oracle infrastructure but for securing the data feeds that underpin RWA pricing, verification, and transparency. Reliable off-chain data has become essential as traditional financial instruments move onto blockchain rails.

The rise of tokenized treasuries and credit products introduces alternative yield benchmarks that compete directly with DeFi-native lending. Protocols must now improve collateral efficiency, strengthen risk fr

Assets like $LINK are gaining attention not only for oracle infrastructure but for securing the data feeds that underpin RWA pricing, verification, and transparency. Reliable off-chain data has become essential as traditional financial instruments move onto blockchain rails.

The rise of tokenized treasuries and credit products introduces alternative yield benchmarks that compete directly with DeFi-native lending. Protocols must now improve collateral efficiency, strengthen risk fr

- Reward

- 3

- Comment

- Repost

- Share

VIP 1-3 Pass

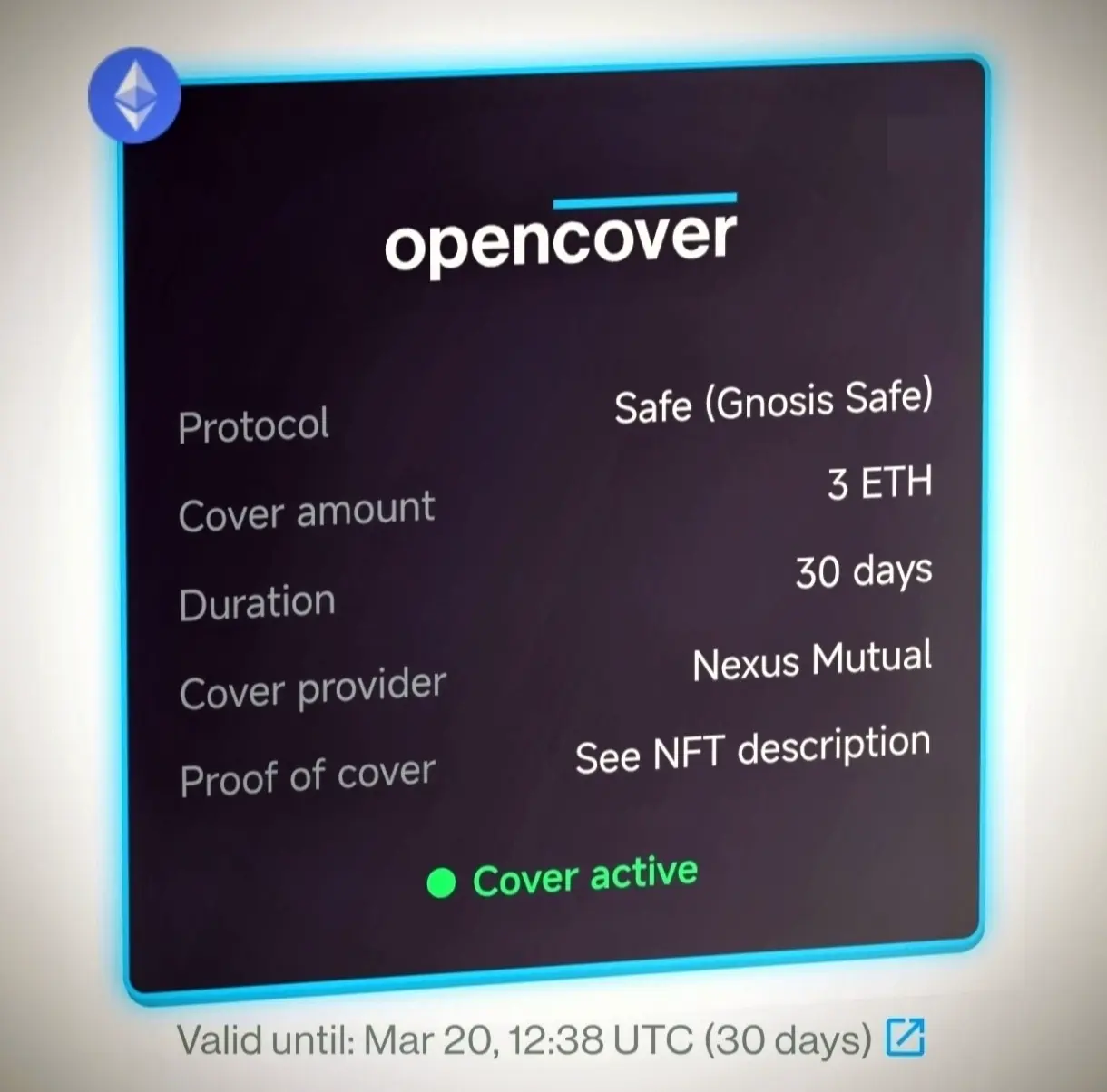

Join The007ArchiTECHture and win x1🎁 3ETH Cover NFT🎉

Rules: Follow and comment #The007Architecture + with your VIP level.

Welcome everyone

VIPs 1-3 Boarding Pass

Join The007ArchiTECHture and win x1🎁 3ETH Cover NFT🎉

Rules: Follow & Comment #The007Architecture + Your VIP Level.

Top 3 Community Vote

View OriginalJoin The007ArchiTECHture and win x1🎁 3ETH Cover NFT🎉

Rules: Follow and comment #The007Architecture + with your VIP level.

Welcome everyone

VIPs 1-3 Boarding Pass

Join The007ArchiTECHture and win x1🎁 3ETH Cover NFT🎉

Rules: Follow & Comment #The007Architecture + Your VIP Level.

Top 3 Community Vote

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Digital Trading Engineering: Elite Strategies in Crypto Markets

In a 24/7 market driven by algorithms and (Market Makers), traditional technical analysis alone is no longer sufficient. Professionalism in cryptocurrencies requires a deep understanding of liquidity flows, whale psychology, and balancing yields with the sovereign risks of platforms.

1. Liquidity Flow Analysis (Order Flow & Order Book)

Professionals don’t just look at "candles," but monitor market depth (Market Depth):

Liquidity zones: identifying stop-loss clusters (Stop Losses) targeted by whales to generate price momentum.

On-C

View OriginalIn a 24/7 market driven by algorithms and (Market Makers), traditional technical analysis alone is no longer sufficient. Professionalism in cryptocurrencies requires a deep understanding of liquidity flows, whale psychology, and balancing yields with the sovereign risks of platforms.

1. Liquidity Flow Analysis (Order Flow & Order Book)

Professionals don’t just look at "candles," but monitor market depth (Market Depth):

Liquidity zones: identifying stop-loss clusters (Stop Losses) targeted by whales to generate price momentum.

On-C

- Reward

- 4

- Comment

- Repost

- Share

yin

yinhe

Created By@RabbitMouseLightYears

Subscription Progress

0.00%

MC:

$0

More Tokens

The target profit-taking zone has been reached. For short-term trades, Bitcoin has gained around 2000 points, and Ethereum over 80 points. On the operational side, take profits where needed. If you want to continue holding, you can take partial profits in batches and set a moving stop-loss to protect the principal. $BTC $ETH #当前行情抄底还是观望?

View Original

- Reward

- 4

- Comment

- Repost

- Share

Built for Generations — Beyond Market Cycles

ATEG.DV is engineered to deliver enduring social and economic value, designed not for short-term speculation, but for long-term impact:

⟶ Protection against long-term inflation

⟶ Stabilization of housing markets

⟶ Enablement of sustainable, affordable living

⟶ Creation of generational wealth with real-world impact

By harnessing blockchain for transparency, security, and operational efficiency, ATEG Capital delivers solutions traditional systems cannot, scalable, sustainable housing infrastructure built to serve people, communities, and future genera

ATEG.DV is engineered to deliver enduring social and economic value, designed not for short-term speculation, but for long-term impact:

⟶ Protection against long-term inflation

⟶ Stabilization of housing markets

⟶ Enablement of sustainable, affordable living

⟶ Creation of generational wealth with real-world impact

By harnessing blockchain for transparency, security, and operational efficiency, ATEG Capital delivers solutions traditional systems cannot, scalable, sustainable housing infrastructure built to serve people, communities, and future genera

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Get ready for the next wave.

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQBHBFTDVG

View Original

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRAA15XBA

View Original

- Reward

- like

- Comment

- Repost

- Share

TradFi Embraces Stablecoins: Payoneer Launches Stablecoin Payments

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More206.5K Popularity

12.56K Popularity

45.26K Popularity

85.93K Popularity

849.88K Popularity

Hot Gate Fun

View More- MC:$2.47KHolders:20.00%

- MC:$2.44KHolders:20.00%

- MC:$2.43KHolders:10.00%

- MC:$2.44KHolders:10.00%

- MC:$2.43KHolders:10.00%

News

View MoreThe Dow Jones Industrial Average closed up 129.47 points, while the S&P 500 and Nasdaq both rose.

26 m

BTC drops below 66,000 USDT

1 h

Federal Reserve Meeting Minutes Reveal "Exchange Rate Checks," Leading to Significant US Dollar Depreciation

1 h

The Federal Reserve meeting minutes show a strong economic outlook, with inflation slightly above expectations

2 h

The Federal Reserve meeting minutes show that participants support a two-way statement on the interest rate decision

2 h

Pin