BandKingKGod

🔥 Guan Hòa Bình, các anh em thân thiết, gửi đến các bạn‼️ Không biết từ khi nào, đã tròn 4 năm đăng ký, ưu đãi giảm giá 5gt dịp Tết nay kết thúc, trở lại giá gốc 10gt‼️ Những người đăng ký đều không ngu, không kiếm được thì đừng có mua😄 Apple có thể nhấn vào👇 hoặc sao chép vào trình duyệt để đăng ký:

https://www.gate.com/zh/profile/波段王k神

🔥 Thứ Tư tuần trước 62.800/1.800 hơn 70.000/2.150 áp lực lại ăn thịt

🔥 Thứ Sáu 70.000/2.150 bán khống 62.950/1.835 ăn thịt

🔥 Thứ Bảy phản tay 63.000/1.840 hơn 68.200/2.050 ăn thịt

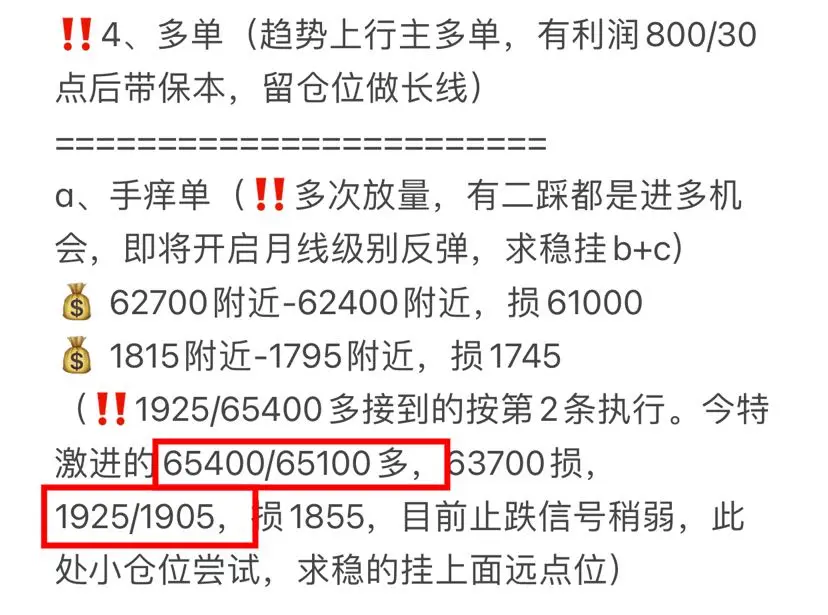

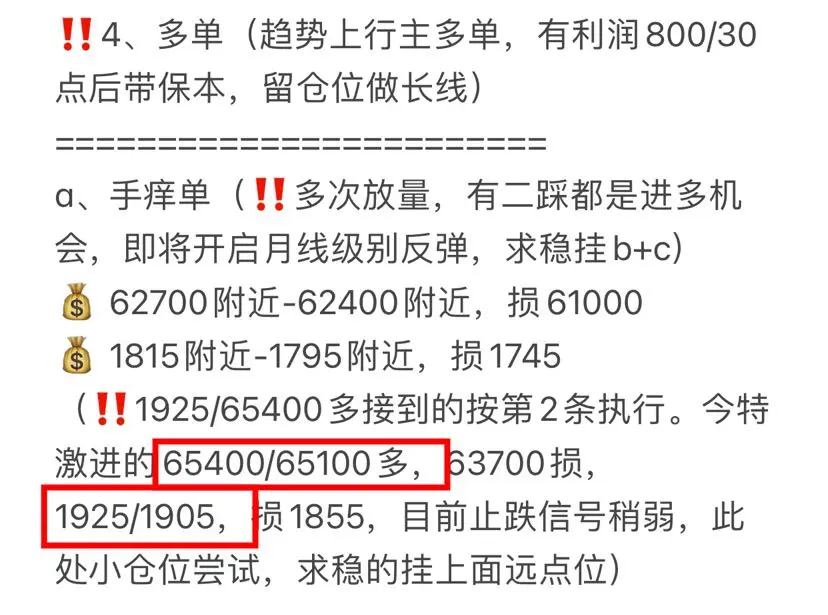

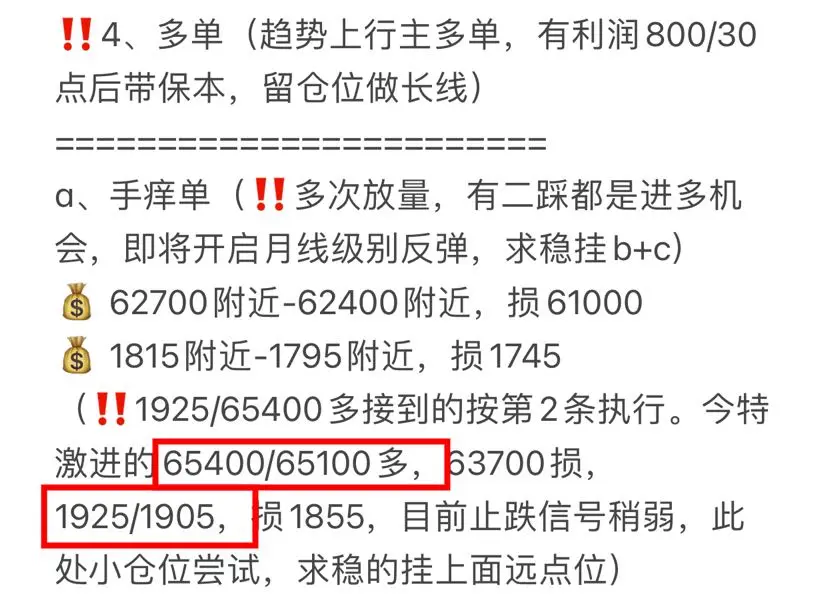

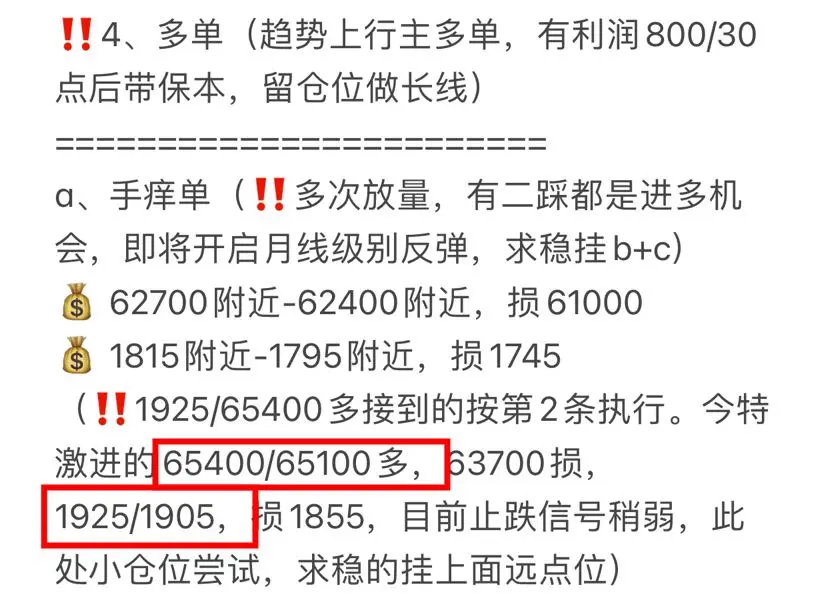

🔥 Sáng hôm qua 19.25/65.300 hơn 20.090/71.800 lại ăn thịt

🔥 Đi quanh khắ

Xem bản gốchttps://www.gate.com/zh/profile/波段王k神

🔥 Thứ Tư tuần trước 62.800/1.800 hơn 70.000/2.150 áp lực lại ăn thịt

🔥 Thứ Sáu 70.000/2.150 bán khống 62.950/1.835 ăn thịt

🔥 Thứ Bảy phản tay 63.000/1.840 hơn 68.200/2.050 ăn thịt

🔥 Sáng hôm qua 19.25/65.300 hơn 20.090/71.800 lại ăn thịt

🔥 Đi quanh khắ

- Phần thưởng

- 10

- 10

- Đăng lại

- Retweed

LoveDudu,LoveHealth :

:

May mắn như ý 🧧Xem thêm

🔥 Guanping Lún Lao Tiên gửi đến các bạn‼️ Không biết từ khi nào đã tròn 4 năm đăng ký, ưu đãi giảm giá 5gt dịp Tết Nguyên Đán sẽ kết thúc tối nay, trở lại giá gốc 10gt‼️ Bạn bè đăng ký chắc chắn không ngu, ai không kiếm thì đừng có đòi 😄 Apple có thể nhấn vào👇 hoặc sao chép vào trình duyệt để đăng ký:

https://www.gate.com/zh/profile/清泉石下流

————————————————

🔥 Thứ Tư tuần trước 62,800/1,800 hơn 70,000/2,150 áp lực lại ăn thịt

🔥 Thứ Sáu 70,000/2,150 bỏ trống 62,950/1,835 ăn thịt

————————————————

🔥 Thứ Bảy phản tay 63,000/1,840 hơn 68,200/2,050 ăn thịt

🔥 Sáng hôm qua 19,25/65,300 hơn 20,90/7

Xem bản gốchttps://www.gate.com/zh/profile/清泉石下流

————————————————

🔥 Thứ Tư tuần trước 62,800/1,800 hơn 70,000/2,150 áp lực lại ăn thịt

🔥 Thứ Sáu 70,000/2,150 bỏ trống 62,950/1,835 ăn thịt

————————————————

🔥 Thứ Bảy phản tay 63,000/1,840 hơn 68,200/2,050 ăn thịt

🔥 Sáng hôm qua 19,25/65,300 hơn 20,90/7

- Phần thưởng

- 10

- 10

- Đăng lại

- Retweed

LoveDudu,LoveHealth :

:

2026 vội vàng 👊Xem thêm

🌹Guan Hòa và các anh chị em trong nhóm gửi đến các bạn‼️ Không biết từ bao giờ, đã tròn 4 năm kể từ khi đăng ký, ưu đãi giảm giá còn 5gt trong dịp Tết Nguyên Đán sẽ kết thúc vào tối nay và trở lại giá gốc 10gt‼️ Những người đăng ký đều không ngu, ai không kiếm được thì chắc chắn là do bạn😄 Các bạn có thể nhấn vào link của Apple👇 hoặc sao chép vào trình duyệt để đăng ký:

https://www.gate.com/zh/profile/何时了秋雨

🌹Thứ Tư tuần trước 62,800/1,800 hơn 70,000/2,150 áp lực lại ăn thịt

🌹Thứ Sáu 70,000/2,150 bỏ trống 62,950/1,835 ăn thịt

🌹Thứ Bảy phản tay 63,000/1,840 hơn 68,200/2,050 ăn thịt

🌹Sáng

Xem bản gốchttps://www.gate.com/zh/profile/何时了秋雨

🌹Thứ Tư tuần trước 62,800/1,800 hơn 70,000/2,150 áp lực lại ăn thịt

🌹Thứ Sáu 70,000/2,150 bỏ trống 62,950/1,835 ăn thịt

🌹Thứ Bảy phản tay 63,000/1,840 hơn 68,200/2,050 ăn thịt

🌹Sáng

- Phần thưởng

- 11

- 10

- Đăng lại

- Retweed

LoveDudu,LoveHealth :

:

Năm Ngựa phát tài 🐴Xem thêm

🌹guan hòa bình 轮家人们给U‼️Không biết từ bao giờ đã tròn 4 năm đăng ký, ưu đãi giảm giá 5gt dịp Tết Nguyên Đán sẽ kết thúc tối nay và trở lại giá gốc 10gt‼️Bạn nào đã đăng ký thì không ai ngu cả, không kiếm được thì cứ để đó 😄Apple có thể nhấn vào 👇 hoặc sao chép vào trình duyệt để đăng ký:

https://www.gate.com/zh/profile/秋雨何时了

————————————————

🌹Thứ Tư tuần trước 62800/1800 hơn 70000/2150 áp lực lại ăn thịt

🌹Thứ Sáu 70000/2150 trống 62950/1835 ăn thịt

————————————————

🌹Thứ Bảy phản tay 63000/1840 hơn 68200/2050 ăn thịt

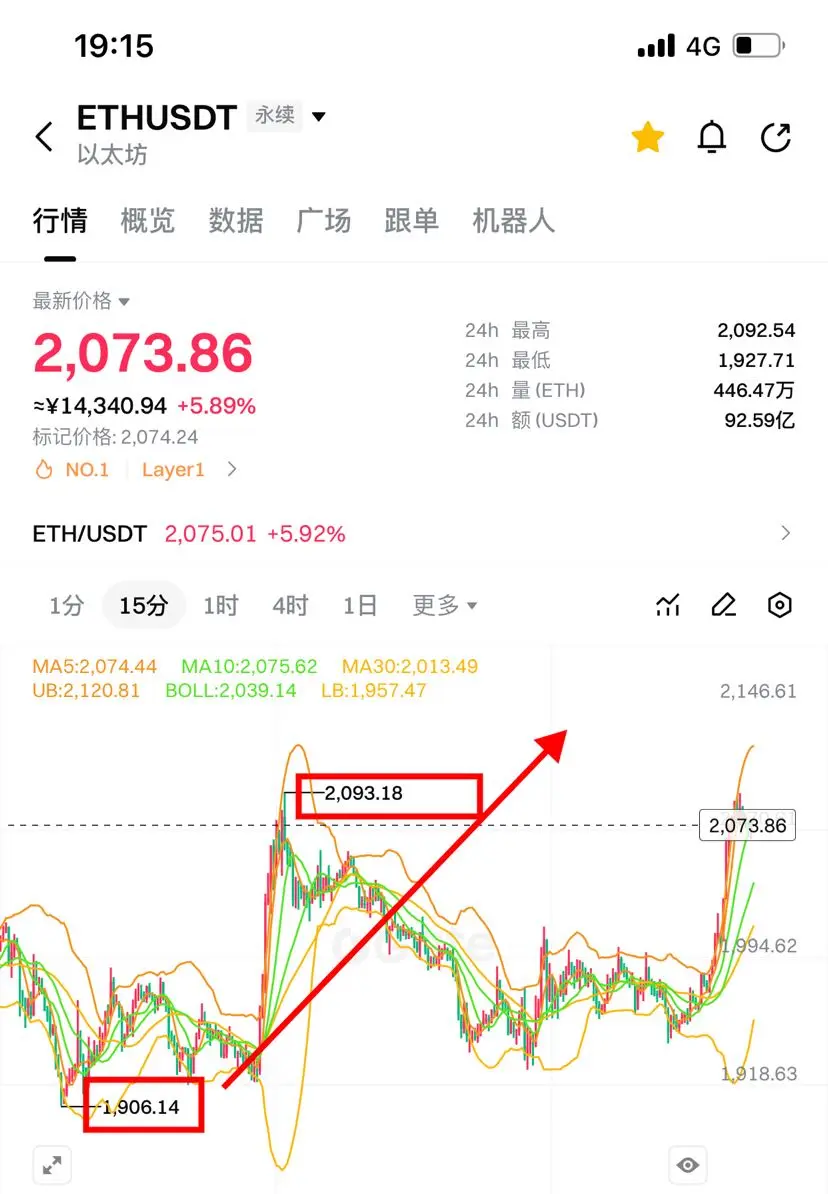

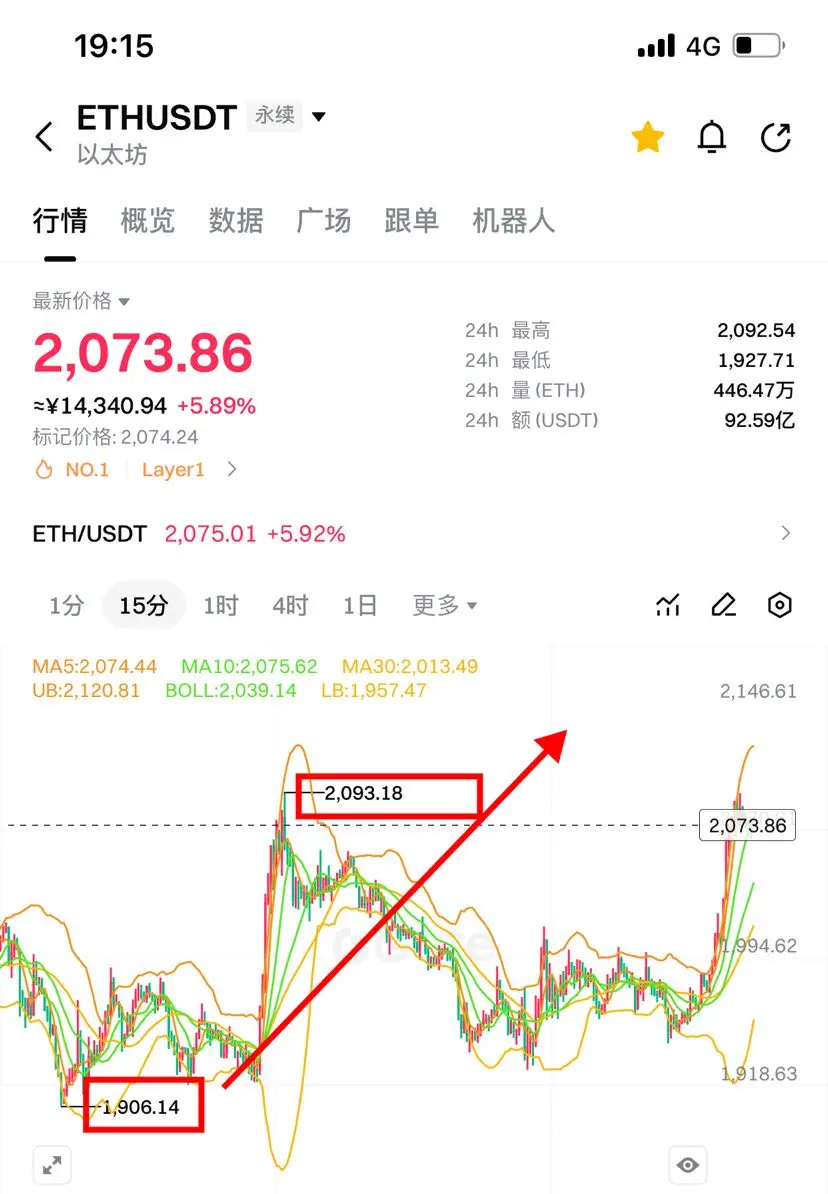

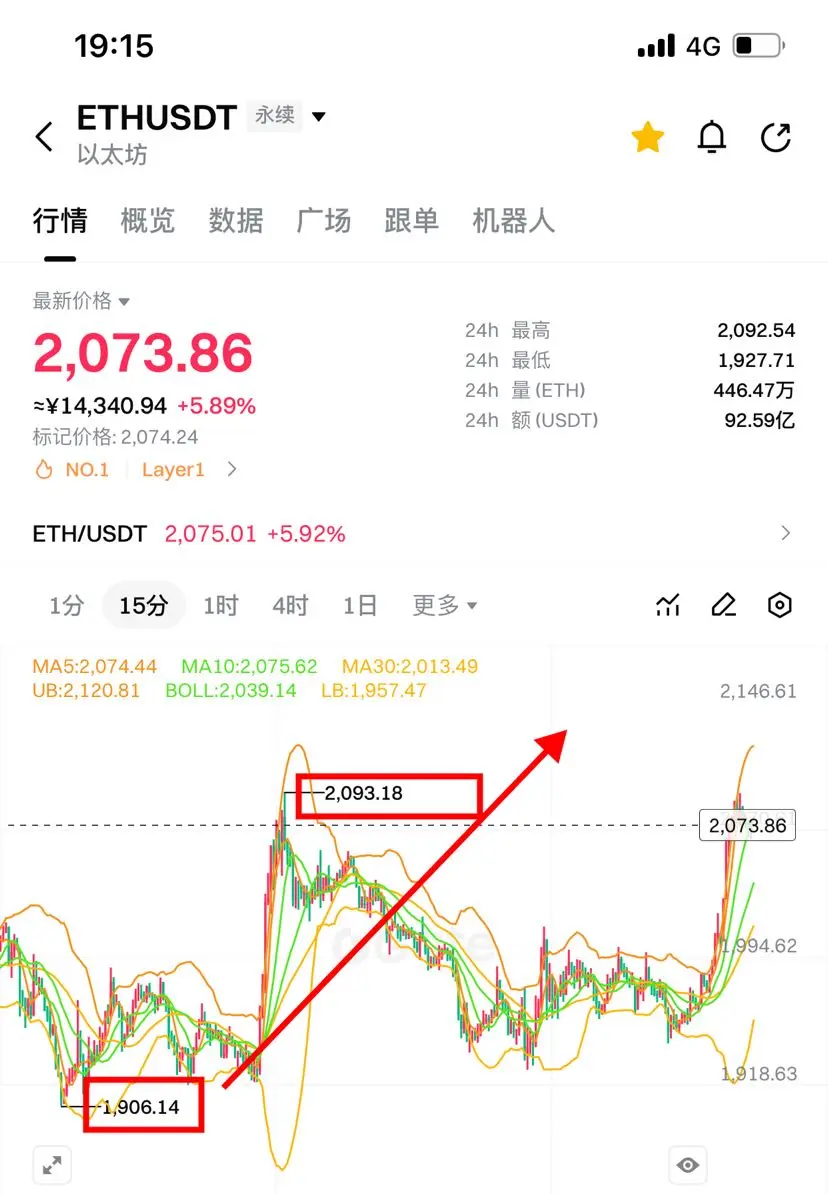

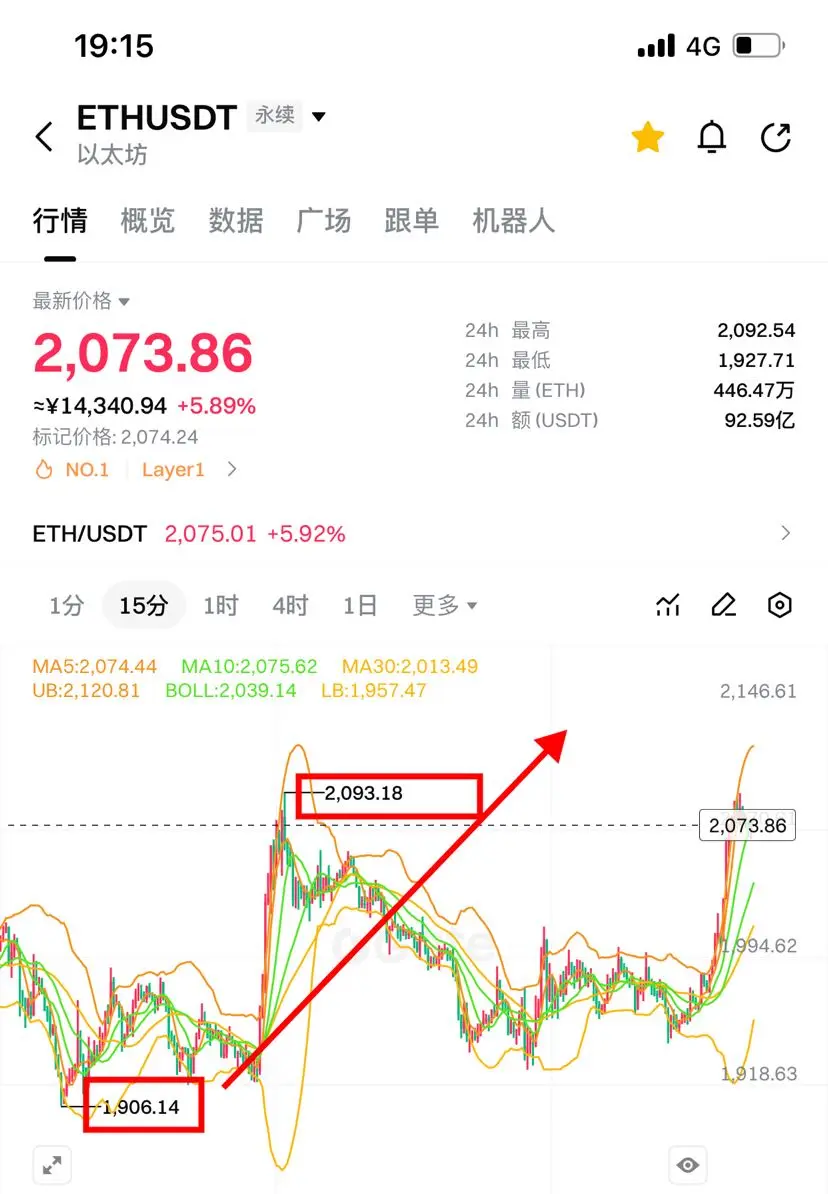

🌹Sáng hôm qua 1925/65300 hơn 2090/71800 lại ăn thịt

————————————————

🌹N

Xem bản gốchttps://www.gate.com/zh/profile/秋雨何时了

————————————————

🌹Thứ Tư tuần trước 62800/1800 hơn 70000/2150 áp lực lại ăn thịt

🌹Thứ Sáu 70000/2150 trống 62950/1835 ăn thịt

————————————————

🌹Thứ Bảy phản tay 63000/1840 hơn 68200/2050 ăn thịt

🌹Sáng hôm qua 1925/65300 hơn 2090/71800 lại ăn thịt

————————————————

🌹N

- Phần thưởng

- 11

- 9

- Đăng lại

- Retweed

KeepUpWithTheRhythmOfTheTimes :

:

2026 vội vàng 👊Xem thêm

#加密市场上涨 #BTC #ETH

2026.03.03 Phân tích chính về xu hướng tăng của BTC/ETH

Hôm nay, thị trường tiền điện tử BTC, ETH đã có sự phục hồi tăng giá, nguyên nhân chính đến từ dòng vốn tổ chức quay trở lại + tình hình Mỹ-Iran với tâm lý phòng ngừa rủi ro trong giai đoạn, cộng thêm việc kỹ thuật sau khi giảm mạnh trước đó đã được phục hồi. Mặc dù xung đột Mỹ-Iran chưa thực sự giảm căng thẳng, nhưng việc Mỹ rút quân khỏi Trung Đông và các động thái ngoại giao của Iran đã làm giảm tạm thời lo ngại về tình hình cực đoan, giá dầu tăng mạnh đã giảm tác động phòng ngừa rủi ro; đồng thời, quỹ tiề

Xem bản gốc2026.03.03 Phân tích chính về xu hướng tăng của BTC/ETH

Hôm nay, thị trường tiền điện tử BTC, ETH đã có sự phục hồi tăng giá, nguyên nhân chính đến từ dòng vốn tổ chức quay trở lại + tình hình Mỹ-Iran với tâm lý phòng ngừa rủi ro trong giai đoạn, cộng thêm việc kỹ thuật sau khi giảm mạnh trước đó đã được phục hồi. Mặc dù xung đột Mỹ-Iran chưa thực sự giảm căng thẳng, nhưng việc Mỹ rút quân khỏi Trung Đông và các động thái ngoại giao của Iran đã làm giảm tạm thời lo ngại về tình hình cực đoan, giá dầu tăng mạnh đã giảm tác động phòng ngừa rủi ro; đồng thời, quỹ tiề

- Phần thưởng

- 8

- 15

- Đăng lại

- Retweed

GetRich1979 :

:

2026 vội vàng 👊Xem thêm

😄📉📊⚡🧠💡🚀💰⏳🔍📚

🔥 «Thông báo Loại bỏ: Bài học trong một tháng.»

«Nếu thị trường quyết định thử thách tôi — nó nên biết tôi học nhanh!» 😄

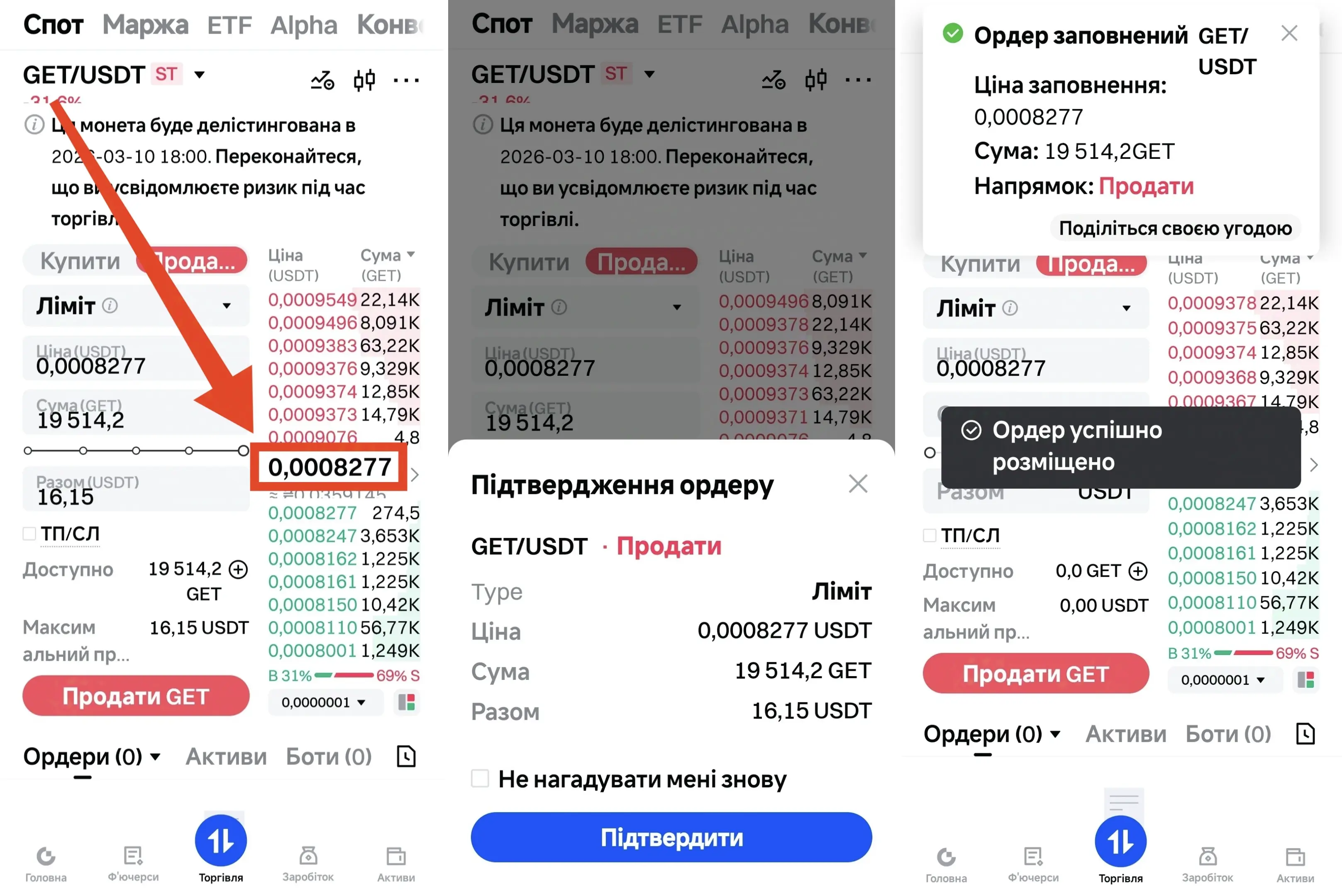

Hôm nay tôi muốn chia sẻ một câu chuyện thực từ kinh nghiệm của mình trên sàn Gate. Tôi mới tham gia crypto được 7 tháng, nên mỗi sự kiện đều là một cấp độ hiểu biết mới đối với tôi. Trong một tháng, tôi đã đăng bài trên Gate Square và kiếm được 19.514,20 GET.

Khi lần đầu tiên tôi vào cặp giao dịch GET/USDT, giá là 0.0015587 USDT. Nếu tôi bán ngay tại giá thị trường, tôi sẽ nhận khoảng 30 USDT. Tuy nhiên, tôi đã đặt lệnh giới hạn cao hơn một chút — khô

🔥 «Thông báo Loại bỏ: Bài học trong một tháng.»

«Nếu thị trường quyết định thử thách tôi — nó nên biết tôi học nhanh!» 😄

Hôm nay tôi muốn chia sẻ một câu chuyện thực từ kinh nghiệm của mình trên sàn Gate. Tôi mới tham gia crypto được 7 tháng, nên mỗi sự kiện đều là một cấp độ hiểu biết mới đối với tôi. Trong một tháng, tôi đã đăng bài trên Gate Square và kiếm được 19.514,20 GET.

Khi lần đầu tiên tôi vào cặp giao dịch GET/USDT, giá là 0.0015587 USDT. Nếu tôi bán ngay tại giá thị trường, tôi sẽ nhận khoảng 30 USDT. Tuy nhiên, tôi đã đặt lệnh giới hạn cao hơn một chút — khô

GET-57,99%

- Phần thưởng

- 10

- 5

- Đăng lại

- Retweed

KatyPaty :

:

Đến Mặt Trăng 🌕Xem thêm

- Phần thưởng

- 4

- 4

- Đăng lại

- Retweed

CoolCommander :

:

Đây chính là một kẻ ngu ngốcXem thêm

Giá mới nhất của Bitcoin và Ethereum

Xem bản gốcĐăng ký độc quyền

Đăng ký ngay để xem nội dung độc quyền- Phần thưởng

- 1

- 3

- Đăng lại

- Retweed

GateUser-185e813f :

:

Hơn 30 đơn hàng nữa có còn nhận được không?Xem thêm

Bài đăng chất lượng cao

Xem bản gốc- Phần thưởng

- 4

- 6

- Đăng lại

- Retweed

KatyPaty :

:

Bài đăng hayXem thêm

- Phần thưởng

- 2

- 3

- Đăng lại

- Retweed

IfYouCan'tHoldOntoIt,JustSell :

:

Đi chơi Bitcoin đi, đã tăng nhiều như vậy rồiXem thêm

#加密市场上涨 #BTC #ETH

Ngày 03.03.2026 Phân tích chính về xu hướng BTC/ETH tăng giá

Hôm nay thị trường tiền điện tử BTC, ETH đón nhận sự phục hồi tăng giá, nguồn động lực chính đến từ dòng vốn tổ chức chảy trở lại + tình hình Mỹ-Iran với tâm lý phòng ngừa rủi ro trong giai đoạn, cộng thêm việc kỹ thuật sau khi giảm quá mức trước đó đã được phục hồi. Mặc dù xung đột Mỹ-Iran chưa thực sự giảm căng thẳng, nhưng việc Mỹ rút quân khỏi Trung Đông và các động thái ngoại giao của Iran khiến lo ngại về tình hình cực đoan tạm thời giảm nhiệt, giá dầu tăng mạnh đã làm giảm tác động phòng ngừa rủi ro; đồng th

Xem bản gốcNgày 03.03.2026 Phân tích chính về xu hướng BTC/ETH tăng giá

Hôm nay thị trường tiền điện tử BTC, ETH đón nhận sự phục hồi tăng giá, nguồn động lực chính đến từ dòng vốn tổ chức chảy trở lại + tình hình Mỹ-Iran với tâm lý phòng ngừa rủi ro trong giai đoạn, cộng thêm việc kỹ thuật sau khi giảm quá mức trước đó đã được phục hồi. Mặc dù xung đột Mỹ-Iran chưa thực sự giảm căng thẳng, nhưng việc Mỹ rút quân khỏi Trung Đông và các động thái ngoại giao của Iran khiến lo ngại về tình hình cực đoan tạm thời giảm nhiệt, giá dầu tăng mạnh đã làm giảm tác động phòng ngừa rủi ro; đồng th

- Phần thưởng

- 7

- 10

- Đăng lại

- Retweed

AllHoldingsReachedTheDaily :

:

Năm Ngựa phát tài 🐴Xem thêm

#加密市场上涨 Đợt phục hồi này mang theo tín hiệu tích cực nhất định, đặt nền móng cho việc mở ra một chu kỳ thị trường mới.

Phân tích thị trường:

Tín hiệu phục hồi tích cực

Bitcoin vượt mức 71.000 USD, Ethereum đứng vững trên 2000 USD, các chỉ số kỹ thuật (như RSI, MACD) cho thấy đà tăng của phe mua đang mạnh lên, khối lượng giao dịch tăng cao, cho thấy tâm lý thị trường đang chuyển sang lạc quan.

Dữ liệu on-chain cho thấy, các nhà nắm giữ dài hạn bắt đầu mua ròng, các địa chỉ cá voi liên tục mua đáy, dòng vốn tổ chức có dấu hiệu chảy trở lại, những yếu tố này cung cấp nền tảng cơ bản cho đợt ph

Xem bản gốcPhân tích thị trường:

Tín hiệu phục hồi tích cực

Bitcoin vượt mức 71.000 USD, Ethereum đứng vững trên 2000 USD, các chỉ số kỹ thuật (như RSI, MACD) cho thấy đà tăng của phe mua đang mạnh lên, khối lượng giao dịch tăng cao, cho thấy tâm lý thị trường đang chuyển sang lạc quan.

Dữ liệu on-chain cho thấy, các nhà nắm giữ dài hạn bắt đầu mua ròng, các địa chỉ cá voi liên tục mua đáy, dòng vốn tổ chức có dấu hiệu chảy trở lại, những yếu tố này cung cấp nền tảng cơ bản cho đợt ph

[Người dùng đã chia sẻ dữ liệu giao dịch của mình. Vào Ứng dụng để xem thêm.]

- Phần thưởng

- 7

- 8

- Đăng lại

- Retweed

ShizukaKazu :

:

Kiên định HODL💎Xem thêm

- Phần thưởng

- 2

- 2

- Đăng lại

- Retweed

GateUser-9a8c98d3 :

:

Lừa tôi 9000 đô laXem thêm

Dự đoán xu hướng trung hạn và ngắn hạn của kỳ đầu tiên tháng 3

Xem bản gốcĐăng ký độc quyền

Đăng ký ngay để xem nội dung độc quyền- Phần thưởng

- 3

- 2

- Đăng lại

- Retweed

HaiGeYixiuYan'anPowder :

:

Chúc mừng năm mới 🧨Xem thêm

🔥 Muốn nhận hàng hóa độc quyền?

Tham gia cuộc thi bình luận để nhận phần thưởng! Bình luận trong buổi phát trực tiếp hàng ngày, và nếu bạn lọt vào Top 3, bạn sẽ nhận được một phần thưởng lớn!🎁

🎉 Người chiến thắng ngày 3 tháng 3 được công bố:

Spirit Doll · Must Turn Things Around · Avril_

✨ Cập nhật hàng hóa hàng ngày, cơ hội thắng mỗi ngày

Người chiến thắng tiếp theo có thể là bạn: https://www.gate.com/announcements/article/44259

#GateLive #评论有奖 #GIVEAWAY🎁

Xem bản gốcTham gia cuộc thi bình luận để nhận phần thưởng! Bình luận trong buổi phát trực tiếp hàng ngày, và nếu bạn lọt vào Top 3, bạn sẽ nhận được một phần thưởng lớn!🎁

🎉 Người chiến thắng ngày 3 tháng 3 được công bố:

Spirit Doll · Must Turn Things Around · Avril_

✨ Cập nhật hàng hóa hàng ngày, cơ hội thắng mỗi ngày

Người chiến thắng tiếp theo có thể là bạn: https://www.gate.com/announcements/article/44259

#GateLive #评论有奖 #GIVEAWAY🎁

- Phần thưởng

- 3

- 3

- Đăng lại

- Retweed

MarketAdvicer :

:

LFG 🔥Xem thêm

Lệnh giao dịch ETH BTC SOL theo thời gian thực

Xem bản gốcĐăng ký độc quyền

Đăng ký ngay để xem nội dung độc quyền- Phần thưởng

- 4

- 3

- Đăng lại

- Retweed

44512 :

:

😂😂😂😂😂Xem thêm

#加密市场上涨

1. Sự bùng nổ của thị trường – Bitcoin dẫn đầu

Bitcoin đã tăng lên mức 71.350–71.400 đô la, ghi nhận mức tăng 7,2–7,5% trong 24 giờ qua. Các mức cao trong ngày thậm chí còn đẩy gần hơn tới 71.800+ đô la, đánh dấu sự phục hồi mạnh mẽ sau giai đoạn tích lũy gần 67k–68k đô la. Động thái này được thúc đẩy bởi sự FOMO mạnh mẽ của nhà đầu tư cá nhân, sự tích lũy của các tổ chức và niềm tin thị trường được củng cố trở lại mặc dù tình hình địa chính trị ở Trung Đông vẫn còn bất ổn, bao gồm căng thẳng liên quan đến Iran, Israel và các đồng minh khu vực.

Tại sao thị trường chưa sụp đổ giữa lúc

Xem bản gốc1. Sự bùng nổ của thị trường – Bitcoin dẫn đầu

Bitcoin đã tăng lên mức 71.350–71.400 đô la, ghi nhận mức tăng 7,2–7,5% trong 24 giờ qua. Các mức cao trong ngày thậm chí còn đẩy gần hơn tới 71.800+ đô la, đánh dấu sự phục hồi mạnh mẽ sau giai đoạn tích lũy gần 67k–68k đô la. Động thái này được thúc đẩy bởi sự FOMO mạnh mẽ của nhà đầu tư cá nhân, sự tích lũy của các tổ chức và niềm tin thị trường được củng cố trở lại mặc dù tình hình địa chính trị ở Trung Đông vẫn còn bất ổn, bao gồm căng thẳng liên quan đến Iran, Israel và các đồng minh khu vực.

Tại sao thị trường chưa sụp đổ giữa lúc

- Phần thưởng

- 6

- 4

- Đăng lại

- Retweed

ShizukaKazu :

:

2026 vội vàng 👊Xem thêm

- Phần thưởng

- 1

- 3

- Đăng lại

- Retweed

AllianceOfFaith :

:

Ảnh đại diện này thật giống một con chó🤭🤭Xem thêm

Đăng nhập vào Stream, Sprint cho VIP+1 và Thưởng hàng tháng https://www.gate.com/campaigns/4159?ref=VLRHVGPAVQ&ref_type=132

Xem bản gốc

- Phần thưởng

- 4

- 2

- Đăng lại

- Retweed

HighAmbition :

:

Cảm ơn bạn đã chia sẻXem thêm

#加密市场上涨 Hôm nay thị trường tiền điện tử BTC, ETH đón nhận sự phục hồi tăng giá, nguồn động lực chính đến từ dòng vốn tổ chức chảy trở lại + tình hình căng thẳng Mỹ-Iran tạm thời giảm nhiệt do các chiến thuật phòng ngừa rủi ro, cộng thêm việc phục hồi kỹ thuật sau đợt giảm sâu trước đó. Mặc dù xung đột Mỹ-Iran chưa thực sự dịu đi, nhưng việc Mỹ rút quân khỏi Trung Đông và các động thái ngoại giao của Iran khiến lo ngại về tình hình cực đoan tạm thời giảm bớt, giá dầu tăng mạnh đã giảm thiểu tác động phòng ngừa rủi ro; đồng thời quỹ tiền điện tử chảy vào ròng trong tuần đạt 1 tỷ USD, ETF BTC/ET

Xem bản gốc

[Người dùng đã chia sẻ dữ liệu giao dịch của mình. Vào Ứng dụng để xem thêm.]

- Phần thưởng

- 5

- 5

- Đăng lại

- Retweed

Vortex_King :

:

GOGOGO 2026 👊Xem thêm

Tải thêm