Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

NEW

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

20.05K Popularity

28.69K Popularity

20.42K Popularity

79.99K Popularity

191.76K Popularity

- Hot Gate FunView More

- MC:$3.63KHolders:40.25%

- MC:$3.55KHolders:10.00%

- MC:$3.6KHolders:20.13%

- MC:$20KHolders:205050.99%

- MC:$3.54KHolders:10.00%

- Pin

SEC non-action letter issued, a small step forward for US stock tokenization

Author: Crypto Salad

On December 15, 2025, U.S. time, Nasdaq officially submitted Form19b-4 to the SEC, requesting to extend trading hours for U.S. stocks and exchange-traded products to 23/5 (trading 23 hours daily, 5 days a week).

However, Nasdaq’s proposed trading hours are not simply extended; instead, they are divided into two official trading sessions:

Day trading session (4:00 AM - 8:00 PM Eastern Time) and night trading session (9:00 PM - 4:00 AM Eastern Time the next day). Trading will be paused from 8:00 PM to 9:00 PM, and all unfilled orders during this pause will be canceled uniformly.

Many readers got excited upon seeing this news, thinking that the U.S. might be preparing for 24/7 tokenized trading of U.S. stocks. But Crypto Salad carefully examined the document and wants to say: don’t rush to conclusions yet, because Nasdaq stated in the filing that many traditional securities trading rules and complex order types are not applicable during the night trading session, and some functionalities will be limited.

We have always been very interested in the tokenization of U.S. stocks, considering it one of the most important targets for real-world asset tokenization, especially given the recent flurry of official actions by the U.S. SEC (Securities and Exchange Commission).

This application has rekindled expectations for the tokenization of U.S. stocks, as it suggests that the U.S. aims to bring securities trading hours closer to the 24/7 model of digital asset markets. However, upon closer inspection:

Nasdaq’s filing does not mention any tokenization-related matters at all; it is solely about institutional reforms for traditional securities.

If you want a deeper understanding of Nasdaq’s actions, Crypto Salad can write a dedicated article for detailed analysis. But today, we still want to focus on concrete news related to the actual tokenization of U.S. stocks ——

The SEC officially “permits” the giant U.S. securities depository to attempt providing tokenization services.

On December 11, 2025, U.S. time, SEC staff from the Division of Trading and Markets issued a “No-Action Letter (NAL)” to DTCC, which was subsequently published on the SEC website. The letter explicitly states that, under certain conditions, the SEC will not take enforcement action against DTC for offering tokenization services related to its securities custody.

At first glance, many readers might think that the SEC has officially “exempted” the use of tokenization technology on U.S. stocks. But a closer look shows that the actual situation is quite different.

So, what exactly does this letter say? How far has the latest development of U.S. stock tokenization progressed? Let’s start with the main subject:

1. Who are DTCC and DTC?

DTCC, the Depository Trust & Clearing Corporation, is a U.S.-based group company comprising various institutions responsible for custody, stock clearing, and bond clearing.

DTC, the Depository Trust Company, is a subsidiary of DTCC and the largest securities depository in the U.S., responsible for the centralized custody of stocks, bonds, and other securities, as well as settlement and transfer. Currently, its custody and bookkeeping scale exceeds $100 trillion. DTC can be understood as the ledger administrator for the entire U.S. stock market.

2. What is the relationship between DTC and U.S. stock tokenization?

In early September 2025, news broke that Nasdaq applied to the SEC to issue stocks in a tokenized form. That application already mentioned DTC.

Nasdaq stated that the only difference between tokenized stocks and traditional stocks lies in the clearing and settlement of orders by DTC.

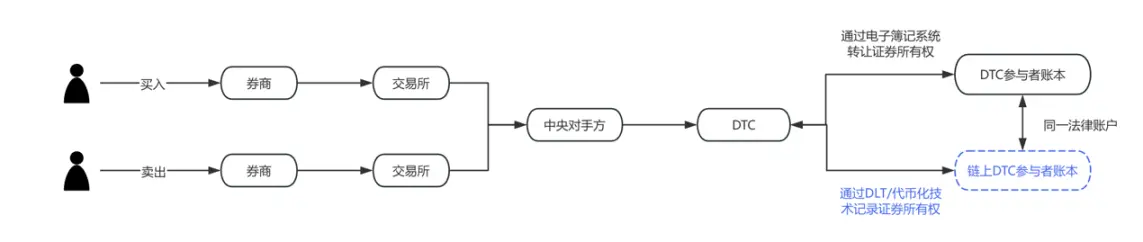

To make this clearer, we’ve drawn a flowchart. The blue part shows the sections of Nasdaq’s September proposal that are being changed. It’s obvious that DTC is the key operational and implementation entity for U.S. stock tokenization.

3. What does the newly published “No-Action Letter” say?

Many people immediately equate this document with the SEC’s approval for DTC to use blockchain for U.S. stock bookkeeping, but that’s not entirely accurate. To understand this correctly, one must recognize a clause in the U.S. Securities Exchange Act:

Section 19(b) of the Securities Exchange Act of 1934 states that any self-regulatory organization (including clearing agencies) must submit rule change proposals to the SEC and obtain approval when changing rules or major business arrangements.

Both of Nasdaq’s proposals were submitted based on this regulation.

However, the rule filing process is usually lengthy, potentially delaying for months, with a maximum of 240 days. If every change requires a new application and approval, the time cost becomes prohibitive. To ensure their securities tokenization pilot activities proceed smoothly, DTC applied for an exemption from fully complying with the 19b filing process during the pilot period, and the SEC granted this.

In other words, the SEC temporarily exempted DTC from some procedural filing obligations, but did not substantively approve the application of tokenization technology in the securities market.

What does this mean for the future of U.S. stock tokenization? We need to clarify two questions:

What pilot activities can DTC conduct without filing?

Currently, the custody and bookkeeping of U.S. stocks operate as follows: assume a broker has an account with DTC, which uses a centralized system to record every buy and sell of stocks and shares. DTC proposed whether it could provide brokers with an option to record these stock holdings as blockchain tokens.

Practically, this involves participants registering a qualified, DTC-approved wallet (Registered Wallet). When a participant issues a tokenization instruction to DTC, DTC will do three things:

a) Move these stocks from the original account to a master ledger pool;

b) Mint tokens on the blockchain;

c) Transfer the tokens to the participant’s wallet, representing their rights to these securities.

After that, these tokens can be transferred directly between brokers without each transfer going through DTC’s centralized ledger. However, all token transfers will be monitored and recorded in real-time by DTC through an off-chain system called LedgerScan, and LedgerScan’s records will constitute DTC’s official ledger. If a participant wishes to exit the tokenized state, they can send a “de-tokenization” instruction to DTC, which will burn the tokens and re-credit the securities rights to a traditional account.

The NAL also details technical and risk control restrictions, including: tokens can only be transferred between wallets approved by DTC, and DTC even has the authority to forcibly transfer or destroy tokens in certain circumstances. The token system is strictly isolated from DTC’s core clearing system, etc.

What is the significance of this letter?

From a legal perspective, Crypto Salad emphasizes that the NAL does not equate to legal authorization or rule modification; it does not have general legal binding force, but merely reflects the SEC staff’s enforcement stance under certain facts and assumptions.

The U.S. securities law system does not have a specific prohibition against using blockchain for bookkeeping. Regulators are more concerned about whether existing market structure, custody responsibilities, risk controls, and reporting obligations are still met after adopting new technology.

Moreover, in the U.S. securities regulatory system, such letters as NAL are long regarded as important indicators of regulatory stance, especially when the subject is systemically important financial institutions like DTC. Their symbolic significance often exceeds their direct legal effect.

The disclosure makes it clear that the SEC’s exemption is premised on DTC not issuing or trading securities directly on-chain, but merely tokenizing existing securities rights within its custody system.

This form of tokenization is essentially a “rights mapping” or “ledger expression” used to improve backend processing efficiency, not to alter the legal nature or ownership structure of securities. The related services operate within a controlled environment and permissioned blockchain, with participants, scope, and technical architecture strictly limited.

Crypto Salad believes this regulatory attitude is very reasonable. On-chain assets are most vulnerable to financial crimes like money laundering and illegal fundraising. Tokenization is a new technology, but it should not become a tool for crime. Regulators need to acknowledge the potential of blockchain in securities infrastructure while maintaining the boundaries of existing securities laws and custody systems.

4. The latest progress in U.S. stock tokenization

Discussions around U.S. stock tokenization are gradually shifting from “compliance” to “implementation.” Analyzing current market practices reveals at least two parallel but logically different paths forming:

One, led by official opinions represented by DTCC and DTC, focuses on tokenization to improve settlement, reconciliation, and asset transfer efficiency, mainly serving institutional and wholesale market participants. In this model, tokenization is almost “invisible” to retail investors; stocks remain stocks, only the backend system is upgraded technologically.

The other involves brokers and trading platforms, such as Robinhood and MSX Ma Tong, which have been exploring products related to crypto assets, fractional trading of stocks, and extended trading hours. If U.S. stock tokenization matures in compliance, these platforms naturally have an advantage as entry points for users. For them, tokenization does not mean reshaping the business model but is more like a technological extension of existing investment experiences—closer to real-time settlement, more flexible asset splitting, and cross-market product integration. Of course, all this depends on a gradually clearer regulatory framework. These explorations often operate near regulatory boundaries, balancing risks and innovation. Their value lies not in short-term scale but in testing the next-generation securities market form. From a practical perspective, they are more like samples for institutional evolution rather than direct replacements for the current U.S. stock market.

To make this more intuitive, here is a comparative diagram:

5. Crypto Salad’s perspective

From a broader perspective, the real goal of U.S. stock tokenization is not to “turn stocks into coins,” but to improve asset transfer efficiency, reduce operational costs, and reserve interfaces for future cross-market collaboration, all while maintaining legal certainty and system security. In this process, compliance, technology, and market structure will coexist and evolve gradually, rather than through radical changes.

It is expected that U.S. stock tokenization will not fundamentally change Wall Street’s operation in the short term, but it is already an important project within the U.S. financial infrastructure agenda. The SEC and DTC’s interaction is more like a “trial” at the institutional level, setting initial boundaries for broader future exploration. For market participants, this may not be the end but a starting point truly worth continuous observation.