Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

NEW

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

20.4K Popularity

28.67K Popularity

20.46K Popularity

80K Popularity

191.76K Popularity

- Hot Gate FunView More

- MC:$3.63KHolders:40.25%

- MC:$3.55KHolders:10.00%

- MC:$3.6KHolders:20.13%

- MC:$20.17KHolders:205051.23%

- MC:$3.54KHolders:10.00%

- Pin

The Next 7 Days Could Define Bitcoin’s Entire Market Direction

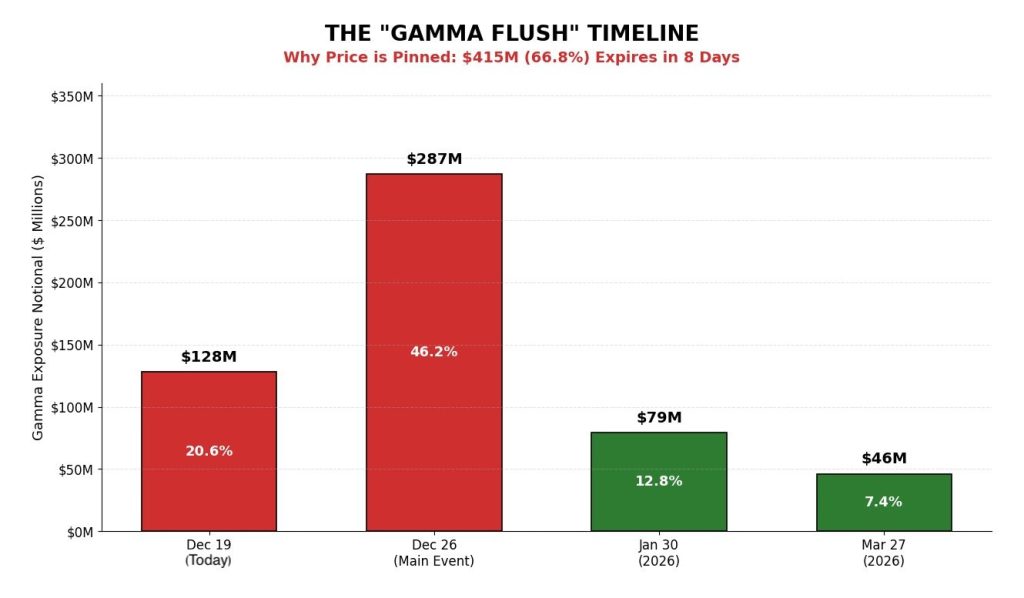

Bitcoin has had plenty of reasons to move lately. Strong headlines, solid fundamentals, and constant chatter about what comes next. Yet the BTC price keeps doing nothing. Every push higher gets shut down. Every dip finds a weak bounce. To a lot of traders, it feels like the market is broken. According to NoLimit, there’s a very clear reason for that. And it has nothing to do with sentiment.

Source: X/@NoLimitGains

Why Bitcoin Is Going Nowhere Right Now At the moment, the Bitcoin price is sitting under a heavy layer of short-term options pressure. Roughly $415 million in options exposure is set to expire over the next seven days. Even more important, most of that pressure is packed into a single date. Today, about $128 million rolls off. But December 26 is the real focal point, with roughly $287 million expiring at once. That’s close to half of all the short-term exposure currently hanging over BTC. When that much money is tied to options, the price movement becomes a problem for the people on the other side of those trades. If the Bitcoin price rips higher, they lose. If it dumps hard, they lose there too. So the easiest solution is to keep the price stuck right where it is. That’s why every recent move feels fake. A small breakout shows up, then instantly fades. A sharp dip hits, then gets bought just enough to stop momentum. It’s not bullish. It’s not bearish. It’s controlled. The Setup Behind the “Gamma Flush” This kind of environment often leads to what traders call a gamma flush. As long as these options are active, the price is effectively pinned in place. But once that exposure expires, the pressure disappears quickly. After December 26, the chart shows a steep drop in remaining exposure. January and March expiries are much smaller by comparison. Replacing nearly $300 million in short-term options isn’t something that happens overnight, especially during a holiday period when liquidity is thin and traders are less active. That’s the key point. The restraint on price isn’t permanent. Read Also: Japan’s Rate Move Puts Bitcoin at Risk of a Big Crash What Changes After December 26 This doesn’t mean Bitcoin immediately pumps or crashes the moment those options expire. What it does mean is that the artificial pressure holding price in place starts to fade. Once that happens, the BTC price can finally react to real buying and selling again. Moves should start to carry follow-through instead of getting slapped down instantly. Volatility won’t feel forced anymore. It’ll feel real. For now, the takeaway is simple. Bitcoin isn’t weak, and it isn’t broken. It’s temporarily pinned. And the next seven days are what decide when that pin finally gets pulled.