Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

NEW

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

18.89K Popularity

27.54K Popularity

26.32K Popularity

80.19K Popularity

193.11K Popularity

- Hot Gate FunView More

- MC:$3.55KHolders:10.00%

- MC:$3.6KHolders:20.13%

- MC:$19.83KHolders:205050.61%

- MC:$3.54KHolders:10.00%

- MC:$3.55KHolders:10.00%

- Pin

The Revenue Flippening Is Here: Solana (SOL) Set to Pass Ethereum (ETH)

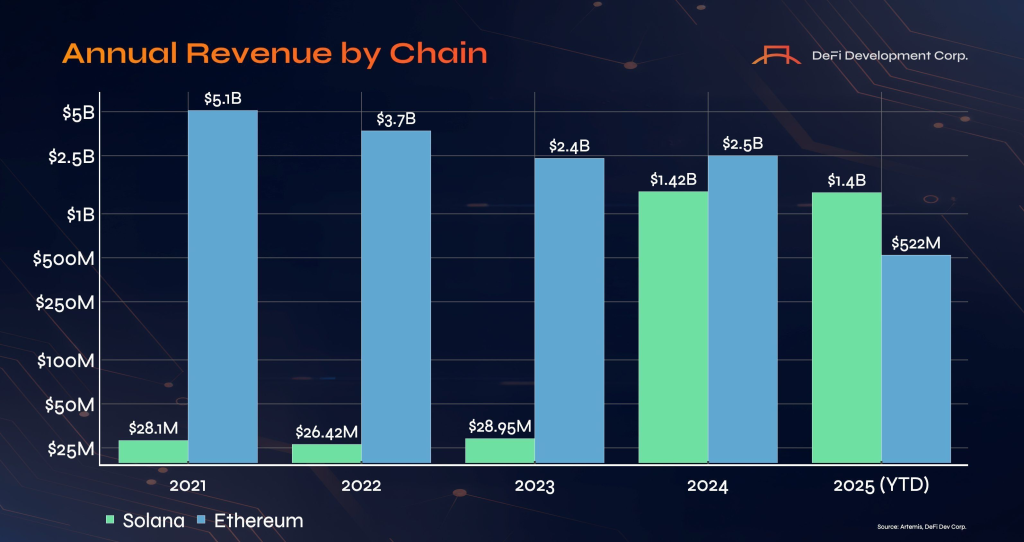

A single chart can sometimes say more than a long debate. One recent image shared by CryptosRus put a spotlight on something that quietly built up over years. Solana revenue appears on track to surpass Ethereum annual revenue for the first time, and the numbers behind it are hard to ignore. What started as a niche ecosystem a few years ago is now challenging the chain that defined smart contracts. That shift is not happening overnight, yet the trend has been forming in plain sight.

Solana Revenue Growth Is Accelerating While Ethereum Revenue Slows CryptosRus explained how Solana revenue grew from roughly $28M in 2021 to about $2.5B in 2025 year to date. That rise stands in contrast to Ethereum revenue, which peaked above $5B in earlier cycles and now sits closer to $1.4B. Those figures do not tell the full story on their own, though they do frame the conversation. Solana growth reflects heavy onchain activity tied to fast settlement, lower fees, and an expanding app ecosystem. Ethereum revenue still remains large, yet the direction of travel looks very different between the two networks.

@CryptosR_Us / X

DeFi Development Corp summed it up by describing Solana as the revenue chain where future applications can live, scale, and operate efficiently. That framing shifts attention away from ideology and toward actual usage. SOL Price And ETH Price Performance Has Reflected This Shift For Years The revenue discussion lines up closely with long term price behavior. SOL price outperformed ETH price for an extended stretch leading into mid 2025. That trend played out gradually rather than through sudden spikes, which made it easy to overlook. Ethereum price held its ground during parts of that period, yet Solana price consistently gained relative strength. Momentum only cooled once the trend finally broke around mid 2025. Until that point, the SOL ETH chart showed a clear pattern of Solana quietly pulling ahead.

SOLETH Price Chart

That relationship matters because sustained price outperformance often mirrors where capital and attention flow over time. Solana did not need dramatic headlines to make progress. The chart did the talking. Solana Speed And App Activity Are Driving Revenue More Than Narratives Solana appeal has rarely centered on complex messaging. Speed, throughput, and cost efficiency sit at the core of the network. Those traits make it easier for high volume applications to operate without friction, which naturally feeds revenue. Meme driven activity also played a role in recent cycles. High frequency trading and rapid transaction turnover tend to favor chains that handle load without congestion. Solana fit that requirement well, and revenue followed. Ethereum continues to evolve and attract developers, yet scaling challenges and fee dynamics still shape user behavior. Revenue leadership often reflects where users feel most comfortable transacting at scale. Read Also: ADA Holders Foot the Bill as Cardano Bets Treasury on Midnight Network Solana Quietly Pressures Ethereum Dominance In Key Metrics Ethereum dominance was built on first mover advantage and deep liquidity. Solana challenge comes from execution and growth curves. Revenue metrics now place that challenge into sharper focus. SOL seems to be quietly testing Ethereum position rather than openly confronting it. The absence of hype makes the shift more interesting. Revenue growth and relative price strength have both pointed in the same direction for a long time. Ethereum remains central to the broader ecosystem, though the gap in dominance no longer looks unbridgeable. Solana presence keeps expanding, and the data shows that the competition is no longer theoretical. The flippening narrative has come and gone many times before. This time, revenue and price behavior suggest something more structural may be unfolding. Watching how Solana and Ethereum evolve from here could offer a clearer picture of where blockchain usage is really heading.