# CryptoMarkets

6.57K

MissCrypto

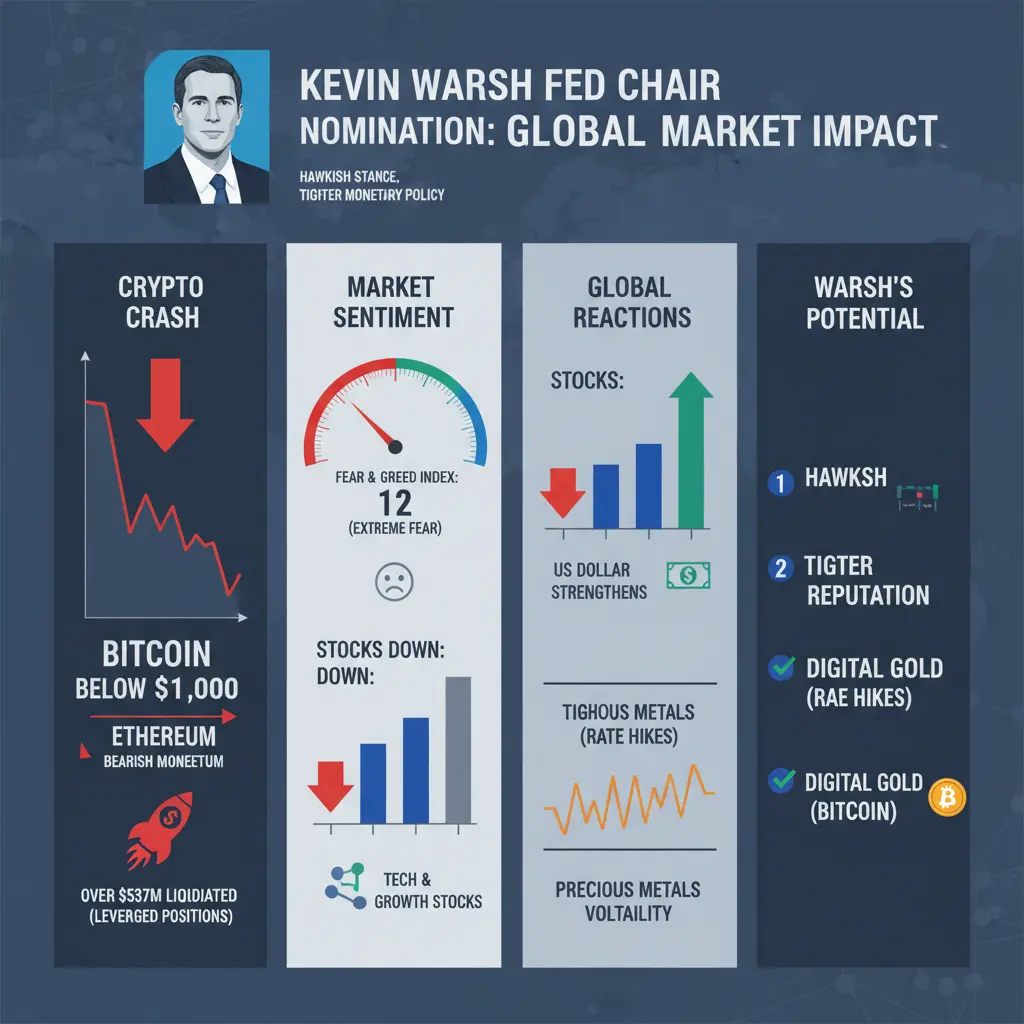

#WarshNominationBullorBear? | Kevin Warsh & Market Shock

The nomination of Kevin Warsh as Fed Chair has sent shockwaves through global risk markets, triggering sharp declines in Bitcoin, equities, and other speculative assets. Bitcoin fell below $71,000, reaching $70,566, marking fresh bear-market lows as investors reassess liquidity, monetary discipline, and the Fed’s future role in market support.

Immediate Market Reaction:

Bitcoin plunged over 7%, Ethereum fell below $2,100, and altcoins faced deeper losses.

Over $537 million in leveraged positions were liquidated in less than 12 hours.

Fea

The nomination of Kevin Warsh as Fed Chair has sent shockwaves through global risk markets, triggering sharp declines in Bitcoin, equities, and other speculative assets. Bitcoin fell below $71,000, reaching $70,566, marking fresh bear-market lows as investors reassess liquidity, monetary discipline, and the Fed’s future role in market support.

Immediate Market Reaction:

Bitcoin plunged over 7%, Ethereum fell below $2,100, and altcoins faced deeper losses.

Over $537 million in leveraged positions were liquidated in less than 12 hours.

Fea

- Reward

- 9

- 16

- Repost

- Share

CryptoChampion :

:

HODL Tight 💪View More

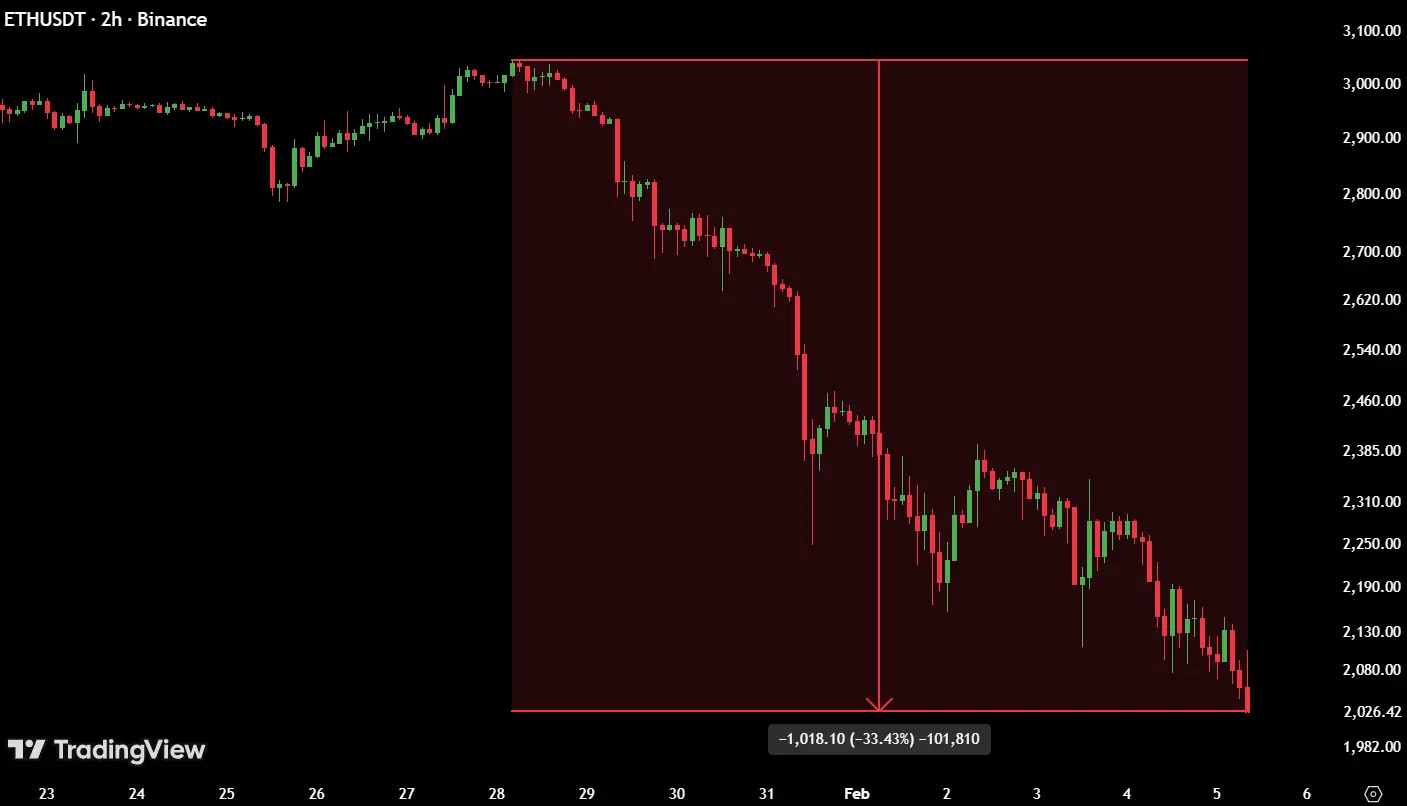

$ETH is down ~$1,000 in just 8 days.

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

ETH-9,06%

- Reward

- like

- Comment

- Repost

- Share

#InstitutionalHoldingsDebate #InstitutionalHoldingsDebate 🏦📊

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

- Reward

- 2

- 2

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

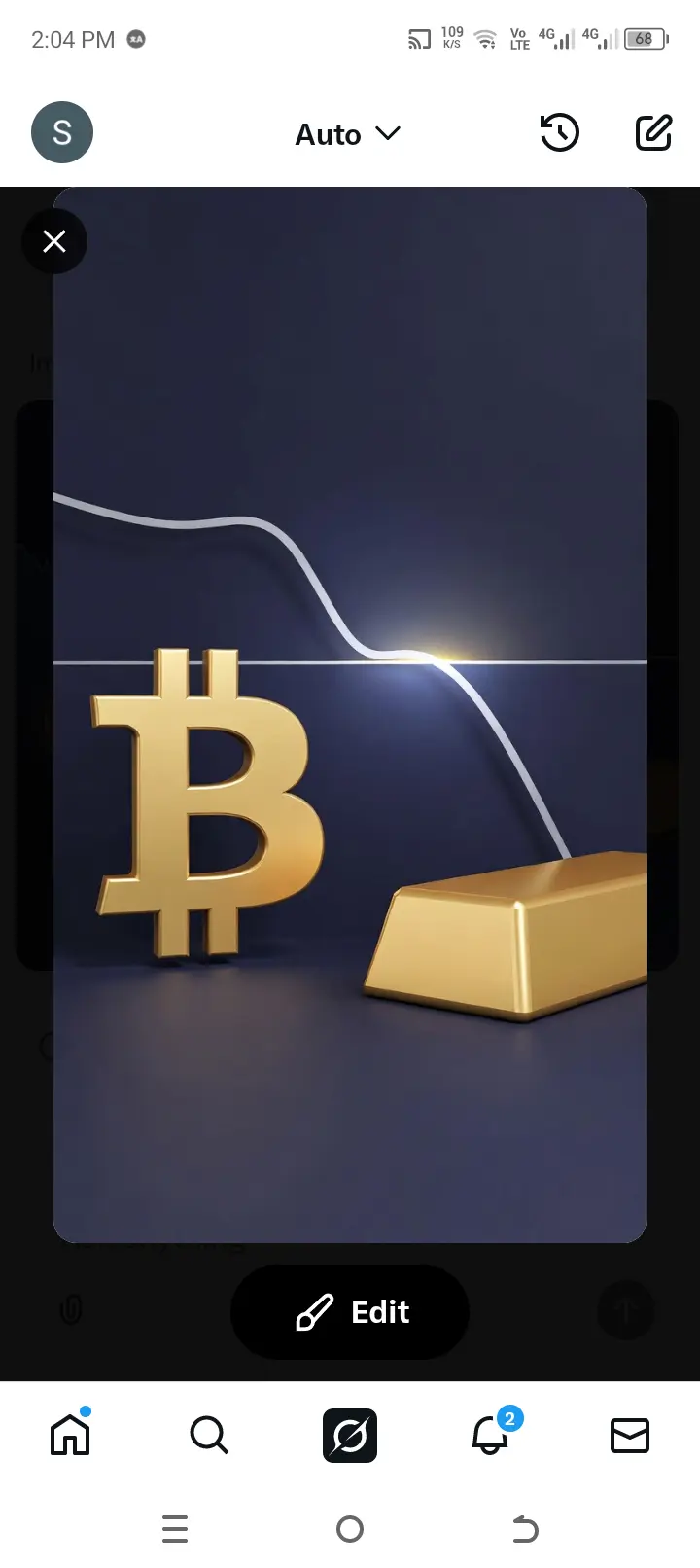

#SEConTokenizedSecurities 💥 Bitcoin vs Gold Ratio Alert

Bitcoin’s BTC/Gold ratio has dropped about 559% from its peak and just slipped below the 200-week moving average — a level many traders watch closely.

📈 What it means:

Potential dip-buying opportunity for BTC

Historically, dips near the 200-week MA have offered high risk-reward

Core BTC exposure + gradual stacking is key — not all-in

⚡ Your move: Are you buying the dip or waiting for confirmation?

#Bitcoin #BTC #CryptoMarkets #DipBuying

Bitcoin’s BTC/Gold ratio has dropped about 559% from its peak and just slipped below the 200-week moving average — a level many traders watch closely.

📈 What it means:

Potential dip-buying opportunity for BTC

Historically, dips near the 200-week MA have offered high risk-reward

Core BTC exposure + gradual stacking is key — not all-in

⚡ Your move: Are you buying the dip or waiting for confirmation?

#Bitcoin #BTC #CryptoMarkets #DipBuying

BTC-8,81%

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats Bitcoin Slides, Gold Soars Amid Macro Tensions

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

BTC-8,81%

- Reward

- 15

- 13

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats Global markets reacted sharply to renewed tariff threats and rising geopolitical tension from the United States, triggering volatility across both traditional and digital assets. Bitcoin fell from above 95,000 toward the 86,000–90,000 range, while gold surged beyond 5,000 to new record highs. This divergence reflects a classic risk-off rotation, with capital moving away from high-beta assets and into defensive stores of value. Macro policy headlines once again proved capable of overpowering short-term fundamentals in crypto markets.

Bitcoin’s decline aligned clos

Bitcoin’s decline aligned clos

BTC-8,81%

- Reward

- 4

- 1

- Repost

- Share

Yajing :

:

2026 GOGOGO 👊🚀📈 #DUSKJumps53.6% | Market Movers Spotlight

DUSK recorded a sharp 53.6% surge, capturing strong attention from traders as momentum and volume accelerated across the market. Such moves highlight renewed interest in select altcoins amid shifting market conditions. 👀💥

🔍 What Traders Are Watching:

⚡ Increased trading activity and liquidity

📊 Momentum-driven price action

🧠 Short-term opportunities alongside volatility management

💡 Stay alert during high-momentum moves and use Gate.io’s advanced charts, indicators, and real-time data to make informed trading decisions.

📌 Volatility creates

DUSK recorded a sharp 53.6% surge, capturing strong attention from traders as momentum and volume accelerated across the market. Such moves highlight renewed interest in select altcoins amid shifting market conditions. 👀💥

🔍 What Traders Are Watching:

⚡ Increased trading activity and liquidity

📊 Momentum-driven price action

🧠 Short-term opportunities alongside volatility management

💡 Stay alert during high-momentum moves and use Gate.io’s advanced charts, indicators, and real-time data to make informed trading decisions.

📌 Volatility creates

- Reward

- 1

- Comment

- Repost

- Share

#WeekendMarketAnalysis 📊 Market Prediction | When One Sentence Moves Global Markets

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

BTC-8,81%

- Reward

- 5

- 8

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

🚨 #NonfarmPayrollsComing — Brace for Market Action!

We’re heading into one of the most market-moving reports of the month: the U.S. Non-Farm Payrolls. Traders across all markets — crypto, stocks, forex — are watching closely. Why? Because NFP often sets the tone for volatility, interest rate expectations, and investor confidence.

This is the kind of moment where smart traders prepare their strategies, manage risk, and avoid emotional decisions. The number might surprise us, but what matters most is how we respond.

Let’s stay sharp, analyze the data, and trade with discipline. Big opportunitie

We’re heading into one of the most market-moving reports of the month: the U.S. Non-Farm Payrolls. Traders across all markets — crypto, stocks, forex — are watching closely. Why? Because NFP often sets the tone for volatility, interest rate expectations, and investor confidence.

This is the kind of moment where smart traders prepare their strategies, manage risk, and avoid emotional decisions. The number might surprise us, but what matters most is how we respond.

Let’s stay sharp, analyze the data, and trade with discipline. Big opportunitie

- Reward

- 10

- 13

- Repost

- Share

NovaCryptoGirl :

:

"Proud of how far you’ve come, keep going strong!"View More

📰 PANews: January 4th Update on Strategy

According to某交易所, Strategy may report a notable Q4 2025 loss due to fluctuations in its Bitcoin holdings. Key points include:

- Strategy holds approximately $60 billion in Bitcoin assets.- Bitcoin declined around 24% in Q4 2025, which could result in a substantial paper loss for the group.- This potential loss may offset the $2.8 billion profit recorded in the previous quarter.- Strategy’s enterprise value is approaching the value of its Bitcoin holdings, prompting market observers to consider whether asset sales may be required.- To manage liquidity a

According to某交易所, Strategy may report a notable Q4 2025 loss due to fluctuations in its Bitcoin holdings. Key points include:

- Strategy holds approximately $60 billion in Bitcoin assets.- Bitcoin declined around 24% in Q4 2025, which could result in a substantial paper loss for the group.- This potential loss may offset the $2.8 billion profit recorded in the previous quarter.- Strategy’s enterprise value is approaching the value of its Bitcoin holdings, prompting market observers to consider whether asset sales may be required.- To manage liquidity a

BTC-8,81%

- Reward

- 21

- 12

- Repost

- Share

Flower89 :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

93.55K Popularity

12.44K Popularity

385.95K Popularity

603 Popularity

81 Popularity

85 Popularity

69 Popularity

133 Popularity

112 Popularity

3.05K Popularity

10.48K Popularity

6.48K Popularity

18.29K Popularity

26.17K Popularity

22.48K Popularity

News

View MoreData: 63.75 BTC transferred out from Cumberland DRW, worth approximately $4.13 million. This transfer indicates a significant movement of funds, which could impact the market or signal a change in holdings. Please monitor for further transactions or related activity.

11 m

Data: The current Crypto Fear & Greed Index is 10, indicating an extreme fear state.

13 m

BTC breaks through 65,000 USDT

18 m

Trader 0xEc0B Faces 21 Liquidations Across Multiple Crypto Assets

26 m

Data: The United States Solana spot ETF experienced a total net inflow of $2.82 million today.

29 m

Pin