# DecemberRateCutForecast,

883

HighAmbition

#DecemberRateCutForecast

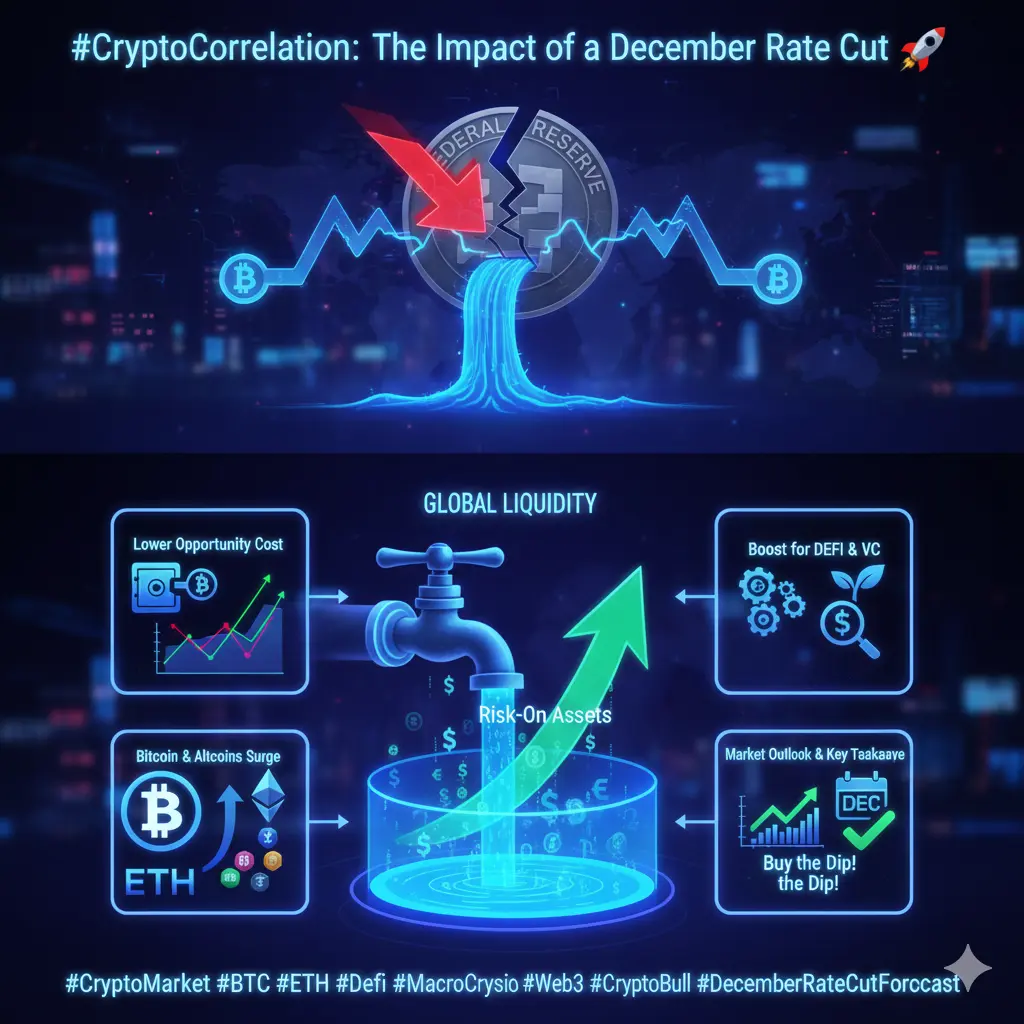

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

- Reward

- 25

- 11

- Repost

- Share

BeautifulDay :

:

1000x Vibes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

22.29K Popularity

13.05K Popularity

12.45K Popularity

3.96K Popularity

7.76K Popularity

8.72K Popularity

8.44K Popularity

29.64K Popularity

18.1K Popularity

10.82K Popularity

1.5K Popularity

9.89K Popularity

22.76K Popularity

19.76K Popularity

230.74K Popularity

News

View MoreU.S. Treasury Secretary Bessent states that there will be no "bailout" for Bitcoin; the $500 million worth of Bitcoin confiscated by the government has increased in value to $15 billion.

1 m

Yili Hua's Trend Research position liquidation price has dropped to $1,640, still holding 463,000 ETH with an unrealized loss of $474 million.

2 m

Galaxy Digital: Clients selling approximately $9 billion worth of Bitcoin not due to "quantum computing risk"

2 m

Bitcoin mining company Cipher's AI subsidiary's junk bond sale garners $13 billion in subscriptions

10 m

Data: 159.27 BTC transferred out from Cumberland DRW, then routed through a relay and sent to another anonymous address

12 m

Pin