# CryptoMarketWatch

224.07K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

HighAmbition

#CryptoMarketWatch

The crypto market is showing a relief bounce after a very rough weekend. Prices dropped sharply due to geopolitical tensions, high interest rates, and U.S. regulatory uncertainty, but buyers stepped in near key support levels.

Bitcoin fell as low as $74,000, and Ethereum dropped close to $2,100 before recovering. This move looks like the end of a bearish phase that started with heavy leverage cleanup in late 2025. Now, both BTC and ETH are sitting at important decision zones.

Bitcoin (BTC) Overview

Current Price: Around $78,500 (just below $79,000)

24h Change: Up 3–5%, show

The crypto market is showing a relief bounce after a very rough weekend. Prices dropped sharply due to geopolitical tensions, high interest rates, and U.S. regulatory uncertainty, but buyers stepped in near key support levels.

Bitcoin fell as low as $74,000, and Ethereum dropped close to $2,100 before recovering. This move looks like the end of a bearish phase that started with heavy leverage cleanup in late 2025. Now, both BTC and ETH are sitting at important decision zones.

Bitcoin (BTC) Overview

Current Price: Around $78,500 (just below $79,000)

24h Change: Up 3–5%, show

- Reward

- 6

- 6

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

CryptoMarketWatch

This 600 word analysis covers the top five cryptocurrencies with key support levels, resistance zones, and possible next market moves based on current price action and technical structure.

Bitcoin BTC

Bitcoin remains the market leader and continues to control overall crypto sentiment.

Current Price is around 77211 USD.

Support Levels. Immediate support is located between 74000 and 75000. This zone has acted as a strong demand area during recent pullbacks. Below this, the psychological 70000 level is a major long term support where institutional buyers are

CryptoMarketWatch

This 600 word analysis covers the top five cryptocurrencies with key support levels, resistance zones, and possible next market moves based on current price action and technical structure.

Bitcoin BTC

Bitcoin remains the market leader and continues to control overall crypto sentiment.

Current Price is around 77211 USD.

Support Levels. Immediate support is located between 74000 and 75000. This zone has acted as a strong demand area during recent pullbacks. Below this, the psychological 70000 level is a major long term support where institutional buyers are

- Reward

- 3

- 4

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

#CryptoMarketWatch 📉 Crypto Market Snapshot – Early February 2026

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

- Reward

- 1

- Comment

- Repost

- Share

Market Volatility Heats Up – Bulls vs Bears in a Tug of War

Recent crypto market swings have intensified, highlighting a clear divergence between bullish momentum and bearish pressure. Traders are now facing a pivotal moment: is this a short-term pullback or the start of a deeper correction?

Dragon Fly Official is closely monitoring key signals:

Bitcoin ($76K–$78K): Watch for sustained support. A strong hold could signal a bullish continuation, while a break below may trigger wider volatility.

Ethereum & Layer-2s: Divergence between price action and network activity can indicate underlying str

Recent crypto market swings have intensified, highlighting a clear divergence between bullish momentum and bearish pressure. Traders are now facing a pivotal moment: is this a short-term pullback or the start of a deeper correction?

Dragon Fly Official is closely monitoring key signals:

Bitcoin ($76K–$78K): Watch for sustained support. A strong hold could signal a bullish continuation, while a break below may trigger wider volatility.

Ethereum & Layer-2s: Divergence between price action and network activity can indicate underlying str

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

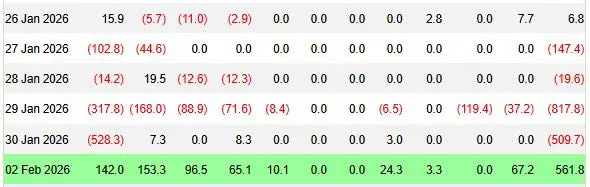

📈 BITCOIN ETF INFLOWS RETURN

Bitcoin spot ETFs recorded $561.9M in net inflows yesterday, ending 4 straight days of outflows.

Not a single ETF saw outflows.

Fidelity led with $153M, followed by BlackRock at $142M.

February’s FIRST inflow day has already outpaced ALL of January.

THE BID IS BACK.

$BTC

#WhenWillBTCRebound?

#StrategyBitcoinPositionTurnsRed

#BTCKeyLevelBreak

#CryptoMarketWatch

#USGovernmentShutdownRisk

Bitcoin spot ETFs recorded $561.9M in net inflows yesterday, ending 4 straight days of outflows.

Not a single ETF saw outflows.

Fidelity led with $153M, followed by BlackRock at $142M.

February’s FIRST inflow day has already outpaced ALL of January.

THE BID IS BACK.

$BTC

#WhenWillBTCRebound?

#StrategyBitcoinPositionTurnsRed

#BTCKeyLevelBreak

#CryptoMarketWatch

#USGovernmentShutdownRisk

BTC-3,92%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Thank you for the helpful information.💰 $SOL /USDT

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 103.45 - 102

🎯 TARGETS - 105.24, 108, 110, 114, 119

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 100.50

#CryptoMarketWatch

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 103.45 - 102

🎯 TARGETS - 105.24, 108, 110, 114, 119

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 100.50

#CryptoMarketWatch

SOL-4,72%

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketWatch

The crypto market is currently experiencing heightened volatility, with sharp swings and increasing divergence between bullish and bearish sentiment. Bitcoin, Ethereum, and selected altcoins are showing a mixture of consolidation, pullbacks, and selective strength, reflecting a complex interplay between macro conditions, investor positioning, derivatives activity, and adoption trends. This period of uncertainty is forcing both retail and institutional participants to carefully evaluate their strategies. While some market participants are leaning bullish in anticipation of a

The crypto market is currently experiencing heightened volatility, with sharp swings and increasing divergence between bullish and bearish sentiment. Bitcoin, Ethereum, and selected altcoins are showing a mixture of consolidation, pullbacks, and selective strength, reflecting a complex interplay between macro conditions, investor positioning, derivatives activity, and adoption trends. This period of uncertainty is forcing both retail and institutional participants to carefully evaluate their strategies. While some market participants are leaning bullish in anticipation of a

- Reward

- 7

- 7

- Repost

- Share

ybaser :

:

Thank you for the information and sharing.View More

#CryptoMarketWatch #CryptoMarketWatch February 2026 Market Snapshot

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging t

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging t

- Reward

- 3

- 4

- Repost

- Share

DragonFlyOfficial :

:

Buy To Earn 💎View More

#CryptoMarketWatch

The most important reality of the current cycle is that cryptocurrency has matured from an isolated speculative experiment into a fully connected global macro asset. In earlier years Bitcoin moved mainly on internal narratives such as halvings, exchange hacks, or retail mania. Today its behavior is deeply tied to interest rates, dollar liquidity, equity markets, and geopolitical uncertainty. When the cost of money rises, investors naturally demand safer returns, and speculative assets like crypto suffer. When central banks inject liquidity or signal easing, the same capital

The most important reality of the current cycle is that cryptocurrency has matured from an isolated speculative experiment into a fully connected global macro asset. In earlier years Bitcoin moved mainly on internal narratives such as halvings, exchange hacks, or retail mania. Today its behavior is deeply tied to interest rates, dollar liquidity, equity markets, and geopolitical uncertainty. When the cost of money rises, investors naturally demand safer returns, and speculative assets like crypto suffer. When central banks inject liquidity or signal easing, the same capital

- Reward

- 10

- 12

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch 📢 Gate Square Daily | Feb 3

Today’s market narrative is shifting from panic to positioning. Let’s break it down:

1️⃣ Institutions Accumulating

Strategy now holds 713,502 BTC at an average price of $76,052.

Big players are not exiting — they’re building long-term exposure.

2️⃣ Ethereum Capital Flow

Bitmine added 41,788 ETH, pushing total ETH holdings to nearly $9.9B.

Quiet accumulation continues while retail hesitates.

3️⃣ Mining Innovation

Tether launched MOS, an open-source Bitcoin mining OS.

Infrastructure development during volatility = long-term confidence signal.

4️⃣ 2

Today’s market narrative is shifting from panic to positioning. Let’s break it down:

1️⃣ Institutions Accumulating

Strategy now holds 713,502 BTC at an average price of $76,052.

Big players are not exiting — they’re building long-term exposure.

2️⃣ Ethereum Capital Flow

Bitmine added 41,788 ETH, pushing total ETH holdings to nearly $9.9B.

Quiet accumulation continues while retail hesitates.

3️⃣ Mining Innovation

Tether launched MOS, an open-source Bitcoin mining OS.

Infrastructure development during volatility = long-term confidence signal.

4️⃣ 2

- Reward

- 7

- 10

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

15.86K Popularity

10.39K Popularity

5.72K Popularity

735 Popularity

4.01K Popularity

5.31K Popularity

17.37K Popularity

15.47K Popularity

12.48K Popularity

13.89K Popularity

10.98K Popularity

2.84K Popularity

85 Popularity

30.03K Popularity

224.07K Popularity

News

View MoreU.S. stocks continue to decline, with the S&P 500 index down 1%

2 m

BTC drops below 76,000 USDT

23 m

The probability that the Federal Reserve will keep interest rates unchanged in March is currently reported at 91%.

37 m

Axie Infinity is planning to launch a new token, bAXS, and will conduct two rounds of airdrops to distribute it to the community.

1 h

Data: Over the past 24 hours, total liquidations across the network reached $279 million, with long positions liquidated at $170 million and short positions at $109 million.

1 h

Pin