# Yap

8.7K

GuiguziResearchInstitu

Many people talk about decentralized storage, and the first name that comes to mind is often IPFS. After all, this thing came out early and sounds quite sci-fi: "content addressing, peer-to-peer, permanent storage." In fact, @irys_xyz has changed everything.

People who have really used it know - it is actually like a "global shared mobile hard drive". It sounds grand, but in practice, there are various issues like "can't find files", "speed is a mystery", and "data relies on friendship".

1. The essential issue of IPFS: a product of idealism

The underlying logic of IPFS is "distributed file

View OriginalPeople who have really used it know - it is actually like a "global shared mobile hard drive". It sounds grand, but in practice, there are various issues like "can't find files", "speed is a mystery", and "data relies on friendship".

1. The essential issue of IPFS: a product of idealism

The underlying logic of IPFS is "distributed file

- Reward

- 7

- 2

- Repost

- Share

GateUser-4b1af250 :

:

Tell a new story. This story has already been played by fil.View More

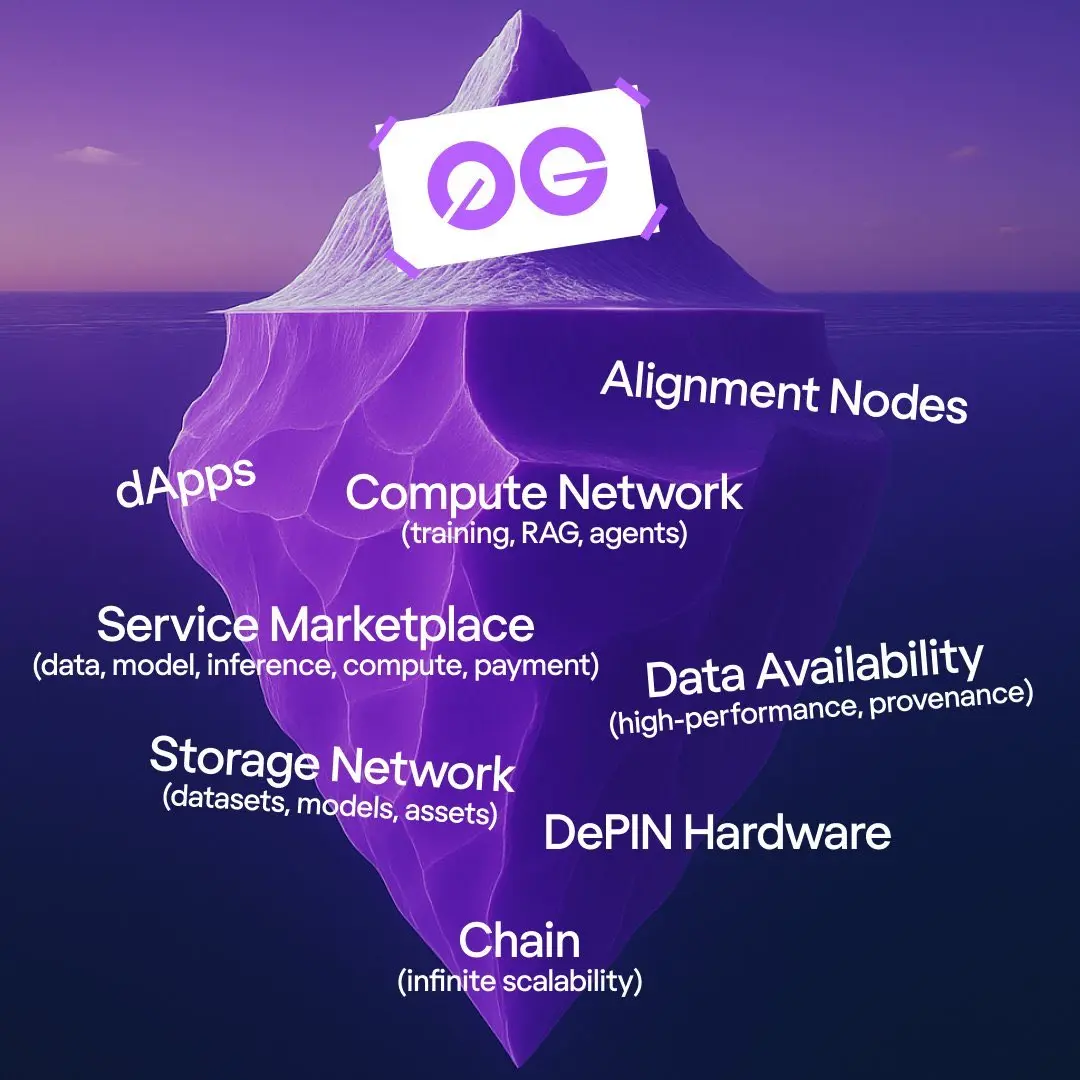

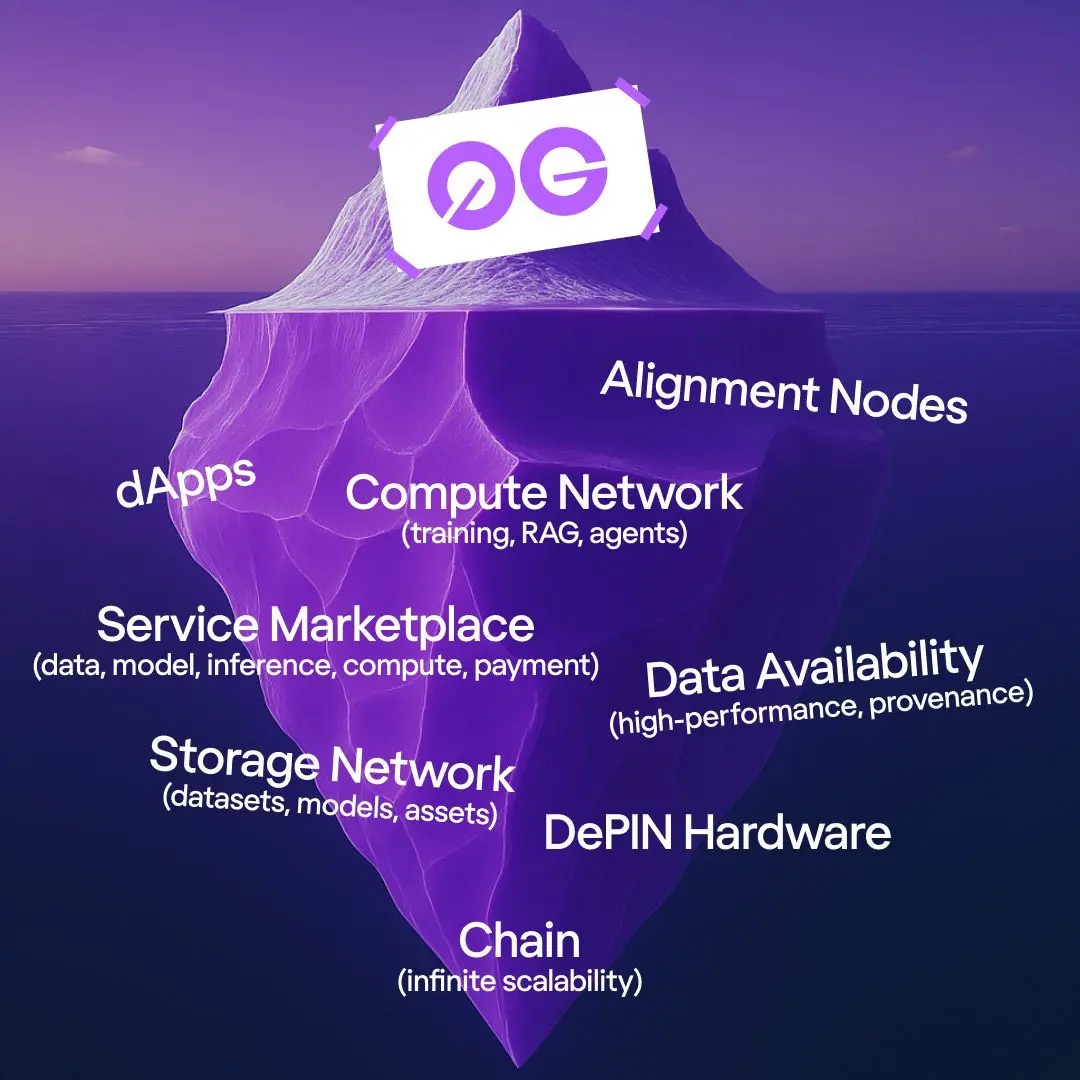

At the intersection of AI and Blockchain, @0G_labs is quietly laying the foundational infrastructure for the future. Since its establishment in 2024, its goal has been clear: to provide a complete ecosystem for Decentralization AI, from chain to computation, from storage to governance, creating a full-stack solution.

The architecture of 0G can be divided into seven core modules: Chain, Storage Network, Service Marketplace, Compute Network, Data Availability, DePIN Hardware, and Alignment Nodes.

Blockchain (Chain) provides unlimited scalability, laying the foundation for future growth in scale;

The architecture of 0G can be divided into seven core modules: Chain, Storage Network, Service Marketplace, Compute Network, Data Availability, DePIN Hardware, and Alignment Nodes.

Blockchain (Chain) provides unlimited scalability, laying the foundation for future growth in scale;

View Original

- Reward

- like

- Comment

- Repost

- Share

Brothers, the rankings have really been heating up these past few days, with the Snapshot approaching, and if you're not careful, you could be overtaken! But to be honest, many people are only focusing on the performance surge of 0G Labs, overlooking an even more explosive piece of news: @0G_labs paired with @symbioticfi feels like it has added a safety plug to 0G, integrating with 0G since the first day of Mainnet launch, filling a crucial gap for the AI public chain.

It is important to know that Symbiotic is a re-staking protocol in the Ethereum ecosystem (similar to EigenLayer), which w

View OriginalIt is important to know that Symbiotic is a re-staking protocol in the Ethereum ecosystem (similar to EigenLayer), which w

- Reward

- like

- Comment

- Repost

- Share

This morning I checked @0G_labs' official Twitter, and caught up on DL Research's interview with @michaelh_0g. In summary:

The future is not about "a single large model dominating the world," but rather an era of thousands of small intelligent agents collaborating. Imagine that AI is no longer a giant, but countless small assistants working simultaneously in different scenarios. To make this model work, real-time data, low-latency computing, and verifiable storage are essential—which is precisely where 0G comes into play.

0G's positioning is also very unique; it is not only a blockchain but al

The future is not about "a single large model dominating the world," but rather an era of thousands of small intelligent agents collaborating. Imagine that AI is no longer a giant, but countless small assistants working simultaneously in different scenarios. To make this model work, real-time data, low-latency computing, and verifiable storage are essential—which is precisely where 0G comes into play.

0G's positioning is also very unique; it is not only a blockchain but al

VC-3,95%

- Reward

- like

- Comment

- Repost

- Share

In the wave of Decentralization AI and NFT integration, @0G_labs has launched a new ecosystem—AIverse, a marketplace specifically designed for minting, trading, and collecting intelligent NFTs.

If you are a holder of @OneGravityNFT, there are exclusive early bird benefits here— a total of 1888 holders can be the first to experience AIverse and mint the first batch of iNFT. The initial minting will take place on the 0G Galileo testnet, and after the mainnet goes live, iNFT can be seamlessly migrated to the mainnet, truly achieving asset flow across chains.

iNFT is an NFT type based on the ERC-7

View OriginalIf you are a holder of @OneGravityNFT, there are exclusive early bird benefits here— a total of 1888 holders can be the first to experience AIverse and mint the first batch of iNFT. The initial minting will take place on the 0G Galileo testnet, and after the mainnet goes live, iNFT can be seamlessly migrated to the mainnet, truly achieving asset flow across chains.

iNFT is an NFT type based on the ERC-7

- Reward

- like

- Comment

- Repost

- Share

[Signal Access... Background Sound: Slight Static Noise]

"Dear listeners, this is the 'Crypto Future Channel'. Today, we have received a signal from the near future, describing how an interstellar spaceship named '@Infinit_Labs' has solved the ancient problem of centralization..."

"The core of this spaceship is a precision engine called 'Governance'. In past spaceships, whoever had more fuel had the louder voice, which we referred to as 'Whale Dominance'."

What is the result? Spaceships often head to the planets of a few people's private interests, while the

"Dear listeners, this is the 'Crypto Future Channel'. Today, we have received a signal from the near future, describing how an interstellar spaceship named '@Infinit_Labs' has solved the ancient problem of centralization..."

"The core of this spaceship is a precision engine called 'Governance'. In past spaceships, whoever had more fuel had the louder voice, which we referred to as 'Whale Dominance'."

What is the result? Spaceships often head to the planets of a few people's private interests, while the

IN-2,88%

- Reward

- like

- Comment

- Repost

- Share

September and October are golden months; the WLFI leading the charge at the beginning of September was truly a pleasant surprise! There are still many project TGEs coming up later this month, but what I’m really looking forward to is the upcoming @0G_labs. I hope everyone can achieve good results.

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

WLFI-5,61%

- Reward

- like

- Comment

- Repost

- Share

September and October are golden months; the WLFI leading the charge at the beginning of September was truly a pleasant surprise! There are still many project TGEs coming up later this month, but what I’m really looking forward to is the upcoming @0G_labs. I hope everyone can achieve good results.

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

WLFI-5,61%

- Reward

- like

- Comment

- Repost

- Share

Everyone has been talking about Irys lately, but very few people truly understand what it aims to do.

In a nutshell: Irys wants to turn "data" into a real asset.

The founder once said a harsh word:

"Data is the most inefficient market in the world; from storage to circulation, every layer is being over-extracted for value. Creating Irys is about completely changing this situation."

What he wants to do is not just "cheaper storage," but to enable data to be used, priced, and circulated —

Let every piece of data have a value label, so it can run on the chain like an asset.

Now Irys is capable of

View OriginalIn a nutshell: Irys wants to turn "data" into a real asset.

The founder once said a harsh word:

"Data is the most inefficient market in the world; from storage to circulation, every layer is being over-extracted for value. Creating Irys is about completely changing this situation."

What he wants to do is not just "cheaper storage," but to enable data to be used, priced, and circulated —

Let every piece of data have a value label, so it can run on the chain like an asset.

Now Irys is capable of

- Reward

- like

- Comment

- Repost

- Share

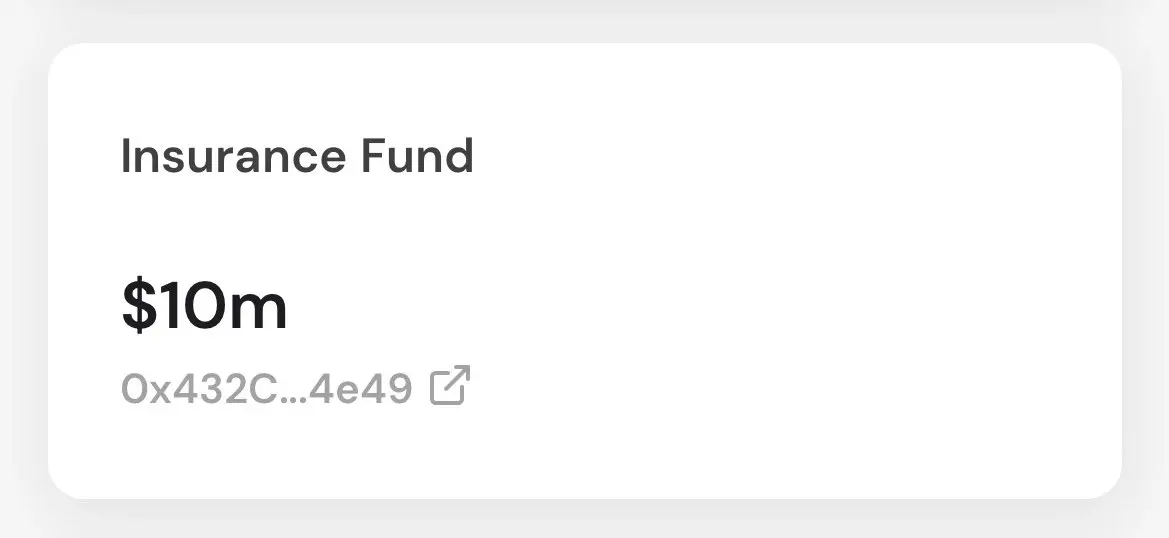

The Falcon insurance fund has been launched, further strengthening the ecological moat!

Falcon Finance announced the injection of the first batch of 10 million USD1 into its on-chain insurance fund. This means that Falcon is not only providing high-yield synthetic dollars USDf, but is also actively building a risk buffer layer to provide long-term security for the entire ecosystem!

▰▰▰▰▰

Why is this important?

※ Protect USDf holders

The insurance fund is a secure backing for USDf. In the event of extreme market conditions, the fund pool can serve as a buffer to reduce user risk.

※ Institutiona

View OriginalFalcon Finance announced the injection of the first batch of 10 million USD1 into its on-chain insurance fund. This means that Falcon is not only providing high-yield synthetic dollars USDf, but is also actively building a risk buffer layer to provide long-term security for the entire ecosystem!

▰▰▰▰▰

Why is this important?

※ Protect USDf holders

The insurance fund is a secure backing for USDf. In the event of extreme market conditions, the fund pool can serve as a buffer to reduce user risk.

※ Institutiona

- Reward

- like

- 2

- Repost

- Share

LittleQueen :

:

should we hold or View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.29K Popularity

31.56K Popularity

11.99K Popularity

2.26K Popularity

1.36K Popularity

877 Popularity

128.36K Popularity

10.23K Popularity

102.82K Popularity

14.96K Popularity

137.87K Popularity

1M Popularity

245.27K Popularity

1.91K Popularity

299.26K Popularity

News

View MoreTom Lee:Vitalik与Sam Altman将出席BitMine股东大会

8 m

Power Spark is about to launch an AI trading large model, dedicated to building intelligent trading infrastructure.

15 m

BlackRock CEO: The US economy will grow above average in the next few years and investments will be safer than a year ago

30 m

The USD/CHF intraday increase has expanded to 0.5%, currently at 0.8038

34 m

Data: 156 BTC transferred from anonymous addresses, worth approximately $15.06 million

35 m

Pin