交易员汤龙

No content yet

交易员汤龙

Ethereum (ETH) Morning Outlook:

From the 4-hour timeframe, the price surged to touch the upper band but faced resistance and pulled back,

Short-term bearish momentum continues to be released, with the trend moving downward,

And it has effectively broken below the middle band support, currently approaching the lower band area.

The Bollinger Bands are showing a generally downward contraction,

All indicators and technical tools are dominated by bearish signals, with a bearish trend structure, and no clear signs of a bottom or reversal in the short term.

Overall, the morning strategy remains to sh

From the 4-hour timeframe, the price surged to touch the upper band but faced resistance and pulled back,

Short-term bearish momentum continues to be released, with the trend moving downward,

And it has effectively broken below the middle band support, currently approaching the lower band area.

The Bollinger Bands are showing a generally downward contraction,

All indicators and technical tools are dominated by bearish signals, with a bearish trend structure, and no clear signs of a bottom or reversal in the short term.

Overall, the morning strategy remains to sh

ETH-2,35%

- Reward

- like

- Comment

- Repost

- Share

1.8 Morning|Bitcoin Trading Strategy: Bulls Weakening, Rebound as Shorting Opportunity

The key to a day is in the morning. As a new day begins, I wish everyone successful trading.

Looking back at yesterday’s market, Bitcoin remained predominantly bearish overall.

After a brief surge in the morning, the price steadily declined, with the overnight low reaching around 90600.

The overall bearish outlook and short-selling strategy have been running smoothly. Currently, the price is consolidating around 91200.

From the market structure perspective, the price failed to show a significant rebound afte

View OriginalThe key to a day is in the morning. As a new day begins, I wish everyone successful trading.

Looking back at yesterday’s market, Bitcoin remained predominantly bearish overall.

After a brief surge in the morning, the price steadily declined, with the overnight low reaching around 90600.

The overall bearish outlook and short-selling strategy have been running smoothly. Currently, the price is consolidating around 91200.

From the market structure perspective, the price failed to show a significant rebound afte

- Reward

- like

- Comment

- Repost

- Share

Deep cultivation will eventually resonate;

Striving will never be in vain.

Every sincere effort

Will slowly sprout over time and eventually bloom.

May all companions stay on the right rhythm.

Friends who want to join, feel free to reach out anytime. #我的2026第一条帖 #ETH走势分析 $BTC $ETH

View OriginalStriving will never be in vain.

Every sincere effort

Will slowly sprout over time and eventually bloom.

May all companions stay on the right rhythm.

Friends who want to join, feel free to reach out anytime. #我的2026第一条帖 #ETH走势分析 $BTC $ETH

- Reward

- like

- 1

- Repost

- Share

CryptoFiler :

:

Happy New Year! 🤑1.7 Evening | Latest Bitcoin Strategy

The core approach for recent operations has always been clear—short on rebounds, short at high levels.

From the intraday trend, the bears remain the dominant force, with rebound strength continuously weakening, and no substantial change in structure.

From a technical perspective:

On the 4-hour chart, the price has broken below the mid-line support, indicating a bearish trend, with further downside potential;

All technical indicators are generally bearish, with a consistent trend direction;

On the 1-hour chart, after a previous surge, the current pattern re

The core approach for recent operations has always been clear—short on rebounds, short at high levels.

From the intraday trend, the bears remain the dominant force, with rebound strength continuously weakening, and no substantial change in structure.

From a technical perspective:

On the 4-hour chart, the price has broken below the mid-line support, indicating a bearish trend, with further downside potential;

All technical indicators are generally bearish, with a consistent trend direction;

On the 1-hour chart, after a previous surge, the current pattern re

BTC-1,25%

- Reward

- like

- Comment

- Repost

- Share

The United States' December ADP employment data and ISM Non-Manufacturing PMI are about to be released,

Their results will directly influence short-term market trends through Fed rate cut expectations.

The following three scenarios are projected:

1️⃣ Data exceeds expectations

Economic resilience is relatively strong → Rate cut expectations cool down

Bitcoin and altcoins may face short-term pressure, with a higher probability of a pullback.

2️⃣ Data falls short of expectations

Signs of economic slowdown intensify → Rate cut expectations increase

Bitcoin and altcoins are likely to experience a s

View OriginalTheir results will directly influence short-term market trends through Fed rate cut expectations.

The following three scenarios are projected:

1️⃣ Data exceeds expectations

Economic resilience is relatively strong → Rate cut expectations cool down

Bitcoin and altcoins may face short-term pressure, with a higher probability of a pullback.

2️⃣ Data falls short of expectations

Signs of economic slowdown intensify → Rate cut expectations increase

Bitcoin and altcoins are likely to experience a s

- Reward

- 1

- Comment

- Repost

- Share

The "Century Battle" of the Federal Reserve Rate Cuts in 2026

Inside the Federal Reserve, the most intense disagreement in nearly six years is unfolding.

Regarding "how much to cut and when," officials are almost at each other's throats—

One faction advocates for a cumulative rate cut of over 100 basis points within the year, openly stating that the current interest rate level of 3.5%–3.75% is continuously suppressing the economy;

The other faction is staunchly defending the inflation guardrail, insisting on a maximum of 25 basis points per cut, refusing to yield an inch.

The two sides are dia

View OriginalInside the Federal Reserve, the most intense disagreement in nearly six years is unfolding.

Regarding "how much to cut and when," officials are almost at each other's throats—

One faction advocates for a cumulative rate cut of over 100 basis points within the year, openly stating that the current interest rate level of 3.5%–3.75% is continuously suppressing the economy;

The other faction is staunchly defending the inflation guardrail, insisting on a maximum of 25 basis points per cut, refusing to yield an inch.

The two sides are dia

- Reward

- 10

- 4

- Repost

- Share

GateUser-9486cebc :

:

Hop on board!🚗View More

Looking back at the altcoin market after yesterday's gap up,

The overall strategy is clear, always focusing on shorting around high levels, with rhythm control always on point.

The real trading performance is as follows:

BNB short entry, capturing 24 points of space

LTC short entry, realizing 4 points of space

SOL short entry, gaining 7 points of space

The market will fluctuate repeatedly; rhythm is the key.

The process of accumulation is destined to be long, requiring time to settle.

Steady steps are more important than any aggressive sprint.

Don't fantasize about getting rich overnight, as i

View OriginalThe overall strategy is clear, always focusing on shorting around high levels, with rhythm control always on point.

The real trading performance is as follows:

BNB short entry, capturing 24 points of space

LTC short entry, realizing 4 points of space

SOL short entry, gaining 7 points of space

The market will fluctuate repeatedly; rhythm is the key.

The process of accumulation is destined to be long, requiring time to settle.

Steady steps are more important than any aggressive sprint.

Don't fantasize about getting rich overnight, as i

- Reward

- like

- Comment

- Repost

- Share

SOL Market Brief Analysis:

The overall trend is relatively stable, with limited volatility, currently mainly in a consolidation phase. In the short term, both bulls and bears have trading opportunities, but caution is needed regarding positioning.

Currently, the price is at a relatively high level, and the short-term strategy is to consider shorting at resistance levels.

Operational reference:

Consider short positions in the 139.5 – 141 range

Focus on targets around 133 – 128 below

Adopt a consolidation approach, trade quickly in and out, and pay attention to controlling pace and risk.

View OriginalThe overall trend is relatively stable, with limited volatility, currently mainly in a consolidation phase. In the short term, both bulls and bears have trading opportunities, but caution is needed regarding positioning.

Currently, the price is at a relatively high level, and the short-term strategy is to consider shorting at resistance levels.

Operational reference:

Consider short positions in the 139.5 – 141 range

Focus on targets around 133 – 128 below

Adopt a consolidation approach, trade quickly in and out, and pay attention to controlling pace and risk.

- Reward

- like

- Comment

- Repost

- Share

BNB Market Brief:

Last night, influenced by the US stock market trend, the price initially surged, then retreated to around 892 in the early morning to find support and rebounded. Currently, it is consolidating around 908.

From a structural perspective, the short-term highs are gradually declining, and the rebound momentum is weak, with limited room for further upward movement.

The short-term strategy is to short on rebounds facing resistance.

Operational references:

Consider short positions when rebounding to the 910–915 range

Watch for support around 890 below

Overall, focus on short

View OriginalLast night, influenced by the US stock market trend, the price initially surged, then retreated to around 892 in the early morning to find support and rebounded. Currently, it is consolidating around 908.

From a structural perspective, the short-term highs are gradually declining, and the rebound momentum is weak, with limited room for further upward movement.

The short-term strategy is to short on rebounds facing resistance.

Operational references:

Consider short positions when rebounding to the 910–915 range

Watch for support around 890 below

Overall, focus on short

- Reward

- like

- Comment

- Repost

- Share

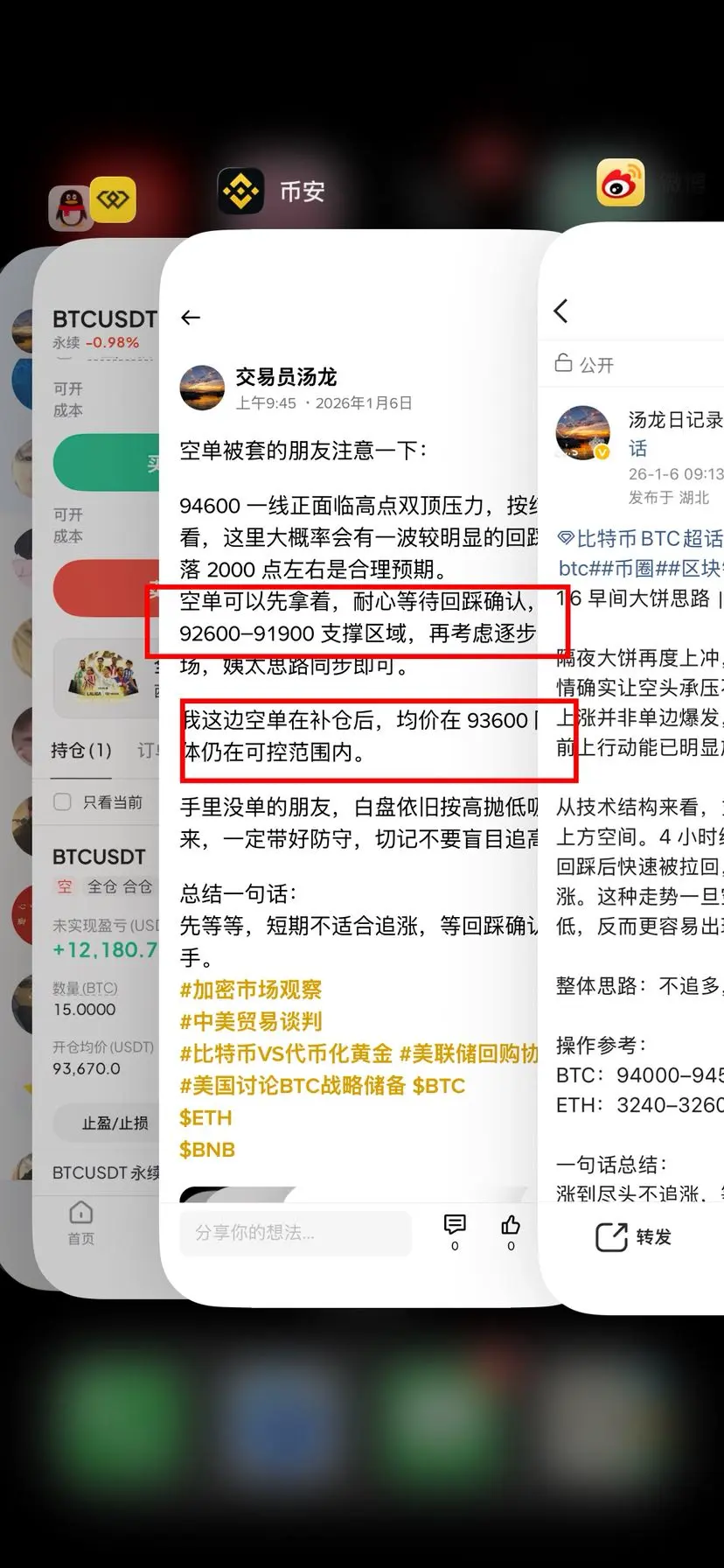

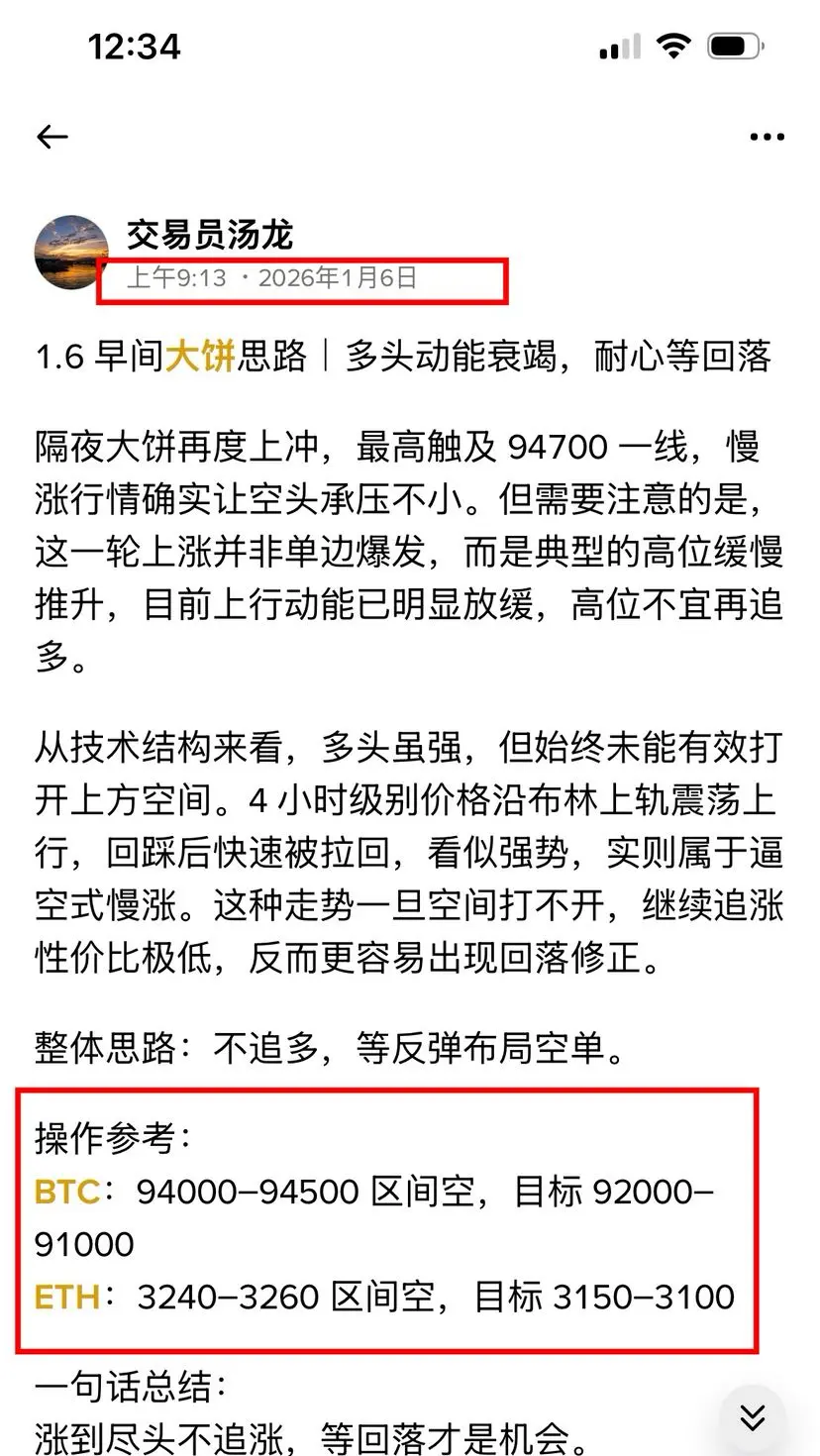

1.7 Morning | Tang Long's Trading Strategy Analysis

The overall rhythm of overnight market movements closely aligns with expectations.

The bullish-to-bearish structure of Bitcoin first played out smoothly, with the price rapidly rising to around 94400 after the US stock market opened. Subsequently, at a key resistance zone, Tang Long decisively issued a short position strategy around the 94000 level. The market then retraced, dipping to around 91200, with ample space for movement, and overall execution was very smooth.

It is important to emphasize that this retracement is a technical correctio

View OriginalThe overall rhythm of overnight market movements closely aligns with expectations.

The bullish-to-bearish structure of Bitcoin first played out smoothly, with the price rapidly rising to around 94400 after the US stock market opened. Subsequently, at a key resistance zone, Tang Long decisively issued a short position strategy around the 94000 level. The market then retraced, dipping to around 91200, with ample space for movement, and overall execution was very smooth.

It is important to emphasize that this retracement is a technical correctio

- Reward

- like

- Comment

- Repost

- Share

92,300 has been reached, the market has come down, brothers.

I have already secured my gains in this wave and exited early, finally able to breathe a sigh of relief.

The morning analysis was very clear—at this stage, I personally will not easily waver:

Support at 91,800, resistance at 94,600, the structure remains clear.

The idea shared by Tanglong in the early session—

Bitcoin at 94,000–94,500, go short directly,

The market dipped to a low of 92,340,

This entire move offers a 2,100-point downward space, with a clean and decisive rhythm.

The points for the mistress (姨太) were slightly off, but

View OriginalI have already secured my gains in this wave and exited early, finally able to breathe a sigh of relief.

The morning analysis was very clear—at this stage, I personally will not easily waver:

Support at 91,800, resistance at 94,600, the structure remains clear.

The idea shared by Tanglong in the early session—

Bitcoin at 94,000–94,500, go short directly,

The market dipped to a low of 92,340,

This entire move offers a 2,100-point downward space, with a clean and decisive rhythm.

The points for the mistress (姨太) were slightly off, but

- Reward

- like

- Comment

- Repost

- Share

Recent market trends have been continuously rising, and many friends' short positions are firmly trapped,

The more they hold on, the more passive they become; the more they add, the more out of control they get, disrupting both the rhythm and mindset.

At this stage, stubbornly holding on is not the solution; blindly adding to positions will only accelerate deterioration.

The truly effective approach is to cut losses when necessary and decisively reverse positions when appropriate.

Real trading example:

Short position stop-loss -3K barrels of oil,

Follow the trend to reverse to a long position,

View OriginalThe more they hold on, the more passive they become; the more they add, the more out of control they get, disrupting both the rhythm and mindset.

At this stage, stubbornly holding on is not the solution; blindly adding to positions will only accelerate deterioration.

The truly effective approach is to cut losses when necessary and decisively reverse positions when appropriate.

Real trading example:

Short position stop-loss -3K barrels of oil,

Follow the trend to reverse to a long position,

- Reward

- 1

- Comment

- Repost

- Share

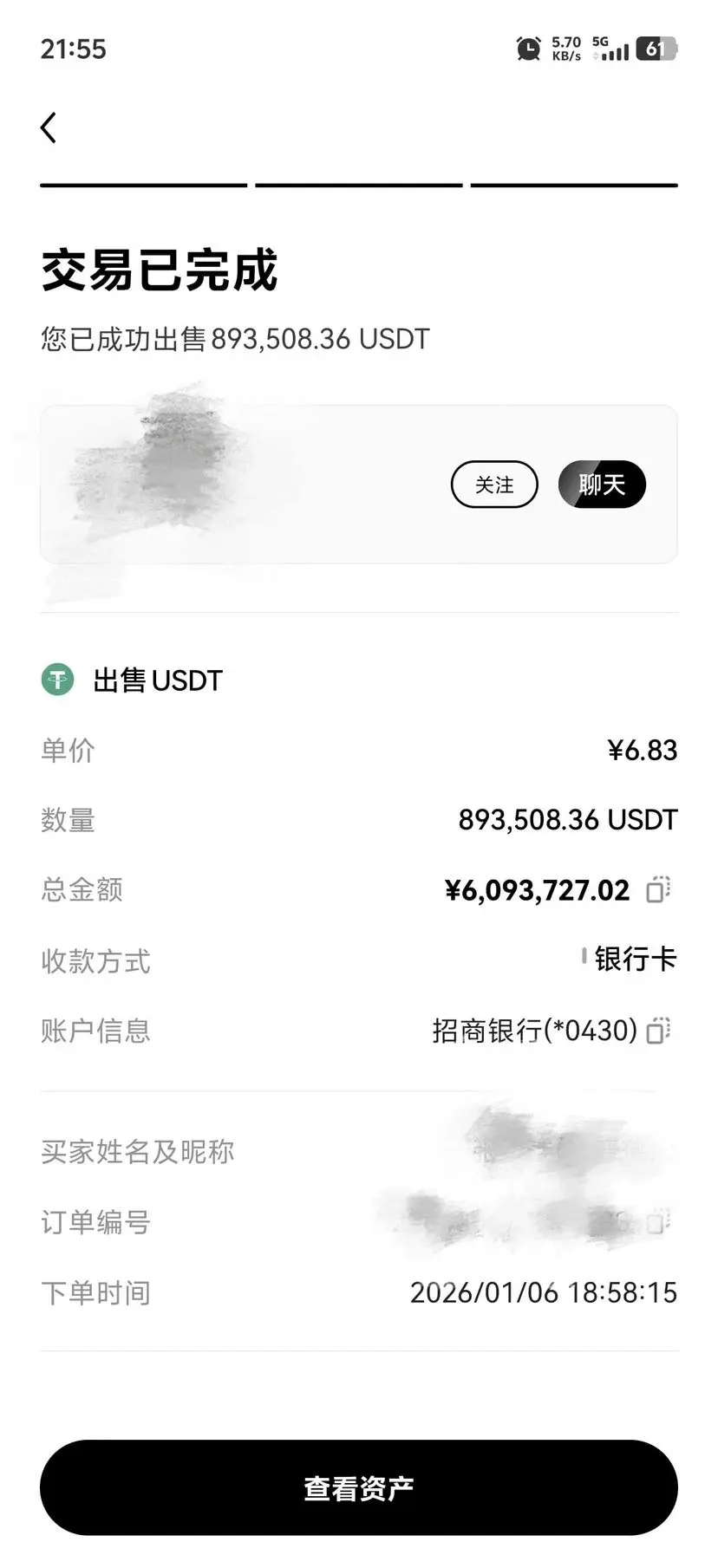

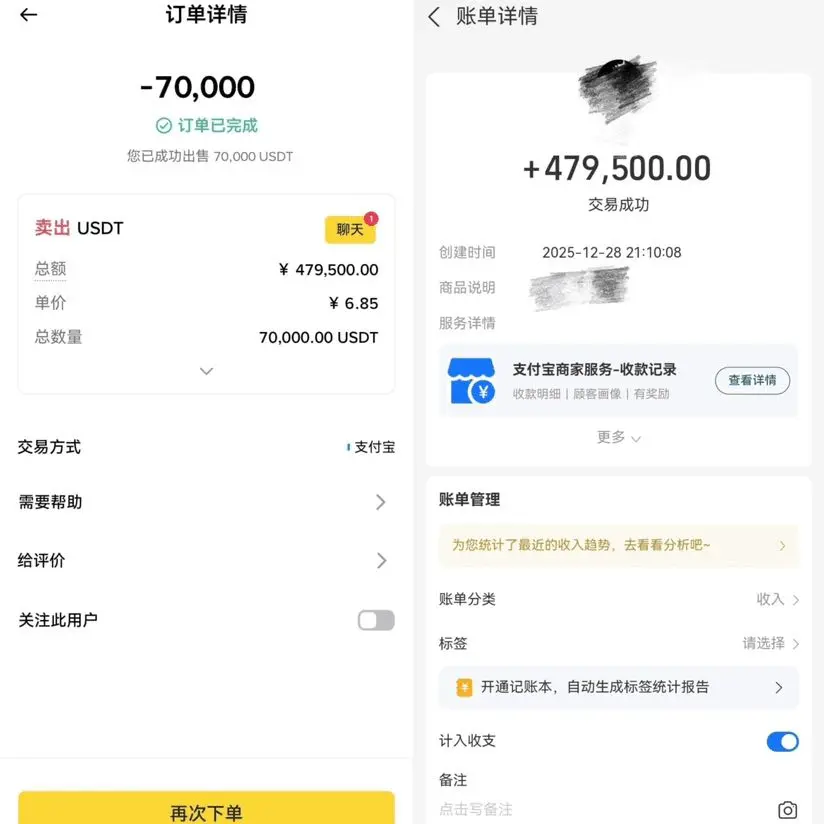

It is uncommon for someone to make a one-time move of over 6 million,

but what is truly rare is maintaining clear execution ability at critical moments.

Next, we will enter a transitional period,

If you currently have no clear direction, feel free to reach out for updates.

The overall strategy remains unchanged, focusing on short-term trades combined with swing trading, riding the trend, and progressing steadily. #ETH走势分析 $ETH

but what is truly rare is maintaining clear execution ability at critical moments.

Next, we will enter a transitional period,

If you currently have no clear direction, feel free to reach out for updates.

The overall strategy remains unchanged, focusing on short-term trades combined with swing trading, riding the trend, and progressing steadily. #ETH走势分析 $ETH

ETH-2,35%

- Reward

- like

- Comment

- Repost

- Share

December is coming to an end, and the year is approaching. The market rhythm is accelerating, and opportunities are entering the countdown stage.

If you have been waiting and watching before, now is the critical window to follow the trend and seize the structural opportunities.

We adhere to not holding against the trend, not going against the market, and maintaining full transparency in strategy execution.

Each round of positioning is based on market logic and risk control systems, serving only traders who truly respect professionalism.

In the current oscillating and structurally biased market

If you have been waiting and watching before, now is the critical window to follow the trend and seize the structural opportunities.

We adhere to not holding against the trend, not going against the market, and maintaining full transparency in strategy execution.

Each round of positioning is based on market logic and risk control systems, serving only traders who truly respect professionalism.

In the current oscillating and structurally biased market

BTC-1,25%

- Reward

- 1

- 1

- Repost

- Share

Ironed :

:

Jump in 🚀The Iron Law of Survival in the Crypto World: Your True Opponent Has Never Been Market Fluctuations

In this gladiatorial arena of the crypto world, what knocks traders down is never the rise or fall itself,

but that uncontrollable hand that always wants to jump ahead.

How many people have fallen to the floor cutting losses, or chased highs at the peak?

The root cause is only one—emotional out of control.

Fearing zero after a decline, fearing missing out after a rise, once driven by emotion, operations begin to distort,

shifting from riding the trend to sending money against the trend.

The mark

In this gladiatorial arena of the crypto world, what knocks traders down is never the rise or fall itself,

but that uncontrollable hand that always wants to jump ahead.

How many people have fallen to the floor cutting losses, or chased highs at the peak?

The root cause is only one—emotional out of control.

Fearing zero after a decline, fearing missing out after a rise, once driven by emotion, operations begin to distort,

shifting from riding the trend to sending money against the trend.

The mark

BTC-1,25%

- Reward

- like

- Comment

- Repost

- Share

BNB Strategy Update:

From the 4-hour timeframe, the price has already experienced a slight pullback and is currently trading below the upper Bollinger Band. The highest touch was at the 916 level, but no sustained momentum was formed, with clear resistance above.

Combined with the 1-hour timeframe, both KDJ and MACD are turning downward simultaneously, indicating weakening short-term momentum. There is still some room for a correction downward.

The overall approach is to focus on shorting rebounds.

Trading suggestion:

Short in the 910–915 range, with a target around 870,

Set stop-loss flexibly

From the 4-hour timeframe, the price has already experienced a slight pullback and is currently trading below the upper Bollinger Band. The highest touch was at the 916 level, but no sustained momentum was formed, with clear resistance above.

Combined with the 1-hour timeframe, both KDJ and MACD are turning downward simultaneously, indicating weakening short-term momentum. There is still some room for a correction downward.

The overall approach is to focus on shorting rebounds.

Trading suggestion:

Short in the 910–915 range, with a target around 870,

Set stop-loss flexibly

BTC-1,25%

- Reward

- like

- Comment

- Repost

- Share

LTC Thinking Update:

The overall trend is relatively mild, and since yesterday, it has been oscillating within a range. The short position above 85 given yesterday has already moved out a certain space during the session.

Currently, the price is above 84, but there are no signs of sustained upward attack, and the momentum is clearly insufficient. The overall trend still leans towards high-level resistance. The strategy remains mainly to short on rebounds.

Operational reference:

Short near 84–85, target the 75–73 zone.

One sentence summary:

No continuation of the rebound, do not chase longs at

The overall trend is relatively mild, and since yesterday, it has been oscillating within a range. The short position above 85 given yesterday has already moved out a certain space during the session.

Currently, the price is above 84, but there are no signs of sustained upward attack, and the momentum is clearly insufficient. The overall trend still leans towards high-level resistance. The strategy remains mainly to short on rebounds.

Operational reference:

Short near 84–85, target the 75–73 zone.

One sentence summary:

No continuation of the rebound, do not chase longs at

BTC-1,25%

- Reward

- like

- Comment

- Repost

- Share