If you stay in this market for a long time, you'll gradually realize one thing: the people who truly can traverse cycles are not the ones with the most accurate predictions, but those with the softest mindset.

What does soft mean? It means not fighting against the K-line. When prices are rising, don’t get carried away; when prices are falling, don’t panic; during sideways movements, don’t be anxious.

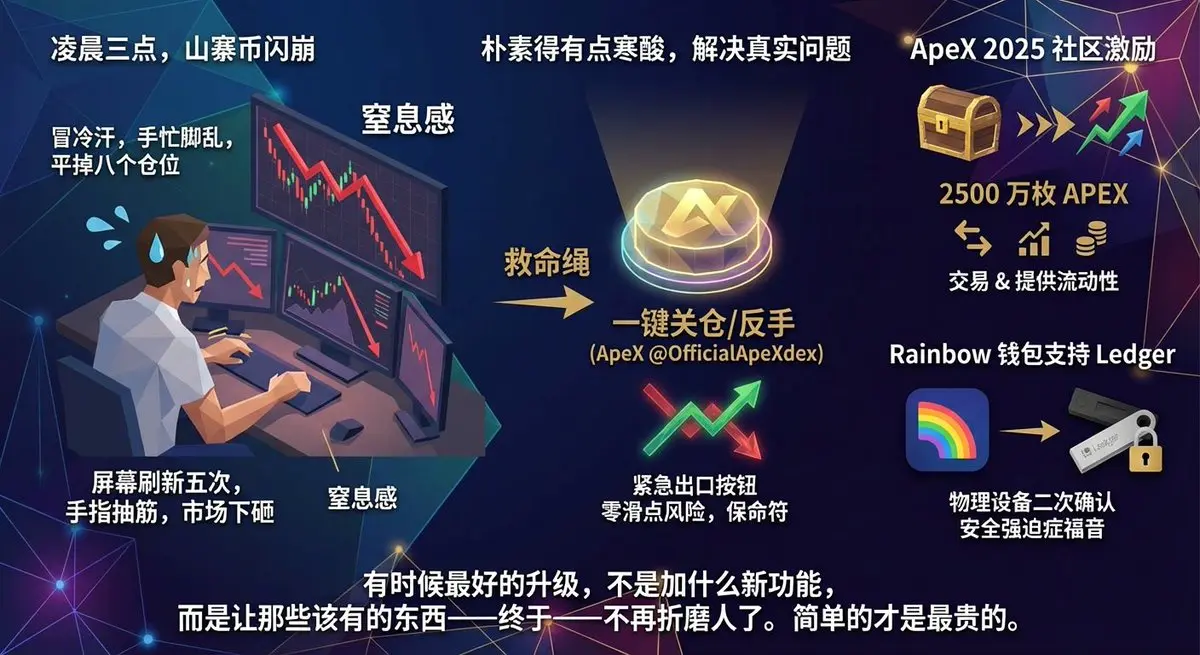

The most expensive cost in this market is never the transaction fee, but the part of yourself that is repeatedly consumed by fear and greed.

Too many people die by "hard holding." Holding on stubb

View OriginalWhat does soft mean? It means not fighting against the K-line. When prices are rising, don’t get carried away; when prices are falling, don’t panic; during sideways movements, don’t be anxious.

The most expensive cost in this market is never the transaction fee, but the part of yourself that is repeatedly consumed by fear and greed.

Too many people die by "hard holding." Holding on stubb