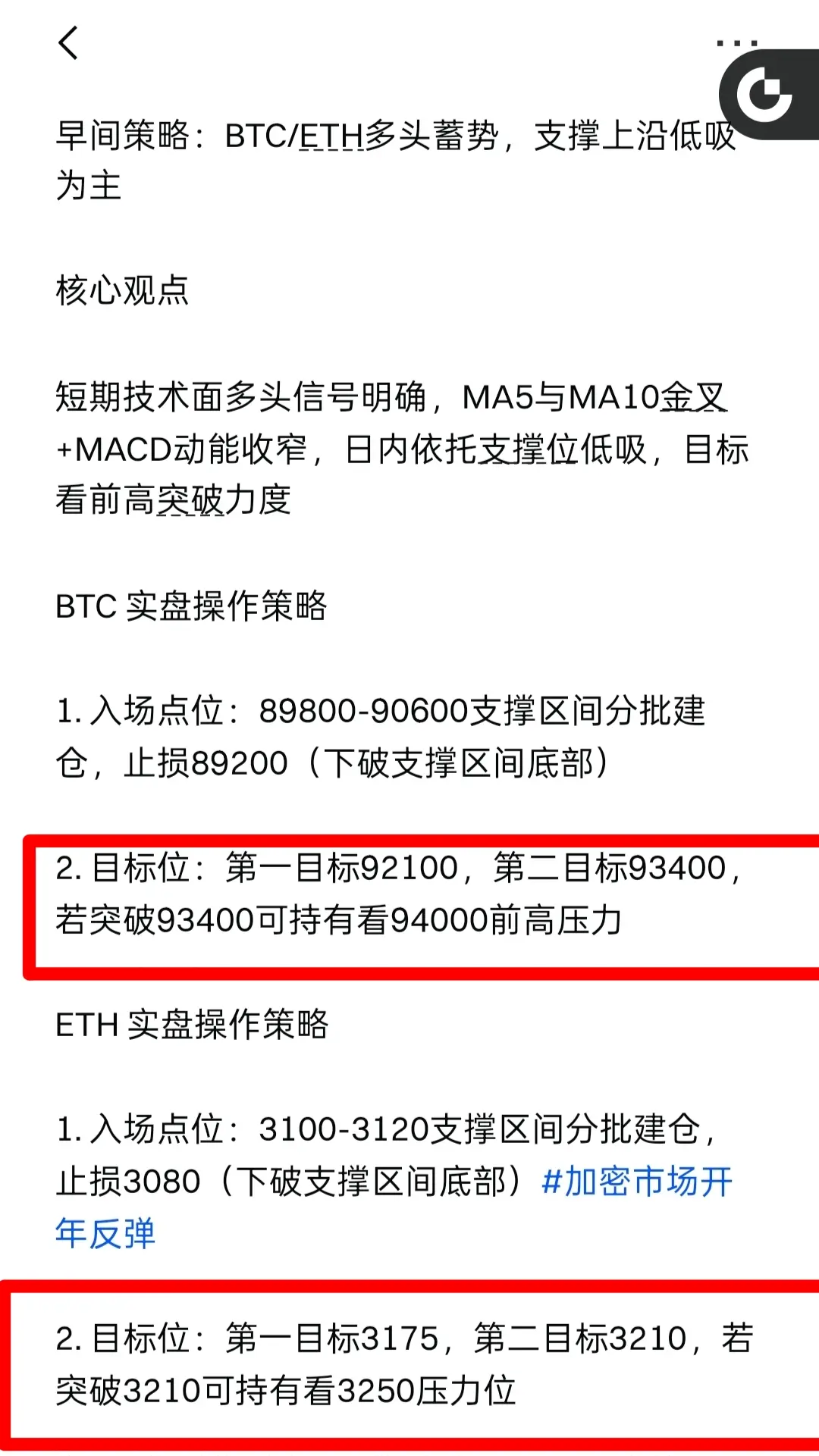

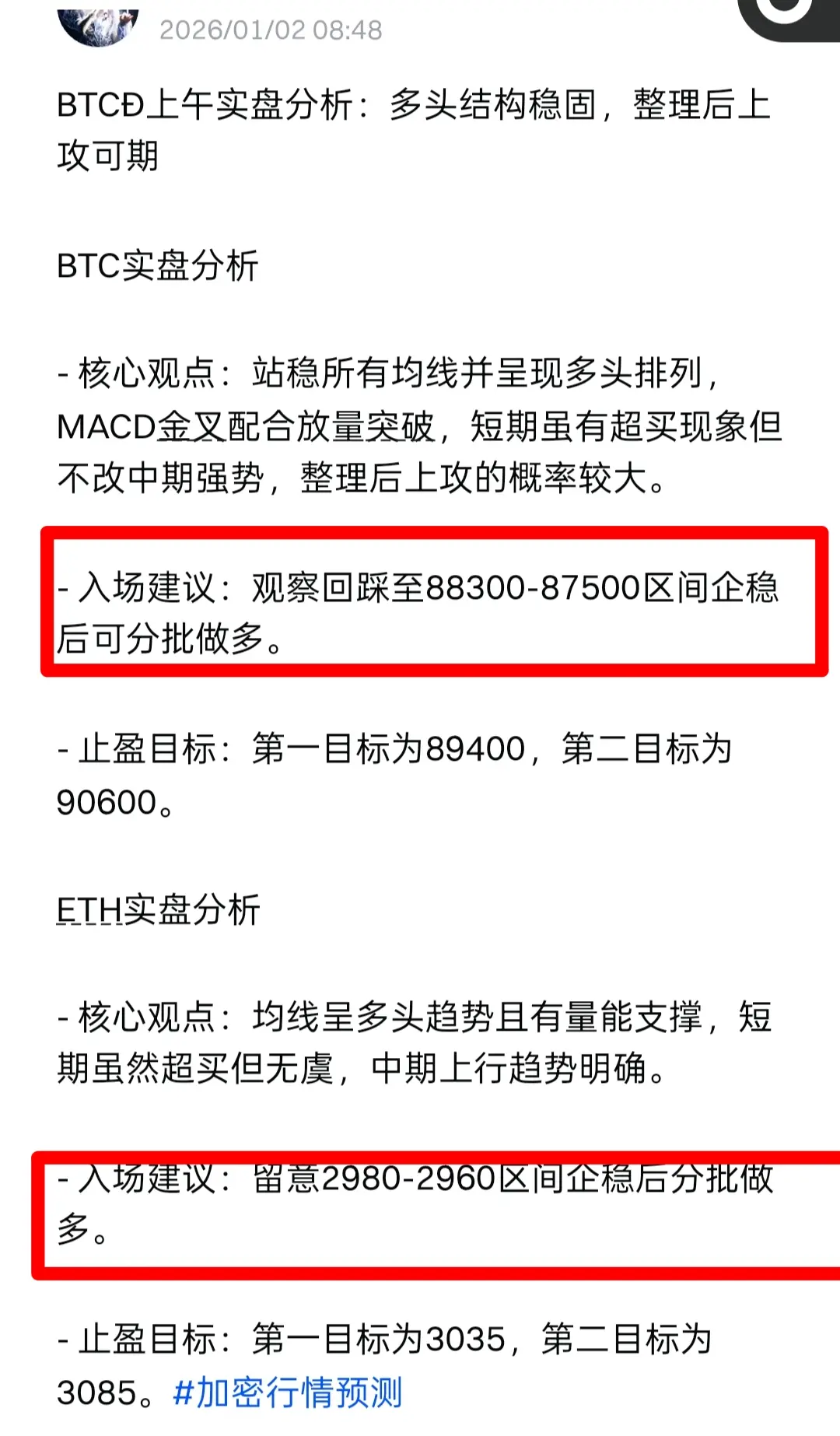

TakeProfitAsTheMainFocus.

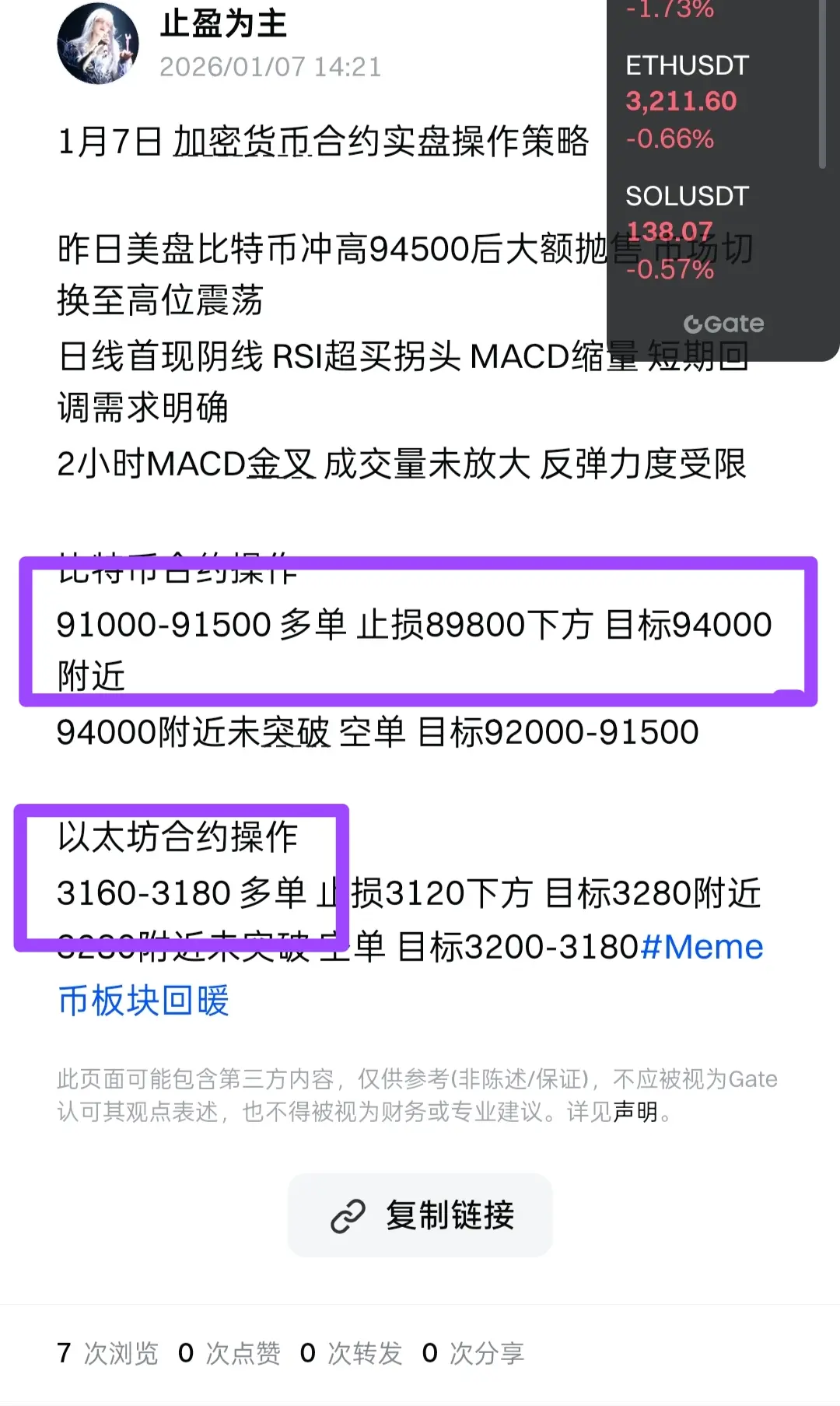

January 8 Bitcoin Contract Trading Analysis

Core Data

Current price around 91,000, 24-hour fluctuation range 91,000-94,400, approximately 2.8% decline. Contract trading volume is active, long and short liquidations are increasing, funding rates are returning to neutral, open interest has slightly increased.

Key Price Levels (Trading Anchors)

Resistance levels: 93,000 (1-hour midline), 94,400 (recent high)

Support levels: 91,000 (intraday liquidation line), 90,300 (4-hour SMA50), 89,000-90,000 (daily dense zone)

Technical Analysis

1-hour RSI 42.5, weak, MACD bearish

4-hour RSI 52.2, neutral, MA

Core Data

Current price around 91,000, 24-hour fluctuation range 91,000-94,400, approximately 2.8% decline. Contract trading volume is active, long and short liquidations are increasing, funding rates are returning to neutral, open interest has slightly increased.

Key Price Levels (Trading Anchors)

Resistance levels: 93,000 (1-hour midline), 94,400 (recent high)

Support levels: 91,000 (intraday liquidation line), 90,300 (4-hour SMA50), 89,000-90,000 (daily dense zone)

Technical Analysis

1-hour RSI 42.5, weak, MACD bearish

4-hour RSI 52.2, neutral, MA

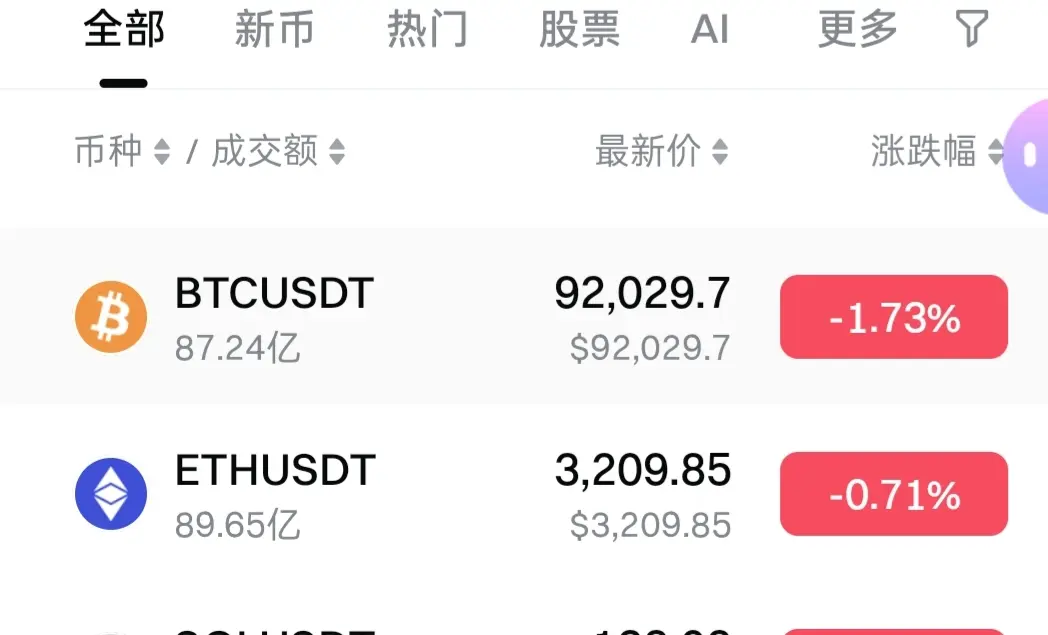

BTC-1,56%