Andy_88

No content yet

Andy_88

⁉️ Mysterious owner acquires IBIT shares worth $436 million

🟠 According to documents filed with the U.S. SEC, the largest new participant in the iShares Bitcoin Trust ETF by BlackRock is Laurore Ltd, which owned 8.79 million IBIT shares valued at $436 million as of December 31, 2025.

📈 This position makes Laurore the largest new IBIT holder appearing in the Q4 reports, although all that is known about the company is the name of the filer and the registration location.

Discussions about who the actual owner of Laurore is boil down to the fact that it comes from a jurisdiction where cryptocu

🟠 According to documents filed with the U.S. SEC, the largest new participant in the iShares Bitcoin Trust ETF by BlackRock is Laurore Ltd, which owned 8.79 million IBIT shares valued at $436 million as of December 31, 2025.

📈 This position makes Laurore the largest new IBIT holder appearing in the Q4 reports, although all that is known about the company is the name of the filer and the registration location.

Discussions about who the actual owner of Laurore is boil down to the fact that it comes from a jurisdiction where cryptocu

BTC-1,58%

- Reward

- 2

- Comment

- Repost

- Share

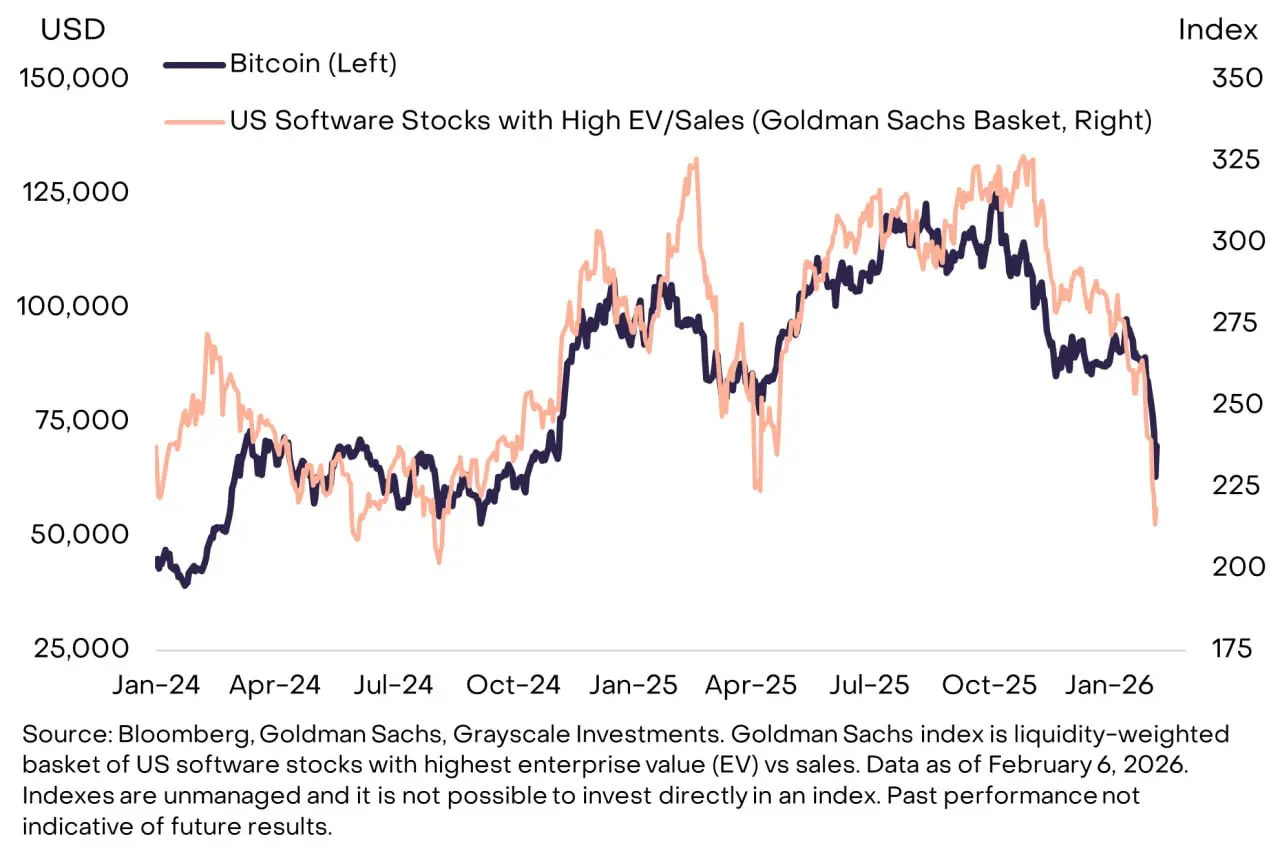

#CelebratingNewYearOnGateSquare 💰 BTC behaves like a tech stock

Bitcoin has moved almost in sync with the stocks of rapidly growing IT companies, according to Grayscale analysts. This has intensified the debate: is it more “digital gold” or a risky growth asset?

💬 Grayscale analysts note that in the short term, Bitcoin behaves like a growth asset. During the sell-off, it moved in tandem with software companies. This suggests that the decline was part of a general investor retreat from risk, rather than solely a crypto-specific problem.

At the same time, the idea of “digital gold” remains int

Bitcoin has moved almost in sync with the stocks of rapidly growing IT companies, according to Grayscale analysts. This has intensified the debate: is it more “digital gold” or a risky growth asset?

💬 Grayscale analysts note that in the short term, Bitcoin behaves like a growth asset. During the sell-off, it moved in tandem with software companies. This suggests that the decline was part of a general investor retreat from risk, rather than solely a crypto-specific problem.

At the same time, the idea of “digital gold” remains int

BTC-1,58%

- Reward

- 1

- Comment

- Repost

- Share

Bank of America records record pessimism on the US dollar February survey

A survey of fund managers controlling assets over $440,000,000,000+.

Coindesk: The number of bearish bets on the US dollar has reached a ten-year high, which could positively impact BTC.

▫️Record low since 2012 for US dollar pessimism – investors are reducing their holdings.

▫️87% of investors believe the dollar's share in global reserves will continue to decline – many are already reducing their "American" exposure or hedging currency risks.

▫️Investors are moving out of the US and reallocating into emerging markets #Ce

A survey of fund managers controlling assets over $440,000,000,000+.

Coindesk: The number of bearish bets on the US dollar has reached a ten-year high, which could positively impact BTC.

▫️Record low since 2012 for US dollar pessimism – investors are reducing their holdings.

▫️87% of investors believe the dollar's share in global reserves will continue to decline – many are already reducing their "American" exposure or hedging currency risks.

▫️Investors are moving out of the US and reallocating into emerging markets #Ce

BTC-1,58%

- Reward

- 2

- Comment

- Repost

- Share

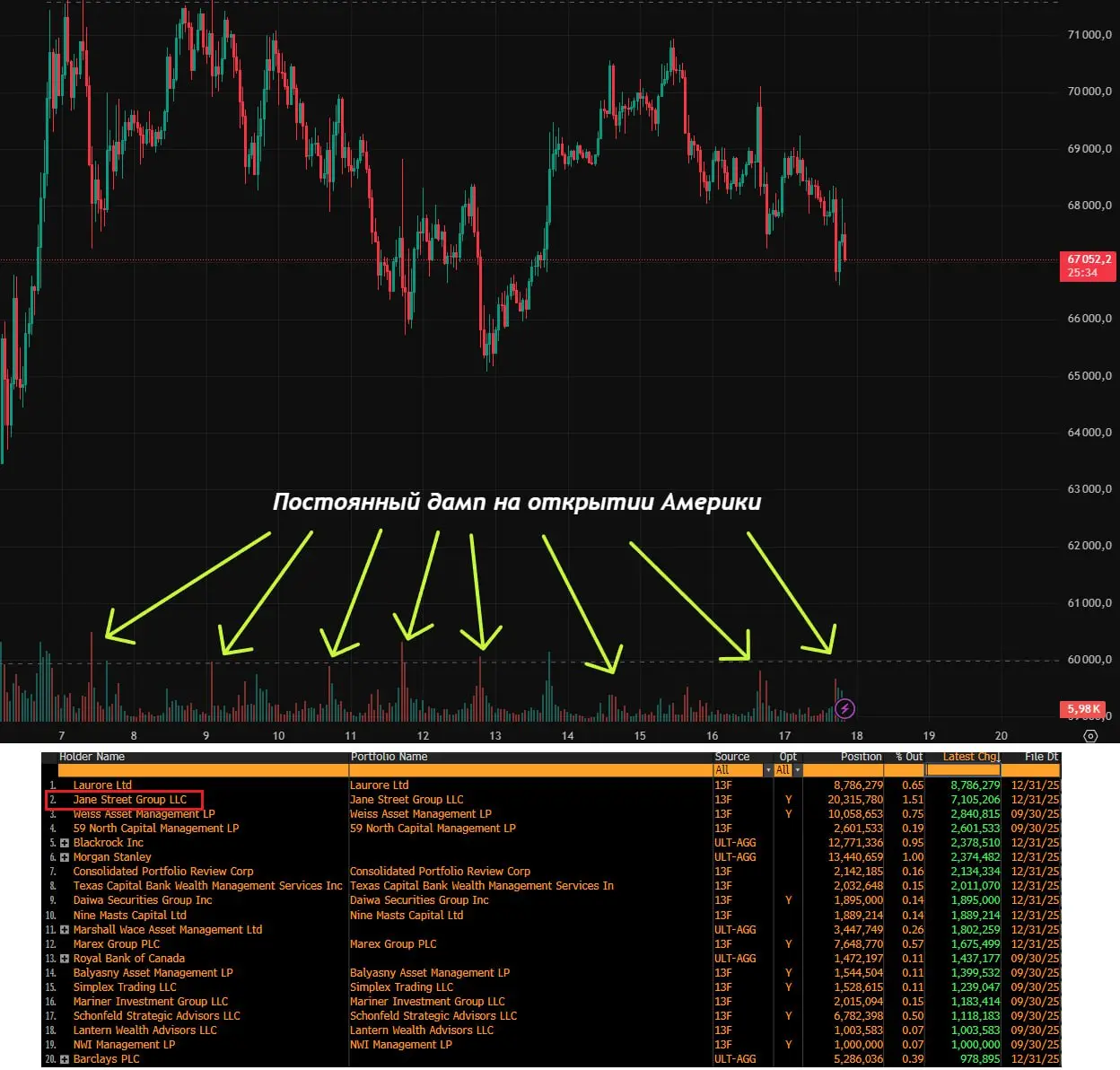

#CelebratingNewYearOnGateSquare 🔥 On Twitter, the manipulation topic is being fueled. Like, a market maker intentionally dumps the price as soon as it rises, during the American session opening at 10 AM. But it turns out they are actually dumping and buying everything cheaply. In the end, they have already accumulated $790 million.

Quote:

Jane Street purchased 7,105,206 $IBIT shares worth $276 million in Q4 2025.

Currently, the company owns 20,315,780 IBIT shares valued at $790 million.

This is the same organization rumored to be behind the daily Bitcoin price manipulations at "10 AM."

P.S.

View OriginalQuote:

Jane Street purchased 7,105,206 $IBIT shares worth $276 million in Q4 2025.

Currently, the company owns 20,315,780 IBIT shares valued at $790 million.

This is the same organization rumored to be behind the daily Bitcoin price manipulations at "10 AM."

P.S.

- Reward

- 3

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare 🇵🇱 Poland risks being left without its own crypto market

President Andrzej Duda has vetoed the MiCA implementation law for the second time, and the deadline — July 1, 2026 — is approaching.

🔴 CASP licenses are not issued in the country, local VASPs will only be able to operate until summer, while foreign exchanges with an EU license will continue their activities without restrictions.

As a result, Polish crypto companies are already relocating licensing to Lithuania and Estonia.

View OriginalPresident Andrzej Duda has vetoed the MiCA implementation law for the second time, and the deadline — July 1, 2026 — is approaching.

🔴 CASP licenses are not issued in the country, local VASPs will only be able to operate until summer, while foreign exchanges with an EU license will continue their activities without restrictions.

As a result, Polish crypto companies are already relocating licensing to Lithuania and Estonia.

- Reward

- 2

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ⚡️ Paxos Urges Banks to Adopt Stablecoins

Paxos states that new regulations in the US, EU, and Singapore present significant opportunities for banks in the stablecoin market.

✅ The company emphasizes that the largest issuers, including Tether and Circle, manage over $100 billion, with annual transaction volumes reaching trillions of dollars.

Paxos believes that clear regulation reduces risks and enables banks to profit from issuing, storing, and settling stablecoins.

Paxos states that new regulations in the US, EU, and Singapore present significant opportunities for banks in the stablecoin market.

✅ The company emphasizes that the largest issuers, including Tether and Circle, manage over $100 billion, with annual transaction volumes reaching trillions of dollars.

Paxos believes that clear regulation reduces risks and enables banks to profit from issuing, storing, and settling stablecoins.

View Original

- Reward

- 1

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ↗️ Polygon surpasses Ethereum in fees

Polygon has been collecting more daily transaction fees than Ethereum in recent days.

🔮 Analysts attribute this to increased activity in the Polymarket prediction market.

On Friday, Polygon received $407 100 in fees, while Ethereum received $211 700.

Polygon has been collecting more daily transaction fees than Ethereum in recent days.

🔮 Analysts attribute this to increased activity in the Polymarket prediction market.

On Friday, Polygon received $407 100 in fees, while Ethereum received $211 700.

ETH-2,2%

- Reward

- like

- Comment

- Repost

- Share

❌ ZeroLend Credit Protocol is Closing

The decentralized credit protocol ZeroLend is ceasing operations entirely.

🔗 The reason — a decline in user activity and liquidity on the blockchains where it operated.

According to the team, some of the supported networks have become inactive, making the project unsustainable.

The decentralized credit protocol ZeroLend is ceasing operations entirely.

🔗 The reason — a decline in user activity and liquidity on the blockchains where it operated.

According to the team, some of the supported networks have become inactive, making the project unsustainable.

View Original

- Reward

- 1

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ❌ ZeroLend is closing.

The project founder announced a complete shutdown, stating that "the protocol is no longer viable."

Reasons:

▪️ Several supported networks have become inactive or lost liquidity.

▪️ Oracle providers have ceased support for certain blockchains.

▪️ The protocol has been operating at a loss for an extended period.

▪️ Increased hacking attacks.

The locked value volume (TVL) has decreased from approximately $359m (peak in November 2024) to $6.6 million.

❗️The team urges users to withdraw their funds.

The project founder announced a complete shutdown, stating that "the protocol is no longer viable."

Reasons:

▪️ Several supported networks have become inactive or lost liquidity.

▪️ Oracle providers have ceased support for certain blockchains.

▪️ The protocol has been operating at a loss for an extended period.

▪️ Increased hacking attacks.

The locked value volume (TVL) has decreased from approximately $359m (peak in November 2024) to $6.6 million.

❗️The team urges users to withdraw their funds.

View Original

- Reward

- like

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ☄️ Logan Paul sold a Pokémon card for $16.5 million

YouTube blogger Logan Paul sold a rare Pokémon card for a record-breaking $16.5 million.

🤑 The buyer was AJ Scaramucci, the son of American financier Anthony Scaramucci.

In 2022, Logan Paul tokenized this card and sold digital shares of it on the Liquid Marketplace platform.

View OriginalYouTube blogger Logan Paul sold a rare Pokémon card for a record-breaking $16.5 million.

🤑 The buyer was AJ Scaramucci, the son of American financier Anthony Scaramucci.

In 2022, Logan Paul tokenized this card and sold digital shares of it on the Liquid Marketplace platform.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 Illegal lenders are turning to cryptocurrency.

Member of the Public Chamber of the Russian Federation, Evgeny Masharov, stated that illegal microfinance organizations (MFOs) have begun actively promoting "loans in cryptocurrency" on social media, disguising them as investment projects.

What’s happening:

➥ Starting March 1, 2026, microfinance companies are required to issue loans only with biometric identification of the borrower.

➥ Amid these changes, illegal lenders have become more active on social media.

➥ They advertise loans as "quick financing in digital currency."

➥ They promise co

View OriginalMember of the Public Chamber of the Russian Federation, Evgeny Masharov, stated that illegal microfinance organizations (MFOs) have begun actively promoting "loans in cryptocurrency" on social media, disguising them as investment projects.

What’s happening:

➥ Starting March 1, 2026, microfinance companies are required to issue loans only with biometric identification of the borrower.

➥ Amid these changes, illegal lenders have become more active on social media.

➥ They advertise loans as "quick financing in digital currency."

➥ They promise co

- Reward

- like

- Comment

- Repost

- Share

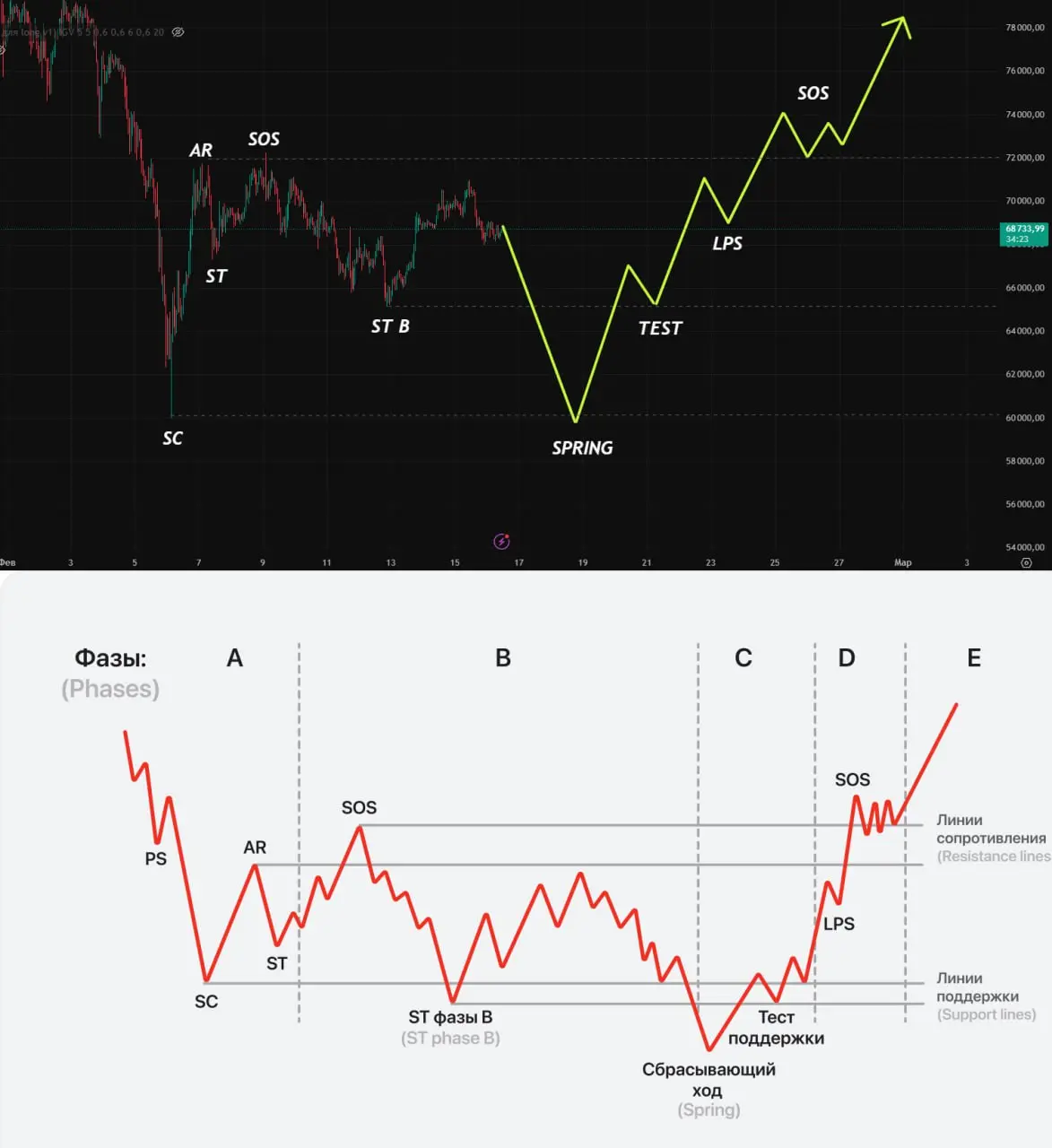

#CelebratingNewYearOnGateSquare 🔥 Wyckoff Model or Plan B for the bulls. Not a fact, just a theory, maybe. Observing.

In case SPX heads down this week and/or next, such a gift to Trump on President's Day from the Democrats, bad reports, whale dumps, and any other unforeseen crap ( new tariffs, AI scams, war with Iran, etc. ).

I drew the Wyckoff model on the chart, with a stop/retake at $60,000. Let’s watch the chart ✍️

What I don’t want is a sideways move like from $80k to $98k for another 2 months.

I’m prepared for both scenarios, but not for a sideways market, with these rises/dips from gri

View OriginalIn case SPX heads down this week and/or next, such a gift to Trump on President's Day from the Democrats, bad reports, whale dumps, and any other unforeseen crap ( new tariffs, AI scams, war with Iran, etc. ).

I drew the Wyckoff model on the chart, with a stop/retake at $60,000. Let’s watch the chart ✍️

What I don’t want is a sideways move like from $80k to $98k for another 2 months.

I’m prepared for both scenarios, but not for a sideways market, with these rises/dips from gri

- Reward

- 1

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ‼️ Nexo Lending Indicates Managed Risks

📈 From January 2025 to January 2026, users of the crypto platform Nexo borrowed nearly $1 billion and repaid over 30%.

✅ CryptoQuant researcher JA Maartun describes this as a sign of stability rather than stress during the downturn.

Nexo's role in the ecosystem has significantly increased after the launch of the world's first crypto-backed payment card, in partnership with Mastercard, allowing users to spend collateralized funds without selling their assets.

📈 From January 2025 to January 2026, users of the crypto platform Nexo borrowed nearly $1 billion and repaid over 30%.

✅ CryptoQuant researcher JA Maartun describes this as a sign of stability rather than stress during the downturn.

Nexo's role in the ecosystem has significantly increased after the launch of the world's first crypto-backed payment card, in partnership with Mastercard, allowing users to spend collateralized funds without selling their assets.

NEXO-5,23%

- Reward

- like

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare 💎 Wintermute launches institutional trading of tokenized gold.

One of the largest market makers in the crypto market has opened OTC trading of (off-exchange market) tokens #PAXG and #XAUT for institutional clients.

According to Wintermute's CEO, the tokenized gold market could grow to $15,000,000,000 this year (2.8x).

View OriginalOne of the largest market makers in the crypto market has opened OTC trading of (off-exchange market) tokens #PAXG and #XAUT for institutional clients.

According to Wintermute's CEO, the tokenized gold market could grow to $15,000,000,000 this year (2.8x).

- Reward

- like

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ‼️ Nexo Lending Indicates Managed Risks

📈 From January 2025 to January 2026, users of the crypto platform Nexo borrowed nearly $1 billion and repaid over 30%.

✅ CryptoQuant researcher JA Maartun describes this as a sign of stability rather than stress during the downturn.

Nexo's role in the ecosystem has significantly increased after the launch of the world's first crypto-backed payment card, in partnership with Mastercard, allowing users to spend collateralized funds without selling their assets.

📈 From January 2025 to January 2026, users of the crypto platform Nexo borrowed nearly $1 billion and repaid over 30%.

✅ CryptoQuant researcher JA Maartun describes this as a sign of stability rather than stress during the downturn.

Nexo's role in the ecosystem has significantly increased after the launch of the world's first crypto-backed payment card, in partnership with Mastercard, allowing users to spend collateralized funds without selling their assets.

NEXO-5,23%

- Reward

- like

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare 📊 Spot ETF Flows: Money Flows Out of BTC and ETH

Last week, investors withdrew funds from BTC and ETH ETFs, while funds in Solana and XRP showed a small inflow.

▪ BTC ETF: -$359.9 million

▪ ETH ETF: -$161.1 million

▪ SOL ETF: +$13.2 million

▪ XRP ETF: +$7.7 million

Capital rotation continues: some demand is shifting toward alternative assets.

View OriginalLast week, investors withdrew funds from BTC and ETH ETFs, while funds in Solana and XRP showed a small inflow.

▪ BTC ETF: -$359.9 million

▪ ETH ETF: -$161.1 million

▪ SOL ETF: +$13.2 million

▪ XRP ETF: +$7.7 million

Capital rotation continues: some demand is shifting toward alternative assets.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More209.97K Popularity

12.78K Popularity

45.64K Popularity

85.86K Popularity

850.12K Popularity

Pin