Cipher_X

No content yet

Cipher_X

BTC Dominance Is Compressing 🚨

Bitcoin dominance is sitting at 58.9%, moving sideways after that sharp rejection near the highs

Here’s what stands out 👇

• Strong drop from the 65–66% zone

• Now consolidating in a tight range around 58–60%

• Volatility compression = expansion loading

If this range breaks down → capital rotates into alts

If dominance reclaims 60% cleanly → BTC likely outperforms again

Bitcoin dominance is sitting at 58.9%, moving sideways after that sharp rejection near the highs

Here’s what stands out 👇

• Strong drop from the 65–66% zone

• Now consolidating in a tight range around 58–60%

• Volatility compression = expansion loading

If this range breaks down → capital rotates into alts

If dominance reclaims 60% cleanly → BTC likely outperforms again

BTC-0,72%

- Reward

- like

- Comment

- Repost

- Share

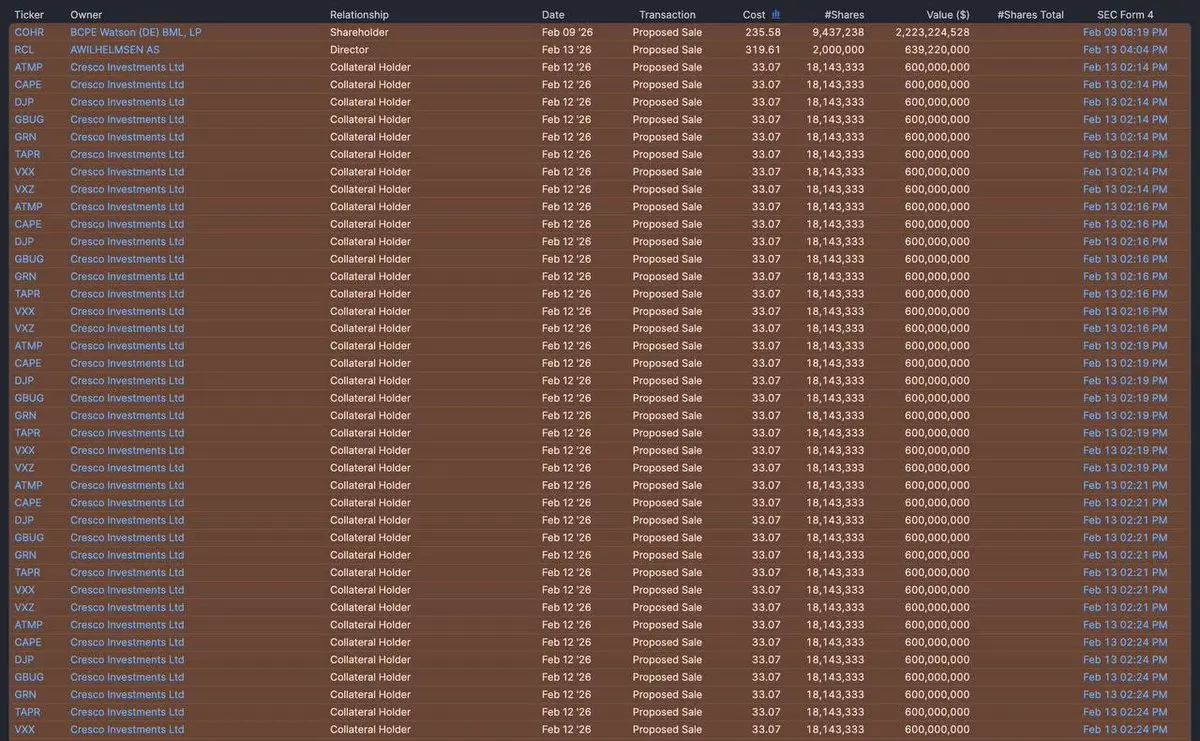

SELLING 🚨

Corporate insiders are unloading shares at the fastest pace we’ve seen in years

Billions of dollars’ worth of stock sold

Virtually zero insider buying to offset it

We haven’t seen this level of selling since the pandemic panic

When the people who know the numbers best are exiting aggressively it raises a serious question

Are they pricing in something the market hasn’t yet?

For months, No Limit has been warning about insider distribution

Stay Safe.

Corporate insiders are unloading shares at the fastest pace we’ve seen in years

Billions of dollars’ worth of stock sold

Virtually zero insider buying to offset it

We haven’t seen this level of selling since the pandemic panic

When the people who know the numbers best are exiting aggressively it raises a serious question

Are they pricing in something the market hasn’t yet?

For months, No Limit has been warning about insider distribution

Stay Safe.

- Reward

- 2

- Comment

- Repost

- Share

$BNB 🚨

BNB just flushed hard from the local range and tapped the 600 zone after rejecting near the previous ATH supply

That gray box around 780–850 acted as resistance again and sellers stepped in aggressively

Now price is reacting around 590–620.

If this level holds I expect a relief bounce toward 680–720

If it loses 580 with continuation, next liquidity sits around 520–540

BNB just flushed hard from the local range and tapped the 600 zone after rejecting near the previous ATH supply

That gray box around 780–850 acted as resistance again and sellers stepped in aggressively

Now price is reacting around 590–620.

If this level holds I expect a relief bounce toward 680–720

If it loses 580 with continuation, next liquidity sits around 520–540

BNB-0,75%

- Reward

- 2

- Comment

- Repost

- Share

China is dumping U.S. assets to buy gold 🚨

Brazil & Japan are doing the same

Stock market collapse next

Let’s break this down clearly 👇

Is China dumping everything?

China has been gradually reducing U.S Treasury exposure for years

That’s diversification not an overnight liquidation.

Are Brazil & Japan exiting too?

Central banks globally have been increasing gold reserves

That’s a hedge against inflation, currency risk, and geopolitical tension not automatic panic selling of U.S. assets

Would markets already show stress?

If major economies were truly “dumping all” U.S. assets

• Treasury yiel

Brazil & Japan are doing the same

Stock market collapse next

Let’s break this down clearly 👇

Is China dumping everything?

China has been gradually reducing U.S Treasury exposure for years

That’s diversification not an overnight liquidation.

Are Brazil & Japan exiting too?

Central banks globally have been increasing gold reserves

That’s a hedge against inflation, currency risk, and geopolitical tension not automatic panic selling of U.S. assets

Would markets already show stress?

If major economies were truly “dumping all” U.S. assets

• Treasury yiel

- Reward

- like

- Comment

- Repost

- Share

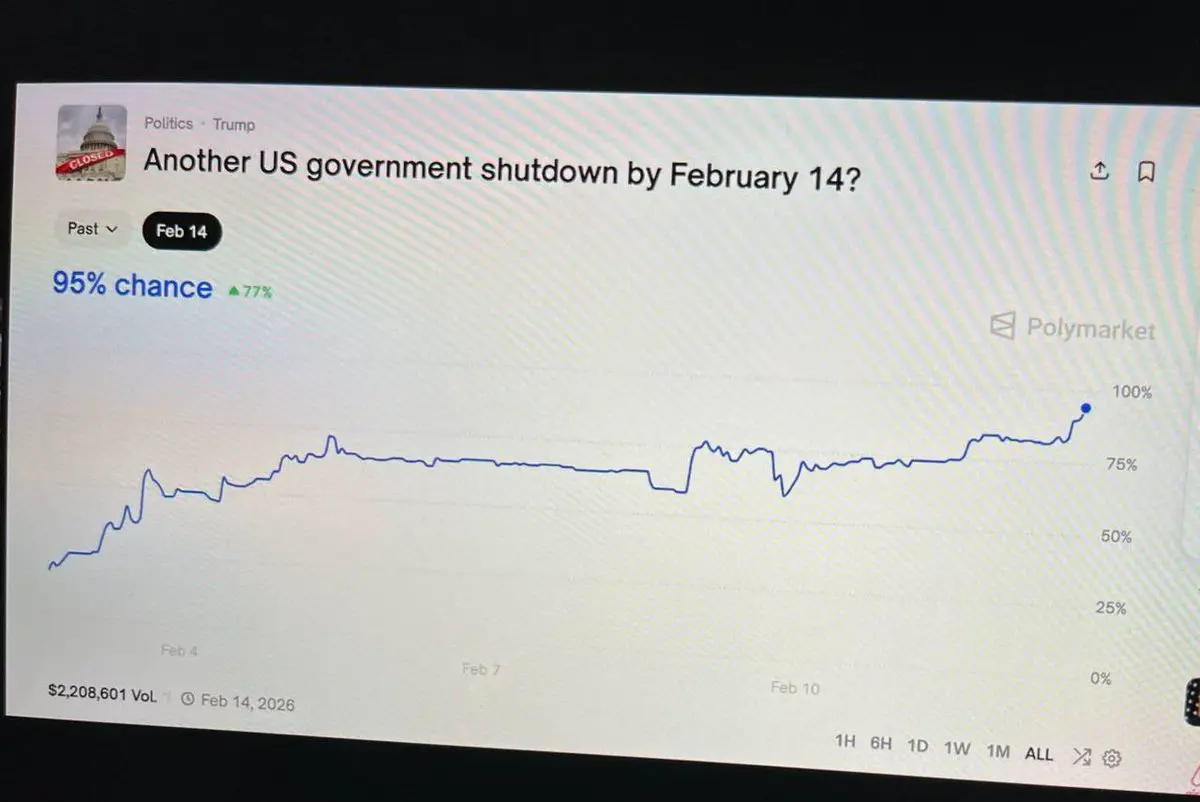

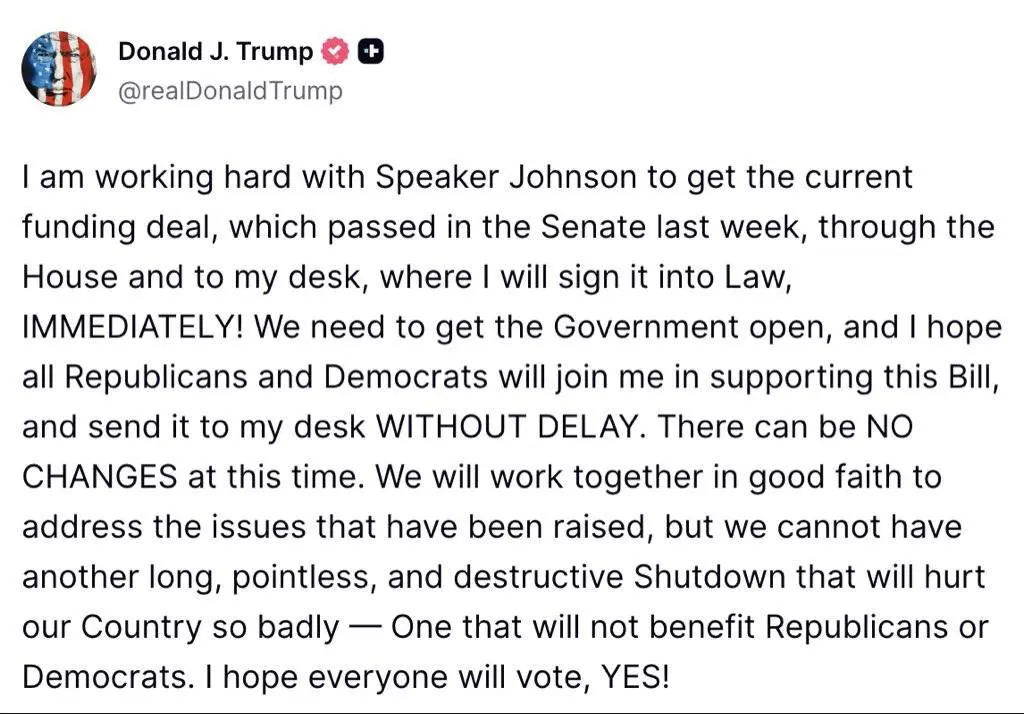

US Government Shutdown Confirmed 🚨

🇺🇸 A shutdown by February 14 is now officially locked in

Prediction markets like Polymarket spiked the odds to 96%

And the reaction was immediate

• $BTC slipped below $65,000

• Risk assets turned defensive

• Liquidity fears creeping back in

When government funding stalls, uncertainty rises

And markets hate uncertainty more than bad news itself.

🇺🇸 A shutdown by February 14 is now officially locked in

Prediction markets like Polymarket spiked the odds to 96%

And the reaction was immediate

• $BTC slipped below $65,000

• Risk assets turned defensive

• Liquidity fears creeping back in

When government funding stalls, uncertainty rises

And markets hate uncertainty more than bad news itself.

BTC-0,72%

- Reward

- like

- Comment

- Repost

- Share

Crypto Fear & Greed Index dropped

Let that sink in 👇

This is lower than:

The tariffs crash

The August 2024 crash

The FTX collapse

The 2020 COVID panic

We are officially in extreme, historic fear territory

But here’s the uncomfortable question:

If fear is worse than during FTX, worse than Luna, worse than a global lockdown…

what exactly is the market pricing in right now?

Capitulation doesn’t happen when people feel a bit nervous.

It happens when confidence is completely gone

Sentiment is at levels that have historically marked major bottoms

Not because the news improves but because s

Let that sink in 👇

This is lower than:

The tariffs crash

The August 2024 crash

The FTX collapse

The 2020 COVID panic

We are officially in extreme, historic fear territory

But here’s the uncomfortable question:

If fear is worse than during FTX, worse than Luna, worse than a global lockdown…

what exactly is the market pricing in right now?

Capitulation doesn’t happen when people feel a bit nervous.

It happens when confidence is completely gone

Sentiment is at levels that have historically marked major bottoms

Not because the news improves but because s

LUNA5,9%

- Reward

- like

- Comment

- Repost

- Share

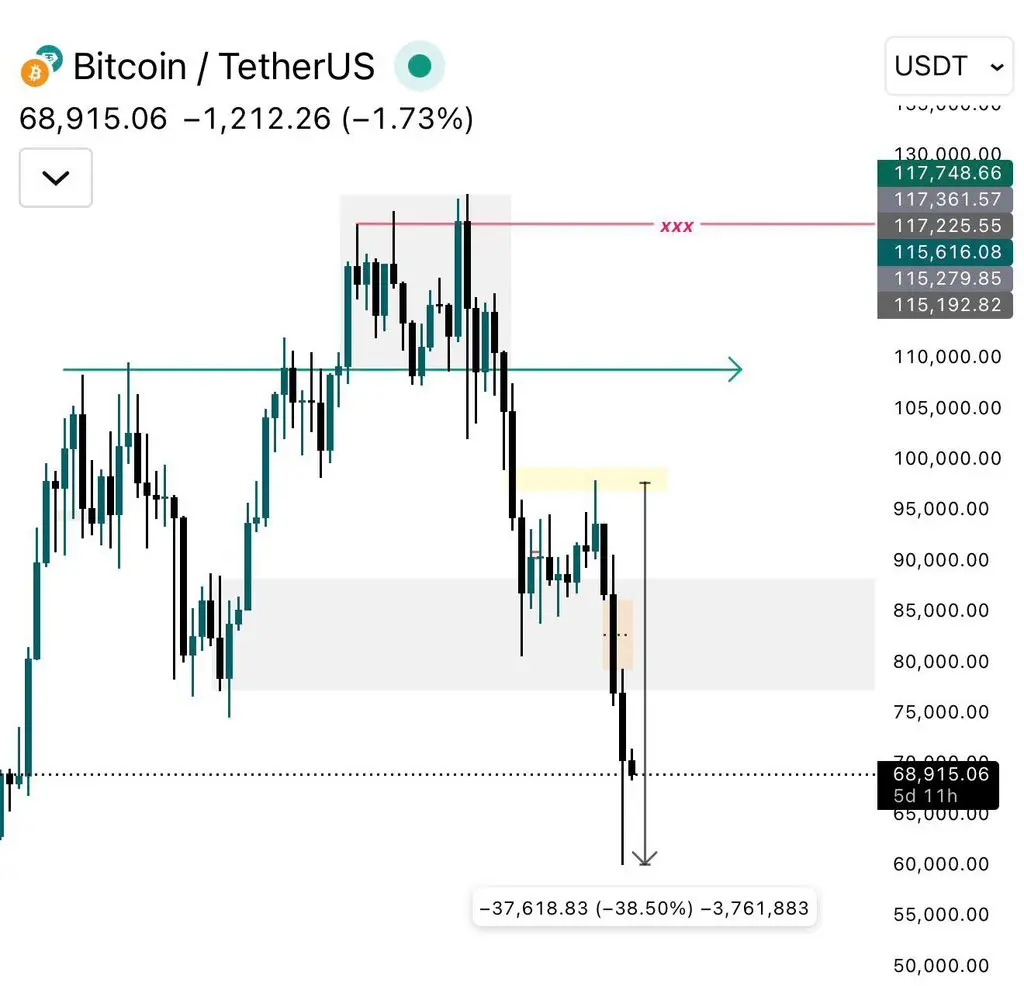

$BTC is compressing right above support 👇

Bitcoin is trading around 66,8K after rejecting the 71–72K resistance and respecting the descending trend-line

Clear lower highs structure

Trendline acting as dynamic resistance

Major support zone: 65.5K–66K

Bigger resistance above: 72K

If 66K holds, I’m expecting a bounce toward 69K first, then another attempt at 71–72K

If 65.5K breaks with momentum, next downside liquidity sits around 63K–64K

Bitcoin is trading around 66,8K after rejecting the 71–72K resistance and respecting the descending trend-line

Clear lower highs structure

Trendline acting as dynamic resistance

Major support zone: 65.5K–66K

Bigger resistance above: 72K

If 66K holds, I’m expecting a bounce toward 69K first, then another attempt at 71–72K

If 65.5K breaks with momentum, next downside liquidity sits around 63K–64K

BTC-0,72%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BIG WEEK 🚨

Feb 10: White House discussions around the Crypto Market Structure / Clarity Act

Feb 11: U.S. unemployment figures

Feb 12: Fresh jobless claims data

Feb 13: CPI and Core CPI inflation prints

Policy clarity, labor conditions, and inflation are all in play at the same time

Together, they shape risk appetite and the Fed’s policy path

This is the kind of week where positioning matters more than opinions.

Feb 10: White House discussions around the Crypto Market Structure / Clarity Act

Feb 11: U.S. unemployment figures

Feb 12: Fresh jobless claims data

Feb 13: CPI and Core CPI inflation prints

Policy clarity, labor conditions, and inflation are all in play at the same time

Together, they shape risk appetite and the Fed’s policy path

This is the kind of week where positioning matters more than opinions.

- Reward

- like

- Comment

- Repost

- Share

China has reportedly instructed banks to cut exposure to US Treasuries 🚨\nThat means sustained selling pressure on Treasuries and a continued rotation into hard assets\nLess confidence in US debt, more demand for Gold and Silver\nAnd this is a structural shift\nThe signal is clear 👇\nreserve diversification is accelerating, and safe-haven metals remain the primary beneficiaries.

- Reward

- like

- Comment

- Repost

- Share

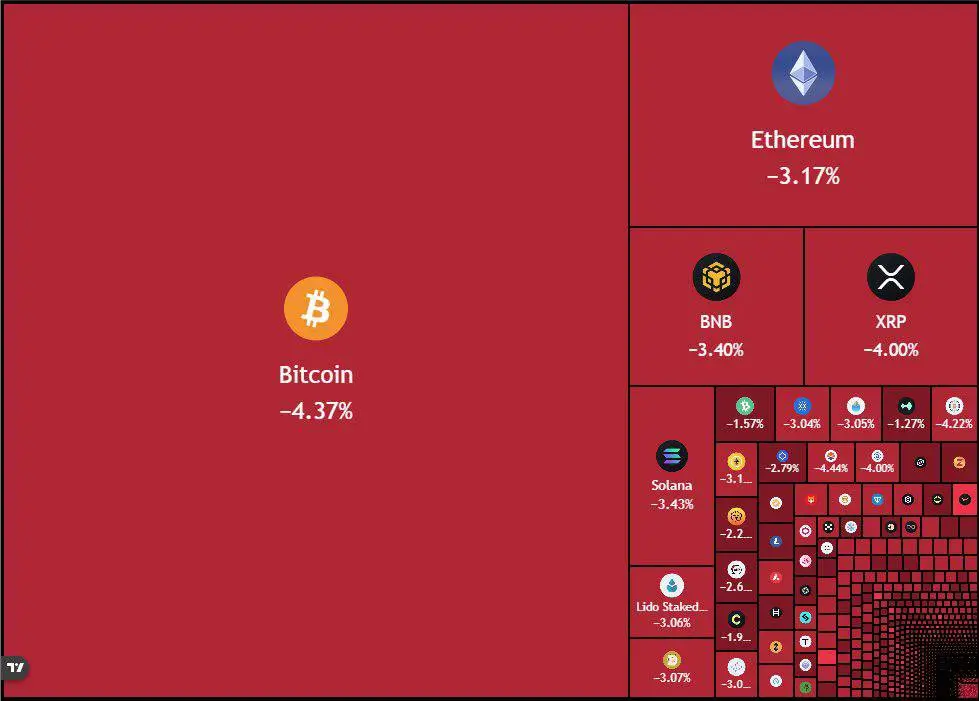

OVER $98M IN CRYPTO LONGS LIQUIDATED 🚨$90B wiped from total market cap in under 4 hoursStay Safe.

- Reward

- 1

- 1

- Repost

- Share

Xerodollar :

:

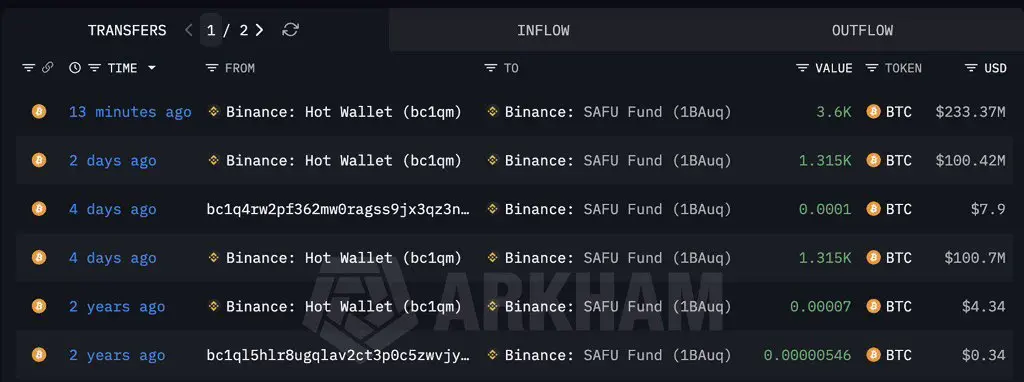

Stay safeFear usually shows up before balance sheets do 👇While traders panic @ just added 3,600 BTC to its SAFU reserve A $233M vote of confidence during market stress That brings the SAFU Fund to over 6,200 BTC, sitting quietly as downside insurance.Big players don’t prepare for sunny daysThey prepare for volatility That should tell you everything about where we are in the cycle.

BTC-0,72%

- Reward

- 1

- Comment

- Repost

- Share

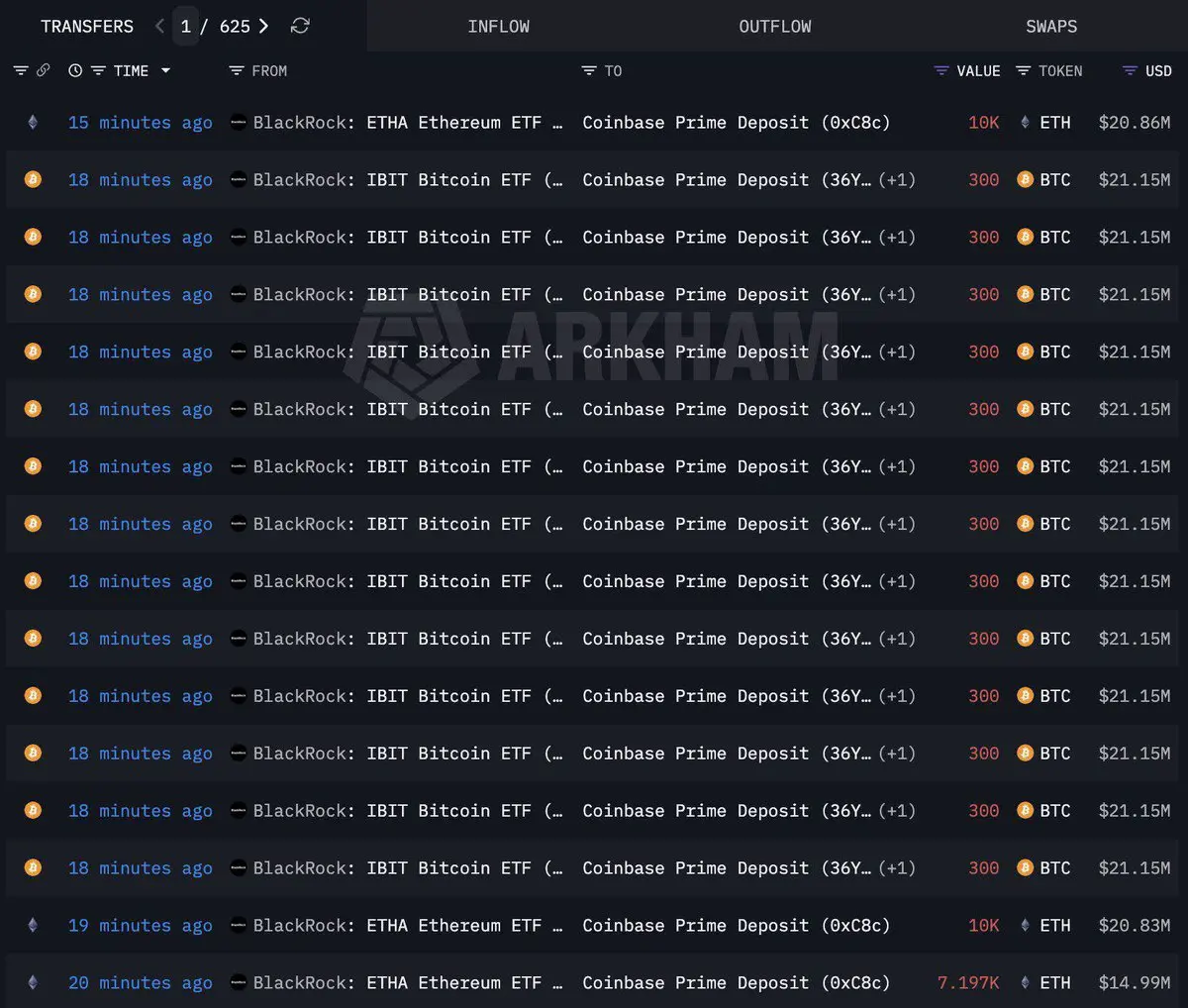

BlackRock has just deposited 3,900 BTC and 27,197 ETH to Coinbase That’s not a neutral moveLarge transfers to exchanges usually signal distributionThis lines up with what we’ve been seeing lately:• Big players reducing exposure• Liquidity being used to sell into strength• Pressure staying on the market short termPrice follows what institutions do, not what they say.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trump just fired a very loud signal 🚨“Government must open IMMEDIATELY” isn’t political noise it’s a liquidity message.What this really implies: - Forced shutdown risk gets pulled off the table - Emergency repricing scenarios are avoided - Volatility pressure on risk assets easesMarkets hate uncertainty more than bad newsRemoving the shutdown tail risk is a green light.

- Reward

- like

- Comment

- Repost

- Share

Every major market is pulling back at the same time 🚨Metals, equities, crypto all redFear is loudConfidence is disappearingThis is the phase where people swear they’re “done” and rush for the exit.I’m not rushing anywhereNo excitement. No panic.Just waiting for prices to come to me.Big gains are built in silence not during euphoria.

- Reward

- like

- Comment

- Repost

- Share

Dollar is downGold is downSilver is downBitcoin is downETH is downBNB is downEverything is bleeding at the same time. You know what that usually means, right?Liquidity is being pulledRisk is being resetAnd the market is shaking out weak hands before the next real move. 🤝

- Reward

- like

- Comment

- Repost

- Share

🚨 FED DECISION DAY 2:30 PM ETSmall cut <25 bps → Risk assets ignite, Bitcoin leads the chargeLarger cut ~50 bps → Liquidity spills into alts, rotation beginsNo cut → Expect the printer: ~$1.5T liquidity injection incomingEither way, liquidity is comingThe Fed speaksMarkets reactCrypto doesn’t stay quiet.

BTC-0,72%

- Reward

- like

- Comment

- Repost

- Share

This is a big deal 🚨The U.S. Dollar Index has broken below a 14-year support levelThat’s not a normal pullback that’s a structural shift.When a currency loses a level it’s respected for over a decade, confidence cracksHistorically, this kind of breakdown fuels hard assets and risk assets.Weak dollar → stronger gold, commodities, and eventually BitcoinThe market is quietly telling you something changed.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More147.47K Popularity

28.05K Popularity

24.95K Popularity

71.1K Popularity

11.67K Popularity

Pin