BabaJi

No content yet

Pin

BabaJi

#GateCEO2025YearEndOpenLetter 🚀 The Gate Story: 12 Years of Magic & Growth!

Hello Friends,

Imagine a tree that was planted 12 years ago. Today, in 2025, that tree has grown so large that it’s reaching the clouds! This is precisely what Gate has achieved.

Here is what Dr. Han (our Captain) shared in his special year-end letter:

🏆 We are the Champions!

Silver Medalist: In the world of trading digital assets, Gate is now ranked #2 globally! It's like being the second-fastest runner in the entire world.

The Super Safe Vault: We have a massive "piggy bank" worth over $11 billion. For every $100 a

Hello Friends,

Imagine a tree that was planted 12 years ago. Today, in 2025, that tree has grown so large that it’s reaching the clouds! This is precisely what Gate has achieved.

Here is what Dr. Han (our Captain) shared in his special year-end letter:

🏆 We are the Champions!

Silver Medalist: In the world of trading digital assets, Gate is now ranked #2 globally! It's like being the second-fastest runner in the entire world.

The Super Safe Vault: We have a massive "piggy bank" worth over $11 billion. For every $100 a

- Reward

- 3

- 5

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

🚀 2026: The Year Crypto Becomes the Global Financial Backbone

As the clock struck midnight and we stepped into 2026, the charts didn't just reset—the narrative did. Dropping my #My2026FirstPost with a vision that goes beyond the green candles.

🌍 The Macro Shift: From "Hedge" to "Standard"

In 2025, we watched Bitcoin break $90k and institutional infrastructure settle into place. Now, in 2026, we are entering the Era of Execution. It's no longer about if Bitcoin will reach $150k; it's about how the Gate Layer and Web3 rails will settle trillions in real-world assets (RWAs).

🎯 My 2026 Strategi

As the clock struck midnight and we stepped into 2026, the charts didn't just reset—the narrative did. Dropping my #My2026FirstPost with a vision that goes beyond the green candles.

🌍 The Macro Shift: From "Hedge" to "Standard"

In 2025, we watched Bitcoin break $90k and institutional infrastructure settle into place. Now, in 2026, we are entering the Era of Execution. It's no longer about if Bitcoin will reach $150k; it's about how the Gate Layer and Web3 rails will settle trillions in real-world assets (RWAs).

🎯 My 2026 Strategi

BTC-2,08%

- Reward

- 5

- 4

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

2026 Strategy: Protocol–Market Fit > Meme Hype 🚀

As we enter January 2026, the crypto market is undergoing a historic re-rating.

The era of “Reflexive Liquidity”—where hype manufactured value—is fading. In its place, we’re seeing the rise of “Structural Value”, where revenue, real usage, and institutional integration anchor long-term prices.

Bitcoin’s march toward $126,000 and Ethereum’s evolution into the Settlement Layer for RWAs are no longer just narratives. They are now supported by multi-billion-dollar institutional flows.

This is why Protocol–Market Fit (PMF) is the ultimate winning st

As we enter January 2026, the crypto market is undergoing a historic re-rating.

The era of “Reflexive Liquidity”—where hype manufactured value—is fading. In its place, we’re seeing the rise of “Structural Value”, where revenue, real usage, and institutional integration anchor long-term prices.

Bitcoin’s march toward $126,000 and Ethereum’s evolution into the Settlement Layer for RWAs are no longer just narratives. They are now supported by multi-billion-dollar institutional flows.

This is why Protocol–Market Fit (PMF) is the ultimate winning st

- Reward

- 6

- 5

- Repost

- Share

SoominStar :

:

Buy To Earn 💎View More

2026: The Year Web3 Moves from "Expectation" to "Production"

The calendar has flipped, and we aren’t just entering a new year—we are entering the Institutional Era of Crypto. As I drop my #MyFirstPost2026 on Gate Square, here’s a deep-dive analysis on why 2026 will redefine everything we know about digital assets.

📉 The 2025 Reflection: The Great Shakeout

2025 was the year of "Selective Growth." The market shifted away from blind hype toward verifiable utility. While the "four-year cycle" theory faced challenges, one thing remained true: quality rises above noise.

Gate’s growth to 50M+ users

The calendar has flipped, and we aren’t just entering a new year—we are entering the Institutional Era of Crypto. As I drop my #MyFirstPost2026 on Gate Square, here’s a deep-dive analysis on why 2026 will redefine everything we know about digital assets.

📉 The 2025 Reflection: The Great Shakeout

2025 was the year of "Selective Growth." The market shifted away from blind hype toward verifiable utility. While the "four-year cycle" theory faced challenges, one thing remained true: quality rises above noise.

Gate’s growth to 50M+ users

- Reward

- 2

- 4

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

DOJ Bitcoin Sale via Coinbase Prime: Why the Market Stayed Calm

The U.S. Department of Justice (DOJ) executing a Bitcoin sale through Coinbase Prime is not a new event, but it always draws attention. While the market reaction was muted this time, it raises important questions about government Bitcoin policy and its long-term impact on market confidence.

🏛️ The “Government Hand” in the Bitcoin Market

When the U.S. government sells seized Bitcoin, it’s more than just a transaction—it’s a signal.

These holdings usually come from:

Seizures linked to criminal cases (e.g., darknet markets, ransomwa

The U.S. Department of Justice (DOJ) executing a Bitcoin sale through Coinbase Prime is not a new event, but it always draws attention. While the market reaction was muted this time, it raises important questions about government Bitcoin policy and its long-term impact on market confidence.

🏛️ The “Government Hand” in the Bitcoin Market

When the U.S. government sells seized Bitcoin, it’s more than just a transaction—it’s a signal.

These holdings usually come from:

Seizures linked to criminal cases (e.g., darknet markets, ransomwa

BTC-2,08%

- Reward

- 1

- 1

- Repost

- Share

BabaJi :

:

“The market’s calm reaction says a lot. OTC execution via regulated platforms turns government BTC sales from a threat into a legitimacy signal. The real issue isn’t selling — it’s long-term policy clarity.🟠 Bitcoin Above $90,000: A Psychological Break That Matters

Bitcoin’s move above $90,000 is more than just a price milestone—it’s a sentiment reset.

After the choppy, low-conviction price action that defined the end of 2025, the market finally looks like it’s shaking off year-end fatigue. As of January 6, 2026, BTC has already tagged the $93,000 level, and the behavior beneath the surface tells a much bigger story.

This isn’t happening in isolation. We’re seeing a clear capital rotation away from defensive assets and back into high-beta risk.

🔍 Market Context: Why This Rally Feels Different

Bitcoin’s move above $90,000 is more than just a price milestone—it’s a sentiment reset.

After the choppy, low-conviction price action that defined the end of 2025, the market finally looks like it’s shaking off year-end fatigue. As of January 6, 2026, BTC has already tagged the $93,000 level, and the behavior beneath the surface tells a much bigger story.

This isn’t happening in isolation. We’re seeing a clear capital rotation away from defensive assets and back into high-beta risk.

🔍 Market Context: Why This Rally Feels Different

- Reward

- 1

- 1

- Repost

- Share

BabaJi :

:

BTC above $90K feels more like a sentiment shift than a simple price move.#Gate 2025 Year-End Community Gala#

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VLRBVGTCCQ&refUid=22362937&ref_type=165&utm_cmp=xjdtmcgP

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VLRBVGTCCQ&refUid=22362937&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

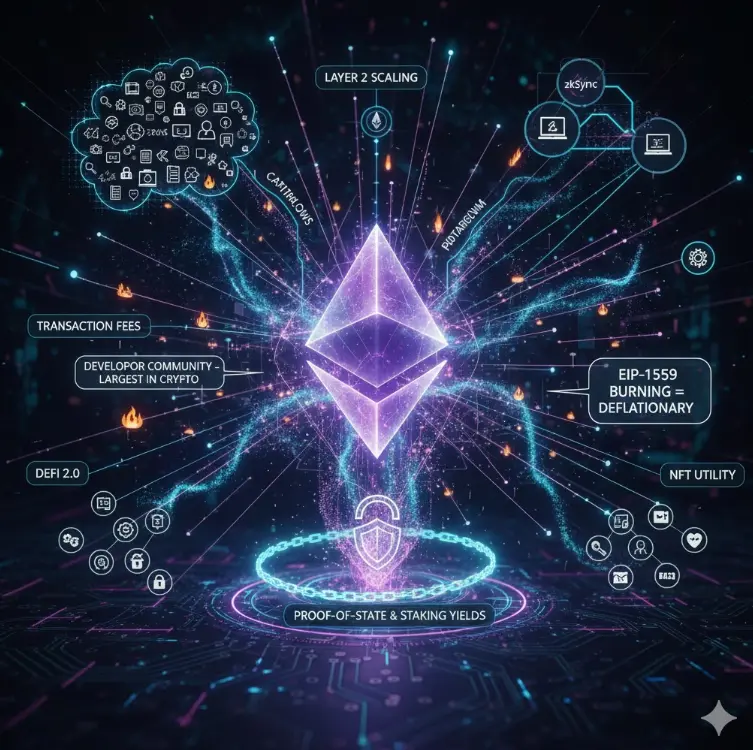

📊 ETHTrendWatch: Beyond the Hype - Deep Dive & Winning Strategy

Ethereum (ETH) is not just another altcoin; it's the foundational layer for the decentralized future. While price action often dominates the headlines, a deeper analysis reveals a far more compelling narrative, especially as we head into a new cycle. This isn't just about technicals; it's about network adoption, developer activity, and the macro-crypto environment.

🔬 Deep Research & Analysis: The Unseen Drivers

1. The Merge & Beyond: A Deflationary Powerhouse

Proof-of-Stake (PoS) Impact: The transition to PoS fundamentally alter

Ethereum (ETH) is not just another altcoin; it's the foundational layer for the decentralized future. While price action often dominates the headlines, a deeper analysis reveals a far more compelling narrative, especially as we head into a new cycle. This isn't just about technicals; it's about network adoption, developer activity, and the macro-crypto environment.

🔬 Deep Research & Analysis: The Unseen Drivers

1. The Merge & Beyond: A Deflationary Powerhouse

Proof-of-Stake (PoS) Impact: The transition to PoS fundamentally alter

- Reward

- 5

- 4

- Repost

- Share

hyygrape :

:

2026 Go Go Go 👊View More

📊 Market Analysis: The Big Picture

The recent breakout above the 2025 highs represents a classic polarization flip, where former resistance has now turned into strong structural support. This type of price behavior often marks the transition from accumulation into a new expansion phase.

1️⃣ Fundamental Strength

Network Security

Mining difficulty has reached record levels, signaling a peak in hashrate. Historically, this is important because it raises the cost of production for new BCH. When production costs rise, miners are less willing to sell at lower prices and tend to hold inventory for

The recent breakout above the 2025 highs represents a classic polarization flip, where former resistance has now turned into strong structural support. This type of price behavior often marks the transition from accumulation into a new expansion phase.

1️⃣ Fundamental Strength

Network Security

Mining difficulty has reached record levels, signaling a peak in hashrate. Historically, this is important because it raises the cost of production for new BCH. When production costs rise, miners are less willing to sell at lower prices and tend to hold inventory for

BCH-0,89%

- Reward

- 3

- 5

- Repost

- Share

GateUser-d9db9896 :

:

2026 Go Go Go 👊View More

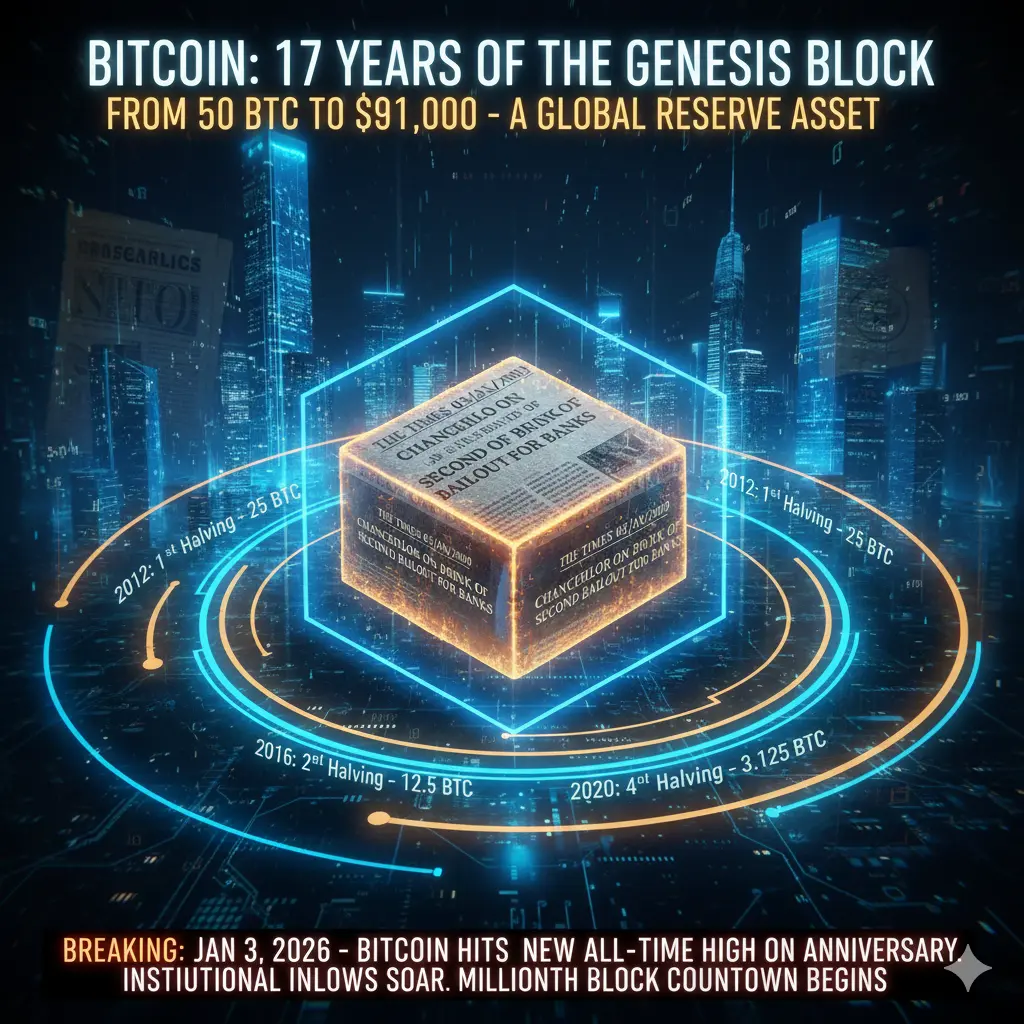

🎉✨ Bitcoin Turns 17! A Journey from Code to Global Revolution 🚀 ✨🎉

On January 3, 2009, a mysterious figure named Satoshi Nakamoto mined the very first Bitcoin block, now famously called the Genesis Block ⛏️.

Embedded in it was a message that would forever mark history:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" 📰💸

This wasn’t just a random note—it was a statement 🌟.

Bitcoin was born during a global financial crisis, a protest against traditional banking, and a vision for decentralized money 🌍💰.

The Early Days: 2009–2010 🐣

Bitcoin started as lines of code

On January 3, 2009, a mysterious figure named Satoshi Nakamoto mined the very first Bitcoin block, now famously called the Genesis Block ⛏️.

Embedded in it was a message that would forever mark history:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" 📰💸

This wasn’t just a random note—it was a statement 🌟.

Bitcoin was born during a global financial crisis, a protest against traditional banking, and a vision for decentralized money 🌍💰.

The Early Days: 2009–2010 🐣

Bitcoin started as lines of code

BTC-2,08%

- Reward

- 2

- 2

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

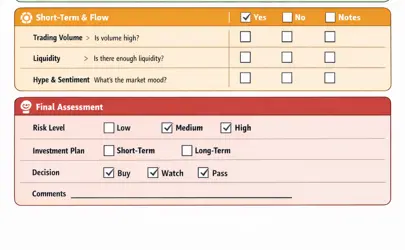

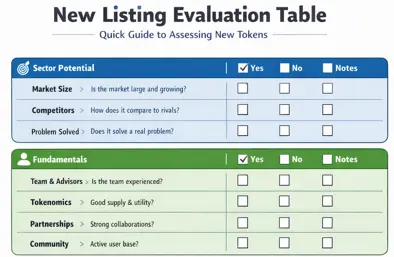

1. Sector Potential (The Big Picture)

This is about what problem the project is solving and how big the market could be.

Blockchain Sector Example:

DeFi (Decentralized Finance): Lending, borrowing, and yield farming platforms. High growth but competitive.

Layer-1 & Layer-2 chains: Base infrastructure like Ethereum, Solana. Long-term potential if adoption grows.

NFTs & Gaming: Speculative, but can explode if the platform gains users.

✅ How to analyze:

Look at the project’s whitepaper—does it solve a real problem?

Check the size of the market it targets. Big markets = more upside.

Compare compet

This is about what problem the project is solving and how big the market could be.

Blockchain Sector Example:

DeFi (Decentralized Finance): Lending, borrowing, and yield farming platforms. High growth but competitive.

Layer-1 & Layer-2 chains: Base infrastructure like Ethereum, Solana. Long-term potential if adoption grows.

NFTs & Gaming: Speculative, but can explode if the platform gains users.

✅ How to analyze:

Look at the project’s whitepaper—does it solve a real problem?

Check the size of the market it targets. Big markets = more upside.

Compare compet

- Reward

- 1

- 1

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”💥 Venezuela Escalation: Geopolitical Shockwaves Hit Global Markets

Post:

On January 3, Caracas faced explosions and air defense alerts after U.S. strikes on Venezuelan military targets. This escalation is significant for both geopolitical and financial markets.

Market Implications:

🛢️ Oil: Venezuela is a modest but symbolic oil producer. Tensions increase the risk premium, likely pushing Brent and WTI futures higher. Short-term spikes are probable if infrastructure or supply fears intensify.

🏦 Precious Metals: Gold and silver typically benefit as safe-haven assets. Investors may rotate capi

Post:

On January 3, Caracas faced explosions and air defense alerts after U.S. strikes on Venezuelan military targets. This escalation is significant for both geopolitical and financial markets.

Market Implications:

🛢️ Oil: Venezuela is a modest but symbolic oil producer. Tensions increase the risk premium, likely pushing Brent and WTI futures higher. Short-term spikes are probable if infrastructure or supply fears intensify.

🏦 Precious Metals: Gold and silver typically benefit as safe-haven assets. Investors may rotate capi

BTC-2,08%

- Reward

- like

- Comment

- Repost

- Share

My First Post of 2026

Why This Campaign Works

This is not just a New Year greeting campaign.

It’s a narrative reset.

By asking for a “first post,” Gate Square encourages users to:

Define their mindset for the year

Move from passive scrolling to active participation

Anchor themselves in the community early in 2026

Psychologically, first actions matter.

What you say at the start of the year often reflects where you intend to go.

Identity Meets Incentives

The campaign blends self-expression with real rewards.

Users aren’t just posting for prizes —

they’re publicly stating goals, reflections, or c

Why This Campaign Works

This is not just a New Year greeting campaign.

It’s a narrative reset.

By asking for a “first post,” Gate Square encourages users to:

Define their mindset for the year

Move from passive scrolling to active participation

Anchor themselves in the community early in 2026

Psychologically, first actions matter.

What you say at the start of the year often reflects where you intend to go.

Identity Meets Incentives

The campaign blends self-expression with real rewards.

Users aren’t just posting for prizes —

they’re publicly stating goals, reflections, or c

- Reward

- 1

- Comment

- Repost

- Share

The Market Has Flipped the Script

After a historic year, traditional safe havens are losing momentum.

Gold and silver are showing signs of exhaustion —

and capital is no longer waiting.

It’s rotating.

Fast.

Back into the Digital Gold ecosystem.

Bitcoin’s move above the previous psychological zone isn’t just symbolic.

It’s confirmation that a higher structural base is forming —

one supported by long-term allocators, not short-term speculation.

🏛️ The Macro Pivot: From Metal to Math

The global hedge trade is evolving.

In a high-speed, digital-first economy, liquidity efficiency matters more tha

After a historic year, traditional safe havens are losing momentum.

Gold and silver are showing signs of exhaustion —

and capital is no longer waiting.

It’s rotating.

Fast.

Back into the Digital Gold ecosystem.

Bitcoin’s move above the previous psychological zone isn’t just symbolic.

It’s confirmation that a higher structural base is forming —

one supported by long-term allocators, not short-term speculation.

🏛️ The Macro Pivot: From Metal to Math

The global hedge trade is evolving.

In a high-speed, digital-first economy, liquidity efficiency matters more tha

- Reward

- 3

- 2

- Repost

- Share

EagleEye :

:

Thanks for sharing this information View More

#Bitcoin2026PriceOutlook

The End of the Four-Year Cycle?

For years, Bitcoin followed a predictable rhythm.

Post-halving surge, then a deep retracement.

By that logic, 2026 should be a bear year.

But that framework is breaking.

Institutional capital has changed the game.

ETFs, corporate balance sheets, and long-term allocators don’t trade like retail.

This capital is patient, strategic, and far less reactive.

At the same time, supply dynamics are tightening.

With post-halving issuance reduced and ETFs absorbing more Bitcoin than miners produce, structural scarcity is becoming the dominant forc

The End of the Four-Year Cycle?

For years, Bitcoin followed a predictable rhythm.

Post-halving surge, then a deep retracement.

By that logic, 2026 should be a bear year.

But that framework is breaking.

Institutional capital has changed the game.

ETFs, corporate balance sheets, and long-term allocators don’t trade like retail.

This capital is patient, strategic, and far less reactive.

At the same time, supply dynamics are tightening.

With post-halving issuance reduced and ETFs absorbing more Bitcoin than miners produce, structural scarcity is becoming the dominant forc

BTC-2,08%

- Reward

- 3

- 4

- Repost

- Share

cryptoBTC1 :

:

Happy New Year! 🤑View More

#Bitcoin17thAnniversary

SEVENTEEN YEARS OF SOVEREIGNTY: BITCOIN’S GENESIS LEGACY

On January 3, 2026, we mark the 17th anniversary of the Bitcoin network. What began as a whitepaper during a global financial collapse has transformed into a trillion-dollar asset class, challenging the very definition of "money" in the digital age.

The Headline That Changed Everything

In 2009, Satoshi Nakamoto inscribed a message into the first block ever mined (the Genesis Block):

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

This wasn’t just a timestamp; it was a critique of the lega

SEVENTEEN YEARS OF SOVEREIGNTY: BITCOIN’S GENESIS LEGACY

On January 3, 2026, we mark the 17th anniversary of the Bitcoin network. What began as a whitepaper during a global financial collapse has transformed into a trillion-dollar asset class, challenging the very definition of "money" in the digital age.

The Headline That Changed Everything

In 2009, Satoshi Nakamoto inscribed a message into the first block ever mined (the Genesis Block):

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

This wasn’t just a timestamp; it was a critique of the lega

BTC-2,08%

- Reward

- 2

- 3

- Repost

- Share

DragonFlyOfficial :

:

good job View More

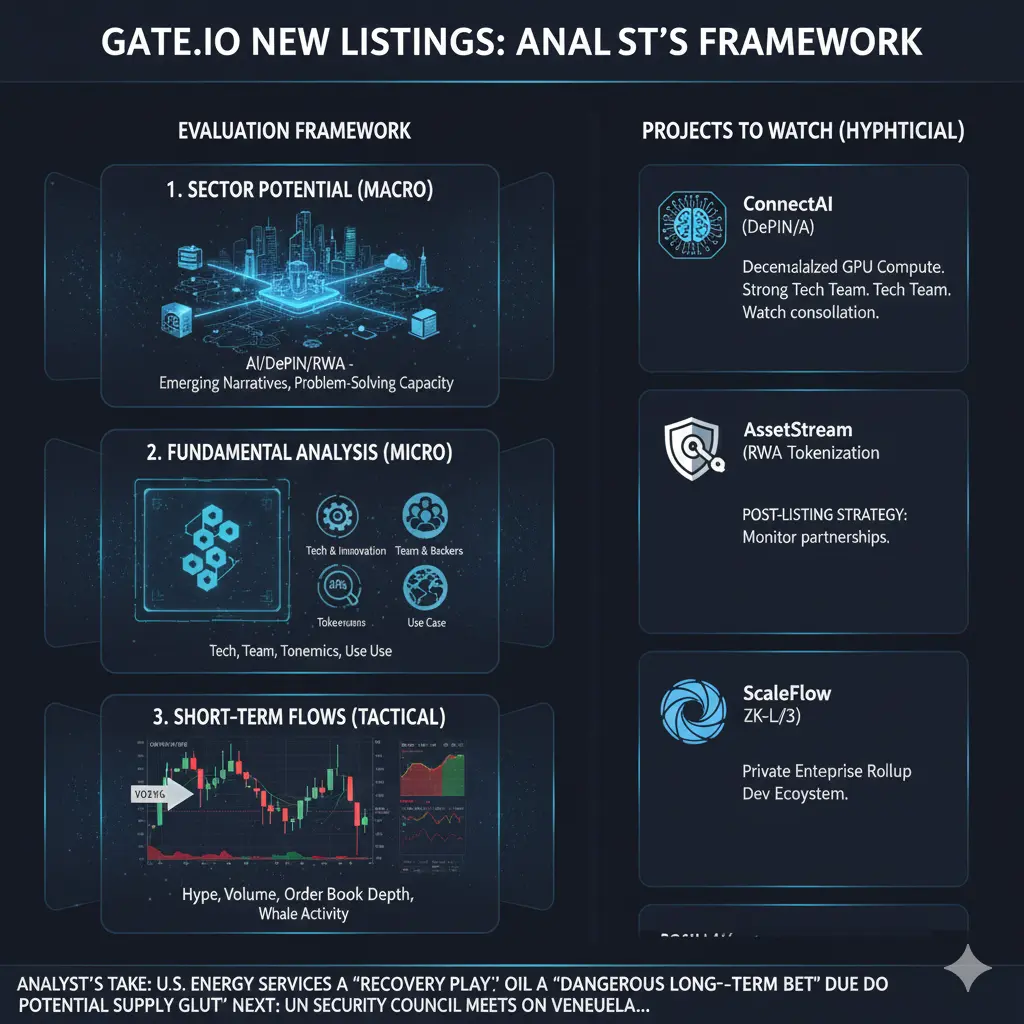

#GateNewTokenWatch

My Evaluation Framework for New Listings on Gate.io

1. Sector Potential (Macro View)

Before diving into individual projects, I assess the broader sector. Is it a trending narrative with strong tailwinds, or a niche with limited growth?

Emerging Narratives: I look for sectors that are either new or experiencing a resurgence due to technological breakthroughs or shifting market demands. Examples include AI-driven protocols, DePIN (Decentralized Physical Infrastructure Networks), RWA (Real World Assets) tokenization, or innovative Layer-2/Layer-3 solutions.

Problem-Solving Cap

My Evaluation Framework for New Listings on Gate.io

1. Sector Potential (Macro View)

Before diving into individual projects, I assess the broader sector. Is it a trending narrative with strong tailwinds, or a niche with limited growth?

Emerging Narratives: I look for sectors that are either new or experiencing a resurgence due to technological breakthroughs or shifting market demands. Examples include AI-driven protocols, DePIN (Decentralized Physical Infrastructure Networks), RWA (Real World Assets) tokenization, or innovative Layer-2/Layer-3 solutions.

Problem-Solving Cap

- Reward

- 3

- 3

- Repost

- Share

DragonFlyOfficial :

:

wawo wonderfull information thank you for sharing thisView More