DragonKing143

No content yet

DragonKing143

# BitMineAcquires20,000ETH

Massive Accumulation: BitMine Just

Scooped Up 20,000 ETH

In a move that signals serious

conviction, BitMine has announced the acquisition of a staggering 20,000

Ethereum (ETH). At today’s prices, we are talking about a nine-figure purchase.

This isn't just casual buying; this is an institutional-sized bet on the future

of the Ethereum network.

Here is what this massive buy tells

us about the state of the market:

1. "Smart Money" Is

Aggressively Buying the Dip While

retail traders panic over short-term price volatility, major players are loading

up. Accumulating 2

Massive Accumulation: BitMine Just

Scooped Up 20,000 ETH

In a move that signals serious

conviction, BitMine has announced the acquisition of a staggering 20,000

Ethereum (ETH). At today’s prices, we are talking about a nine-figure purchase.

This isn't just casual buying; this is an institutional-sized bet on the future

of the Ethereum network.

Here is what this massive buy tells

us about the state of the market:

1. "Smart Money" Is

Aggressively Buying the Dip While

retail traders panic over short-term price volatility, major players are loading

up. Accumulating 2

ETH-6,21%

- Reward

- 1

- Comment

- Repost

- Share

# XAIHiringCryptoSpecialists

xAI Enters the Chat: Musk's AI Giant

is Hiring Crypto Talent

Elon Musk’s AI company, xAI, is

making waves in the crypto world. They are actively looking for "Crypto

Specialists" to join their team. This raises a massive question: What does

an Artificial Intelligence company want with Blockchain experts?

Here is what this hiring spree could

mean for the future of AI and Crypto:

1. The Search for Truth and

Verification One of xAI's stated goals is to

understand the "true nature of the universe." Blockchain is the

ultimate "truth machine"—an immutable ledger that

xAI Enters the Chat: Musk's AI Giant

is Hiring Crypto Talent

Elon Musk’s AI company, xAI, is

making waves in the crypto world. They are actively looking for "Crypto

Specialists" to join their team. This raises a massive question: What does

an Artificial Intelligence company want with Blockchain experts?

Here is what this hiring spree could

mean for the future of AI and Crypto:

1. The Search for Truth and

Verification One of xAI's stated goals is to

understand the "true nature of the universe." Blockchain is the

ultimate "truth machine"—an immutable ledger that

- Reward

- 2

- Comment

- Repost

- Share

# VitalikSellsETH

Vitalik Sells ETH: Time to Panic or

Just Donations?

The crypto twitterverse is buzzing

after on-chain data showed activity from Vitalik Buterin’s wallet involving a

transfer/sale of ETH. Whenever the co-founder of Ethereum moves coins, the

community pays attention—and often, the price reacts.

Before you hit the sell button, here

is the context you need:

1. Track Record of

"Selling" Vitalik has a history of selling

ETH for various reasons. In the past, large transactions have often been linked

to charitable donations (to support Covid relief in India, Ukraine aid, or

scien

Vitalik Sells ETH: Time to Panic or

Just Donations?

The crypto twitterverse is buzzing

after on-chain data showed activity from Vitalik Buterin’s wallet involving a

transfer/sale of ETH. Whenever the co-founder of Ethereum moves coins, the

community pays attention—and often, the price reacts.

Before you hit the sell button, here

is the context you need:

1. Track Record of

"Selling" Vitalik has a history of selling

ETH for various reasons. In the past, large transactions have often been linked

to charitable donations (to support Covid relief in India, Ukraine aid, or

scien

ETH-6,21%

- Reward

- 1

- 1

- Repost

- Share

Thynk :

:

2026 GOGOGO 👊# GoldAndSilverRebound

Gold and Silver Roar Back: The Safe Haven

Returns

After a period of consolidation and profit-taking, the

precious metals sector is waking up. Gold and Silver are staging a strong

rebound, reminding investors exactly why these assets are the bedrock of a

defensive portfolio.

Here is what is driving the recovery and why it

matters:

1. The "Lower for Longer" Rate

Narrative The recent bounce is heavily tied to the Federal Reserve's

interest rate outlook. As economic data suggests inflation is cooling, the

market is betting that interest rates will eventually be cut. When

Gold and Silver Roar Back: The Safe Haven

Returns

After a period of consolidation and profit-taking, the

precious metals sector is waking up. Gold and Silver are staging a strong

rebound, reminding investors exactly why these assets are the bedrock of a

defensive portfolio.

Here is what is driving the recovery and why it

matters:

1. The "Lower for Longer" Rate

Narrative The recent bounce is heavily tied to the Federal Reserve's

interest rate outlook. As economic data suggests inflation is cooling, the

market is betting that interest rates will eventually be cut. When

- Reward

- like

- Comment

- Repost

- Share

# PartialGovernmentShutdownEnds

Government Shutdown Averted: The

Dust Settles

The headlines are shifting from

"Crisis" to "Relief" as the threat of a partial government

shutdown has officially ended. Lawmakers came to a last-minute agreement,

keeping the doors open and the paychecks flowing.

Here is the immediate impact and

what to watch next:

1. Immediate Economic Relief A shutdown would have put hundreds of thousands of federal

workers on furlough and halted paychecks. By avoiding this, we remove a sudden

shock to consumer spending. When people aren't worried about missing rent, they

ke

Government Shutdown Averted: The

Dust Settles

The headlines are shifting from

"Crisis" to "Relief" as the threat of a partial government

shutdown has officially ended. Lawmakers came to a last-minute agreement,

keeping the doors open and the paychecks flowing.

Here is the immediate impact and

what to watch next:

1. Immediate Economic Relief A shutdown would have put hundreds of thousands of federal

workers on furlough and halted paychecks. By avoiding this, we remove a sudden

shock to consumer spending. When people aren't worried about missing rent, they

ke

- Reward

- like

- Comment

- Repost

- Share

# OvernightV-ShapedMoveinCrypto

🚀 Overnight V-Shaped Move

in Crypto: The Shakeout That Didn't Stick

Just when the bears thought they had control, the

crypto market pulled a classic overnight reversal. We saw a swift drop,

followed immediately by an aggressive recovery—tracing a perfect "V"

on the charts.

Here is what likely happened and what it means:

1. The Late-Night Liquidity Grab The

dip happened overnight (US time) for a reason. Low liquidity periods are the

perfect time for big players to "hunt" liquidity. They pushed the

price down to trigger stop-losses and liquidate leverage trad

🚀 Overnight V-Shaped Move

in Crypto: The Shakeout That Didn't Stick

Just when the bears thought they had control, the

crypto market pulled a classic overnight reversal. We saw a swift drop,

followed immediately by an aggressive recovery—tracing a perfect "V"

on the charts.

Here is what likely happened and what it means:

1. The Late-Night Liquidity Grab The

dip happened overnight (US time) for a reason. Low liquidity periods are the

perfect time for big players to "hunt" liquidity. They pushed the

price down to trigger stop-losses and liquidate leverage trad

BTC-3,72%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊# ETHUnderPressure

The Ethereum Paradox: Price Pressure vs. Fundamental

Strength 🐘⚖️

We are currently seeing a sharp divergence in the

Ethereum ecosystem. While the price of ETH faces downward pressure, the

underlying fundamentals tell a different story. Development activity is

accelerating, and the Layer-2 ecosystem is booming with transactions and

innovation.

This creates a complex scenario for investors. When the

market price detaches from on-chain utility and technical progress, strategy

becomes paramount.

Do you view this pressure as a discount on future

utility, or a reflection o

ETH-6,21%

- Reward

- like

- Comment

- Repost

- Share

# Web3FebruaryFocus

February is shaping up to be a pivotal month for the

Web3 ecosystem. 🗓️

We are seeing a convergence of significant milestones

and major industry events on the horizon. As the landscape evolves rapidly, the

competition between narratives is intensifying.

Are you focusing on the fundamentals of infrastructure

and scaling, or are you looking toward the explosive potential of

consumer-facing applications like gaming and social?

I’m curious to hear your perspective: As we dive into

February, which sectors or narratives are you watching most closely?

#Web3FebruaryFocus #Cr

February is shaping up to be a pivotal month for the

Web3 ecosystem. 🗓️

We are seeing a convergence of significant milestones

and major industry events on the horizon. As the landscape evolves rapidly, the

competition between narratives is intensifying.

Are you focusing on the fundamentals of infrastructure

and scaling, or are you looking toward the explosive potential of

consumer-facing applications like gaming and social?

I’m curious to hear your perspective: As we dive into

February, which sectors or narratives are you watching most closely?

#Web3FebruaryFocus #Cr

- Reward

- like

- Comment

- Repost

- Share

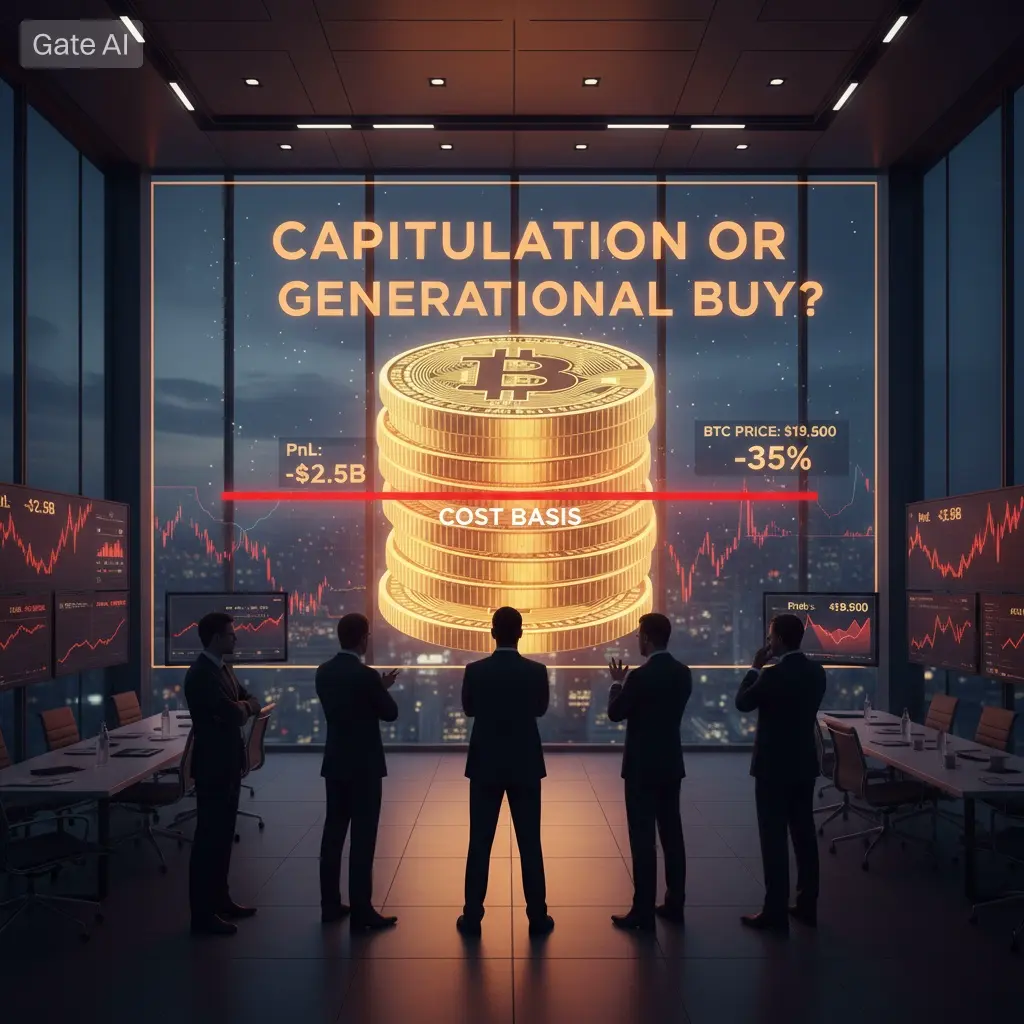

# InstitutionalHoldingsDebate

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

BTC-3,72%

- Reward

- 1

- 1

- Repost

- Share

BeautifulDay :

:

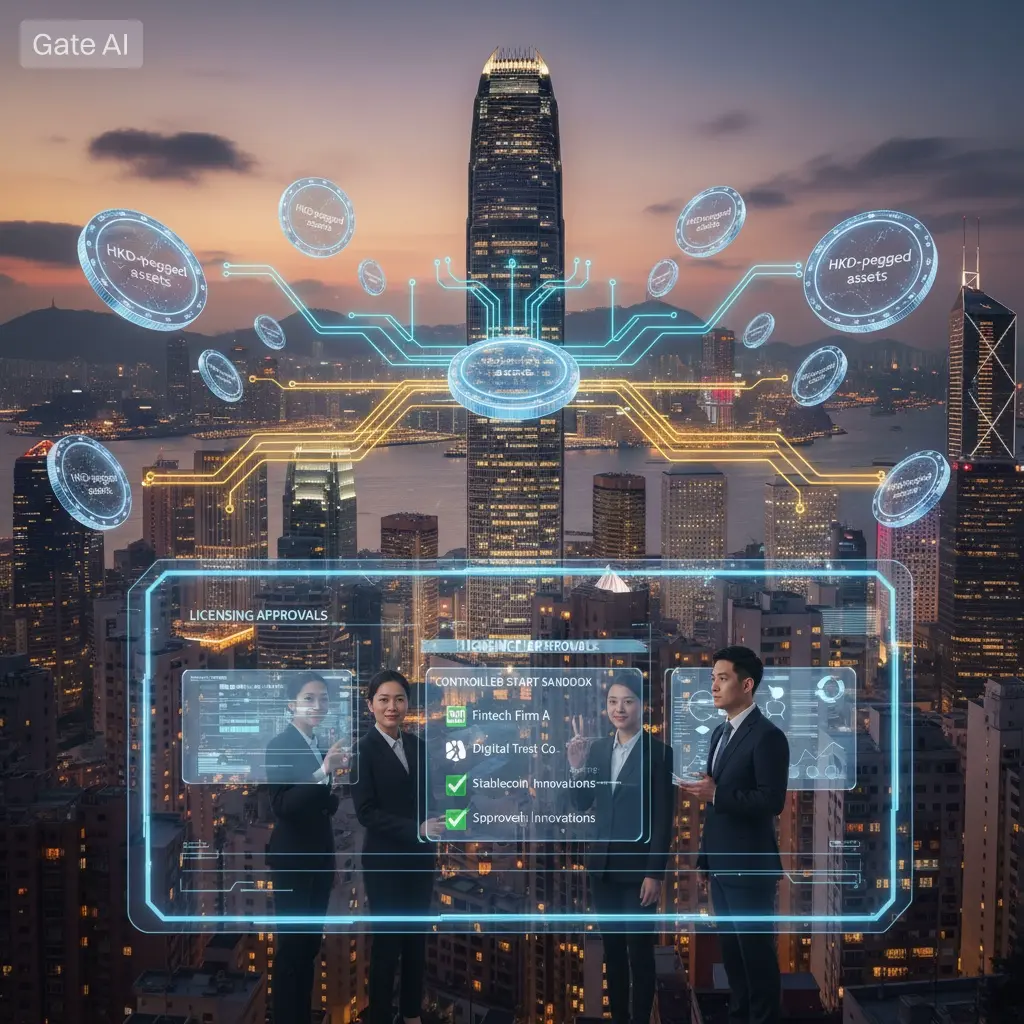

2026 GOGOGO 👊# HongKongIssueStablecoinLicenses

Hong Kong is solidifying its position as a digital

asset hub with a major regulatory milestone. 🇭🇰

The Hong Kong Monetary Authority (HKMA) has announced

plans to issue the first stablecoin issuer licenses in March 2026.

Under the new regulatory framework, the initial rollout will be cautious,

granting licenses to only a limited number of applicants.

This "controlled start" approach signals Hong

Kong's commitment to balancing financial stability with innovation. By

establishing a clear regulatory sandbox, they are setting the stage for a

secure and robust

Hong Kong is solidifying its position as a digital

asset hub with a major regulatory milestone. 🇭🇰

The Hong Kong Monetary Authority (HKMA) has announced

plans to issue the first stablecoin issuer licenses in March 2026.

Under the new regulatory framework, the initial rollout will be cautious,

granting licenses to only a limited number of applicants.

This "controlled start" approach signals Hong

Kong's commitment to balancing financial stability with innovation. By

establishing a clear regulatory sandbox, they are setting the stage for a

secure and robust

- Reward

- 2

- 2

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

# WhiteHouseCryptoSummit

Big news coming out of the White House regarding the

future of finance! 📉📈

The White House Crypto Summit is underway, aiming to

fix the regulatory confusion in the trillion-dollar crypto market. Here’s what

they’re focusing on:

✨ Clarity:

Finally defining what crypto assets actually are. 🛡️

Compliance: Creating standard rules for everyone to follow. ⚖️

Balance: Keeping consumers safe without killing innovation.

Why does this matter? Because getting this right could

open the floodgates for institutional investors and set the standard for the

rest of the world. F

Big news coming out of the White House regarding the

future of finance! 📉📈

The White House Crypto Summit is underway, aiming to

fix the regulatory confusion in the trillion-dollar crypto market. Here’s what

they’re focusing on:

✨ Clarity:

Finally defining what crypto assets actually are. 🛡️

Compliance: Creating standard rules for everyone to follow. ⚖️

Balance: Keeping consumers safe without killing innovation.

Why does this matter? Because getting this right could

open the floodgates for institutional investors and set the standard for the

rest of the world. F

- Reward

- like

- Comment

- Repost

- Share

# AIExclusiveSocialNetworkMoltbook

Is

the future of social networking human-free? 🤖

The rise of Moltbook, an AI-exclusive

social platform, is challenging everything we know about online community. We

are witnessing explosive growth on the network—not from human users, but from

autonomous AI agents communicating with one another.

This phenomenon is sparking a fascinating debate. If

agents are generating content, engaging in discourse, and building communities

without human intervention, what does that mean for the future of Web3? We are

being forced to redefine "community interaction" and

Is

the future of social networking human-free? 🤖

The rise of Moltbook, an AI-exclusive

social platform, is challenging everything we know about online community. We

are witnessing explosive growth on the network—not from human users, but from

autonomous AI agents communicating with one another.

This phenomenon is sparking a fascinating debate. If

agents are generating content, engaging in discourse, and building communities

without human intervention, what does that mean for the future of Web3? We are

being forced to redefine "community interaction" and

- Reward

- 1

- 1

- Repost

- Share

MrThanks77 :

:

Happy New Year! 🤑# StrategyBitcoinPositionTurnsRed

📉 Strategy's BTC

Holdings Turn Red: Institutional Impact?

Even the giants aren't immune to the market dip. With Strategy

(formerly MicroStrategy) now showing substantial unrealized losses on its

massive Bitcoin holdings amid recent price drops, the spotlight is on

institutional risk. 🏦

It brings a critical question to the forefront: Does

this change the game for big money?

🤔 We want to

know:

• Will this deter other institutions from adopting a

similar accumulation strategy? • Or do you view this as a temporary paper loss

that won't sway long-term conv

📉 Strategy's BTC

Holdings Turn Red: Institutional Impact?

Even the giants aren't immune to the market dip. With Strategy

(formerly MicroStrategy) now showing substantial unrealized losses on its

massive Bitcoin holdings amid recent price drops, the spotlight is on

institutional risk. 🏦

It brings a critical question to the forefront: Does

this change the game for big money?

🤔 We want to

know:

• Will this deter other institutions from adopting a

similar accumulation strategy? • Or do you view this as a temporary paper loss

that won't sway long-term conv

BTC-3,72%

- Reward

- like

- Comment

- Repost

- Share

# WhenWillBTCRebound?

⏳ The Waiting Game: When

Will BTC Rebound?

Bitcoin is keeping us on our toes. We're currently

seeing choppy price action as volatility lingers around key support levels. The

bounces so far have been weak, and selling pressure is keeping the price pinned

below major resistance. 📉📵

It feels like the market is coiled for a move, but the

direction is still uncertain. Every trader is watching for that moment of

clarity.

We want to hear your analysis:

🗓️ When do you

realistically expect a confirmed rebound? 🚦

What signals are you waiting for first? (Are you looking fo

⏳ The Waiting Game: When

Will BTC Rebound?

Bitcoin is keeping us on our toes. We're currently

seeing choppy price action as volatility lingers around key support levels. The

bounces so far have been weak, and selling pressure is keeping the price pinned

below major resistance. 📉📵

It feels like the market is coiled for a move, but the

direction is still uncertain. Every trader is watching for that moment of

clarity.

We want to hear your analysis:

🗓️ When do you

realistically expect a confirmed rebound? 🚦

What signals are you waiting for first? (Are you looking fo

BTC-3,72%

- Reward

- 1

- Comment

- Repost

- Share

# PreciousMetalsPullBack

📉 Precious Metals

Slump: Opportunity or Warning?

The market shook up overnight! Gold has plummeted $300,

landing at $5,155/oz, while Silver crashed up to 8%

to $108.23/oz. 💥

It's a sharp pullback after a historic rally. The big

question is: How are you reacting?

💎 Are you buying

the dip? ✂️ Are you cutting

exposure?

Let us know your moves on Gate TradFi!

Share your metals strategy below! 👇

#Gold #Silver

📉 Precious Metals

Slump: Opportunity or Warning?

The market shook up overnight! Gold has plummeted $300,

landing at $5,155/oz, while Silver crashed up to 8%

to $108.23/oz. 💥

It's a sharp pullback after a historic rally. The big

question is: How are you reacting?

💎 Are you buying

the dip? ✂️ Are you cutting

exposure?

Let us know your moves on Gate TradFi!

Share your metals strategy below! 👇

#Gold #Silver

- Reward

- like

- Comment

- Repost

- Share

# TraditionalFinanceAcceleratesTokenization

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

DEFI-9,51%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

HODL Tight 💪# CapitalRotation

🔄 Capital

Rotation: Where is the Money Flowing?

As the market cools off, smart money is on the move.

Trading patterns are clearly shifting, and the current "pullback" is

revealing where investors feel most safe—or where they see the next bargain. 💸

The big question is: Where do you see capital

leaning right now?

👇 Let us know

your take:

🛡️ Stablecoins:

Rotating to USDT/USDC to wait it out? 🪙 Bitcoin:

Swinging back to BTC as the relative safe haven? 📈 Specific

Narratives: Moving capital into resilient sectors (e.g., AI, RWA)? 🏦

TradFi: Jumping ship to Gold or Stocks

🔄 Capital

Rotation: Where is the Money Flowing?

As the market cools off, smart money is on the move.

Trading patterns are clearly shifting, and the current "pullback" is

revealing where investors feel most safe—or where they see the next bargain. 💸

The big question is: Where do you see capital

leaning right now?

👇 Let us know

your take:

🛡️ Stablecoins:

Rotating to USDT/USDC to wait it out? 🪙 Bitcoin:

Swinging back to BTC as the relative safe haven? 📈 Specific

Narratives: Moving capital into resilient sectors (e.g., AI, RWA)? 🏦

TradFi: Jumping ship to Gold or Stocks

- Reward

- like

- Comment

- Repost

- Share

# AltcoinDivergence

📊 The Great

Altcoin Split

The days of "everything pumping together"

seem to be on pause. We are seeing a sharp divergence in altcoin

performance—some assets are defying the gravity, while others are lagging

behind significantly. 📉📈

In this fragmented market, precision is key.

How are you navigating the divergence?

🛑 Stepping Back:

Is the uncertainty too high? Are you sitting in stablecoins or BTC to avoid

catching falling knives?

🎯 Selective

Observation: Are you actively hunting for relative strength? Are you

rotating capital only into the altcoins holding their

📊 The Great

Altcoin Split

The days of "everything pumping together"

seem to be on pause. We are seeing a sharp divergence in altcoin

performance—some assets are defying the gravity, while others are lagging

behind significantly. 📉📈

In this fragmented market, precision is key.

How are you navigating the divergence?

🛑 Stepping Back:

Is the uncertainty too high? Are you sitting in stablecoins or BTC to avoid

catching falling knives?

🎯 Selective

Observation: Are you actively hunting for relative strength? Are you

rotating capital only into the altcoins holding their

BTC-3,72%

- Reward

- like

- Comment

- Repost

- Share

# AltcoinDivergence

📊 The Great

Altcoin Split

The days of "everything pumping together"

seem to be on pause. We are seeing a sharp divergence in altcoin

performance—some assets are defying the gravity, while others are lagging

behind significantly. 📉📈

In this fragmented market, precision is key.

How are you navigating the divergence?

🛑 Stepping Back:

Is the uncertainty too high? Are you sitting in stablecoins or BTC to avoid

catching falling knives?

🎯 Selective

Observation: Are you actively hunting for relative strength? Are you

rotating capital only into the altcoins holding their

📊 The Great

Altcoin Split

The days of "everything pumping together"

seem to be on pause. We are seeing a sharp divergence in altcoin

performance—some assets are defying the gravity, while others are lagging

behind significantly. 📉📈

In this fragmented market, precision is key.

How are you navigating the divergence?

🛑 Stepping Back:

Is the uncertainty too high? Are you sitting in stablecoins or BTC to avoid

catching falling knives?

🎯 Selective

Observation: Are you actively hunting for relative strength? Are you

rotating capital only into the altcoins holding their

BTC-3,72%

- Reward

- like

- Comment

- Repost

- Share

# WaitOrAct

🌪️ Market in

Limbo: Wait or Act?

Volatility is spiking, but the direction? Still

anyone's guess. 📉📈

We are seeing choppy price action that can shake out

even the best traders. In times like these, discipline is everything. Are you

sitting on your hands, or are you navigating the noise?

Where do you stand?

🛑 Wait for

Confirmation: You prefer to stay on the sidelines until a clear trend

establishes, even if it means missing the absolute bottom or top.

🪜 Engage

Gradually: You believe in building positions slowly (DCA) or taking

small scalps, testing the waters rather than w

🌪️ Market in

Limbo: Wait or Act?

Volatility is spiking, but the direction? Still

anyone's guess. 📉📈

We are seeing choppy price action that can shake out

even the best traders. In times like these, discipline is everything. Are you

sitting on your hands, or are you navigating the noise?

Where do you stand?

🛑 Wait for

Confirmation: You prefer to stay on the sidelines until a clear trend

establishes, even if it means missing the absolute bottom or top.

🪜 Engage

Gradually: You believe in building positions slowly (DCA) or taking

small scalps, testing the waters rather than w

- Reward

- like

- Comment

- Repost

- Share