DurjoyCrypto

No content yet

DurjoyCrypto

$ENSO just went from sleepy to “everyone’s watching” in two candles. Daily flipped after that base around 1.10 to 1.20, then we got the vertical expansion straight into 1.90 with a wick up near 2.20. That’s usually where late FOMO gets punished, even if the trend stays bullish.

ENSO32,35%

- Reward

- 1

- Comment

- Repost

- Share

Clean read. I like how it frames the shift as a migration, not another cycle, and backs it with real scale logic instead of hype. The UI point is what hits for me. Giving TradFi its own top tab feels like an actual decision, not just “we added stocks too.” And the whole

- Reward

- 1

- Comment

- Repost

- Share

$SOL cooling off around 83 after that brutal drop from 120+.

What I’m seeing now is compression. Small candles, tight range, volatility drying up.

This is usually where the next real move starts loading.If 80 holds, this turns into a higher low structure and 90+ is back on the table fast.

Lose 78 and it gets messy again.$SOL looks quiet… and quiet charts don’t stay quiet for long.

What I’m seeing now is compression. Small candles, tight range, volatility drying up.

This is usually where the next real move starts loading.If 80 holds, this turns into a higher low structure and 90+ is back on the table fast.

Lose 78 and it gets messy again.$SOL looks quiet… and quiet charts don’t stay quiet for long.

SOL2,73%

- Reward

- 1

- Comment

- Repost

- Share

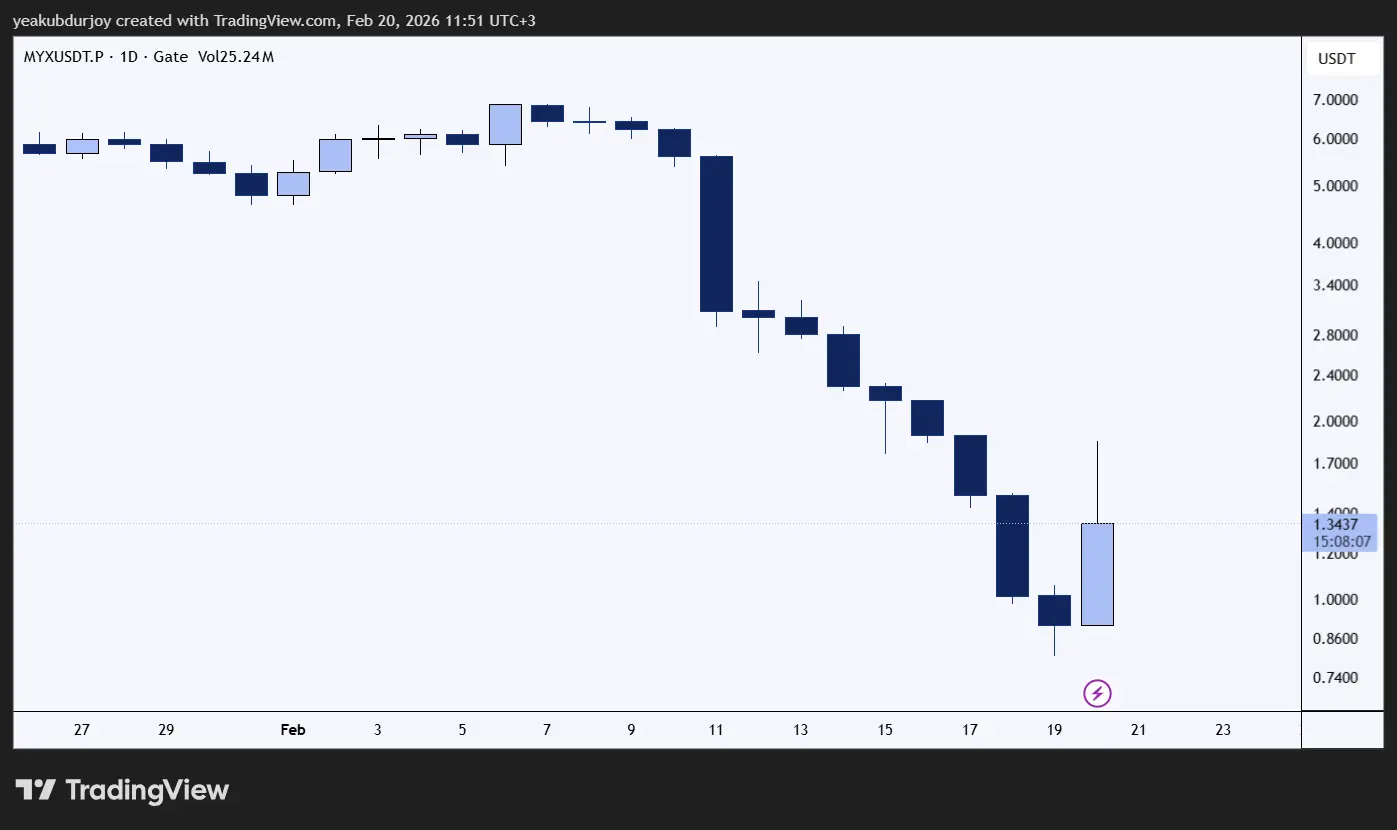

$MYX had one of those charts that reminds you why catching falling knives is expensive.

Daily went from grinding around 6+ to a straight dump into the 1 area. Then today we finally get a bounce, big green candle, but with a nasty upper wick around 1.7 to 1.8. That wick is basically the chart saying “buyers showed up, but sellers are still active.”

How I’m reading it right now: this looks more like a relief bounce than a clean trend reversal. I’m not interested in longing the middle of this candle. If MYX can hold above 1.20 to 1.25 on a pullback and build a base, then I’ll start respecting t

Daily went from grinding around 6+ to a straight dump into the 1 area. Then today we finally get a bounce, big green candle, but with a nasty upper wick around 1.7 to 1.8. That wick is basically the chart saying “buyers showed up, but sellers are still active.”

How I’m reading it right now: this looks more like a relief bounce than a clean trend reversal. I’m not interested in longing the middle of this candle. If MYX can hold above 1.20 to 1.25 on a pullback and build a base, then I’ll start respecting t

MYX23,32%

- Reward

- 3

- 2

- Repost

- Share

Mrworldwide :

:

sharp 😁 just dey observe....... and you all can follow me for any information concerning the crypto space....

View More

$ENSO just went from sleepy to “everyone’s watching” in two candles.

Daily flipped after that base around 1.10 to 1.20, then we got the vertical expansion straight into 1.90 with a wick up near 2.20. That’s usually where late FOMO gets punished, even if the trend stays bullish.

My play here is simple. I’m not chasing the top of a breakout candle. If ENSO holds above 1.70 on a pullback, I’m interested. If it reclaims 2.00 clean with acceptance, I’ll look for continuation. If it loses 1.70, I’m out and waiting.

Lesson I keep repeating to myself: big green candles are for managing risk, not for

Daily flipped after that base around 1.10 to 1.20, then we got the vertical expansion straight into 1.90 with a wick up near 2.20. That’s usually where late FOMO gets punished, even if the trend stays bullish.

My play here is simple. I’m not chasing the top of a breakout candle. If ENSO holds above 1.70 on a pullback, I’m interested. If it reclaims 2.00 clean with acceptance, I’ll look for continuation. If it loses 1.70, I’m out and waiting.

Lesson I keep repeating to myself: big green candles are for managing risk, not for

ENSO32,35%

- Reward

- 1

- Comment

- Repost

- Share

Weekend setup feels spicy, US strike risk on Iran and Fed minutes putting hikes back on the table. That made me think about, oil gets a war premium, USD gets a rate premium, and stocks/crypto get weekend gap risk. Brent around $70 is already reacting, but if headlines escalate,

- Reward

- 3

- Comment

- Repost

- Share

2021 genuinely had people believing JPEGs were a fast track to generational wealth. At the peak of the NFT frenzy, some pieces hit around $635,000. Now that same kind of “trophy asset” is worth less than a solid dinner out. That whole stretch was unreal. Celebrities jumping in,

- Reward

- 1

- Comment

- Repost

- Share

I bought my first heavy silver bar because I wanted something real to hold when markets felt shaky. No moonshot, just a simple hedge. What surprised me is how tradable silver is. It swings. It gives setups. Sometimes the best move is to ride the move, take profit, then go back

- Reward

- like

- Comment

- Repost

- Share

$XRP just gave a classic flush and bounce on 24h.Hard selloff into the 1.35 to 1.40 zone, now reclaiming 1.50 with a strong green push. That level is key. If 1.50 holds on a retest, this can extend toward 1.60 and possibly 1.75.

If we lose 1.50 again, I expect another sweep of the lows.I’m not chasing. Either I buy the confirmed hold above 1.50 or I wait for a clean break and hold over 1.60.

Are you treating this as a reversal or just a relief bounce?

If we lose 1.50 again, I expect another sweep of the lows.I’m not chasing. Either I buy the confirmed hold above 1.50 or I wait for a clean break and hold over 1.60.

Are you treating this as a reversal or just a relief bounce?

XRP-0,21%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Good Morning people! Can I get a gm back today?

- Reward

- like

- Comment

- Repost

- Share

Seeing hedge funds flip bullish on JPY right after strong US payrolls got my attention. Yen holding up while the dollar should be strong usually means positioning is shifting before most people notice. At the same time, coffee just lost the $3 level again. Big crop expectations

- Reward

- 1

- Comment

- Repost

- Share

Good morning CT! Can I get a gm back?

- Reward

- like

- Comment

- Repost

- Share

Good Morning CT! Can I get a gm back?

- Reward

- like

- Comment

- Repost

- Share