EagleEye

No content yet

EagleEye

#TrumpGroupMullsGazaStablecoin

Seeing reports that the Trump Group is considering launching a Gaza-backed stablecoin really caught my attention. Honestly, it feels like a convergence of so many different trends at once geopolitical tension, digital finance innovation, and the ever-expanding reach of cryptocurrencies. My initial thought is that this isn’t just a simple financial move; it’s a signal about how the boundaries of blockchain finance are being tested in politically sensitive and high-risk areas.

What I find particularly striking is the context. Stablecoins are usually pegged to fia

Seeing reports that the Trump Group is considering launching a Gaza-backed stablecoin really caught my attention. Honestly, it feels like a convergence of so many different trends at once geopolitical tension, digital finance innovation, and the ever-expanding reach of cryptocurrencies. My initial thought is that this isn’t just a simple financial move; it’s a signal about how the boundaries of blockchain finance are being tested in politically sensitive and high-risk areas.

What I find particularly striking is the context. Stablecoins are usually pegged to fia

- Reward

- like

- Comment

- Repost

- Share

#AIFearsSendIBMDown11%

Honestly, seeing IBM drop 11% in a single session really got me thinking about how fast markets react to AI news these days. It’s not just about numbers on a screen it feels like the market is telling a story about fear, expectation, and pressure on even the most established companies. IBM has been a technology giant for decades, pioneering everything from enterprise computing to AI research with Watson. And yet, this huge drop shows that history and experience alone aren’t enough anymore; perception and narrative matter just as much.

What strikes me is that this decli

Honestly, seeing IBM drop 11% in a single session really got me thinking about how fast markets react to AI news these days. It’s not just about numbers on a screen it feels like the market is telling a story about fear, expectation, and pressure on even the most established companies. IBM has been a technology giant for decades, pioneering everything from enterprise computing to AI research with Watson. And yet, this huge drop shows that history and experience alone aren’t enough anymore; perception and narrative matter just as much.

What strikes me is that this decli

- Reward

- 2

- 4

- Repost

- Share

MoonGirl :

:

To The Moon 🌕View More

#EthereumFoundationAdvancesDeFipunk

Ethereum Foundation Advances DeFiPunk Analysis and Perspective

The recent initiatives by the Ethereum Foundation around DeFiPunk mark a significant step forward for decentralized finance and NFT-driven innovation. This development is not just another technical upgrade or protocol deployment it reflects how the Ethereum ecosystem continues to expand the boundaries of finance, digital ownership, and community governance. DeFiPunk sits at the intersection of NFTs, DeFi protocols, and social finance, and Ethereum Foundation’s backing signals that these experi

Ethereum Foundation Advances DeFiPunk Analysis and Perspective

The recent initiatives by the Ethereum Foundation around DeFiPunk mark a significant step forward for decentralized finance and NFT-driven innovation. This development is not just another technical upgrade or protocol deployment it reflects how the Ethereum ecosystem continues to expand the boundaries of finance, digital ownership, and community governance. DeFiPunk sits at the intersection of NFTs, DeFi protocols, and social finance, and Ethereum Foundation’s backing signals that these experi

- Reward

- 2

- 4

- Repost

- Share

AylaShinex :

:

LFG 🔥View More

#BitdeerLiquidates943.1BTCReserves

In my view, Bitdeer’s decision to liquidate 943.1 BTC from its reserves, effectively bringing its corporate bitcoin holdings to zero, is far more than a routine financial maneuver. To me, it signals a seismic shift in how leading cryptocurrency miners are positioning themselves in a rapidly evolving market. For years, miners treated bitcoin not just as a product of operations but as a strategic asset, a hedge against inflation, and a store of value. By completely liquidating its reserves, Bitdeer is signaling that liquidity, flexibility, and strategic reinve

In my view, Bitdeer’s decision to liquidate 943.1 BTC from its reserves, effectively bringing its corporate bitcoin holdings to zero, is far more than a routine financial maneuver. To me, it signals a seismic shift in how leading cryptocurrency miners are positioning themselves in a rapidly evolving market. For years, miners treated bitcoin not just as a product of operations but as a strategic asset, a hedge against inflation, and a store of value. By completely liquidating its reserves, Bitdeer is signaling that liquidity, flexibility, and strategic reinve

- Reward

- 2

- 3

- Repost

- Share

MoonGirl :

:

To The Moon 🌕View More

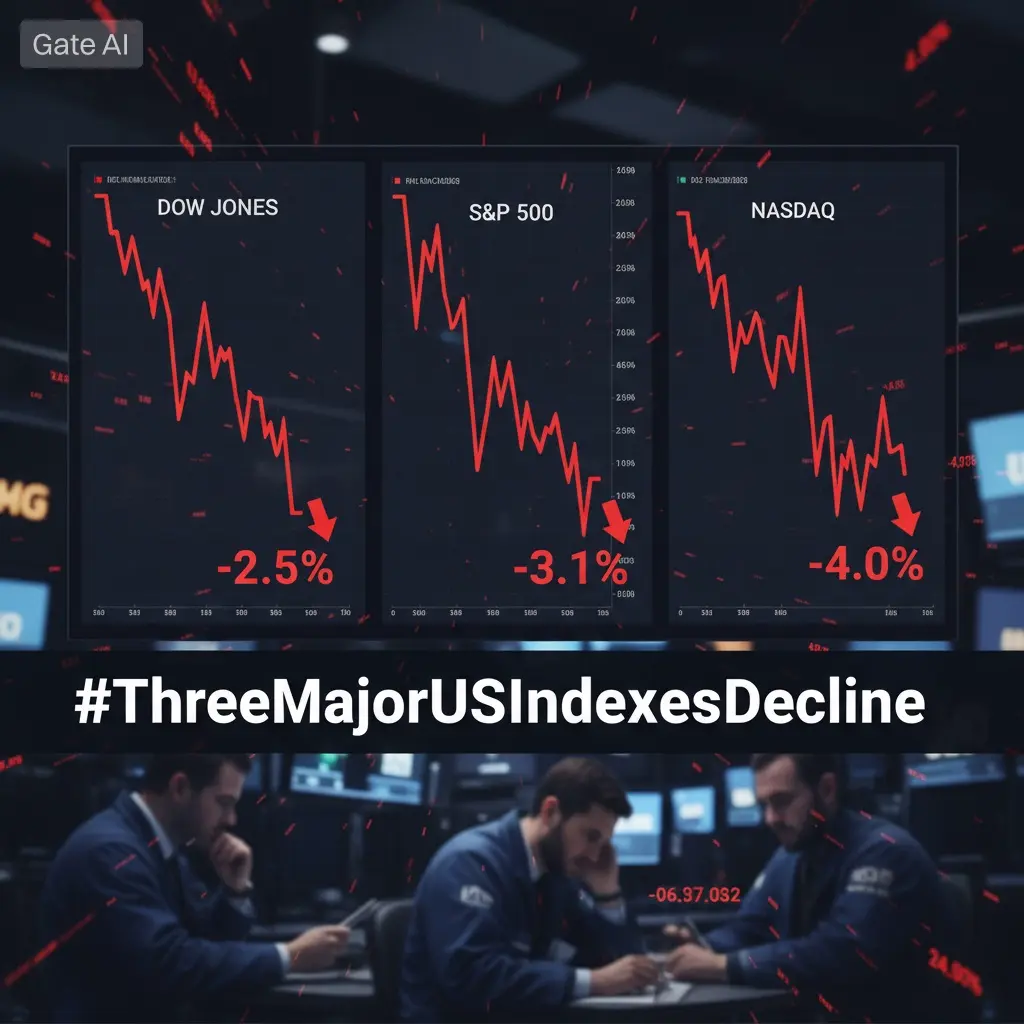

#ThreeMajorUSIndexesDecline

In my view, the recent decline across the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite is not just another red day on the charts — it is a reflection of shifting economic psychology. Markets are often described as numbers, percentages, and points, but beneath those figures lies something far more powerful: collective belief. When all three major benchmarks move downward together, I believe it reveals a deeper recalibration of expectations about growth, risk, and the stability of the broader economic system.

From my perspective, the Dow’s decl

In my view, the recent decline across the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite is not just another red day on the charts — it is a reflection of shifting economic psychology. Markets are often described as numbers, percentages, and points, but beneath those figures lies something far more powerful: collective belief. When all three major benchmarks move downward together, I believe it reveals a deeper recalibration of expectations about growth, risk, and the stability of the broader economic system.

From my perspective, the Dow’s decl

- Reward

- 4

- 6

- Repost

- Share

MoonGirl :

:

To The Moon 🌕View More

#MyViewOnWeb4.0’sOutlook

In my view, Web 4.0 is more than just the next step in internet evolution it is a fundamental transformation in how humans will interact with information, technology, and each other. I believe that Web 4.0 represents a shift from a predominantly digital world to an intelligent, interconnected, and human-centric cyber-ecosystem that blends data, experience, and automation in ways we are just beginning to imagine. While previous iterations of the web focused on connectivity (Web 1.0) and interactivity/social engagement (Web 2.0), and then personalization and collaborat

In my view, Web 4.0 is more than just the next step in internet evolution it is a fundamental transformation in how humans will interact with information, technology, and each other. I believe that Web 4.0 represents a shift from a predominantly digital world to an intelligent, interconnected, and human-centric cyber-ecosystem that blends data, experience, and automation in ways we are just beginning to imagine. While previous iterations of the web focused on connectivity (Web 1.0) and interactivity/social engagement (Web 2.0), and then personalization and collaborat

- Reward

- 4

- 8

- Repost

- Share

MoonGirl :

:

To The Moon 🌕View More

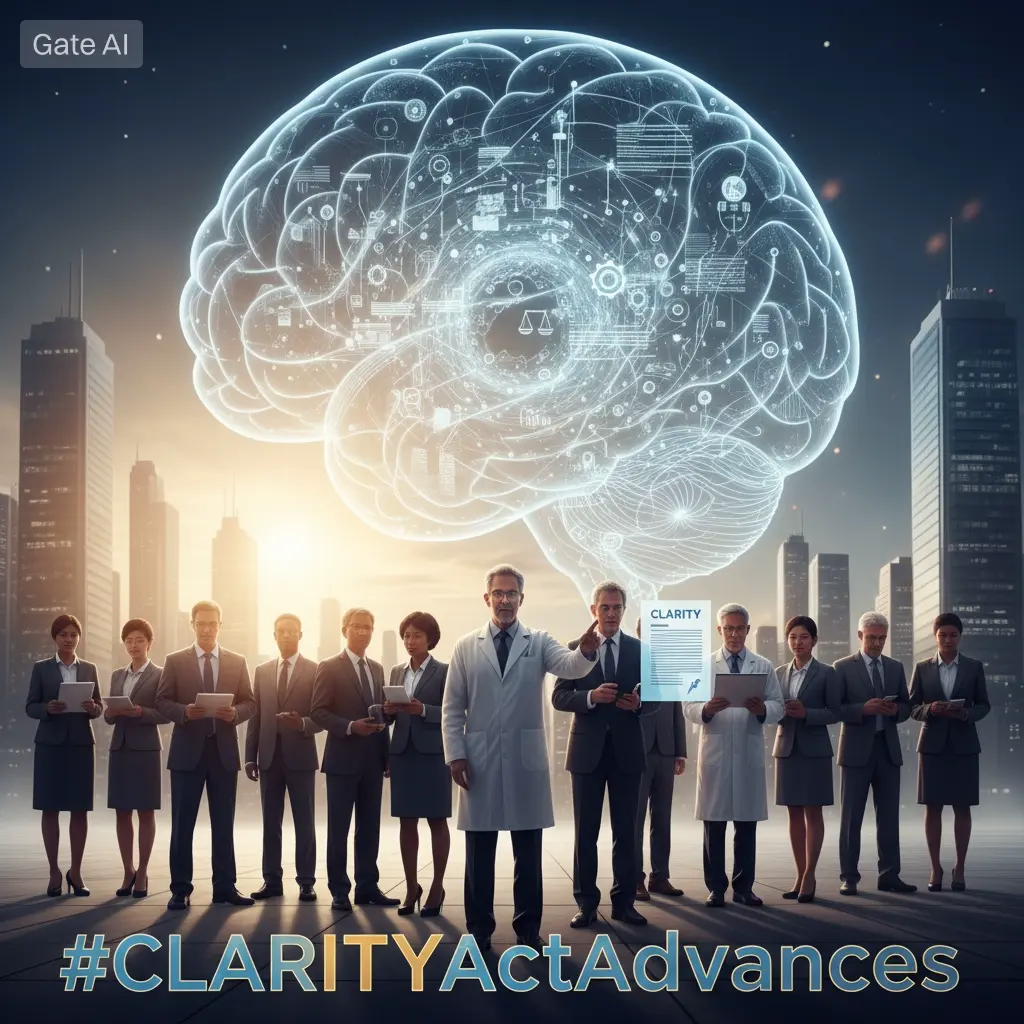

#CLARITYActAdvances

In my opinion, the Clarity Act Advances are not simply policy improvements they represent a deeper correction to a long-standing structural weakness in governance. I have always believed that ambiguity is one of the most dangerous elements within any system of authority. When laws, regulations, or institutional standards are unclear, power becomes unevenly distributed. Those with more resources, better legal interpretation, or strategic leverage can navigate gray areas to their advantage, while ordinary stakeholders are left uncertain and unprotected. From my perspective,

In my opinion, the Clarity Act Advances are not simply policy improvements they represent a deeper correction to a long-standing structural weakness in governance. I have always believed that ambiguity is one of the most dangerous elements within any system of authority. When laws, regulations, or institutional standards are unclear, power becomes unevenly distributed. Those with more resources, better legal interpretation, or strategic leverage can navigate gray areas to their advantage, while ordinary stakeholders are left uncertain and unprotected. From my perspective,

- Reward

- 3

- 7

- Repost

- Share

MoonGirl :

:

LFG 🔥View More

#What’sNextForUSIranTensions?

The relationship between the United States and Iran has long been one of the most complex and high-stakes dynamics in global geopolitics. As of early 2026, tensions remain elevated across multiple dimensions, ranging from nuclear negotiations and regional influence to economic sanctions and proxy conflicts. From my perspective, the current environment reflects a convergence of short-term political incentives, structural strategic calculations, and broader global risk considerations. This means that every diplomatic signal, military maneuver, or policy announcemen

The relationship between the United States and Iran has long been one of the most complex and high-stakes dynamics in global geopolitics. As of early 2026, tensions remain elevated across multiple dimensions, ranging from nuclear negotiations and regional influence to economic sanctions and proxy conflicts. From my perspective, the current environment reflects a convergence of short-term political incentives, structural strategic calculations, and broader global risk considerations. This means that every diplomatic signal, military maneuver, or policy announcemen

- Reward

- 14

- 19

- Repost

- Share

Miss_1903 :

:

2026 GOGOGO 👊View More

#LatestMarketInsights

As we move through early 2026, global markets are navigating a landscape defined by both resilience and heightened uncertainty. Macro conditions remain in flux, with central banks signaling caution around monetary policy. In the United States, Federal Reserve officials describe the likelihood of a March rate cut as a “coin flip,” reflecting the tension between slowing growth and persistent inflationary pressures. Labor data and price dynamics suggest that the economy is not yet in a position for aggressive easing, leaving markets sensitive to each new data point. In my v

As we move through early 2026, global markets are navigating a landscape defined by both resilience and heightened uncertainty. Macro conditions remain in flux, with central banks signaling caution around monetary policy. In the United States, Federal Reserve officials describe the likelihood of a March rate cut as a “coin flip,” reflecting the tension between slowing growth and persistent inflationary pressures. Labor data and price dynamics suggest that the economy is not yet in a position for aggressive easing, leaving markets sensitive to each new data point. In my v

- Reward

- 14

- 20

- Repost

- Share

Miss_1903 :

:

To The Moon 🌕View More

#VitalikSells21.7KETH

In February 2026, Ethereum co-founder Vitalik Buterin made headlines by selling approximately 21,700 ETH from his personal holdings, a move that sparked widespread discussion across the crypto community. While the raw numbers valued at tens of millions of dollars may appear dramatic at first glance, the broader context provides a more nuanced understanding. These sales are part of a publicly stated plan announced in late January, in which Vitalik committed to allocating 16,384 ETH over time to fund open-source projects, software development, infrastructure upgrades, and

In February 2026, Ethereum co-founder Vitalik Buterin made headlines by selling approximately 21,700 ETH from his personal holdings, a move that sparked widespread discussion across the crypto community. While the raw numbers valued at tens of millions of dollars may appear dramatic at first glance, the broader context provides a more nuanced understanding. These sales are part of a publicly stated plan announced in late January, in which Vitalik committed to allocating 16,384 ETH over time to fund open-source projects, software development, infrastructure upgrades, and

ETH-0,6%

- Reward

- 14

- 17

- Repost

- Share

Miss_1903 :

:

2026 GOGOGO 👊View More

#GoldTops$5,190

From my perspective, gold surpassing $5,190 per ounce is more than just a numerical milestone it is a reflection of broader shifts in global risk perception and investor behavior.

Over the past few months, I have observed mounting uncertainty across financial markets, driven by geopolitical tensions, evolving trade policies, and fluctuating macroeconomic indicators. In such an environment, gold naturally reasserts its role as a safe-haven asset. What strikes me about this move is that it highlights the continuing relevance of gold in portfolio strategy: even as modern financi

From my perspective, gold surpassing $5,190 per ounce is more than just a numerical milestone it is a reflection of broader shifts in global risk perception and investor behavior.

Over the past few months, I have observed mounting uncertainty across financial markets, driven by geopolitical tensions, evolving trade policies, and fluctuating macroeconomic indicators. In such an environment, gold naturally reasserts its role as a safe-haven asset. What strikes me about this move is that it highlights the continuing relevance of gold in portfolio strategy: even as modern financi

- Reward

- 13

- 18

- Repost

- Share

Miss_1903 :

:

2026 GOGOGO 👊View More

#SpotBTCETFsLogFiveWeekOutflows

Over the past five weeks, U.S. spot Bitcoin ETFs have experienced consecutive net outflows totaling approximately $3.8 billion. This streak is the longest observed since early 2025 and has drawn attention because it coincides with a period of heightened macroeconomic uncertainty and market volatility. At first glance, such outflows might suggest waning interest in Bitcoin, but a deeper look reveals a more nuanced picture. Despite these withdrawals, cumulative inflows since the ETFs’ inception remain substantial, around $54 billion, and total assets under manage

Over the past five weeks, U.S. spot Bitcoin ETFs have experienced consecutive net outflows totaling approximately $3.8 billion. This streak is the longest observed since early 2025 and has drawn attention because it coincides with a period of heightened macroeconomic uncertainty and market volatility. At first glance, such outflows might suggest waning interest in Bitcoin, but a deeper look reveals a more nuanced picture. Despite these withdrawals, cumulative inflows since the ETFs’ inception remain substantial, around $54 billion, and total assets under manage

- Reward

- 13

- 17

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#TrumpGroupMullsGazaStablecoin

The emerging discussion about a “Gaza stablecoin” backed or considered by a group associated with former President Donald Trump has sparked intense debate across geopolitical, economic, technological, and humanitarian domains. At first glance, the phrase “Gaza stablecoin” may sound like a crypto initiative, but the context, purpose, and implications are far broader involving conflict economics, digital finance innovation, foreign policy strategy, and ethical considerations. To fully understand what this concept entails and why it matters, it’s necessary to unpa

The emerging discussion about a “Gaza stablecoin” backed or considered by a group associated with former President Donald Trump has sparked intense debate across geopolitical, economic, technological, and humanitarian domains. At first glance, the phrase “Gaza stablecoin” may sound like a crypto initiative, but the context, purpose, and implications are far broader involving conflict economics, digital finance innovation, foreign policy strategy, and ethical considerations. To fully understand what this concept entails and why it matters, it’s necessary to unpa

- Reward

- 13

- 19

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#AIFearsSendIBMDown11%

Shares of IBM fell sharply by 11% following investor concerns tied to artificial intelligence positioning, competitive pressure, and forward-looking revenue expectations. While IBM has been actively repositioning itself as a hybrid cloud and enterprise AI company, the market reaction suggests growing skepticism about whether its AI strategy can compete effectively in a rapidly evolving landscape dominated by hyperscalers and next-generation AI-native firms.

Market Reaction: Why 11% Matters

An 11% single-session decline in a large-cap, established technology company is s

Shares of IBM fell sharply by 11% following investor concerns tied to artificial intelligence positioning, competitive pressure, and forward-looking revenue expectations. While IBM has been actively repositioning itself as a hybrid cloud and enterprise AI company, the market reaction suggests growing skepticism about whether its AI strategy can compete effectively in a rapidly evolving landscape dominated by hyperscalers and next-generation AI-native firms.

Market Reaction: Why 11% Matters

An 11% single-session decline in a large-cap, established technology company is s

- Reward

- 12

- 21

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#EthereumFoundationAdvancesDeFipunk

Ethereum Foundation Advances DeFi-Punk Vision Strengthening Open Finance and Cultural Ethos

The recent push by the Ethereum Foundation to advance what many are calling a “DeFi-punk” direction signals a renewed commitment to the original cypherpunk ethos that shaped early blockchain development. At its core, this vision blends decentralized finance innovation with the cultural principles of self-sovereignty, permissionless access, censorship resistance, and open-source collaboration. Rather than focusing purely on institutional adoption or regulatory alignm

Ethereum Foundation Advances DeFi-Punk Vision Strengthening Open Finance and Cultural Ethos

The recent push by the Ethereum Foundation to advance what many are calling a “DeFi-punk” direction signals a renewed commitment to the original cypherpunk ethos that shaped early blockchain development. At its core, this vision blends decentralized finance innovation with the cultural principles of self-sovereignty, permissionless access, censorship resistance, and open-source collaboration. Rather than focusing purely on institutional adoption or regulatory alignm

ETH-0,6%

- Reward

- 11

- 15

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#BitdeerLiquidates943.1BTCReserves

Bitdeer Liquidates 943.1 BTC Reserves Deep Structural, Market, and Strategic Analysis

The decision by Bitdeer Technologies Group to liquidate 943.1 BTC is not just a treasury update it is a window into the evolving financial mechanics of the Bitcoin mining industry. In crypto markets, miner behavior often acts as a leading indicator because miners sit at the production layer of Bitcoin’s supply chain. They generate newly minted BTC, face constant operational expenses, and must continuously decide between holding for long-term appreciation or selling to mai

Bitdeer Liquidates 943.1 BTC Reserves Deep Structural, Market, and Strategic Analysis

The decision by Bitdeer Technologies Group to liquidate 943.1 BTC is not just a treasury update it is a window into the evolving financial mechanics of the Bitcoin mining industry. In crypto markets, miner behavior often acts as a leading indicator because miners sit at the production layer of Bitcoin’s supply chain. They generate newly minted BTC, face constant operational expenses, and must continuously decide between holding for long-term appreciation or selling to mai

BTC-0,93%

- Reward

- 10

- 11

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#ThreeMajorUSIndexesDecline

Three Major US Indexes Decline Deep Dive Into Causes, Market Signals, and Strategic Implications

The decline of the three major U.S. stock indexes the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite represents more than just a routine red trading session. When all three benchmarks move lower in tandem, it typically reflects broad-based risk aversion rather than isolated sector weakness. Such synchronized declines often signal that investors are collectively reassessing economic conditions, corporate earnings expectations, monetary policy outl

Three Major US Indexes Decline Deep Dive Into Causes, Market Signals, and Strategic Implications

The decline of the three major U.S. stock indexes the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite represents more than just a routine red trading session. When all three benchmarks move lower in tandem, it typically reflects broad-based risk aversion rather than isolated sector weakness. Such synchronized declines often signal that investors are collectively reassessing economic conditions, corporate earnings expectations, monetary policy outl

- Reward

- 7

- 8

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#MyViewOnWeb4.0’sOutlook

My View on Web 4.0’s Outlook Vision, Evolution, and Real-World Impact

Web 4.0 represents the next evolution of the internet one that moves beyond the static information era of Web 1.0 and the social, interactive landscape of Web 2.0 toward a more semantic, autonomous, and symbiotic digital ecosystem. At its core, Web 4.0 envisions an internet where machines understand context, data is interoperable across platforms, and user experiences are tailored, immersive, and empowered by artificial intelligence and decentralized frameworks. Unlike earlier stages, which focuse

My View on Web 4.0’s Outlook Vision, Evolution, and Real-World Impact

Web 4.0 represents the next evolution of the internet one that moves beyond the static information era of Web 1.0 and the social, interactive landscape of Web 2.0 toward a more semantic, autonomous, and symbiotic digital ecosystem. At its core, Web 4.0 envisions an internet where machines understand context, data is interoperable across platforms, and user experiences are tailored, immersive, and empowered by artificial intelligence and decentralized frameworks. Unlike earlier stages, which focuse

TOKEN2,13%

- Reward

- 9

- 12

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#GateSquare$50KRedPacketGiveaway

Gate Square’s $50,000 Red Packet Giveaway is more than just a promotional campaign it is a strategic celebration of community, engagement, and digital innovation. By combining substantial financial incentives with cultural resonance, the platform creates an event that draws both new and existing users into its ecosystem, fostering excitement while encouraging meaningful participation. Red Packet giveaways are inspired by traditional practices, widely recognized in East Asian cultures as symbols of luck, sharing, and celebration, and translating this into the

Gate Square’s $50,000 Red Packet Giveaway is more than just a promotional campaign it is a strategic celebration of community, engagement, and digital innovation. By combining substantial financial incentives with cultural resonance, the platform creates an event that draws both new and existing users into its ecosystem, fostering excitement while encouraging meaningful participation. Red Packet giveaways are inspired by traditional practices, widely recognized in East Asian cultures as symbols of luck, sharing, and celebration, and translating this into the

TOKEN2,13%

- Reward

- 12

- 15

- 1

- Share

xxx40xxx :

:

To The Moon 🌕View More

#TrumpAnnouncesNewTariffs

The announcement of new tariffs by former President Donald Trump represents a pivotal moment in U.S. trade policy, reflecting an aggressive protectionist approach aimed at reshaping the balance of global commerce. Unlike routine trade measures, tariffs are powerful levers of economic strategy: they can protect domestic industries, influence international negotiations, and signal political priorities. However, they also introduce layers of uncertainty across global markets, supply chains, and investment strategies. The latest tariffs targeted specific imported goods i

The announcement of new tariffs by former President Donald Trump represents a pivotal moment in U.S. trade policy, reflecting an aggressive protectionist approach aimed at reshaping the balance of global commerce. Unlike routine trade measures, tariffs are powerful levers of economic strategy: they can protect domestic industries, influence international negotiations, and signal political priorities. However, they also introduce layers of uncertainty across global markets, supply chains, and investment strategies. The latest tariffs targeted specific imported goods i

- Reward

- 7

- 7

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More