MarcoJohanning

No content yet

MarcoJohanning

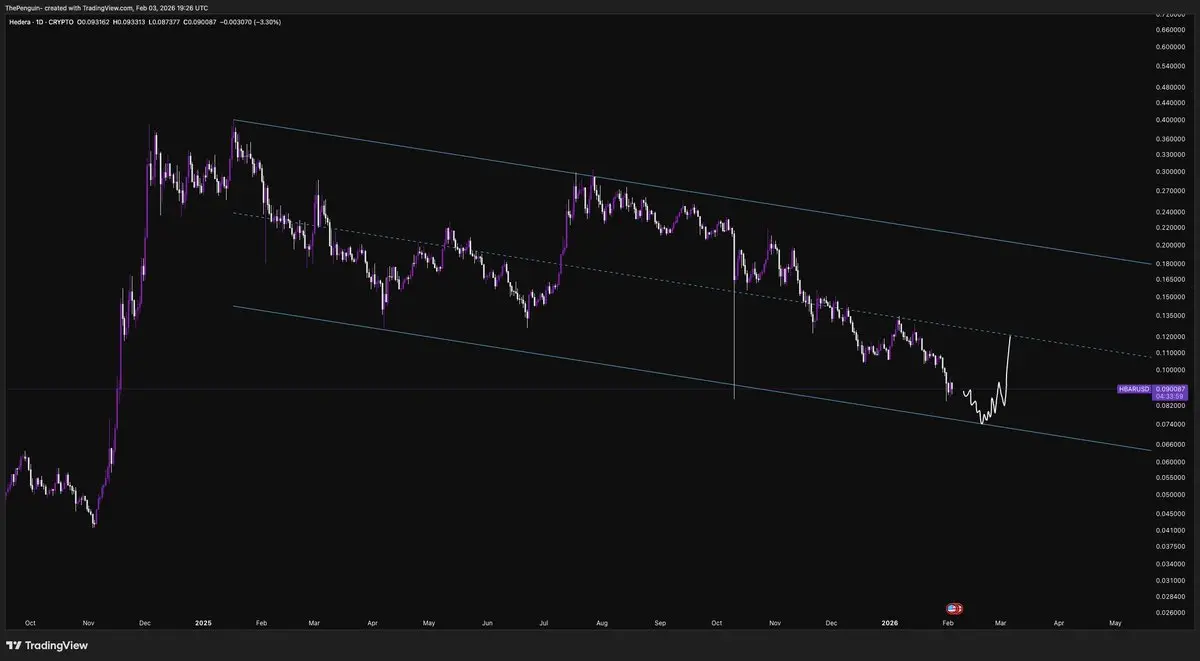

USDT.D hit similar levels than previous bear market bottom.

Historically, when we’ve observed this setup, it has been followed by a bounce across the crypto market.

So some hopium here, but tbh, for the next months I expect a new ATH here, which would send Bitcoin lower.

Historically, when we’ve observed this setup, it has been followed by a bounce across the crypto market.

So some hopium here, but tbh, for the next months I expect a new ATH here, which would send Bitcoin lower.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

Gm and happy Tuesday ☕️

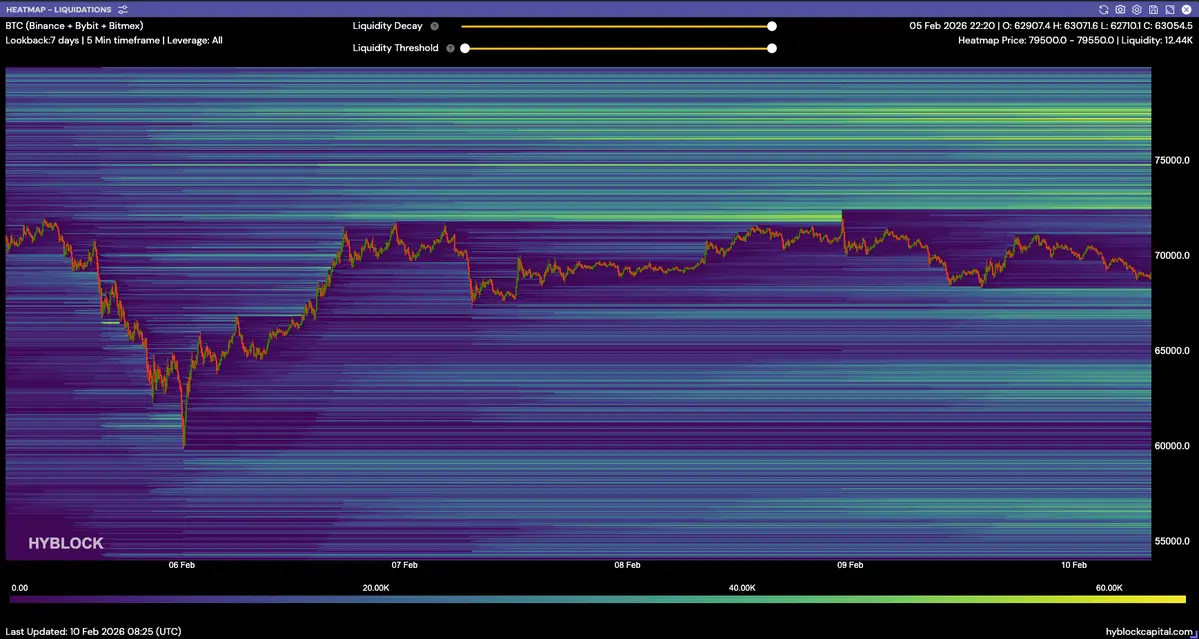

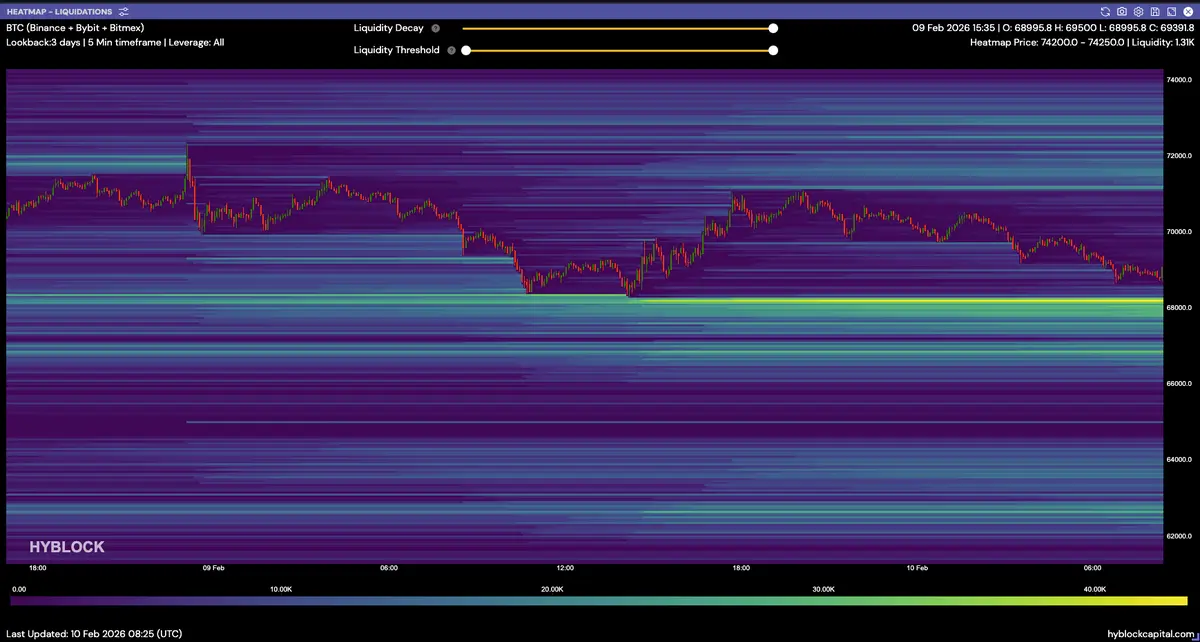

$BTC Heatmap update

Bitcoin is compressing just below resistance and looks close to resolving. A breakout to one side should happen soon.

Liquidity is still present both above and below price, which keeps the question open:

Do we finally see a harder downside reaction following the sweep of the highs?

Or is Bitcoin stabilizing around the 2021 ATH zone at 69k, building acceptance before pushing higher again?

The next expansion should give the answer.

$BTC Heatmap update

Bitcoin is compressing just below resistance and looks close to resolving. A breakout to one side should happen soon.

Liquidity is still present both above and below price, which keeps the question open:

Do we finally see a harder downside reaction following the sweep of the highs?

Or is Bitcoin stabilizing around the 2021 ATH zone at 69k, building acceptance before pushing higher again?

The next expansion should give the answer.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

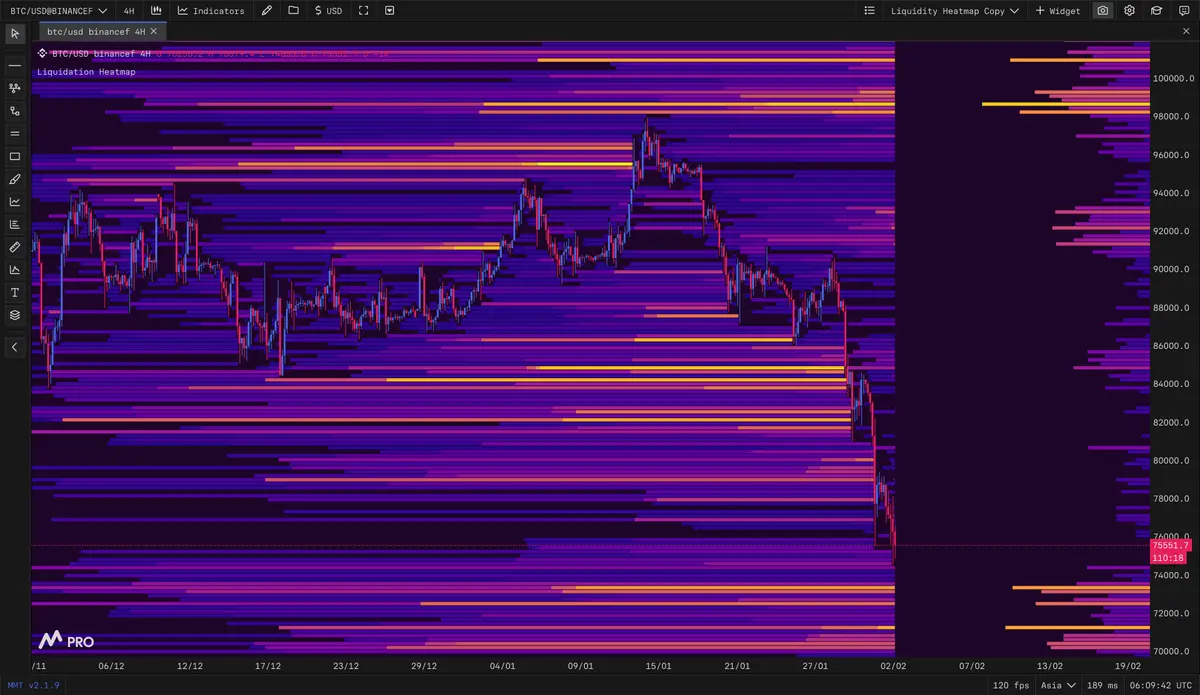

Live footage of the market makers clearing the path for the next sweep.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Gm and happy Monday! ☀️$BTC Heatmap updateAny attempt to base over the weekend failed.Price couldn’t hold the lows and has now pushed straight into deeper liquidity.Weak reactions + lower value = the auction still moving down, not forming structure.So the bias stays with the move.Lower liquidity remains the draw until we see real stabilisation.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

$ETH updateStructure broke and the move accelerated fast following btc.Once support gave way, it wasn’t chop - it was straight expansion lower.Lower highs → loss of base → continuation.We’re now stretched after the flush, so this is reaction territory, not ideal chase territory.Hold here → relief bounceFail → next liquidity pocket lowerTrend is down.Short term = watch for stabilisation before the next move.

- Reward

- 1

- Comment

- Repost

- Share

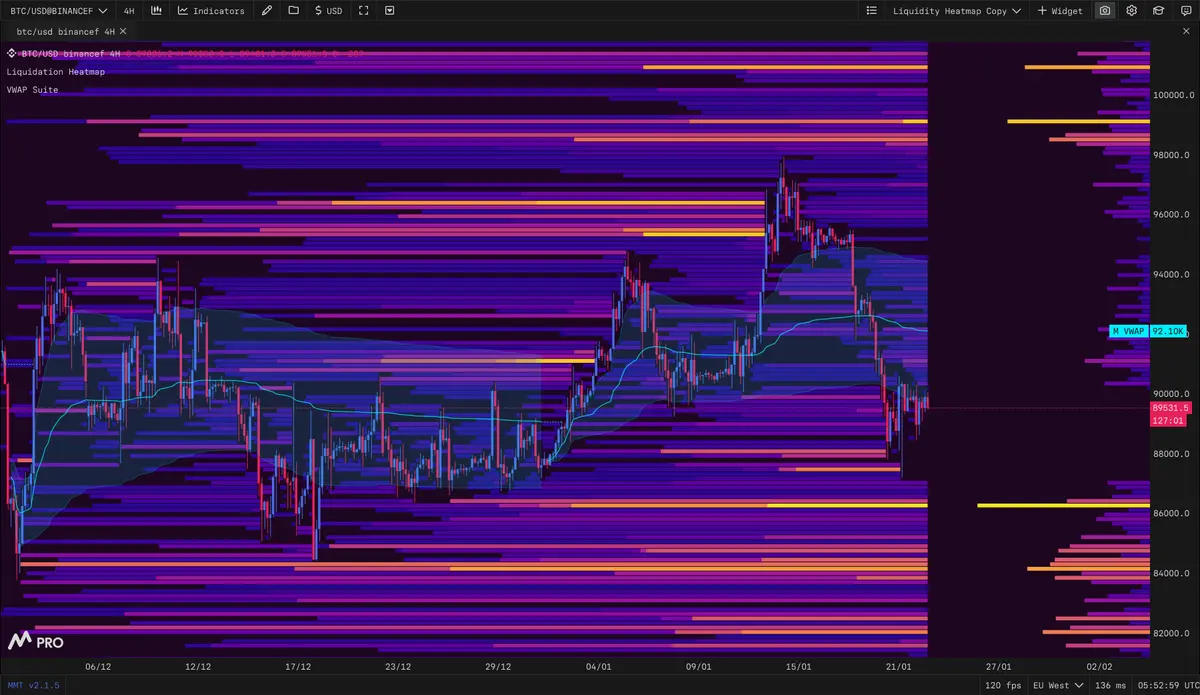

GM and happy Friday! ☀️\n\n$BTC Heatmap update\n\nPrice is holding in the lower range after the sweep, still building value around the 89–90k area.\n\nNo reaction back to VWAP yet, which keeps the focus on acceptance down here.\n\nThis is no longer about where price came from.\nIt’s about whether this zone can form a base.\n\nCompression after an extension usually comes before rotation.\n\nIf value continues to build here, the next meaningful move is a strong push back toward higher reference.\n\nLet the market show its hand.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

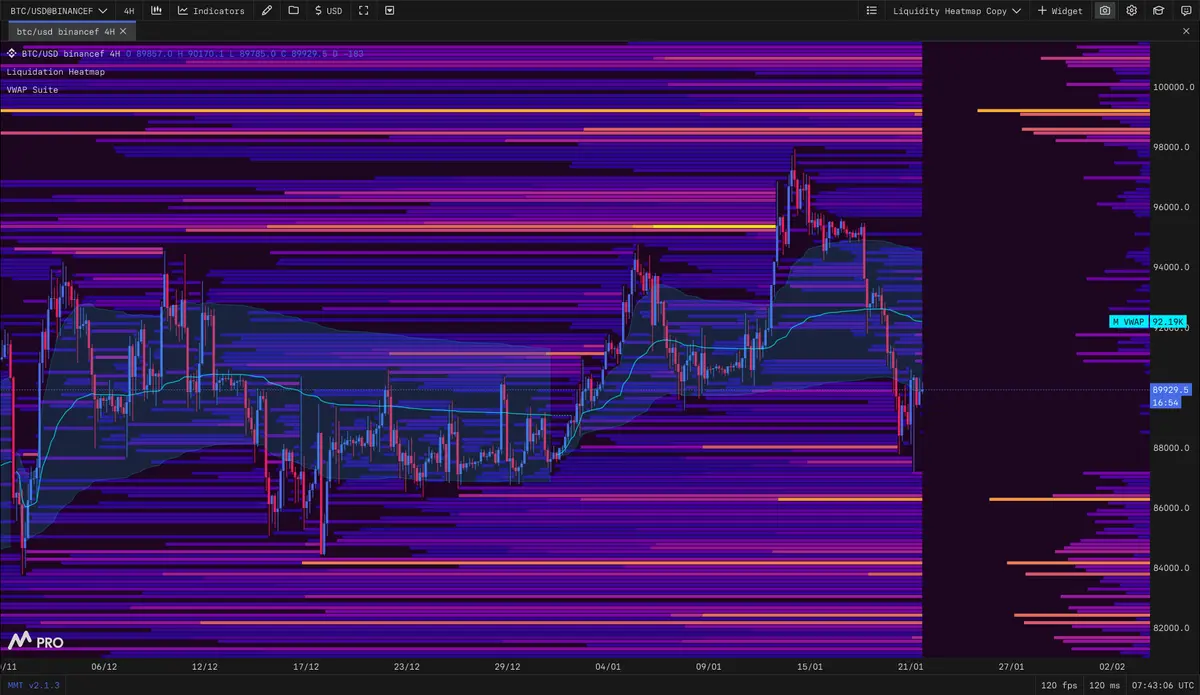

Gm and happy Thursday! ☀️\n\n$BTC Heatmap update\n\nThe sell‑side sweep did its job and price is now compressing inside a defined pocket of liquidity.\n\nThis isn’t about searching for lows anymore, it’s about how tight value gets built here.\n\nWith price consolidating at the bottom of the range and\nvolatility already being absorbed.\n\nIt\'s now the phase before expansion, not continuation lower.\n\nThe longer price holds and trades here, the more energy gets stored.\n\nBreaks come from compression, not panic.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

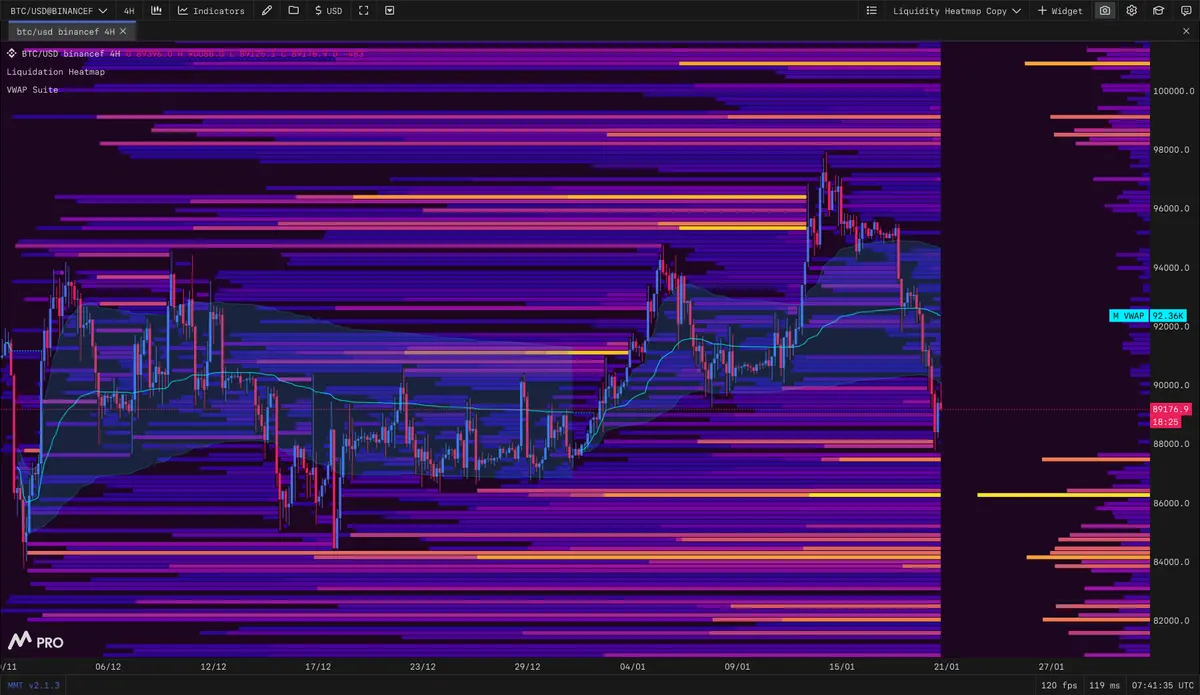

GM and happy Wednesday ☀️\n\n$BTC Heatmap update\n\nYesterday we talked about value shifting lower and the market beginning a new phase of value discovery.\n\nThat narrative still holds.\n\nPrice has now completed the liquidation sweep and is developing acceptance around the 89k area.\n\nThis isn’t mean reversion anymore, it’s the market choosing where it wants to build from.\n\nWe’re past reaction.\nWe’re in structure formation.\n\nWhen price spends time building value after an extension, it’s usually preparation, not exhaustion.\n\nOnce acceptance is established, direction follows.\n\nLet va

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

You thought VWAP was support or resistance?👀

It’s a fair value reference.

Price above VWAP = market is trading at a premium.

Price below VWAP = market is trading at a discount.

What matters isn’t touching VWAP.

What matters is acceptance around it.

Quick tap and rejection → VWAP stays a reference

Trading through and building volume → VWAP loses control

Holding above or below → value shifts

That’s how you know when the market is rotating…

and when it’s actually changing where it believes price should be.

VWAP shows you where value is being argued.

Acceptance shows you where value is being deci

It’s a fair value reference.

Price above VWAP = market is trading at a premium.

Price below VWAP = market is trading at a discount.

What matters isn’t touching VWAP.

What matters is acceptance around it.

Quick tap and rejection → VWAP stays a reference

Trading through and building volume → VWAP loses control

Holding above or below → value shifts

That’s how you know when the market is rotating…

and when it’s actually changing where it believes price should be.

VWAP shows you where value is being argued.

Acceptance shows you where value is being deci

- Reward

- like

- Comment

- Repost

- Share

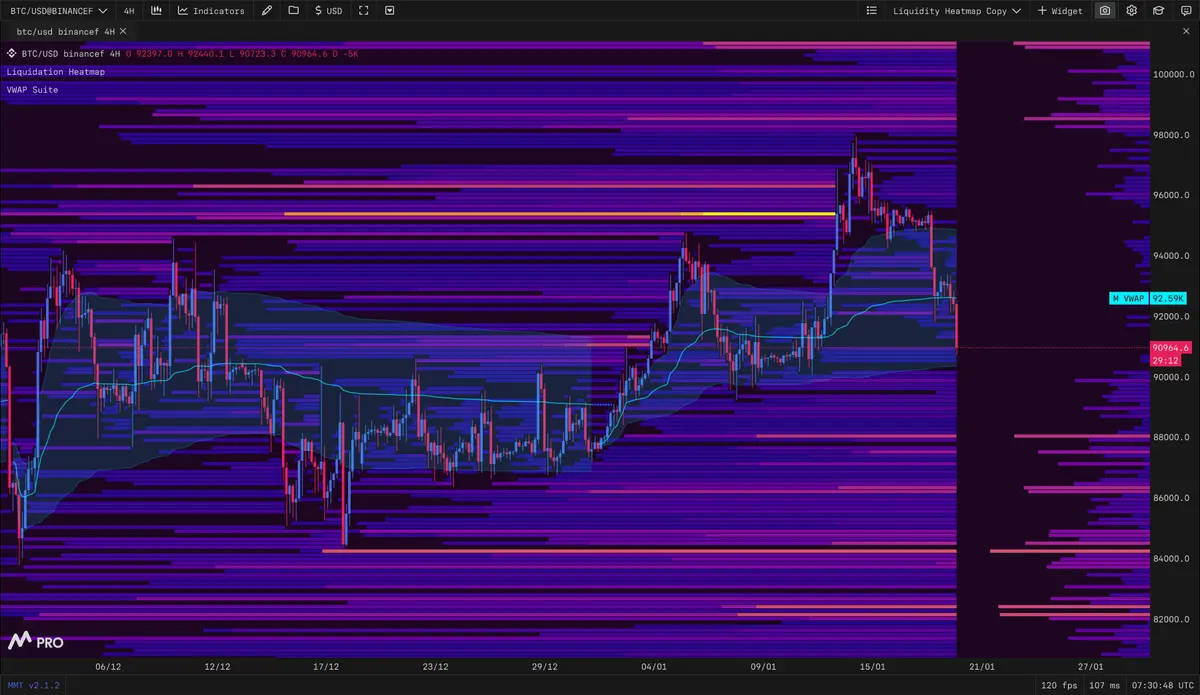

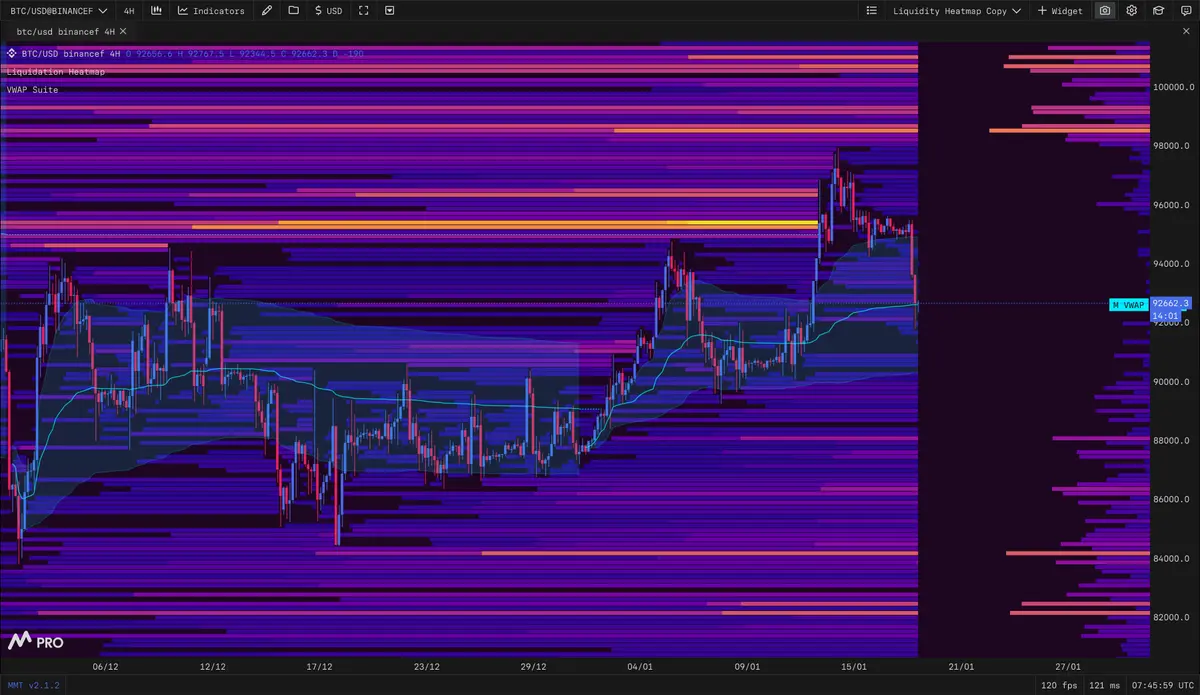

Gm And happy Tuesday!☀️

$BTC Heatmap update

Yesterday price traded through VWAP and accepted lower, down into the 91k area.

That wasn’t a bounce, it was value shifting.

VWAP is no longer balance right now, it’s overhead reference.

The market is building acceptance below it.

Liquidity is thicker underneath than above,

so this is about establishing new value, not continuation yet.

If price can reclaim and hold VWAP, the picture changes.

If not, then this lower range is where the market is choosing to work.

$BTC Heatmap update

Yesterday price traded through VWAP and accepted lower, down into the 91k area.

That wasn’t a bounce, it was value shifting.

VWAP is no longer balance right now, it’s overhead reference.

The market is building acceptance below it.

Liquidity is thicker underneath than above,

so this is about establishing new value, not continuation yet.

If price can reclaim and hold VWAP, the picture changes.

If not, then this lower range is where the market is choosing to work.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

JenaTran :

:

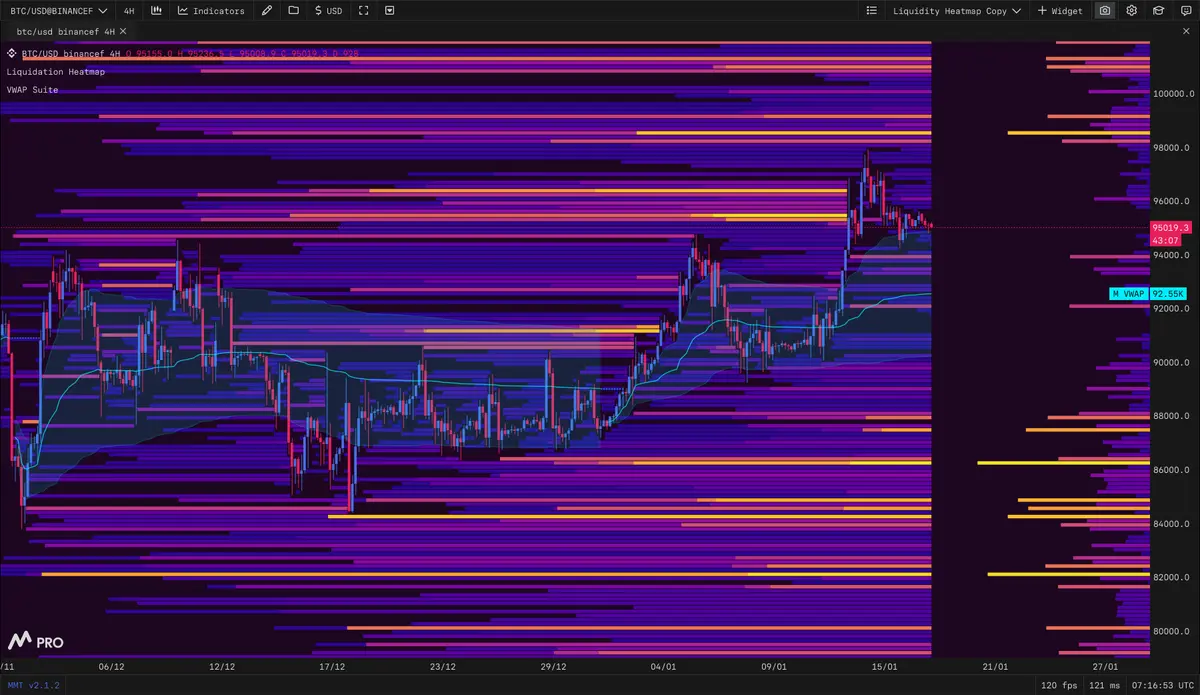

1000x Vibes 🤑Gm And happy Monday!☀️

$BTC Heatmap update

Yesterday’s move was a full rotation back into VWAP after the auction played out.

That’s the market resetting, not reversing.

Price found balance, and now liquidity is starting to rebuild again.

No chase, no confirmation yet, just re‑positioning.

Trend can stay higher while the market reloads.

This is just a pause between legs.

$BTC Heatmap update

Yesterday’s move was a full rotation back into VWAP after the auction played out.

That’s the market resetting, not reversing.

Price found balance, and now liquidity is starting to rebuild again.

No chase, no confirmation yet, just re‑positioning.

Trend can stay higher while the market reloads.

This is just a pause between legs.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

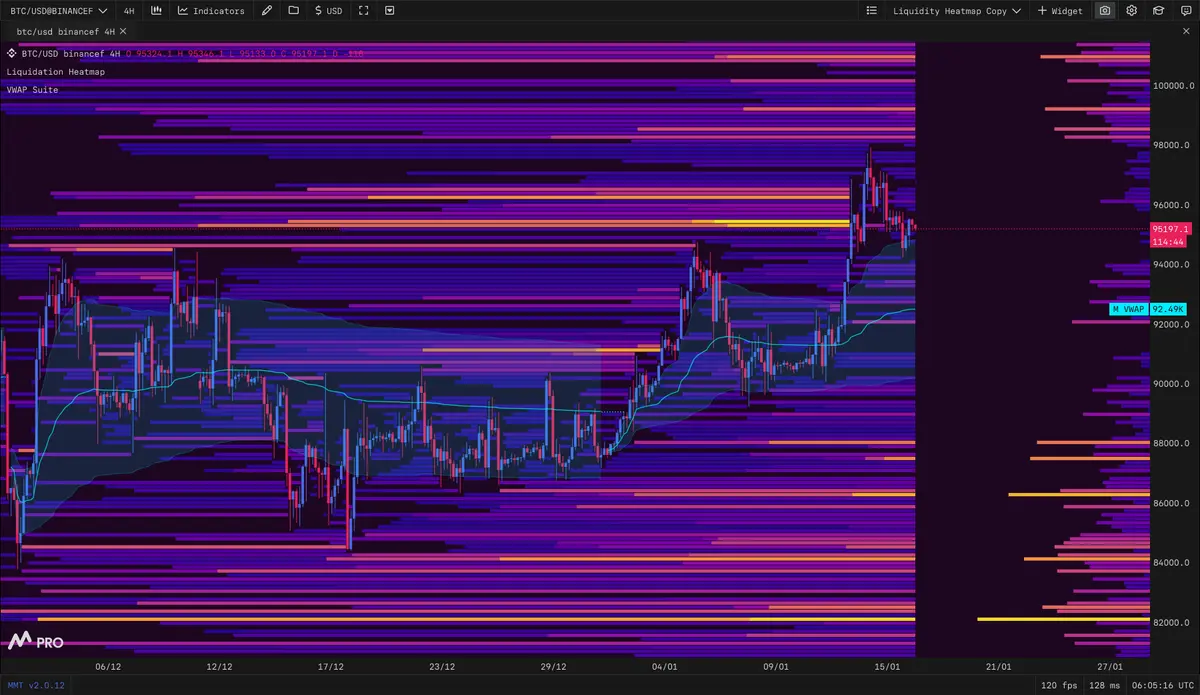

Gm and happy Sunday☀️

$BTC Heatmap update

Price is consolidating around mid channel, with liquidity starting to stack back above.

That usually suggests positioning for another attempt higher rather than distribution.

A sweep back toward the 94k area would make sense to reset structure and test demand.

If liquidity above continues to build after that, a breakout becomes high probability.

$BTC Heatmap update

Price is consolidating around mid channel, with liquidity starting to stack back above.

That usually suggests positioning for another attempt higher rather than distribution.

A sweep back toward the 94k area would make sense to reset structure and test demand.

If liquidity above continues to build after that, a breakout becomes high probability.

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

GM and happy Saturday ☀️

$BTC Heatmap update

Earlier this week liquidity was stacked above, which was bullish because price was being drawn higher.

Now the thicker bands are sitting below, and that changes the role of liquidity.

That doesn’t mean we flip bearish.

It means liquidity has shifted from draw to support.

Liquidity as a draw:

When liquidity is stacked above price, it acts like a magnet, price is incentivised to move up to go and trade into it. That’s when you say “price follows liquidity” in a directional sense.

Liquidity as support:

When liquidity is stacked below price, it’s not pu

$BTC Heatmap update

Earlier this week liquidity was stacked above, which was bullish because price was being drawn higher.

Now the thicker bands are sitting below, and that changes the role of liquidity.

That doesn’t mean we flip bearish.

It means liquidity has shifted from draw to support.

Liquidity as a draw:

When liquidity is stacked above price, it acts like a magnet, price is incentivised to move up to go and trade into it. That’s when you say “price follows liquidity” in a directional sense.

Liquidity as support:

When liquidity is stacked below price, it’s not pu

BTC0,85%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share