MrThanks77

No content yet

MrThanks77

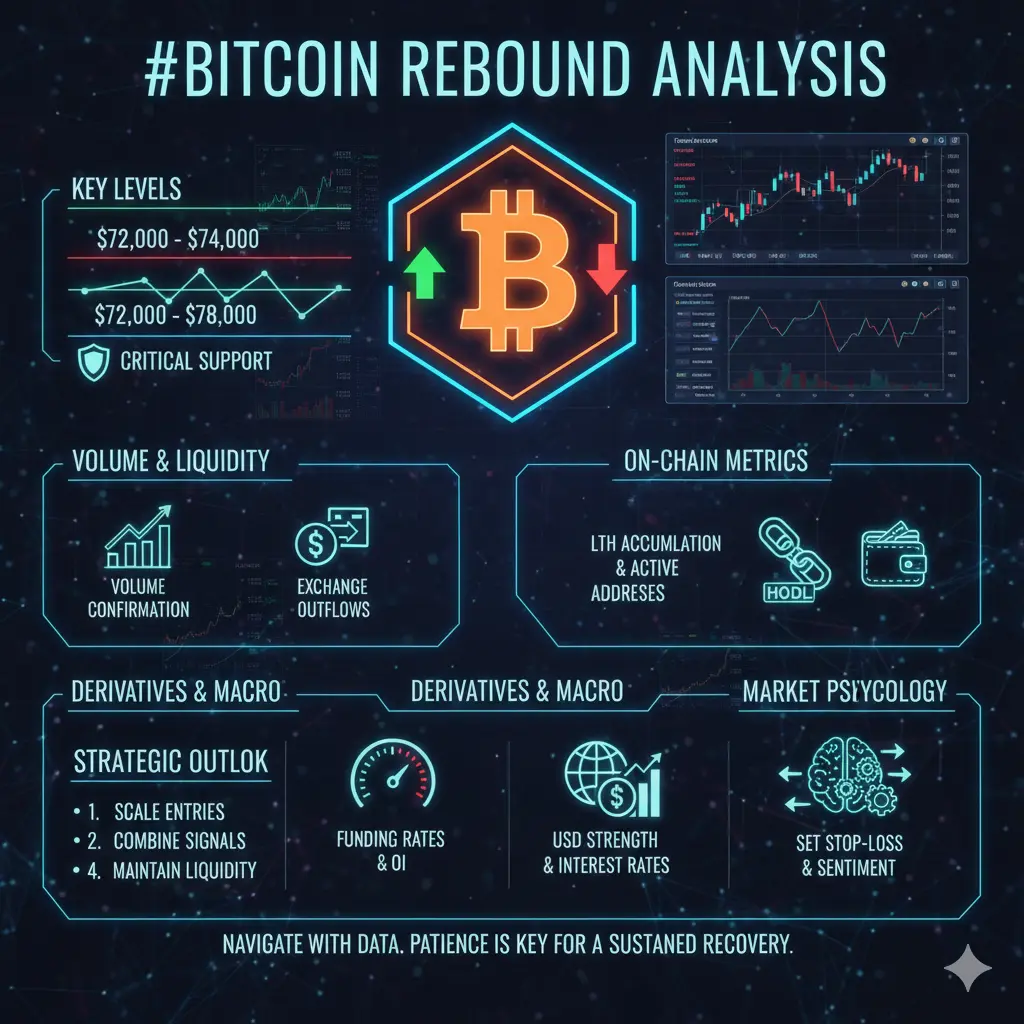

#StrategyBitcoinPositionTurnsRed Strategy Bitcoin Position Turns Red: Navigating Market Volatility #StrategyBitcoinPositionTurnsRed

Bitcoin traders and investors are facing a challenging moment as a number of strategic positions have turned red, reflecting recent market volatility and shifts in sentiment. This situation has sparked discussion about portfolio management, risk mitigation, and market timing in highly dynamic conditions.

The decline in positions is primarily driven by recent market corrections, macroeconomic uncertainties, and shifts in investor sentiment. Bitcoin’s price movement

Bitcoin traders and investors are facing a challenging moment as a number of strategic positions have turned red, reflecting recent market volatility and shifts in sentiment. This situation has sparked discussion about portfolio management, risk mitigation, and market timing in highly dynamic conditions.

The decline in positions is primarily driven by recent market corrections, macroeconomic uncertainties, and shifts in investor sentiment. Bitcoin’s price movement

BTC-11,4%

- Reward

- 6

- 6

- Repost

- Share

PrincessOfBitcoin :

:

You are going to do amazing on Gate.io! 🌟 Sending you a universe of good luck, positive vibes, and success for your future there. May every move be strategic and every outcome be brilliant! 💖💖🥰View More

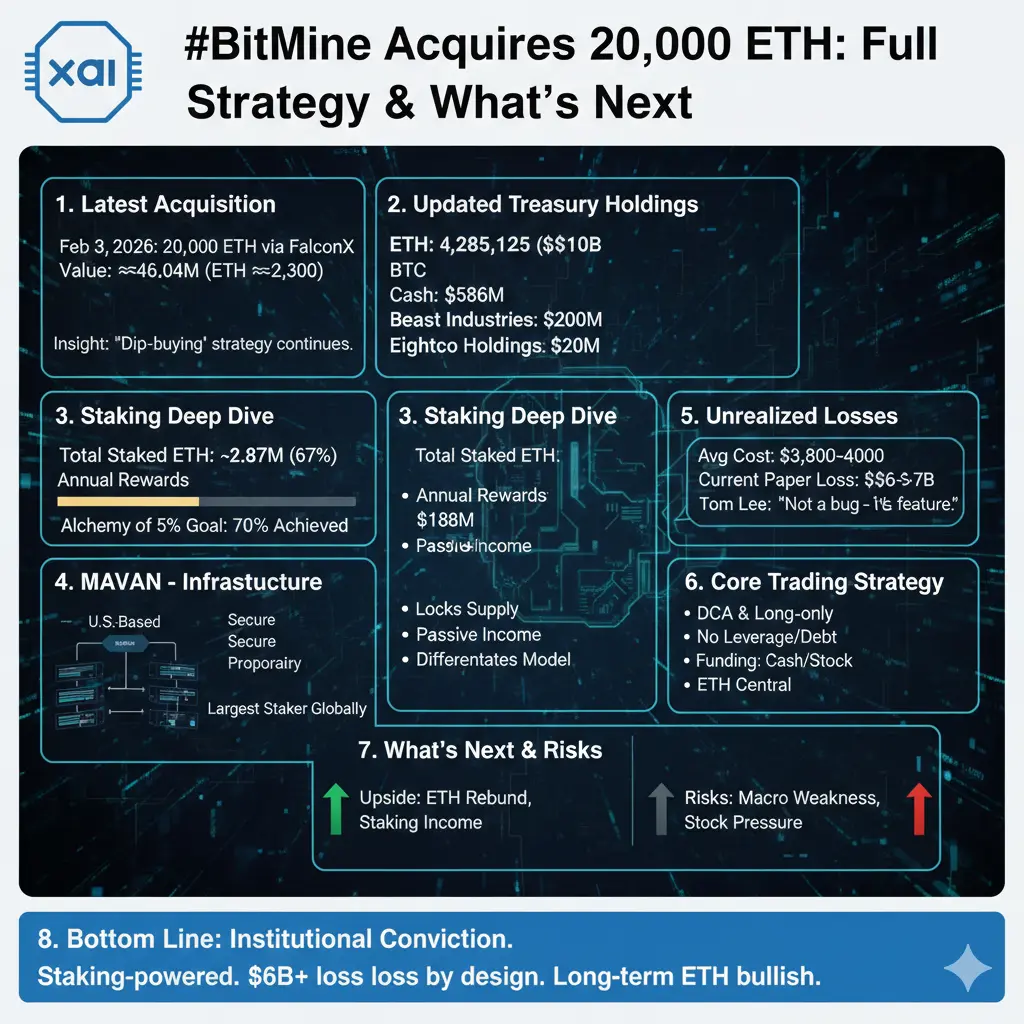

#BitMineAcquires20,000ETH BitMine Acquires 20,000 ETH: Strategic Move Signals Confidence in Ethereum #BitMineAcquires20,000ETH

BitMine, a leading cryptocurrency mining and investment firm, has announced the acquisition of 20,000 ETH, a bold move that signals confidence in Ethereum’s long-term growth and network potential. This significant purchase has sparked discussions across crypto markets about institutional accumulation, market dynamics, and Ethereum’s evolving role in decentralized finance.

The acquisition represents both a strategic investment and a hedge against market volatility. By i

BitMine, a leading cryptocurrency mining and investment firm, has announced the acquisition of 20,000 ETH, a bold move that signals confidence in Ethereum’s long-term growth and network potential. This significant purchase has sparked discussions across crypto markets about institutional accumulation, market dynamics, and Ethereum’s evolving role in decentralized finance.

The acquisition represents both a strategic investment and a hedge against market volatility. By i

- Reward

- 5

- 5

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4020?ref=VGDEVLFACA&ref_type=132

- Reward

- 4

- 6

- Repost

- Share

PrincessOfBitcoin :

:

You are going to do amazing on Gate.io! 🌟 Sending you a universe of good luck, positive vibes, and success for your future there. May every move be strategic and every outcome be brilliant! 💖💖🥰View More

#FedLeadershipImpact Fed Leadership Impact: How Policy Shifts Shape Global Markets #FedLeadershipImpact

The leadership of the Federal Reserve continues to have profound implications for global financial markets, economic stability, and investor sentiment. Changes in Fed leadership—whether through new appointments, policy shifts, or strategic decisions—directly influence interest rates, liquidity conditions, and risk perception worldwide.

Market participants closely monitor Fed statements, meeting minutes, and speeches for guidance on monetary policy direction. Leadership priorities can affect

The leadership of the Federal Reserve continues to have profound implications for global financial markets, economic stability, and investor sentiment. Changes in Fed leadership—whether through new appointments, policy shifts, or strategic decisions—directly influence interest rates, liquidity conditions, and risk perception worldwide.

Market participants closely monitor Fed statements, meeting minutes, and speeches for guidance on monetary policy direction. Leadership priorities can affect

- Reward

- 3

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎#InstitutionalHoldingsDebate Institutional Holdings Debate: The Growing Influence of Big Players in Crypto #InstitutionalHoldingsDebate

The cryptocurrency market is witnessing a profound shift as institutional participation continues to grow. The debate over institutional holdings and their impact on market stability, volatility, and adoption has become a central topic for investors, analysts, and regulators alike.

Institutional investors, including hedge funds, family offices, and publicly traded companies, are increasingly allocating capital to Bitcoin, Ethereum, and other digital assets. Th

The cryptocurrency market is witnessing a profound shift as institutional participation continues to grow. The debate over institutional holdings and their impact on market stability, volatility, and adoption has become a central topic for investors, analysts, and regulators alike.

Institutional investors, including hedge funds, family offices, and publicly traded companies, are increasingly allocating capital to Bitcoin, Ethereum, and other digital assets. Th

- Reward

- 2

- 2

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

#GateJanTransparencyReport Gate January Transparency Report: Driving Trust and Accountability #GateJanTransparencyReport

Gate is proud to release its January Transparency Report, reflecting our commitment to openness, accountability, and trust within the global crypto community. Transparency is a cornerstone of Gate’s operations, ensuring that users, investors, and partners can monitor platform performance, liquidity, and operational integrity in real time.

The January report highlights trading volumes, asset distribution, and security measures, offering insight into the platform’s activities

Gate is proud to release its January Transparency Report, reflecting our commitment to openness, accountability, and trust within the global crypto community. Transparency is a cornerstone of Gate’s operations, ensuring that users, investors, and partners can monitor platform performance, liquidity, and operational integrity in real time.

The January report highlights trading volumes, asset distribution, and security measures, offering insight into the platform’s activities

- Reward

- 3

- 3

- Repost

- Share

PrincessOfBitcoin :

:

You are going to do amazing on Gate.io! 🌟 Sending you a universe of good luck, positive vibes, and success for your future there. May every move be strategic and every outcome be brilliant! 💖💖🥰View More

#BitcoinHitsBearMarketLow Bitcoin Hits Bear Market Low: What It Means for Traders and Investors #BitcoinHitsBearMarketLow

Bitcoin has officially reached a bear market low, sparking discussions across crypto markets about the implications for traders, investors, and the broader blockchain ecosystem. After months of price decline, intensified by macroeconomic pressures, regulatory uncertainty, and market sentiment shifts, Bitcoin now tests critical support levels that will define its next trajectory.

Market analysts note that Bitcoin’s latest drop reflects a combination of technical corrections,

Bitcoin has officially reached a bear market low, sparking discussions across crypto markets about the implications for traders, investors, and the broader blockchain ecosystem. After months of price decline, intensified by macroeconomic pressures, regulatory uncertainty, and market sentiment shifts, Bitcoin now tests critical support levels that will define its next trajectory.

Market analysts note that Bitcoin’s latest drop reflects a combination of technical corrections,

- Reward

- 2

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎#BitcoinHitsBearMarketLow Bitcoin Hits Bear Market Low: What It Means for Traders and Investors #BitcoinHitsBearMarketLow

Bitcoin has officially reached a bear market low, sparking discussions across crypto markets about the implications for traders, investors, and the broader blockchain ecosystem. After months of price decline, intensified by macroeconomic pressures, regulatory uncertainty, and market sentiment shifts, Bitcoin now tests critical support levels that will define its next trajectory.

Market analysts note that Bitcoin’s latest drop reflects a combination of technical corrections,

Bitcoin has officially reached a bear market low, sparking discussions across crypto markets about the implications for traders, investors, and the broader blockchain ecosystem. After months of price decline, intensified by macroeconomic pressures, regulatory uncertainty, and market sentiment shifts, Bitcoin now tests critical support levels that will define its next trajectory.

Market analysts note that Bitcoin’s latest drop reflects a combination of technical corrections,

BTC-11,4%

- Reward

- 2

- 1

- Repost

- Share

PrincessOfBitcoin :

:

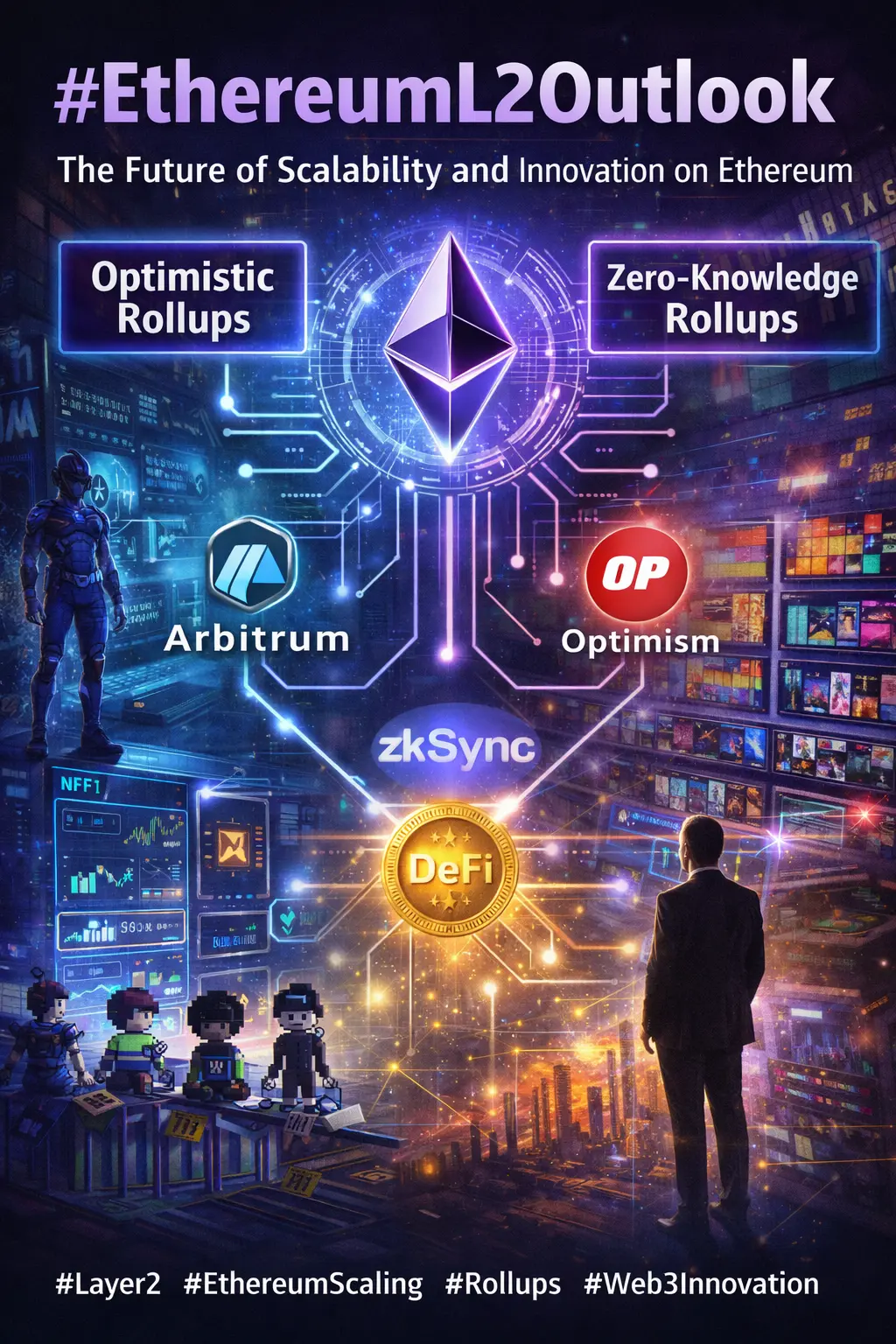

Buy To Earn 💎#EthereumL2Outlook Ethereum Layer 2 Outlook: Scaling for the Future #EthereumL2Outlook

Ethereum’s growth and adoption continue to face a fundamental challenge: scalability. As decentralized applications, DeFi protocols, and NFT marketplaces expand, network congestion and high gas fees have made it increasingly clear that Layer 2 (L2) solutions are essential for Ethereum’s sustainable growth. The #EthereumL2Outlook explores current trends, technological developments, and market implications of the L2 ecosystem.

Layer 2 solutions are designed to process transactions off the Ethereum mainnet, red

Ethereum’s growth and adoption continue to face a fundamental challenge: scalability. As decentralized applications, DeFi protocols, and NFT marketplaces expand, network congestion and high gas fees have made it increasingly clear that Layer 2 (L2) solutions are essential for Ethereum’s sustainable growth. The #EthereumL2Outlook explores current trends, technological developments, and market implications of the L2 ecosystem.

Layer 2 solutions are designed to process transactions off the Ethereum mainnet, red

- Reward

- 2

- 2

- Repost

- Share

PrincessOfBitcoin :

:

You are going to do amazing on Gate.io! 🌟 Sending you a universe of good luck, positive vibes, and success for your future there. May every move be strategic and every outcome be brilliant! 💖💖🥰View More

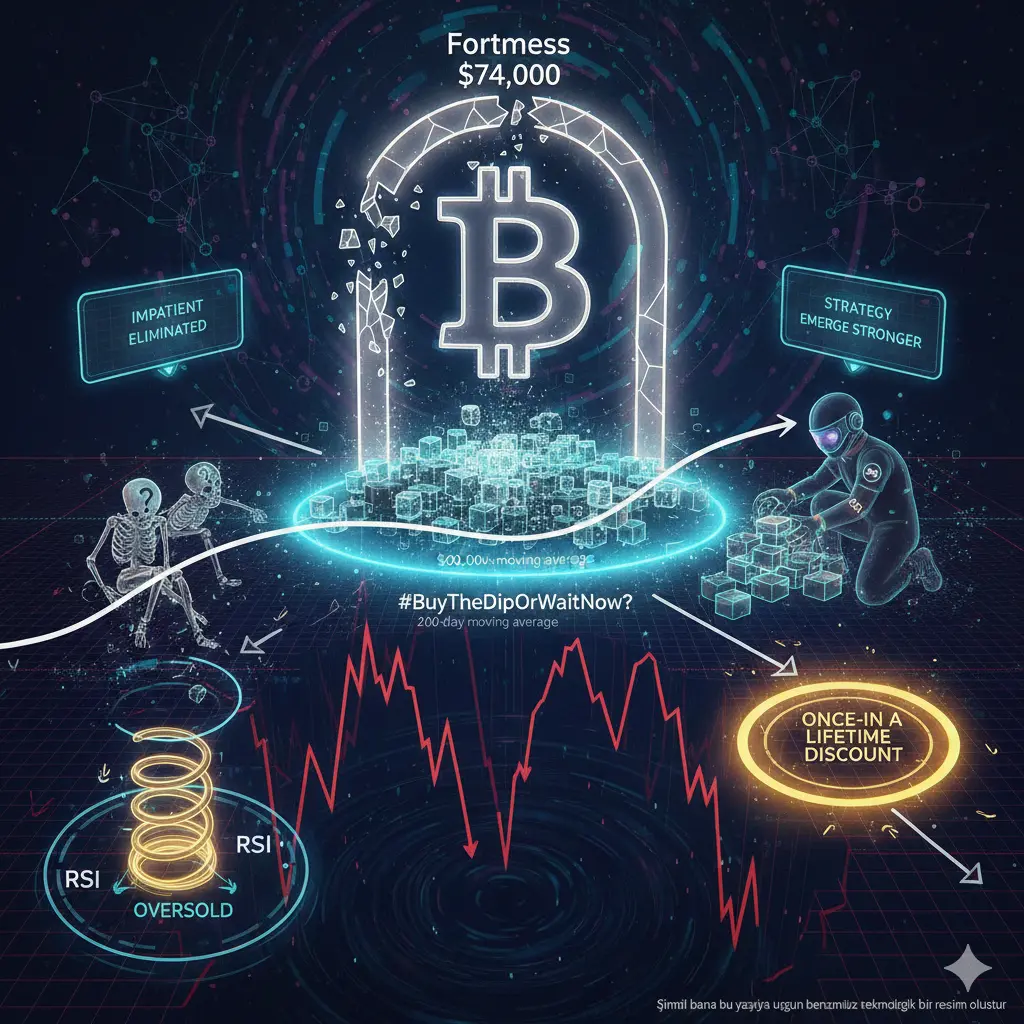

#BuyTheDipOrWaitNow? Buy the Dip or Wait Now? Understanding Market Dynamics in Volatile Times #BuyTheDipOrWaitNow

Investors around the world are asking the same question: is now the right time to buy the dip, or is patience the better strategy? In volatile markets, making informed decisions requires understanding market structure, macroeconomic signals, and asset-specific fundamentals.

Recent market movements have created a flurry of activity in cryptocurrencies, equities, and commodities. Prices for key assets have experienced sharp declines followed by partial recoveries, leading many to con

Investors around the world are asking the same question: is now the right time to buy the dip, or is patience the better strategy? In volatile markets, making informed decisions requires understanding market structure, macroeconomic signals, and asset-specific fundamentals.

Recent market movements have created a flurry of activity in cryptocurrencies, equities, and commodities. Prices for key assets have experienced sharp declines followed by partial recoveries, leading many to con

- Reward

- 1

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4025?ref=VGDEVLFACA&ref_type=132&utm_cmp=fbFT2Eqd

- Reward

- 1

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎#USIranNuclearTalksTurmoil US-Iran Nuclear Talks Turmoil: Tensions Rise Amid Diplomatic Uncertainty #USIranNuclearTalksTurmoil

Global attention is once again focused on the Middle East as US-Iran nuclear negotiations face renewed turmoil. After months of indirect talks mediated by European powers, recent developments have heightened concerns over regional security, international energy markets, and geopolitical stability.

Diplomatic sources report deadlocked discussions over Iran’s nuclear enrichment levels, sanctions relief, and verification mechanisms. Each side has issued firm statements em

Global attention is once again focused on the Middle East as US-Iran nuclear negotiations face renewed turmoil. After months of indirect talks mediated by European powers, recent developments have heightened concerns over regional security, international energy markets, and geopolitical stability.

Diplomatic sources report deadlocked discussions over Iran’s nuclear enrichment levels, sanctions relief, and verification mechanisms. Each side has issued firm statements em

- Reward

- 1

- 2

- Repost

- Share

PrincessOfBitcoin :

:

Happy New Year! 🤑View More

#GateLunarNewYearOn-ChainGala Gate Lunar New Year On-Chain Gala 2026! #GateLunarNewYearOn-ChainGala

As the Lunar New Year approaches, Gate is thrilled to bring you our biggest on-chain community celebration yet—the Gate Lunar New Year On-Chain Gala! This is where festive magic meets cutting-edge blockchain technology. Get ready for an unforgettable celebration filled with crypto rewards, NFTs, trading challenges, and interactive fun for everyone in our global Gate community.

💡 What’s Happening?

Step into the Year of the [Dragon/Rabbit—insert your year! 🐲/🐇] with a series of exciting, inter

As the Lunar New Year approaches, Gate is thrilled to bring you our biggest on-chain community celebration yet—the Gate Lunar New Year On-Chain Gala! This is where festive magic meets cutting-edge blockchain technology. Get ready for an unforgettable celebration filled with crypto rewards, NFTs, trading challenges, and interactive fun for everyone in our global Gate community.

💡 What’s Happening?

Step into the Year of the [Dragon/Rabbit—insert your year! 🐲/🐇] with a series of exciting, inter

- Reward

- 1

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎#FidelityLaunchesFIDD 📰 Future Breaking News: Fidelity Launches FIDD — A New Era in Digital Dollars

Boston / Global Markets – February 4, 2026 – Fidelity Investments has officially announced the launch of its first proprietary stablecoin, Fidelity Digital Dollar (FIDD), marking a historic expansion of traditional finance into blockchain-based digital currency. This stablecoin is designed for use by both retail and institutional investors, blending the reliability of fiat with the speed and programmability of digital assets.

🔦 Fidelity has launched FIDD, its first U.S. dollar–pegged stablecoi

Boston / Global Markets – February 4, 2026 – Fidelity Investments has officially announced the launch of its first proprietary stablecoin, Fidelity Digital Dollar (FIDD), marking a historic expansion of traditional finance into blockchain-based digital currency. This stablecoin is designed for use by both retail and institutional investors, blending the reliability of fiat with the speed and programmability of digital assets.

🔦 Fidelity has launched FIDD, its first U.S. dollar–pegged stablecoi

- Reward

- 1

- 2

- Repost

- Share

PrincessOfBitcoin :

:

Happy New Year! 🤑View More

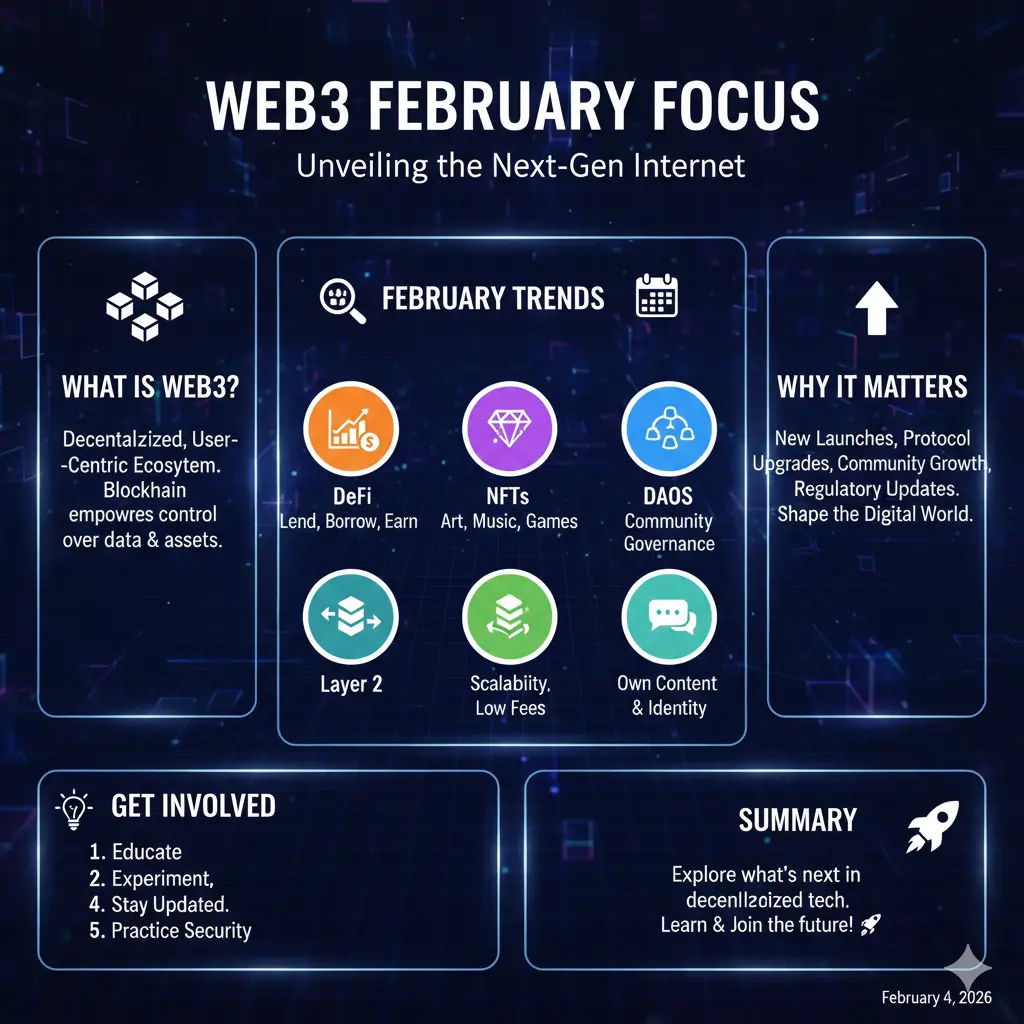

#Web3FebruaryFocus #Web3FebruaryFocus — The Future is Now

February marks an important moment for Web3, a space where innovation meets decentralization. Developers, creators, investors, and enthusiasts are all turning their attention to the opportunities emerging in this evolving ecosystem.

---

The Current Landscape

Web3 continues to grow beyond its early experimentation phase. From decentralized finance to blockchain-based social platforms, the landscape is rich with ideas and applications that aim to empower users and disrupt traditional structures. This month is especially significant as new

February marks an important moment for Web3, a space where innovation meets decentralization. Developers, creators, investors, and enthusiasts are all turning their attention to the opportunities emerging in this evolving ecosystem.

---

The Current Landscape

Web3 continues to grow beyond its early experimentation phase. From decentralized finance to blockchain-based social platforms, the landscape is rich with ideas and applications that aim to empower users and disrupt traditional structures. This month is especially significant as new

- Reward

- 1

- 2

- Repost

- Share

PrincessOfBitcoin :

:

Happy New Year! 🤑View More

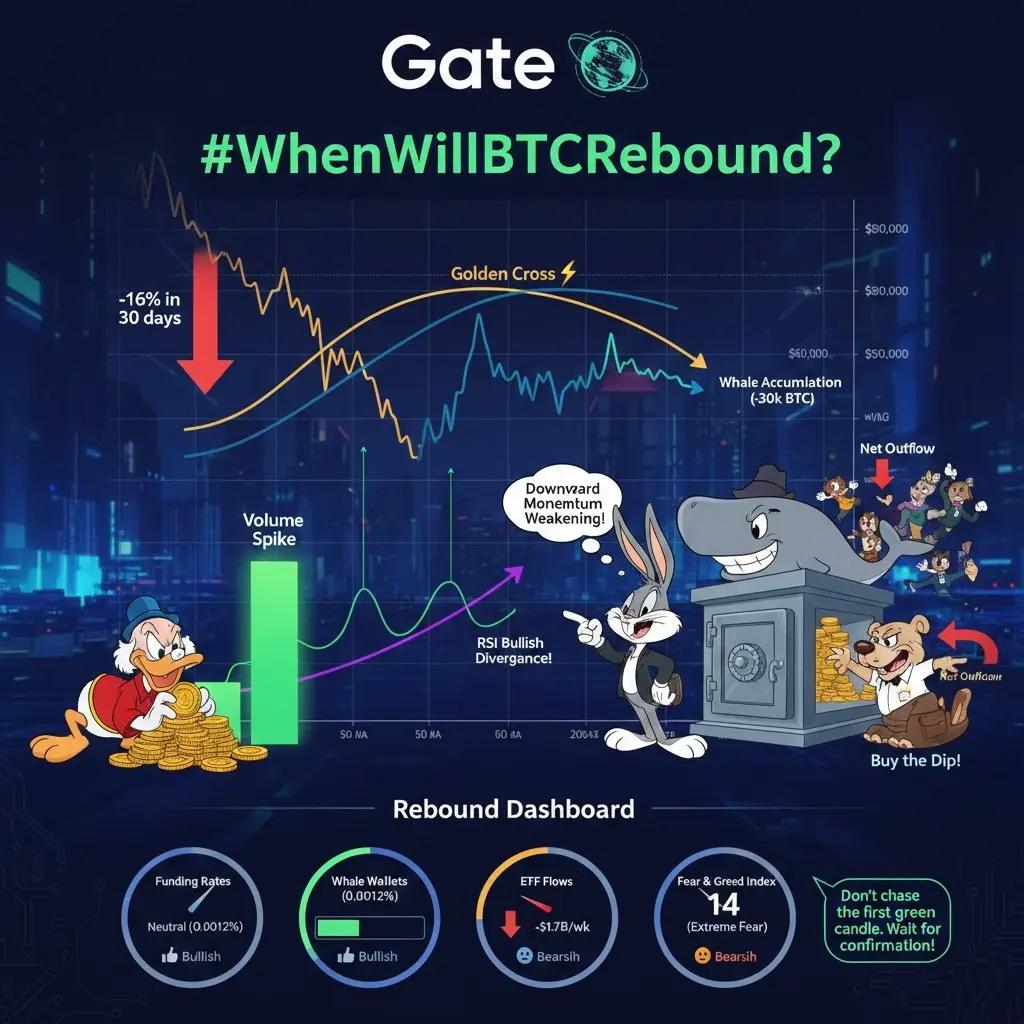

#WhenWillBTCRebound? Bitcoin Today — Market Snapshot

The crypto market has been experiencing pressure recently, with Bitcoin facing a period of uncertainty. Traders and investors are watching closely as sentiment shifts, and many are wondering when the next rebound will arrive.

---

When Will Bitcoin Rebound? — A Deep Look Ahead

Current Market Context

Bitcoin has gone through a challenging phase, reflecting both global financial conditions and shifts in investor sentiment. Corrections are a natural part of any market cycle, and crypto is no exception. Recent activity shows caution among traders

The crypto market has been experiencing pressure recently, with Bitcoin facing a period of uncertainty. Traders and investors are watching closely as sentiment shifts, and many are wondering when the next rebound will arrive.

---

When Will Bitcoin Rebound? — A Deep Look Ahead

Current Market Context

Bitcoin has gone through a challenging phase, reflecting both global financial conditions and shifts in investor sentiment. Corrections are a natural part of any market cycle, and crypto is no exception. Recent activity shows caution among traders

BTC-11,4%

- Reward

- 1

- 1

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎#EthereumL2Outlook #EthereumL2Outlook 🚀

The future of Ethereum Layer 2 is shaping the next era of blockchain scalability, adoption, and innovation. As congestion and high gas fees remain persistent challenges on Ethereum Mainnet, Layer 2 solutions are emerging as the gateway to faster, cheaper, and more efficient transactions. Rollups, both optimistic and zero-knowledge, are leading the charge, providing a foundation for seamless user experiences while retaining the security of Ethereum’s decentralized network.

Optimistic Rollups like Optimism and Arbitrum utilize fraud proofs to batch transa

The future of Ethereum Layer 2 is shaping the next era of blockchain scalability, adoption, and innovation. As congestion and high gas fees remain persistent challenges on Ethereum Mainnet, Layer 2 solutions are emerging as the gateway to faster, cheaper, and more efficient transactions. Rollups, both optimistic and zero-knowledge, are leading the charge, providing a foundation for seamless user experiences while retaining the security of Ethereum’s decentralized network.

Optimistic Rollups like Optimism and Arbitrum utilize fraud proofs to batch transa

- Reward

- 6

- 3

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

#WhenWillBTCRebound? #WhenWillBTCRebound? — The Strategic Perspective on Bitcoin’s Next Move

Bitcoin is at a critical juncture. Everyone is asking: When will BTC rebound? The answer is never simple, because Bitcoin does not move according to calendars — it moves according to cycles, liquidity, sentiment, and structural alignment. Historically, the most significant rebounds began not with hype, but with quiet accumulation during periods of uncertainty, when the majority of market participants were distracted or fearful. Red candles may dominate charts temporarily, but these are often the prelud

Bitcoin is at a critical juncture. Everyone is asking: When will BTC rebound? The answer is never simple, because Bitcoin does not move according to calendars — it moves according to cycles, liquidity, sentiment, and structural alignment. Historically, the most significant rebounds began not with hype, but with quiet accumulation during periods of uncertainty, when the majority of market participants were distracted or fearful. Red candles may dominate charts temporarily, but these are often the prelud

BTC-11,4%

- Reward

- 9

- 7

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

#WhenWillBTCRebound? #WhenWillBTCRebound? — The Calm Before the Next Bitcoin Wave

Bitcoin is at a pivotal moment, and everyone is asking the same question: When will BTC rebound? To answer this, we must look beyond short-term price swings and understand the underlying mechanics of the market. Bitcoin never moves in straight lines. Every historic rebound has been preceded by periods of uncertainty, consolidation, and quiet accumulation, moments when weak hands exit and strong hands quietly build positions. Red candles may dominate charts temporarily, but they often signal the groundwork for a s

Bitcoin is at a pivotal moment, and everyone is asking the same question: When will BTC rebound? To answer this, we must look beyond short-term price swings and understand the underlying mechanics of the market. Bitcoin never moves in straight lines. Every historic rebound has been preceded by periods of uncertainty, consolidation, and quiet accumulation, moments when weak hands exit and strong hands quietly build positions. Red candles may dominate charts temporarily, but they often signal the groundwork for a s

BTC-11,4%

- Reward

- 9

- 11

- Repost

- Share

PrincessOfBitcoin :

:

Happy New Year! 🤑View More

Trending Topics

View More85.65K Popularity

9.56K Popularity

2.77K Popularity

4.28K Popularity

9.06K Popularity

Pin