RETURN TO FUNDAMENTALS.

Andy2024

No content yet

andy2024

Gm.

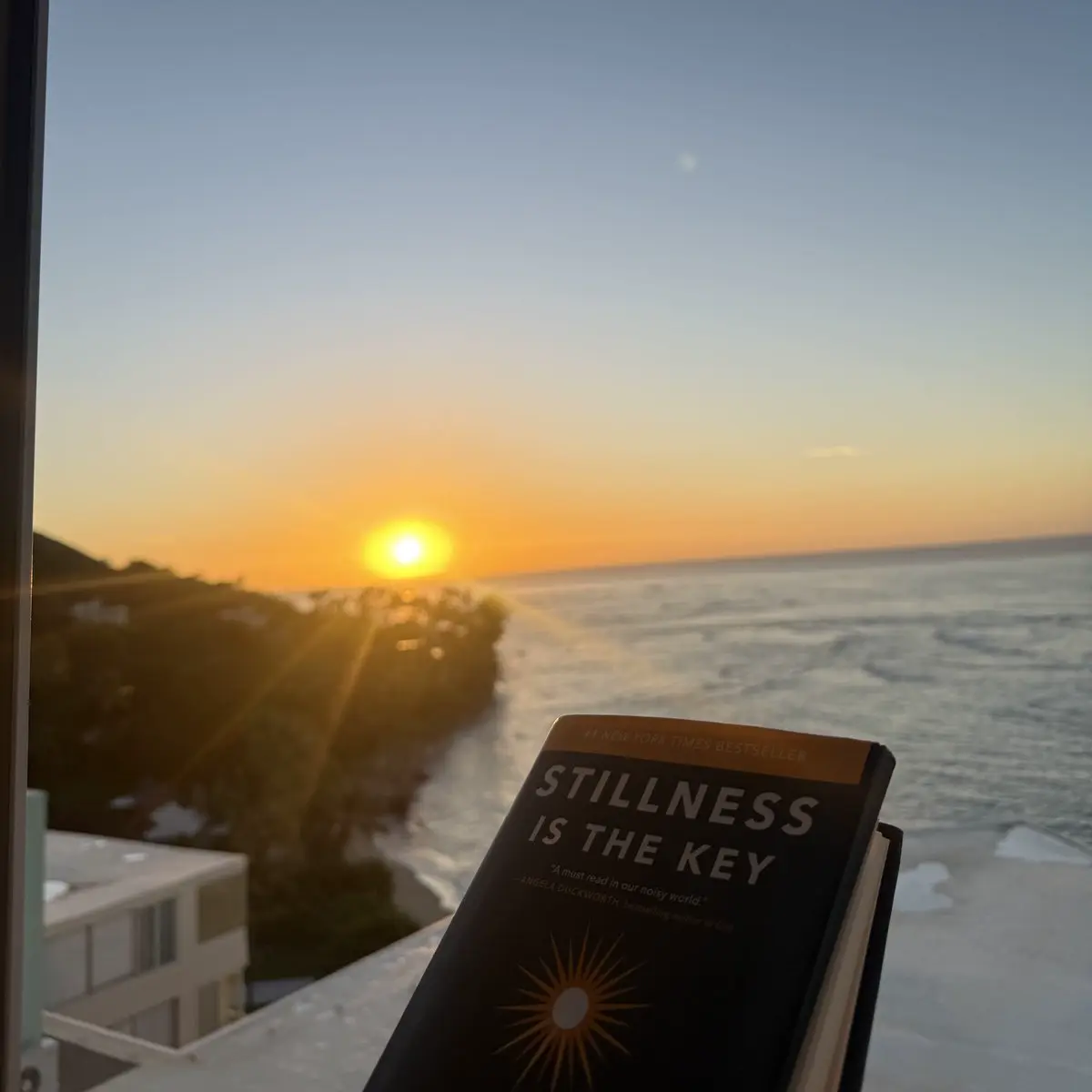

Every weekday this month I've read in the morning and journaled while watching the sunrise, it's been an extremely calming and energizing experience.

Would recommend 🫡

Every weekday this month I've read in the morning and journaled while watching the sunrise, it's been an extremely calming and energizing experience.

Would recommend 🫡

- Reward

- like

- Comment

- Repost

- Share

Gm. Every weekday this month I've read in the morning and journaled while watching the sunset, it's been an extremely calming and energizing experience.

Would recommend.

Would recommend.

- Reward

- like

- Comment

- Repost

- Share

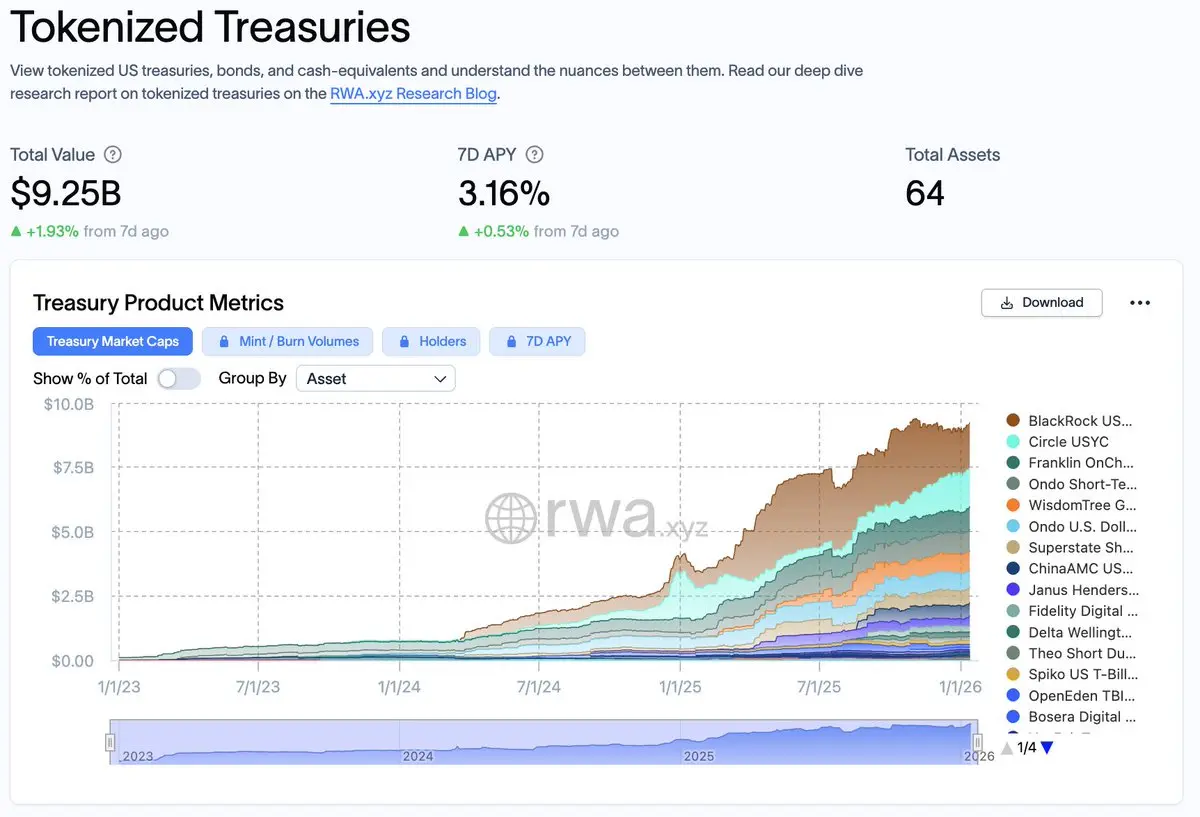

According to Stablewatch, there was 88 new yield-bearing stablecoins that entered the market in 2025.

The question remains: How will these businesses generating revenue with an ever accelerating decrease in interest rates from the fed?

Did we overindex on the profitability of being a stablecoin issuer because of the success of Circle and Tether???

Given the latest stablecoin specific language in the market structure bull prohibiting yield passing to users, I'd argue yes.

If that reverses, I think we'll see a full cambrian explosion of stablecoins.

The question remains: How will these businesses generating revenue with an ever accelerating decrease in interest rates from the fed?

Did we overindex on the profitability of being a stablecoin issuer because of the success of Circle and Tether???

Given the latest stablecoin specific language in the market structure bull prohibiting yield passing to users, I'd argue yes.

If that reverses, I think we'll see a full cambrian explosion of stablecoins.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

This seems siginificant.

Visa’s stablecoin settlement activity is now running at a $4.5B/yr. Demand driven by card programs via neobank platforms that use stablecoins for settlement.

Gemini, Crypto com, EtherFi and a ton of others likely.

Visa does $14.2T/yr so its peanuts still but the growth is enough for them to double down on this line of business and expand into more chains and currencies.

To me, this gives the "green light" of sorts to pretty much any other payment processor to get into this business.

Stablecoin supercyle continues, we are expecting a 50-60% YoY growth for supply in 2026

Visa’s stablecoin settlement activity is now running at a $4.5B/yr. Demand driven by card programs via neobank platforms that use stablecoins for settlement.

Gemini, Crypto com, EtherFi and a ton of others likely.

Visa does $14.2T/yr so its peanuts still but the growth is enough for them to double down on this line of business and expand into more chains and currencies.

To me, this gives the "green light" of sorts to pretty much any other payment processor to get into this business.

Stablecoin supercyle continues, we are expecting a 50-60% YoY growth for supply in 2026

- Reward

- like

- Comment

- Repost

- Share

Crypto's capital formation process is finally undergoing a major regime shift for the better.

What I mean by this is we've really undergone a shift away from the excessively high seed round valuation games, beta chasing VC copycat tactics to hit a "management fee" and create illiquid paper profits on their books that don't actually exist in reality.

That gig is up.

Why does that affect the capital formation process in this industry?

Well, because now there is a new cohort of really strong founders from legacy finance coming in and raising at sensible valuations with much clearer business mod

What I mean by this is we've really undergone a shift away from the excessively high seed round valuation games, beta chasing VC copycat tactics to hit a "management fee" and create illiquid paper profits on their books that don't actually exist in reality.

That gig is up.

Why does that affect the capital formation process in this industry?

Well, because now there is a new cohort of really strong founders from legacy finance coming in and raising at sensible valuations with much clearer business mod

- Reward

- like

- Comment

- Repost

- Share

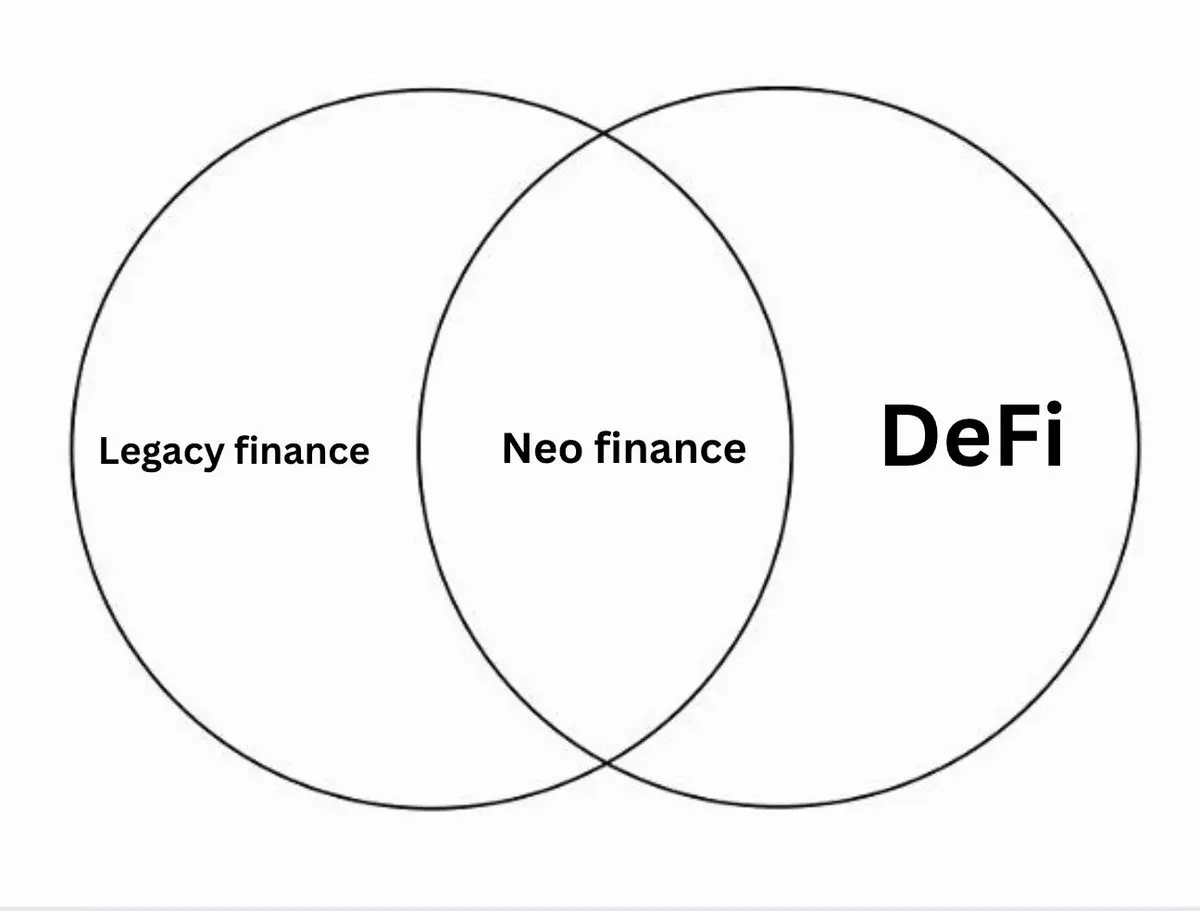

It's the future of France.

Its not DeFi.

Its not legacy finance.

Its not CeDeFi.

Its not fugazi DAO governance.

Its not pool2 yield farms.

Its not infra or gaming.

Its not seed phrases.

Its not ponzinomics.

Its not decentralization theatre.

Its real mainstream adoption. Its RWAs, stablecoins, payments, neobanks, issuers, trading, insurance, energy, and more.

Its neo fucking finance. Expect to hear alot more of this in 2026.

Its not DeFi.

Its not legacy finance.

Its not CeDeFi.

Its not fugazi DAO governance.

Its not pool2 yield farms.

Its not infra or gaming.

Its not seed phrases.

Its not ponzinomics.

Its not decentralization theatre.

Its real mainstream adoption. Its RWAs, stablecoins, payments, neobanks, issuers, trading, insurance, energy, and more.

Its neo fucking finance. Expect to hear alot more of this in 2026.

- Reward

- like

- Comment

- Repost

- Share

When will there be a single UX where we access every single prediction market across all venues so we can place bets with max liquidity and onboard real size???

- Reward

- like

- Comment

- Repost

- Share

LIVE.

Crypto M&A is super hot still, neo finance is gaining traction with the right companies and influencers, trend is clear. My debasement portfolio is working.

Hosting Polygon team for the update on their major acquisition.

Crypto M&A is super hot still, neo finance is gaining traction with the right companies and influencers, trend is clear. My debasement portfolio is working.

Hosting Polygon team for the update on their major acquisition.

- Reward

- like

- Comment

- Repost

- Share

I have a feeling things are about to get really silly around here. Not sure why. Just an intuition. Once you sit around and watch this market for years, you can just tell. Trump going at FED chair forcing lower rates. Oil prices meaningfully staying lower. Silver and Gold debasement face ripping rally has started. I bought Uranium. Been scared for weeks. It feels like its time. Whether its a dead cat or a rip to ATHs, we are going to get the catchup trade and its going to be glorious.

I will not be shaken out. The road to ATHs is imminent. 4 year cycle is done. Global institutional TWAP is hap

I will not be shaken out. The road to ATHs is imminent. 4 year cycle is done. Global institutional TWAP is hap

- Reward

- like

- Comment

- Repost

- Share

gm to all the bulls out there 🫡

- Reward

- like

- Comment

- Repost

- Share

It's honestly crazy how many things I've gotten wrong about this market in the past 7-8 years.

Truly like how many bad theses, lost capital, wrong timings, and absolute terrible trades I’ve taken. Yet, to still able to come out and stick around to build and invest for the long haul is a blessing. This industry gives you the most asymmetric upside of anything else in the entire world and I firmly believe it will continue to do so.

Even if your hit rate is not high, or your timing is off. Frankly, it's not easy to be right and being ‘right’ often requires immense research, a lot of skill, and

Truly like how many bad theses, lost capital, wrong timings, and absolute terrible trades I’ve taken. Yet, to still able to come out and stick around to build and invest for the long haul is a blessing. This industry gives you the most asymmetric upside of anything else in the entire world and I firmly believe it will continue to do so.

Even if your hit rate is not high, or your timing is off. Frankly, it's not easy to be right and being ‘right’ often requires immense research, a lot of skill, and

- Reward

- like

- Comment

- Repost

- Share

Hot take:

99% of proof-of-stake blockchains are still overpaying for their security and nuking their community with excessive inflationary tokenomics, due to perverse incentives for investors, team, and early adopters.

99% of proof-of-stake blockchains are still overpaying for their security and nuking their community with excessive inflationary tokenomics, due to perverse incentives for investors, team, and early adopters.

- Reward

- like

- Comment

- Repost

- Share

You're allowed to be bullish on crypto, stocks, and metals at the same time without making one of them your personality btw

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More11.87K Popularity

33.33K Popularity

13.85K Popularity

4.07K Popularity

2.13K Popularity

Pin