Cryptopsychedelic

No content yet

cryptopsychedelic

$BEAT is printing a strong higher-high sequence on the 4H timeframe, which usually confirms that buyers are still in control of momentum rather than this being just a short-term bounce.

The structure looks healthy with steady pullbacks and continuation candles, showing accumulation instead of exhaustion.

As long as price holds above the 0.22 support region, the probability favors a continuation push toward the 0.28–0.31 liquidity zone.

A breakdown below support would weaken the bullish structure, so risk management remains key.

🚸 BEAT (USDT)

🔰 LEVERAGE: 1X to 20x

🚀 LONG

✅ ENTRY: 0.242 – 0.

The structure looks healthy with steady pullbacks and continuation candles, showing accumulation instead of exhaustion.

As long as price holds above the 0.22 support region, the probability favors a continuation push toward the 0.28–0.31 liquidity zone.

A breakdown below support would weaken the bullish structure, so risk management remains key.

🚸 BEAT (USDT)

🔰 LEVERAGE: 1X to 20x

🚀 LONG

✅ ENTRY: 0.242 – 0.

BEAT0,19%

- Reward

- 1

- Comment

- Repost

- Share

$ZAMA is showing early signs of bottom formation after extended downside pressure.

Price is stabilizing near support with decreasing selling momentum, which usually hints at a potential reversal phase.

If buyers defend the 0.0185 demand zone, a gradual push toward higher liquidity levels around 0.0215 → 0.0230 becomes likely.

However, losing 0.0175 would invalidate the recovery structure, so risk control remains important.

🚸 ZAMA (USDT)

🔰 LEVERAGE: 1X to 20x

🚀 LONG

✅ ENTRY: 0.01850 – 0.01890

PROFIT TARGETS

1️⃣ 0.02000

2️⃣ 0.02150

3️⃣ 0.02300++++

🛑 STOP LOSS: 0.01750

#CelebratingNewYearOnG

Price is stabilizing near support with decreasing selling momentum, which usually hints at a potential reversal phase.

If buyers defend the 0.0185 demand zone, a gradual push toward higher liquidity levels around 0.0215 → 0.0230 becomes likely.

However, losing 0.0175 would invalidate the recovery structure, so risk control remains important.

🚸 ZAMA (USDT)

🔰 LEVERAGE: 1X to 20x

🚀 LONG

✅ ENTRY: 0.01850 – 0.01890

PROFIT TARGETS

1️⃣ 0.02000

2️⃣ 0.02150

3️⃣ 0.02300++++

🛑 STOP LOSS: 0.01750

#CelebratingNewYearOnG

ZAMA-3,54%

- Reward

- 2

- 1

- Repost

- Share

User_MVS :

:

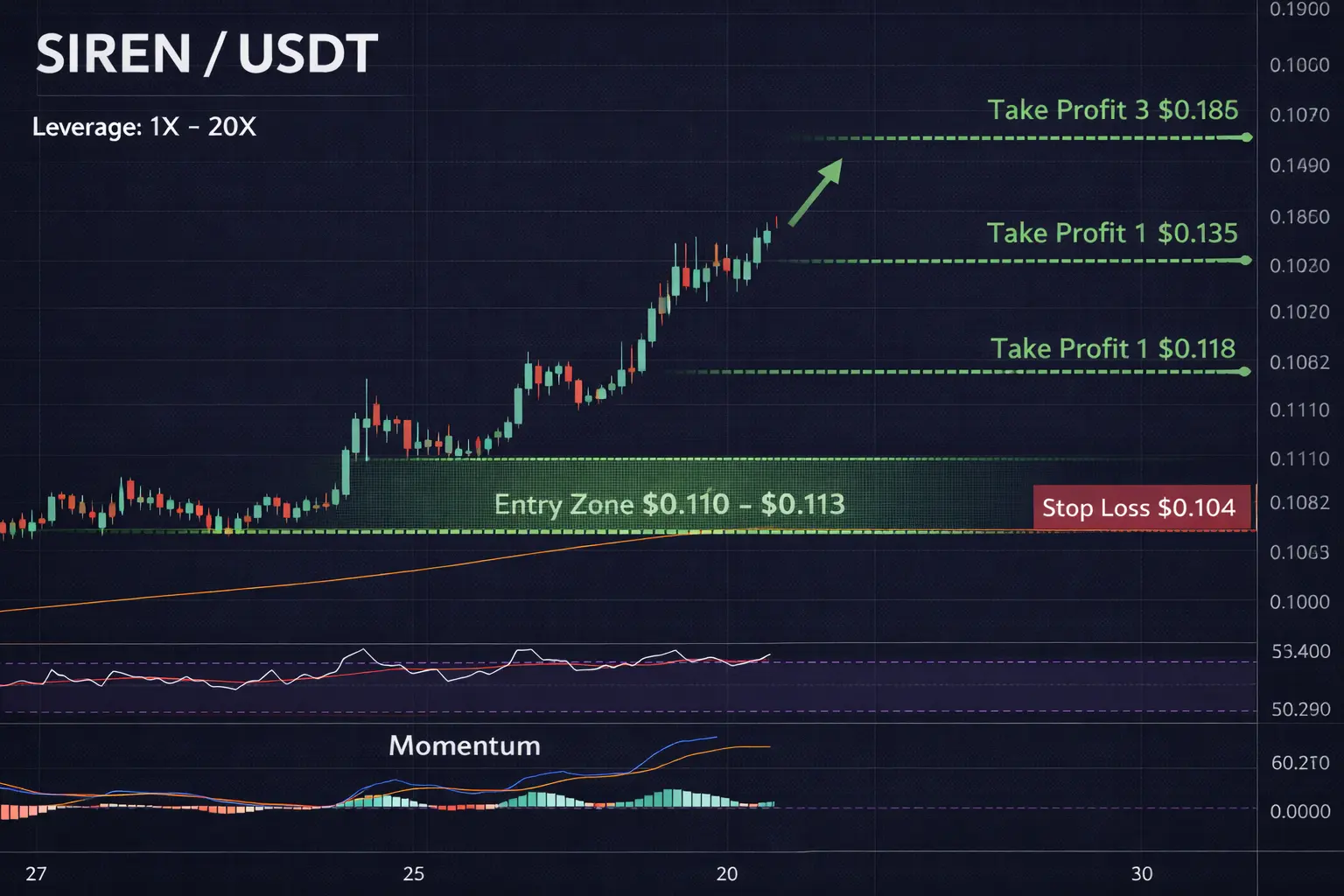

No, it's still too early.$SIREN After a long consolidation phase, price has delivered a decisive bullish breakout with expanding momentum, confirming a shift in market control from sellers to buyers. The previous breakout region is now acting as fresh support, and the formation of higher highs signals healthy trend continuation rather than a short-term spike.

As long as price holds above the 0.110–0.113 zone, the structure favors a steady move toward 0.118 → 0.125 → 0.135, where the next liquidity and resistance clusters sit. A loss of 0.104 would weaken the bullish continuation thesis.

🚸 SIREN (USDT)

🔰 LEVERAGE: 1

As long as price holds above the 0.110–0.113 zone, the structure favors a steady move toward 0.118 → 0.125 → 0.135, where the next liquidity and resistance clusters sit. A loss of 0.104 would weaken the bullish continuation thesis.

🚸 SIREN (USDT)

🔰 LEVERAGE: 1

SIREN40,19%

- Reward

- 3

- Comment

- Repost

- Share

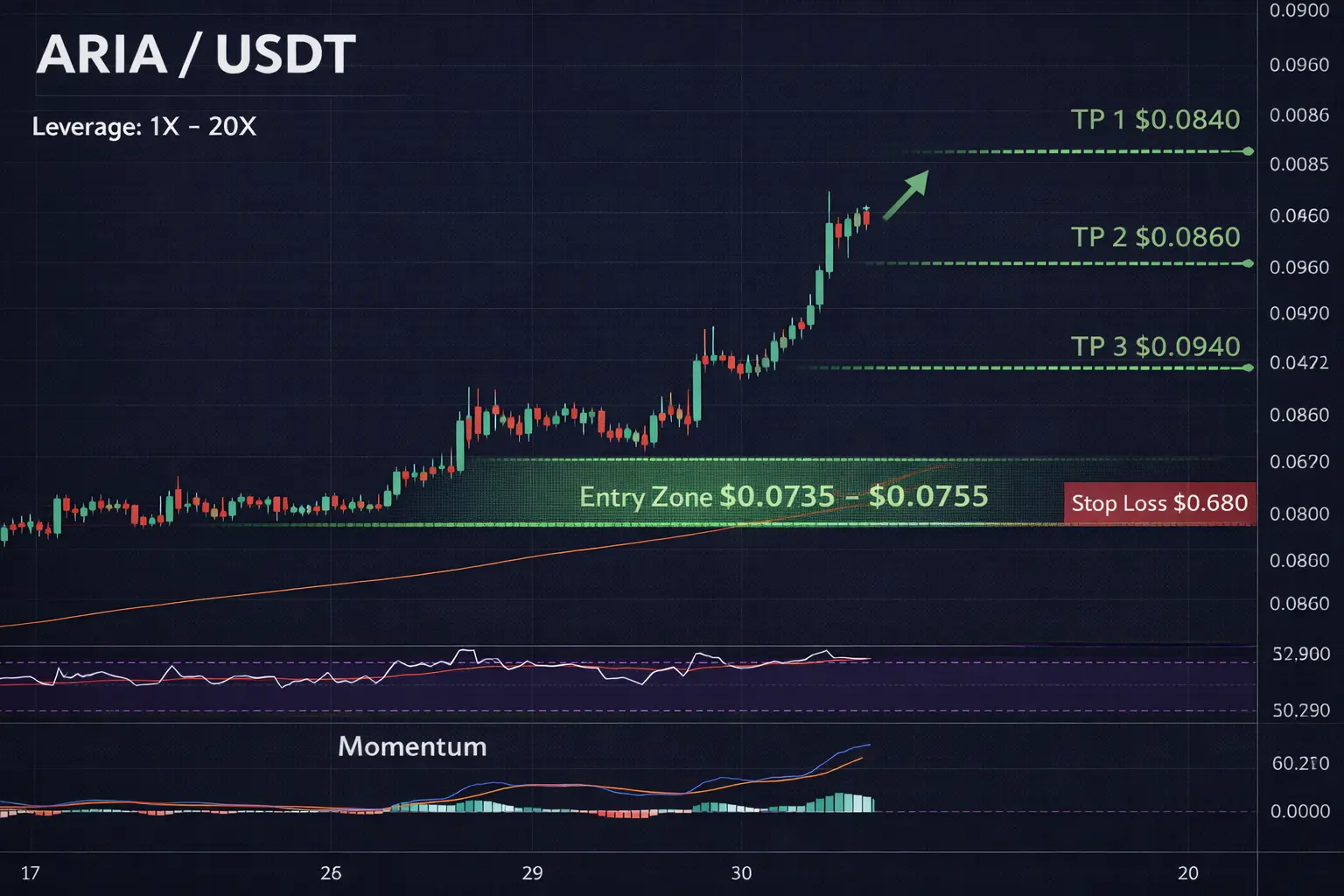

$ARIA After a sharp impulsive breakout from long consolidation, buyers stepped in with clear strength and flipped the short-term structure bullish. Momentum is expanding rather than fading — a key sign that this move is trend continuation, not just a temporary spike.

As long as price holds above the recent breakout region, dips into the 0.0735–0.0755 zone are likely to act as support. That keeps the path open toward 0.080 → 0.086 → 0.094 where the next liquidity clusters sit.

🚸 ARIA (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.0735 – 0.0755

🎯 PROFIT

1️⃣ 0.0800

2️⃣ 0.0860

3️⃣ 0.0940

🛑 S

As long as price holds above the recent breakout region, dips into the 0.0735–0.0755 zone are likely to act as support. That keeps the path open toward 0.080 → 0.086 → 0.094 where the next liquidity clusters sit.

🚸 ARIA (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.0735 – 0.0755

🎯 PROFIT

1️⃣ 0.0800

2️⃣ 0.0860

3️⃣ 0.0940

🛑 S

ARIA-1,54%

- Reward

- 1

- Comment

- Repost

- Share

$AWE Price is holding firmly above the $0.082–$0.084 support zone after a shallow pullback, which usually signals healthy continuation rather than weakness. Buyers are clearly defending this range, and the structure remains bullish as long as support stays intact.

A clean reclaim and push above $0.086 would likely unlock momentum toward the $0.088–$0.090 liquidity pocket, confirming continuation of the rebound trend.

🚸 AWE (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.0825 – 0.0842

🎯 PROFIT

1️⃣ 0.086

2️⃣ 0.088

3️⃣ 0.090

🛑 STOP LOSS: 0.081

#CelebratingNewYearOnGateSquare

Support me — ju

A clean reclaim and push above $0.086 would likely unlock momentum toward the $0.088–$0.090 liquidity pocket, confirming continuation of the rebound trend.

🚸 AWE (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.0825 – 0.0842

🎯 PROFIT

1️⃣ 0.086

2️⃣ 0.088

3️⃣ 0.090

🛑 STOP LOSS: 0.081

#CelebratingNewYearOnGateSquare

Support me — ju

AWE0,98%

- Reward

- 1

- Comment

- Repost

- Share

$ZRO After an aggressive ~84% correction inside a multi-month descending channel, price is now compressing near the HTF breakout boundary—a phase that often appears right before a volatility expansion. What makes this structure interesting is the clear accumulation between $1.50 and $1.20, showing sustained demand rather than panic selling.

If price accepts above $2.50, the entire market structure shifts from corrective to macro bullish, opening the path toward large measured-move targets. Until then, pullbacks into $1.80 or deeper $1.50–$1.20 remain strategic long-term positioning zones, whil

If price accepts above $2.50, the entire market structure shifts from corrective to macro bullish, opening the path toward large measured-move targets. Until then, pullbacks into $1.80 or deeper $1.50–$1.20 remain strategic long-term positioning zones, whil

ZRO-14,27%

- Reward

- 1

- Comment

- Repost

- Share

$BLUAI Price is showing a bullish consolidation with rising higher lows, which typically reflects accumulation rather than distribution. The reclaim of the $0.00660 structure zone confirms buyers stepping back in, while the tight range just below $0.00710 resistance suggests pressure building for a breakout move.

As long as price holds above $0.00670, continuation toward the next upside liquidity levels $0.00720 → $0.00760 → $0.00820 remains the higher-probability path.

🚸 BLUAI (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.00670 – 0.00695

🎯 PROFIT

1️⃣ 0.00720

2️⃣ 0.00760

3️⃣ 0.00820

🛑 ST

As long as price holds above $0.00670, continuation toward the next upside liquidity levels $0.00720 → $0.00760 → $0.00820 remains the higher-probability path.

🚸 BLUAI (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.00670 – 0.00695

🎯 PROFIT

1️⃣ 0.00720

2️⃣ 0.00760

3️⃣ 0.00820

🛑 ST

BLUAI-10,73%

- Reward

- 1

- Comment

- Repost

- Share

$MANTA Price has broken out from a clear base with expanding bullish momentum, which usually signals the start of a continuation phase rather than a fake move. Structure is holding higher lows, and buyers are stepping in on minor pullbacks — a healthy trend behavior.

As long as 0.065 remains protected, dips into 0.068–0.071 look like accumulation. If momentum sustains, the path toward 0.074 → 0.078 → 0.085 stays technically valid with upside liquidity waiting above.

🚸 MANTA (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.068 – 0.071

🎯 PROFIT

1️⃣ 0.074

2️⃣ 0.078

3️⃣ 0.085

🛑 STOP LOSS: 0.065

As long as 0.065 remains protected, dips into 0.068–0.071 look like accumulation. If momentum sustains, the path toward 0.074 → 0.078 → 0.085 stays technically valid with upside liquidity waiting above.

🚸 MANTA (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 LONG

✅ ENTRY: 0.068 – 0.071

🎯 PROFIT

1️⃣ 0.074

2️⃣ 0.078

3️⃣ 0.085

🛑 STOP LOSS: 0.065

MANTA8,54%

- Reward

- 2

- Comment

- Repost

- Share

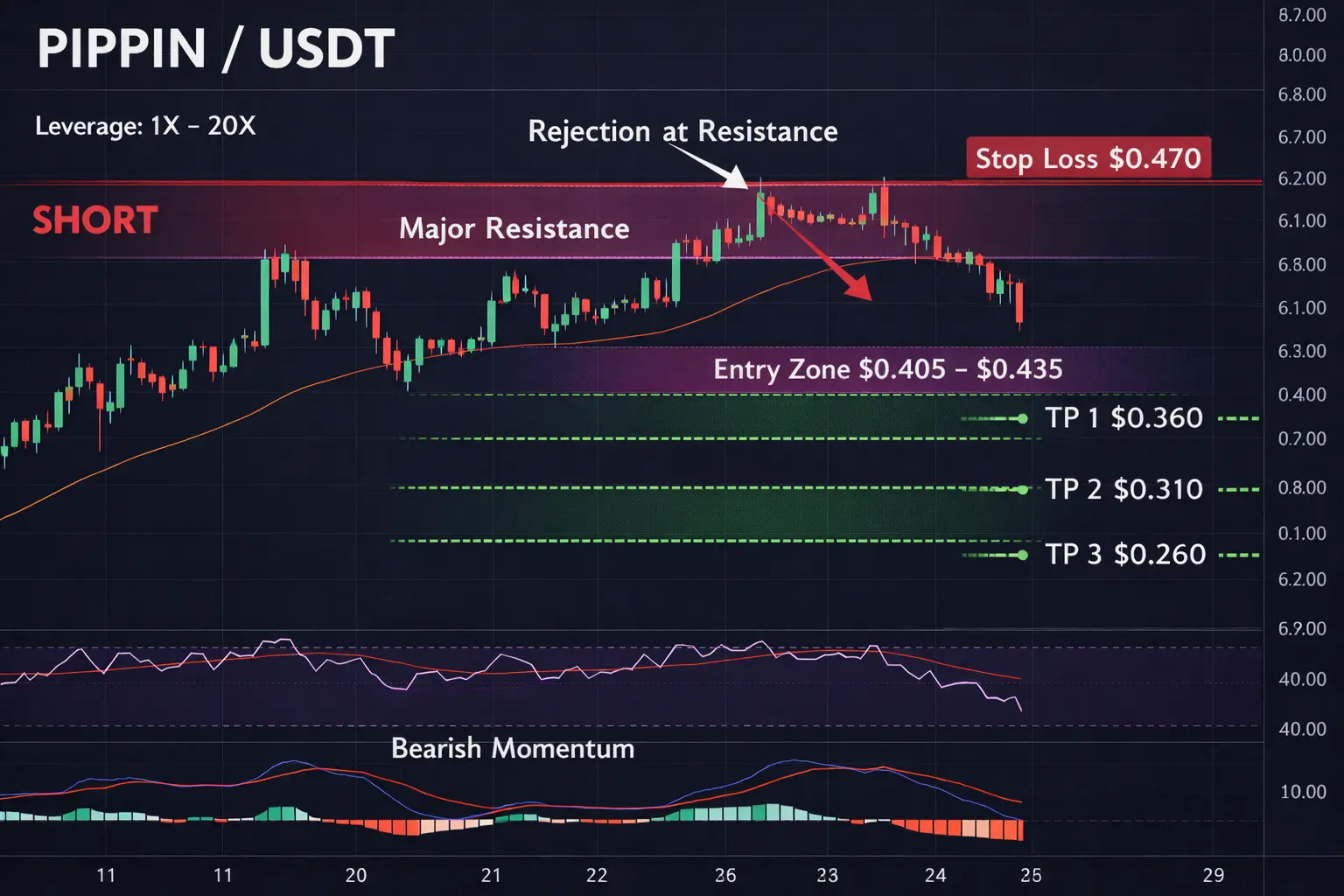

$PIPPIN Price is showing rejection near a major resistance zone, and momentum is starting to fade instead of expanding. That kind of behavior usually signals distribution or a liquidity sweep rather than real breakout strength.

If the market fails to reclaim the upper band and keeps printing weaker highs, the probability shifts toward a pullback into lower demand levels. As long as 0.470 stays protected, the short structure remains valid with downside targets stepping in gradually.

🚸 PIPPIN (USDT)

🔰 LEVERAGE: 1X to 20X

🔻 SHORT

✅ ENTRY: 0.405 – 0.435

🎯 PROFIT

1️⃣ 0.360

2️⃣ 0.310

3️⃣ 0.260

�

If the market fails to reclaim the upper band and keeps printing weaker highs, the probability shifts toward a pullback into lower demand levels. As long as 0.470 stays protected, the short structure remains valid with downside targets stepping in gradually.

🚸 PIPPIN (USDT)

🔰 LEVERAGE: 1X to 20X

🔻 SHORT

✅ ENTRY: 0.405 – 0.435

🎯 PROFIT

1️⃣ 0.360

2️⃣ 0.310

3️⃣ 0.260

�

PIPPIN3,13%

- Reward

- 1

- Comment

- Repost

- Share

$RIVER Momentum is clearly on the bullish side after a strong impulse move pushed price into a higher structure. Instead of sharp rejection, price is stabilizing and forming continuation behavior above previous resistance — a classic sign of buyers holding control.

As long as $16.90 remains protected, dips into the $17.80–$18.50 zone look like accumulation rather than weakness. If continuation follows through, the path toward $20 → $22 → $25 becomes structurally logical with expanding upside liquidity.

🚸 RIVER (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 long

✅ ENTRY: 17.80 – 18.50

🎯 PROFIT

1️⃣ 20.10

2️

As long as $16.90 remains protected, dips into the $17.80–$18.50 zone look like accumulation rather than weakness. If continuation follows through, the path toward $20 → $22 → $25 becomes structurally logical with expanding upside liquidity.

🚸 RIVER (USDT)

🔰 LEVERAGE: 1X to 20X

🚀 long

✅ ENTRY: 17.80 – 18.50

🎯 PROFIT

1️⃣ 20.10

2️

- Reward

- 1

- Comment

- Repost

- Share

$SOL is showing early signs of weakness after struggling to hold above the recent resistance band. Price tapped into the $82.50–$83.50 region and is facing selling pressure, suggesting this could be a liquidity grab before continuation to the downside. Momentum is slowing on lower timeframes, and structure looks vulnerable if support fails to hold.

The key idea behind this trade is simple — rejection at resistance + weakening structure = short opportunity toward lower demand zones. If price fails to reclaim $85, bears likely stay in control.

🚸 SOL (USDT)

🔰 LEVERAGE: 1X to 20X

🔻 SHORT

✅ ENTR

The key idea behind this trade is simple — rejection at resistance + weakening structure = short opportunity toward lower demand zones. If price fails to reclaim $85, bears likely stay in control.

🚸 SOL (USDT)

🔰 LEVERAGE: 1X to 20X

🔻 SHORT

✅ ENTR

SOL-2,74%

- Reward

- 2

- 2

- Repost

- Share

Chickito :

:

sounds niceView More

$OG is showing a strong breakout structure with expanding momentum, which usually signals fresh buyer interest entering the trend rather than a short-term spike.

Price pushing above recent resistance with steady strength suggests the market is preparing for a continuation move toward higher liquidity zones.

As long as momentum holds and support stays protected, the probability favors upside continuation toward the 5.50–6.00 region.

🚸 OG / USDT

🔰 LEVERAGE: 1X to 25X

🚀 DIRECTION: LONG

✅ ENTRY:

4.80 – 4.95

🎯 PROFIT TARGETS:

1️⃣ 5.20

2️⃣ 5.55

3️⃣ 6.00

🛑 STOP LOSS:

4.55

#CelebratingNewYearOnG

Price pushing above recent resistance with steady strength suggests the market is preparing for a continuation move toward higher liquidity zones.

As long as momentum holds and support stays protected, the probability favors upside continuation toward the 5.50–6.00 region.

🚸 OG / USDT

🔰 LEVERAGE: 1X to 25X

🚀 DIRECTION: LONG

✅ ENTRY:

4.80 – 4.95

🎯 PROFIT TARGETS:

1️⃣ 5.20

2️⃣ 5.55

3️⃣ 6.00

🛑 STOP LOSS:

4.55

#CelebratingNewYearOnG

OG7,3%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More22.03K Popularity

9.82K Popularity

4.35K Popularity

36.5K Popularity

251.15K Popularity

Pin